Summary Points:

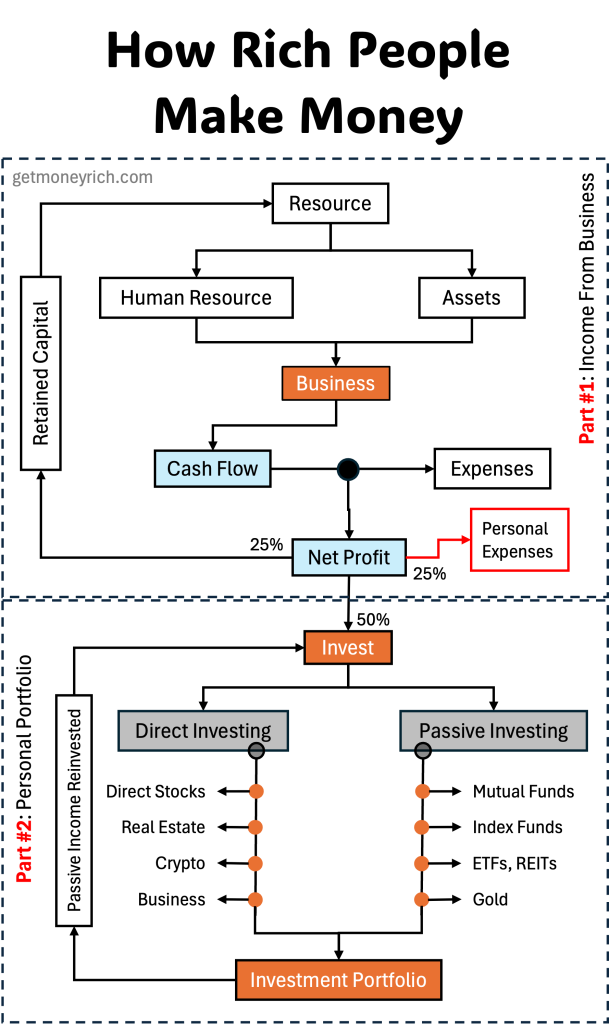

- I’ll explain how rich people focus on cash flow and net profit to grow their business, like my example of an ice-cream store. Check this mind-map

- You’ll see an example where how profits was split as 25% for business growth, 25% for family, and 50% for investing.

- I’ll share how they use direct investing (like my friend Ramesh buying land) and passive investing (like mutual funds) to make their money grow.

- We’ll talk about their long-term thinking, diversification, and discipline, with examples like Dhirubhai Ambani and Narayana Murthy.

- Lastly, I’ll show why knowledge and networks matter, and how we can start small to improve our own lives.

Have you wondered how do rich people make money? I mean, we see these big businessmen, Bollywood stars, and tech entrepreneurs with their fancy cars and big houses, and we can’t help but think, “how do they do it?” Today in this blog post, I’ll try to give a most simplified explanation of how they do it. I’ll not make it complicated so that it makes sense to a majority who are reading this post. Over the year of observation and experience, I’ve noted a key factor that differentiates majority from rich people.

So in my effort to keep the explanations simple so everyone can understand it quickly, I’ve prepared this flow chart. It is basically a mind map of a person who is actually rich and how he thinks about money.

The Starting Point

Let’s talk about the foundation of how most rich people build their wealth.

Many of them start with a business. It can be a small shop, an online enterprise, or a big company. But it’s not just about starting a business; it’s about understanding how money flows in and out of it. You see in the flow-chart there are two elements named as “cash flow” and “net profit.” These two are the key focus points for which one will start the business.

Let me explain this in simple way. Imagine you run a small ice-cream store in your mohalla.

- Every day, you different types of ice-creams and money comes into your pocket. that’s your cash flow coming in.

- But you also have to pay for things like rent, electricity, and buying more raw materials, that’s money going out – your expenses.

- Now, at the end of the month, after paying all these expenses (including interest on loan and taxes), whatever money is left with you is your net profit.

For example, if you made Rs.50,000 from sales of the ice-creams. This is your cash flow. But you also have expenses to run your business. Let’s say it is Rs.35,000 on expenses. So, the net profit that remains in your bank account (after paying all expenses) will be your profit. In this case, your net profit is Rs.15,000. Simple, right?

Rich people are very smart about this. They focus on a few aspects of business more than others.

- They make sure their cash flow is always positive. It means, more money comes in (sales) than goes out (expenses).

- The above control always keep them as “net-profit-positive.”

- Moreover, how they use their profit is also interesting. They don’t just spend all their net profit on fancy things. Instead, they do something clever and wise. They divide the total net profit into three parts.

- The first part (25%) they retain to make their business grow, and over time, their profits become even bigger.

- Second part (25%) they use to manage their person family expenses. This is the main differentiating point. Generally, for people like us, we use about 80-90% of our salary (income) to manage our personal expenses. Rich, people do it differently here. Probably they started business right in their early 20s. Possibly, they also got money from their parents which they invested to grow their business. By the time they have a family, their business income is so high that a 25% bite of it is enough to manage a living. Moreover, today’s rich people have mostly stayed a minimalist life in in their 20s and 30s.

- Third part (50%), this is where the main action happens. They use this money to invest and make it grow faster over time.

That’s the first lesson we can learn from them: don’t spend everything you earn. Put some back into your work to make it grow. Also, start investing very early.

Investing: Making Money Work for Them

Now, here’s where rich people start pulling ahead of the rest. Once their business is doing well and they have some extra net profit, they don’t let that money just sit in a bank account gathering dust. They make their money work for them.

That’s where the second part of the flow chart comes in. In the flow chart you will see, it talks about direct investing” and “passive investing. Let me tell you what this means with a story.

Direct Investing

I have a friend, Ramesh, who runs a small garment shop in Mumbai.

- A few years ago, he started making good profits, around Rs.2 lakh a year after all expenses.

- Instead of spending it all, he decided to use some of that money wisely. He heard about “direct investing,” which means putting your money into things you understand and control yourself.

- So, Ramesh bought a small piece of land in his village because he knew land prices there were going up.

- Two years later, he sold it for double the price. That’s direct investing.

Indirect Investing

But not everyone has the time or knowledge to practice direct investing. That’s where “passive investing” comes in. This is what a lot of rich people do when they don’t want to manage everything themselves. They put their money into things like mutual funds or fixed deposits. In these investment options, someone else like a fund manager, takes care of the money.

For example, Mukesh Ambani doesn’t spend all his time picking stocks himself. He has experts who manage his investments in the stock market, real estate, and other businesses. This way, his money keeps growing even when he’s busy running Reliance or enjoying time with his family.

What’s interesting is that rich people often do both.

Some direct investing when they see a good opportunity, and some passive investing to keep things safe and steady.

In India, we have options like Fixed Deposits, Public Provident Fund (PPF), or even mutual funds that are great for passive investing. My cousin Priya started putting Rs.5,000 every month into a mutual fund three years ago. Aand now her money has grown to almost Rs.2.5 lakh.

Thinking Long-Term

One thing I’ve noticed about rich people is that they think long-term.

We normal Indians often focus on short-term needs, like saving for a festival or buying a new phone. But rich people plan for the next 10 or 20 years. They’re not afraid to take calculated risks, and they don’t get shaken up by small losses.

Let me give you an example.

Back in the early 1958, a man named Dhirubhai Ambani started Reliance group with very little money. Back then, he named the company as Reliance Commercial Corporation. Later in 1973, it was renamed as Reliance Industries. He took risks, invested in new ideas like petrochemicals, and kept putting profits back into the business. Today, his family is among the richest in the world.

Did he become a billionaire overnight? No. It took years of hard work, smart decisions, and patience.

That’s something we can learn from. We can’t expect to get rich with short-term goals as our priority. They are also important, but what’s more important to get rich is a long-term plan and focus to achieve it.

Diversification

Rich people also diversify their money.

If they have a business, they might also invest in stocks, real estate, or even start another company. Take someone like Ratan Tata, he didn’t just stick to one thing. The Tata Group has businesses in cars, steel, tea, and even hotels. If one business doesn’t do well, the others can still keep them going.

But we are not Tata’s and Ambanis (for now). In our own small way, we can apply the diversification rule.

Maybe you run a small business, but you can also put some money in a stock, mutual funds, or buy a little gold for the future.

A Little Bit of Discipline Goes a Long Way

Another thing I’ve seen is that rich people are very disciplined about money. They don’t waste it on things they don’t need.

I know it’s tempting to buy that new iPhone or splurge on a big wedding, or go on a Dubai vacation. These things are so tempting that it seems unavoidable when they creep into our minds. But think about it, does that really help you in the long run? Rich people ask themselves, “Will this make me more money in the future?” before spending. If the answer is no, they often skip it.

For example, I read about Narayana Murthy, the founder of Infosys. Even when he became super rich, he lived a simple life. He didn’t spend on fancy cars or big houses early on. Instead, he put his money into growing his company. That discipline paid off. Today, Infosys is a global name, and he’s worth billions.

A similar example (may be even bigger) is that of Warren Buffett. Read more about Mr.Buffett here (check this thread).

We don’t have to be that extreme, but we can definitely learn to control our spending and save more for the future. Making this as our priority (in our mind) will be the first big step. Following it will be the next move.

Why Knowledge and Networks Matter

Lastly, let’s talk about something that doesn’t show up in my flow chart but is so important, knowledge and networks.

People who are getting perpetually rich, day after day, are always learning and networking.

They read about new opportunities, understand the market, and stay updated. They also surround themselves with smart people who can help them grow. Ever noticed how successful people often know other successful people? That’s not a coincidence. They share ideas, give each other advice, and sometimes even partner up for new ventures.

Even in India, we have so many examples of this.

Look at someone like Kiran Mazumdar-Shaw, who started Biocon. She began with almost nothing but learned about biotechnology, connected with the right people, and built a massive company.

We can do this in our own way too. Maybe join a local business group, talk to people who are doing well. We can also read up on simple business and investment tips online.

The more we know, the better decisions we can make. And here, the knowledge need not be only limited to our domain, it can be knowledge about anything in general. I believe that, everything is connected to each other at some level.

Conclusion

So, what have we learned today.

Rich people make money by being smart with their business. They keep an eye on cash flow, saving their net profit, and use profits wisely to make it count and grow (business).

They also make their money work for them through direct and passive investing. They think long-term instead of chasing quick gains.

They’re disciplined, they keep learning, and they build strong networks to support their growth.

Does this mean we can all become billionaires? Maybe not, but we can definitely improve our lives by following these steps.

Start small, track your earnings, save a little every month. Then, we can explore safe investment options like mutual funds, ETFs etc.

Over time, you’ll see your money grow, just like the rich do. And who knows, maybe one day we’ll be the ones giving advice to others.

What do you think, ready to take the first step? Tell me your views in the comment section below.

Have a happy investing.