Summary Points:

- Traditional businesses (like TCS, RIL, Britannia) focus on making and selling—revenue growth and margins are king.

- Banks (like HDFC or SBI) thrive on managing money: loans, deposits, and interest spreads drive them.

- Key differences lie in risks, metrics, and economic triggers: competition for one, bad loans for the other.

- Mixing up their analysis can mess up your investment calls: knowing the game matters!

Introduction

As a long term stock investor, you’ve probably wondered how analysts look at companies differently. I mean, not every business is the same, right? Take a company like TCS or Reliance, and then think about a bank like HDFC or SBI. They’re both giants in their own worlds, but analyzing them? That’s a whole different ball game. Today, I want to share with you about how I’d dig into a traditional business versus a banking business. We’ll explore what makes them tick, where they differ, and why understanding these differences can make or break your investment decisions. So, let’s dive in,

The Traditional Business

When I think of a traditional business—say, TCS, RIL (Reliance Ind.), or Britannia, I picture companies that make stuff or provide services we use every day.

- TCS writes software that powers businesses.

- RIL pumps out everything from oil to Jio sims, and

- Britannia keeps our biscuit jars full.

These are companies with factories, offices, or tech labs, places where raw materials turn into products or ideas become solutions.

Income Statement

As an financial blogger, my first stop is almost always at their income statement.

How much are they selling? Is their revenue growing year after year?

- For TCS, I’d check how many new clients they’ve bagged globally, because IT services thrive on contracts.

- With RIL, I’d peek at their oil refining margins or how Jio’s subscriber base is expanding.

- And Britannia? I’d want to know if their Good Day biscuits are still flying off shelves or if Parle-G is eating their lunch.

Revenue growth tells me if the company’s engine is working fine or not.

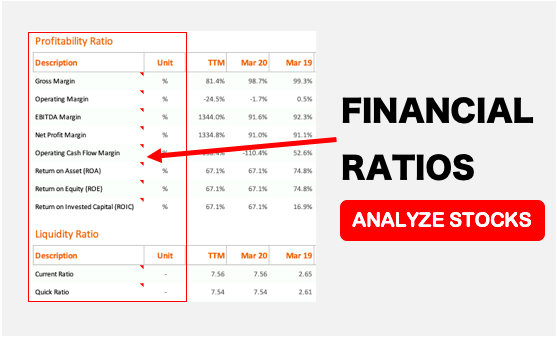

Next, I’d zoom into profitability.

Are they making decent money after paying for raw materials, employees, and all that jazz? Gross margins, operating margins, these numbers actually tell if a business if profitable or not.

- A company like RIL might have slimmer margins in refining but massive cash flows from telecom.

- TCS, on the other hand, enjoys fat margins because software doesn’t need warehouses full of inventory.

- Britannia’s profitability hinges on keeping costs low, wheat prices going up could squeeze them hard.

Balance Sheet

Then there’s the balance sheet.

How much debt do they have?

- Reliance, for instance, has borrowed big to build Jio, but their cash flows seem to handle it.

- TCS is almost debt-free, a rare gem.

I’d also look at their assets. Things like plants, machinery, patents and keep a note of it. Then, I’ll go asking, Are they investing enough to stay ahead?

A traditional business lives or dies by how well it uses its resources to keep customers happy and competitors at bay.

The Banking Business (It’s Different)

Now, let’s talk about banks like that of HDFC Bank or State Bank of India (SBI).

Banks don’t make biscuits or software; they deal in money itself.

Their “product” is loans, deposits, and trust. When I analyze a bank, I’m not thinking about factories or supply chains. Instead, I’m asking, How well do they manage money, their money (loans) and our money (deposits)?

Income Statement

I’ll start by looking at their Net Interest Income (NII).

This is the difference between what they earn from loans and what they pay on deposits.

It’s like their bread and butter.

- If HDFC Bank’s NII is growing, it means they’re lending smartly while keeping deposit costs low.

- SBI, being a public sector bank, might have a different story, government pressure to lend to certain sectors could pinch their margins.

Interest rates play a huge role here. When the RBI hikes rates, banks can charge more for loans, but they also have to pay depositors better. It’s a tightrope walk when it comes to interest rate changes.

Balance Sheet

Then there’s asset quality.

Are their loans turning into NPAs (non-performing assets)? In simple terms, are borrowers paying back or defaulting?

A bank with too many bad loans, like some PSU banks in the past, is a red flag.

- HDFC Bank’s reputation for clean books makes it investors favourite.

- While SBI’s massive size means it sometimes carries baggage from legacy loans.

While investigating a bank’s NPAs, I’d dig into their Provision Coverage Ratio too. This value tell me how much they’ve set aside for their bad loans (NPAs). Its like, even if their are NPAs if they have made provisions for it, the business is safe.

Capital adequacy is another important metric.

Banks need to hold enough capital to cushion losses, it works as their safety net. The RBI’s Basel norms set the rules here. HDFC usually stays well above the minimum, while SBI sometimes flirts closer to the line because of its sheer scale.

And then we have deposits. A bank with a loyal deposit base, like SBI’s millions of savings accounts, has cheap, stable funding. That’s gold in banking.

Where They Are Different (Traditional Business vs. Banking)

So, what’s the real difference?

- A traditional business is about creating value through products or services. Their success depends on innovation, efficiency, and demand. If TCS builds cutting-edge AI tools or Britannia launches a trendy health biscuit, they win.

- Banks, though, are middlemen of money. They don’t “create” in the same way, they profit by managing risk and trust.

For example, TCS doesn’t care if their customer defaults on his/her credit card, but for HDFC Bank this data is super critical.

The metrics I focus on shift dramatically.

- For a traditional company, it’s all about sales growth, cost control, and cash flow.

- For a bank, it’s about interest spreads, loan quality, and capital strength.

Imagine analyzing Reliance without checking oil prices or TCS without IT spending trends, that’d be silly, right?

Same way, you can’t judge SBI without understanding NPAs or interest rate cycles.

The risks are different too. A traditional business might flop if a competitor undercuts them. A bank? It could sink if too many loans go bad or if a scam shakes depositor confidence (remember Yes Bank).

Anyways, to give more clarity about how a traditional business is difference from a banking business, I’ve created the below table.

| Aspect | Traditional Business (e.g., TCS, Reliance, Britannia) | Banking Business (e.g., HDFC Bank, SBI) |

|---|---|---|

| Core Activity | Creating and selling products or services—software (TCS), oil/telecom (Reliance), biscuits (Britannia). | Managing money—lending to borrowers, accepting deposits, and earning from the spread. |

| Revenue Driver | Sales of goods/services. E.g., TCS’s client contracts, Reliance’s refinery output, Britannia’s biscuit volumes. | Net Interest Income (NII)—difference between interest earned on loans and paid on deposits. |

| Key Profitability Metric | Gross and operating margins. E.g., TCS’s high margins from low-cost IT, Britannia’s squeeze from wheat prices. | Net Interest Margin (NIM)—how efficiently they profit from lending vs. deposit costs. |

| Primary Risk | Market competition and demand shifts. E.g., Parle-G undercutting Britannia, or TCS losing a big client to Infosys. | Credit risk—borrowers defaulting on loans (NPAs). E.g., SBI’s legacy bad loans vs. HDFC’s clean record. |

| Asset Focus | Tangible/intangible assets like factories (Reliance), software IP (TCS), or inventory (Britannia). | Loan portfolio—quality and size of loans given out, plus cash reserves and investments. |

| Liability Concern | Debt to fund operations/expansion. E.g., Reliance’s borrowings for Jio, TCS’s near-zero debt comfort. | Deposits—ensuring enough stable, low-cost funds. E.g., SBI’s vast savings base vs. HDFC’s premium deposits. |

| Capital Needs | Investment in growth—R&D for TCS, refineries for Reliance, new flavors for Britannia. | Regulatory capital—meeting RBI’s Basel norms to absorb losses. E.g., HDFC’s buffer vs. SBI’s tightrope. |

| Economic Sensitivity | Tied to consumer/industry demand. E.g., Britannia booms in lockdowns, TCS rides digital waves. | Linked to interest rates and credit cycles. E.g., HDFC gains when rates rise, struggles with NPAs in slumps. |

| Performance Indicator | Cash flow from operations, EBITDA. E.g., Reliance’s telecom cash vs. Britannia’s steady biscuit profits. | Return on Assets (ROA), Return on Equity (ROE). E.g., HDFC’s high ROE vs. SBI’s broader systemic role. |

| Growth Strategy | Innovation and market expansion. E.g., TCS’s AI push, Reliance’s Jio rollout, Britannia’s health snacks. | Loan book expansion and deposit growth. E.g., HDFC’s retail lending focus, SBI’s rural reach. |

| Crisis Impact | Varies by sector—Britannia thrived in 2020 (stockpiling), TCS adapted (digital boom), Reliance adjusted (oil dips). | Systemic shocks—NPAs spiked in 2020 for banks, moratoriums hit cash flows (Yes Bank’s collapse as extreme). |

Takeaway For An Investor

An investor cannot analyze a bank like a regular company. The business model of a bank is completely different from other companies.

If I value TCS like a bank, focusing on how it is using its cash, I probably do not know the nature of their business. If I’ll try to judge HDFC Bank by its “product innovation,” I’d miss the real story in its balance sheet. These differences aren’t just technical, they define how these companies exist and grow.

Take 2020, for example. When the pandemic hit, Britannia’s sales spiked, people stocked up on biscuits. TCS thrived as companies went digital. But banks? Many struggled with loan moratoriums and NPAs.

An investor who didn’t see these dynamics would’ve misread the market.

Knowing what drives each business helps us spot opportunities, or dodge disasters.

Should you bet on RIL (Reliance) when oil prices climbing or falling? Or, is HDFC Bank is a good stock when rates are rising or falling?

That’s the power of understanding the business and then investing?

Conclusion

Whether it’s a traditional giant like TCS or a banking king like SBI, the trick is to wear the right lens.

Traditional businesses are about selling a product or services.

Banks are about lending, protecting, or even growing your money.

One thrives on creativity, the other on stability.

As an Indian investor, I feel we must know to differentiate between these companies. Next time you’re buying a stock, ask yourself, What game is this company playing? Because trust me, knowing the business model helps us see clearly from where the company’s revenue is coming, or how they are converting their cash into profit.

I hope you liked this post about the difference between a traditional business and a banking business. Tell me in the comment section what more you would like to know about it.

Suggested Reading: