As a young professional, who is just starting a career at the age of 22, your thought process seems right. You are also thinking about investment. At this age, your professional journey has just started. You will face multiple money needs in times to come. Starting your investment journey so early will definitely give you an edge.

People who start so early tend to build wealth bigger than late starters. It’s commendable that you’re already thinking about investing in mutual funds. You will be one of the early starters, no doubt. But it is also true that starting early is only the first step. To make this investment count, other control points must also be managed.

In this blog post, I’ll share how, a young person like you, must holistically think about investment. I’ll tell you what other points you must keep in mind and control, to make this early start really count.

#1. The Journey Begins

Before diving into the specifics of how much you should invest, it’s important to understand the broader context of the financial journey. As a young earner, you have a significant advantage – time.

Time is a valuable asset when it comes to wealth building. The earlier you start investing, the more your money can grow through the magic of compounding.

Imagine you have a favorite video game where you collect coins. You start with 100 coins. This game has a special feature – every day, the number of coins you collect doubles. So, on the first day, you get 100 coins. On the second day, you get 200 coins (double the previous day), and it keeps doubling each day.

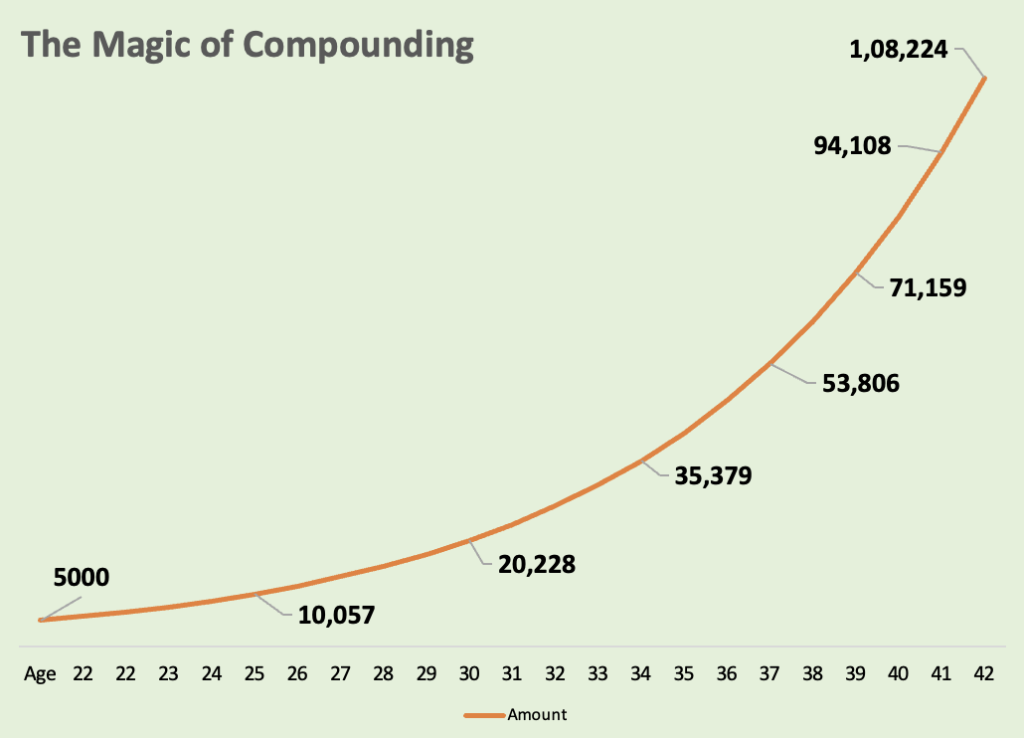

Now, let’s relate this to investing. Suppose you start with an initial investment of 5,000 INR in a mutual fund. If that mutual fund grows at a constant annual rate of 15%, after one year, your investment is worth 5,750 INR. In the second year, it grew to 6,613 INR because it earned 15% on the previous year’s balance, not just your initial 5,000 INR.

Just like your video game coins doubling each day, your investment keeps earning on both your original investment and the earnings from previous years.

Over time, the growth becomes astonishing, especially when you start early. By the time you’re 43, your 5,000 INR investment will grow to 1 lakh INR.

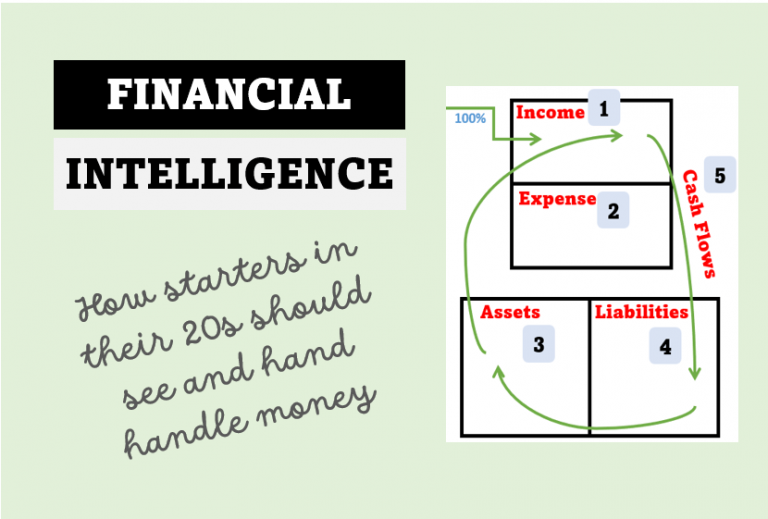

#2. Thought Process – What’s The Purpose

Your investment journey will feel rewarding only if you start with the right thought process. It’s not just about how much you should invest in mutual funds. It’s more about understanding why you’re investing in the first place.

What are your financial goals? Do you want to buy a home, travel the world, or retire early?

Knowing your goals will help you determine how much you need to save and invest.

Imagine you’re planning a road trip. You could just hop in your car and drive aimlessly. But that wouldn’t be very fulfilling, would it? Instead, you decide on a destination, like a beautiful beach.

In this analogy, deciding on the destination is akin to understanding why you’re investing. Are you saving for a dream vacation, a new home, or your retirement? Knowing your destination gives your journey a purpose.

Now, once you know you want to go to the beach, you can plan your route, budget your expenses, and make your trip enjoyable.

In the same way, understanding your financial goals, whether short-term or long-term, is like setting your destination. It gives you a clear purpose for your investments, making your financial journey rewarding and fulfilling.

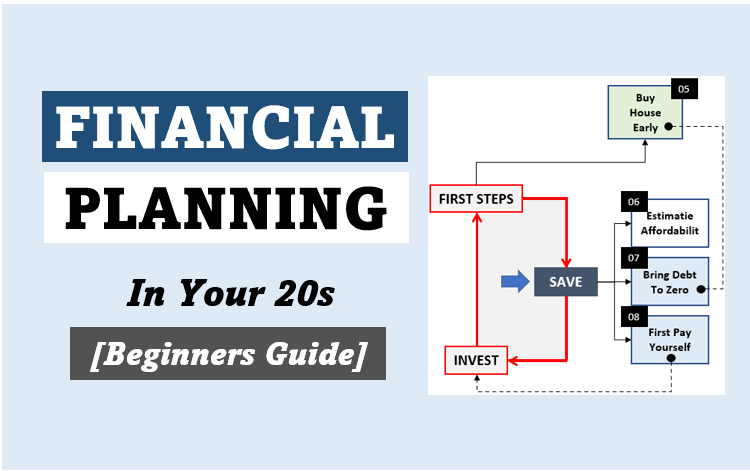

#3. How Much to Save and Invest

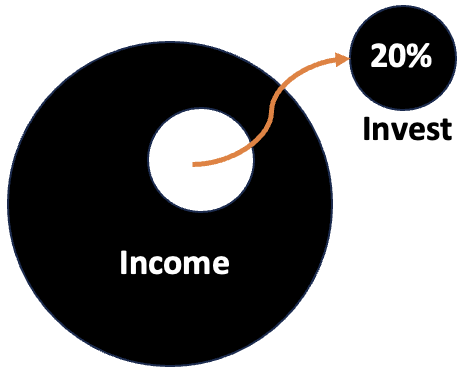

A commonly recommended guideline is to save and invest at least 20% of one’s income. In your case, with a monthly salary of 25,000 INR, this would mean setting aside 5,000 INR every month. This 20% is a good starting point, but it can vary depending on your specific financial goals and expenses.

Investing about 20% of income is advised because it strikes a balance between securing the financial future and meeting current needs. It forces one to think prudently before spending as 20% is not available for spending.

A significant portion of income is already allocated towards wealth-building. The remaining 80% to cover essential expenses, emergencies, and discretionary spending.

Keep in mind that this 20% figure can be adjusted based on individual circumstances and financial goals, but it serves as a robust foundation for building a secure financial future.

Let’s see an example:

Say, your immediate goal is to create an emergency fund, which is typically (at least) three months’ worth of living expenses. If your monthly expenses amount to 20,000 INR, you would want to save at least 60,000 INR in a fixed deposit account.

Once you have this emergency fund parked safely, you can consider aggressive investments like equity mutual funds. Why equity? We know this next…

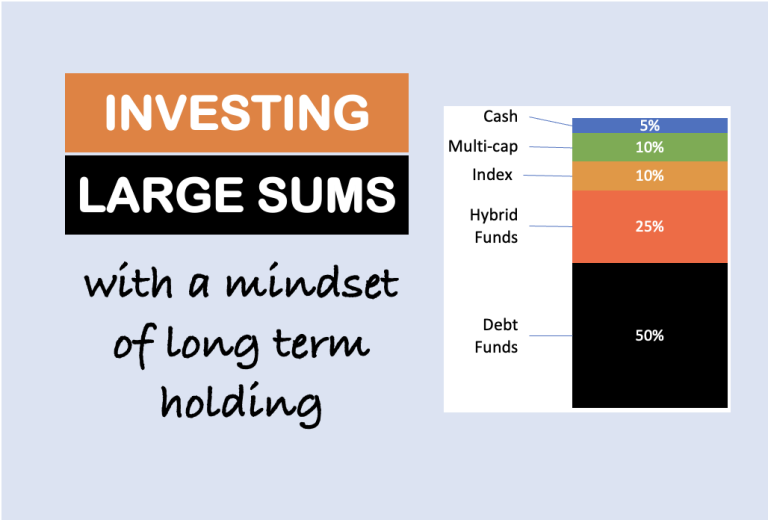

#4. Where to Invest

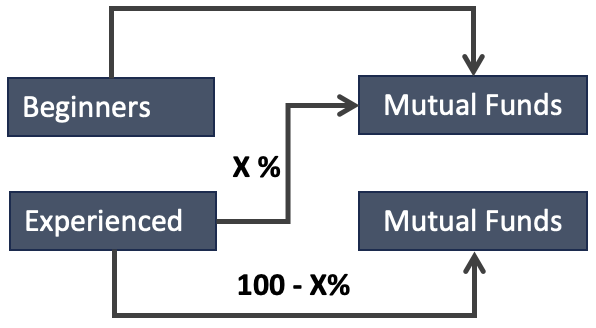

Now that you’ve decided to invest, the next question is where to invest. Mutual funds are a popular choice, and for good reason. They offer diversification, professional management, and flexibility. In India, you can choose from various types of mutual funds based on your risk tolerance and financial goals.

Starting your investment journey with mutual funds is wise for several reasons. Mutual funds offer diversification, which means your money is spread across various assets, reducing risk. Professional fund managers make investment decisions, which is beneficial for those with limited financial knowledge. Read about the benefits of mutual funds.

They also provide flexibility, allowing you to start with small amounts (SIPs).

Investing too defensively at a young age could also result in missed growth opportunities. Given the extended time horizon available to people in their 20s, they can afford controlled aggression. Overly aggressive investments may expose one to unnecessary risk.

Mutual funds offer a balanced approach, aligning with your risk tolerance while fostering long-term growth. They strike the right balance, making them an excellent starting point for young investors.

Let’s understand using an Example.

If you’re comfortable with moderate risk and have a long-term investment horizon, consider pure equity mutual funds. On the other hand, if you’re risk-averse and also want stability, hybrid mutual funds might be more suitable. Read about the types of mutual funds.

People who are a beginner in the world of investment, and direct stock investing will like over-aggression. So, starting mildly with SIPs in mutual funds is a fair way to begin the investment journey.

#5. Your Time Horizon Matters

One of the key factors that determine your investment strategy is your time horizon. The longer you can leave your money invested, the more risk you can afford to take, and potentially, the more you can earn. As a 22-year-old, you have decades ahead of you. This allows you to take a long-term approach to investing.

The power of time in investing cannot be overstated. When you have a longer investment horizon, like a 22-year-old with decades ahead, you can embrace a long-term approach to investing. This means you can consider investments with potentially higher returns, which often come with higher volatility. How?

It is because you have more time to ride out market fluctuations. With time on your side, compounding can work its magic, and even small initial investments can grow significantly. This extended time horizon allows you to absorb the inevitable market ups and downs.

Let’s understand this using an example.

Suppose you invest 5,000 INR per month (SIP) in an equity mutual fund with an average annual return of 15%. In 10 years, your investment could grow to approximately 13.9 lakhs INR.

However, if you continue this for 38 years (age 60), the same investment could grow to a staggering 11.6 crores INR. This 11.6 crores INR is equivalent to today’s 1.6 crores INR. Just imagine yourself carrying an investment portfolio with 1.6 crores INR (today). Will it not make a huge difference to your financial well-being? I’m sure your answer is a huge Yes. Check this SIP calculator.

This is a simple illustration of the power of compounding and the benefit of starting early.

#6. Investment Mindset

Building wealth through mutual funds requires discipline and a long-term mindset. Don’t be discouraged or influenced by short-term market fluctuations. Investing is a marathon, not a sprint. Stay committed to your investment plan, and avoid making impulsive decisions based on market volatility.

Short-term market fluctuations are a natural part of investing. It’s crucial not to be disheartened by these temporary ups and downs. Investing is more like a marathon than a sprint. Staying committed to your investment plan and resisting the urge to make impulsive decisions driven by market volatility. This way, you allow your investments to grow steadily over time.

Reacting emotionally to short-term changes can lead to poor decisions that hinder long-term success.

Patience and a steadfast approach to your investment strategy are essential for building wealth and achieving your financial goals in the marathon of investing.

Example:

Consider the story of Mr. A, who started investing in mutual funds at the age of 25. Over the years, he faced several market downturns, but he stayed invested. By the time he turned 55, he had accumulated a substantial nest egg, allowing him to retire comfortably.

Mr. A’s journey exemplifies the rewards of steadfast investing. Starting at 25, he weathered market turbulence over the years, maintaining his investments despite downturns. His resilience paid off as his investments continued to grow, taking advantage of compounding.

By age 55, he had amassed a significant financial cushion. This not only demonstrates the power of long-term investing but also how staying the course, even during market uncertainties, can lead to a comfortable retirement.

Mr. A’s story emphasizes the importance of discipline, as he reaped the benefits of his early commitment to mutual funds and reaped the rewards of financial security in his retirement years.

#7. The Final Goal: Financial Independence

As you continue your journey towards wealth building, keep your ultimate goal in mind – financial independence. The concept of financial independence represents the point at which you’ve accumulated enough assets to sustain your desired lifestyle. A financially independent person would live without relying on a regular paycheck or the need to work for a salary.

The ultimate goal of financial independence is not just about accumulating wealth for the sake of having money. It’s about achieving a level of financial security and freedom that empowers you to live life on your own terms. Read about how to achieve financial independence in stages.

Imagine being in your 40s or 50s when you have achieved financial independence. You’ll have the freedom to pursue your passions, travel the world, or simply relax without worrying about money.

Achieving financial independence is a powerful motivator, and it’s within your reach with the right financial planning and disciplined investing.

Conclusion

As a 22-year-old with a monthly salary of 25,000 INR, there’s no one-size-fits-all answer to how much you should invest in mutual funds. It depends on your financial goals, risk tolerance, and expenses.

However, a good starting point is to save and invest at least 20% of your income. Till you become more experienced and confident with equity, consider mutual funds as a promising avenue for long-term growth. For more experienced investors, stocks can be a better compounder.

Remember, the key to wealth building is not just about how much you invest; it’s about staying committed, being patient, and making informed decisions along the way.

Keep your financial goals in sight, and embrace the journey towards financial independence. It is a journey that can lead to a more secure and fulfilling future.

Have a happy investing.

Suggested Reading: