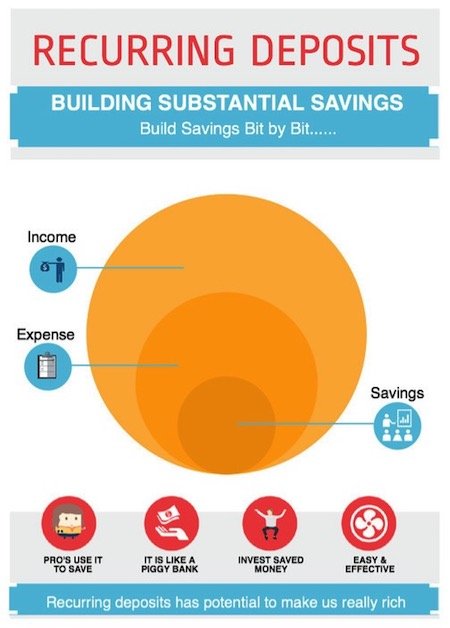

Recurring deposits has potential to make us a millionaire. How?

We all want to become rich, and recurring deposits can help us achieve this target.

I have personally gone past a rough patch in my life because of scarcity of money.

Since that day I continuously try to improve my finances.

One investment vehicle that was used most effectively was recurring deposit.

But recurring deposit alone cannot make one rich.

A combination of recurring deposits and other high yielding assets can prove profitable.

Unfortunately money cannot be earned via a short-cut path.

It can happen if one gets lucky and wins a lottery, but that happens only one is a billion.

A simple tool like recurring deposits has power to make us a millionaire. How?

We will see how to use recurring deposits to our benefit.

Recurring deposits can lift our standard of living 10 folds

Don’t worry this is not a publicity stunt. A simply savings scheme like recurring deposits can do a world of good to our finances.

But if becoming rich is so simple then why not everybody become rich.

The reason being that, majority people does not not know how to use recurring deposits.

The best thing about recurring deposit is that it accessible to all.

Recurring deposits allow us to save money automatically.

If we decide to save $100 each month, then this will happen automatically without we being aware of it.

By the time one year is completed we will have $1,200 in your kitty.

But problem is, this is where the charm of recurring deposits ends for majority of people.

We must learn to take the savings of recurring deposits to next level.

How Pro investors may be using Recurring Deposits?

Investors treats recurring deposits very differently than common men.

When an investor saves $100 in recurring deposit, he uses the accumulated funds to buy assets.

A pro investor will never buy liabilities from his investment linked savings.

This statement is perhaps the most important statement a common man can learn to become rich.

Never spend your investment linked savings to buy liabilities. Always buy assets from your recurring deposit savings.

Liabilities like a car, house, etc increases your expenditure while assets adds money to our pockets.

In order to become a millionaire, the faster we accumulate assets the quicker we become rich.

Imagine an Asset as a Huge Piggy Bank

Our savings in recurring deposits shall be used to buy assets.

This is why I said that recurring deposits along cannot make us rich.

But if our recurring deposit savings can be used to buy assets, RD savings can make us a millionaire.

Every $1 coin we add in the piggy bank corresponds to an assets. A piggy bank full of one million $1 coin corresponds to a huge asset.

If this piggy bank worth $1 million start generating interest income, it will really make us financially independent.

Recurring deposit is a very liquid asset.

It is very easy to redeem recurring deposits. So it is essential to lock our savings generated from recurring deposits.

Suppose we are saving Rs 20,000 each month for next 5 years.

At rate of 8% per annum, our accumulate savings from recurring deposit will be Rs 14,50,000.

The ease with which these Rs 14 lakh got generated, if we do not lock this money, it will get spent with same ease.

My suggestion is to buy an asset with dual purpose of locking funds and income generation.

Similarly, real estate property also generates regular source of income in form of rental income

What can be done from Recurring Deposits Accumulated Savings?

Buying real estate property or value stocks from recurring deposit savings is a good idea.

Value investors can use recurring deposit type savings to great benefits.

Value investors are those category of investors who buys stocks only when dooms day is announced in the market.

When everyone is pessimistic about market, value investors go on accumulating value stocks.

And when common man are buying heavily stocks, value investors stay away from market.

When everyone else is buying stocks, value investors use only recurring deposits type savings scheme.

Value stocks are great source of fixed income generation in form of dividends.

The bottom line is :

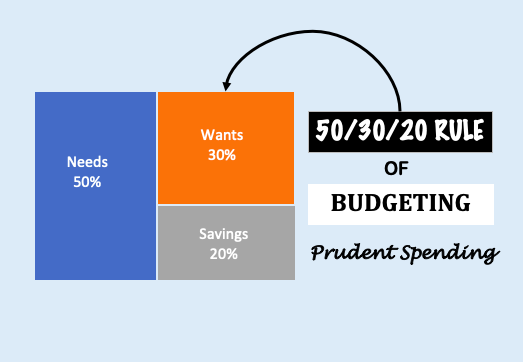

Decide how much you can save per month Rs.2500

Save this money each month in a recurring deposits (RD) type scheme. It can give return @7-8% p.a.

After twenty years your savings will amount to Rs.14,00,000

Use the savings generated from (RD) to buy a asset that locks your funds and generates income.

If a person has several such income generating assets, for sure he/she will become a millionaire soon.

Don’t just save, invest your savings to buy assets. Never buy liabilities from your savings

A millionaire is one who thinks like a millionaire. I appreciate how the writer has analyzed the topic from a different point of view. Feels like an end-moment lecture from a friend before an exam. Short, descriptive, and beneficial.

You mentioned “Value investors are those category of investors who buys stocks only when dooms day is announced in the market.”. But isn’t this the same as timing the market? And no-one can time the the market perfectly.

Also, consider this situation…

-Person A invests in ELSS / Mutual funds since 2010 and then in 2020 the markets crash due to covid19, but he continues to stay in (and does not withdraw) for the next 10 yrs (until 2030)

-Person B invested in RD’s since 2010 (and so earned much less than person A). And then when the markets crashed in 2020, he entered the market and stayed for the next 10 yrs (until 2030)

Any hypothesis on which will generate greater returns? (I’ve been trying to search for any link online to answer this, but couldn’t find so was hoping that you could shed some light on this…)

Thanks for the content mani 👏👏👏👏

Calculation is incorrect. May be to see if someone notices it. Well, I did 🙂

Without any Interest accounted for 15000*12*20 is 36,00,000

Thanks for pointing the typo error.

The calculation will should be (2500×12*20 = Rs.14,00,000)