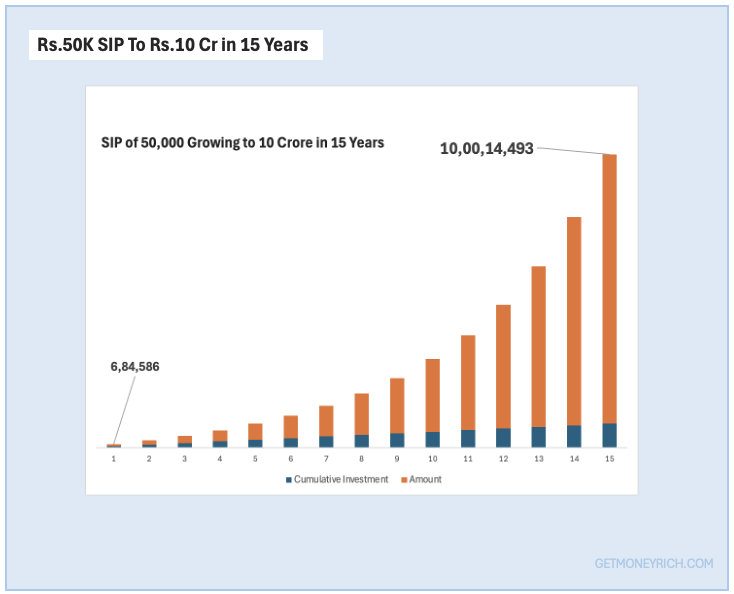

Building a corpus of ₹10 Crore in 15 years is a significant financial goal. To achieve this, if one can invest ₹50,000 monthly in a disciplined manner, it can be one way out. I recently got an email from one of my subscribers who has a capacity to do a ₹50,000 SIP. He wanted to first know that if it is practical to think about building a ₹10 Crore portfolio in 15 years. If this is possible, he then wanted to know what should be his investment strategy. For sure, reaching this goal is not easy as it requires a substantial return of 25.5% per annum.

Achieving an average return of 25.5% per annum, for a 15 years time horizon, is a big challenge.

In the last 15 years (from Sep’09 to 09-Sep’24), Nifty 50 has appreciated from 4,680 to 24,850 levels. It has done it a CAGR growth rate of 11.77% per annum. For an equity investment, earning a 8% equity premium over Nifty 50 growth is considered an exceptional performance. It means, suppose a mutual fund has earned an average return of 19% per annum (11.77%+8%), it can be considered phenomenal.

But in our example, the SIP investment has to grow at an annualized growth rate of 22.5% per annum to reach the goal of ₹10 Crore in 15 years. This is the reason why an equity investment strategy is required to make it a reality.

In this article, we’ll know about such an investment strategy.

Topics

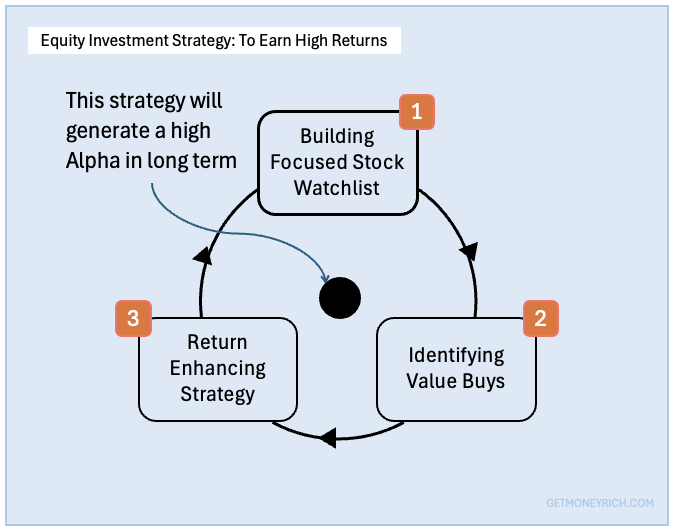

1. Building a Focused Stock Watchlist

To achieve a goal of ₹10 Crore in 15 years with a ₹50,000 monthly SIP, a targeted approach is essential.

The first step is to build a focused stock watchlist. This watchlist will consist of quality stocks from the big indices like Nifty 50, Nifty Next 50, Nifty Midcap 50, and Nifty Small Cap 50 indices.

Each of these indices represents a different segment of the market. Picking stocks from these indices will provide a diversified pool of quality stocks with growth potential.

1.1 Watchlist Strategy: How To Select Quality Stocks

Start by creating a watchlist with stocks from these four indices. This step ensures a selection of quality companies with strong fundamentals.

- The Nifty 50 contains large-cap companies with established businesses and stable growth rates. The Nifty Next 50 consists of companies that are likely to enter the Nifty 50 in the future. These stocks often carry the character of a market leader. They not only represent quality but also companies with stable performance. They are large companies enjoying economic moat.

- The Nifty Midcap 50 includes mid-sized companies with potential for higher growth. These companies are generally more dynamic, with opportunities to expand faster than their large-cap counterparts.

- Finally, the Nifty Small Cap 50 consists of smaller companies. These companies carry higher risks but offer the potential for substantial returns. Including them can provide exposure to higher growth options.

This strategic selection covers all market segments. The selection is done to balance the risk and reward. It ensures that the portfolio captures growth opportunities but also ensures the quality of the selected stocks. As stocks are picked from different market caps, it can enhancing the potential for higher returns.

1.2 Criteria for Stock Selection

Choosing stocks from these indices makes sense for several reasons:

- Quality and Stability: Stocks in the Nifty 50 and Nifty Next 50 have proven track records. These are stocks that qualify as the best blue-chips in India. They have strong management teams, good corporate governance, and consistent earnings growth. These factors reduce the risk of significant losses.

- Liquidity: Stocks from these indices are highly liquid. This means they can be easily bought or sold without a significant price impact. Liquidity ensures that investors can enter and exit positions with ease, especially during volatile periods.

- Market Presence: Companies in these indices are well-recognized. They tend to be leaders in their sectors, with strong brand value and customer loyalty. This market presence often translates into consistent revenue and profit growth.

- Growth Potential: Mid-cap and small-cap stocks, while riskier, offer high growth potential. They have the capacity to grow faster due to smaller bases, innovative business models, or untapped markets. Selecting stocks from these indices provides a balanced exposure to both stability and growth.

1.3 Study The Stocks In Your Watchlist

A static watchlist may not serve well in the long run. Market conditions, company fundamentals, and sector performance are always changing. Thus, it is crucial to regularly update the watchlist based on these factors.

- Performance Review: Regularly analyze the performance of each stock in your watchlist. Look for changes in revenue growth, profit margins, and market share. Remove stocks that show declining fundamentals or consistent underperformance. Replace them with better-performing stocks from the different indices.

- Market Trends and Sector Rotation: Pay attention to macroeconomic trends and sectoral shifts. For example, If the banking sector is projected to grow due to increased adoption of digital banking services, consider adding more of these stocks. Conversely, if a sector is facing headwinds, invest only low amounts but in the best of their stocks. At this time, avoid small and mid caps. The goal is to stay ahead of market changes, capitalize on emerging opportunities, and keep tapping quality out of favour stocks.

- Quarterly Earnings Reports: Review quarterly earnings reports of the companies in your watchlist. Look for indicators of growth, such as increased sales, cost management, or expansion into new markets. Consistent strong earnings performance is a positive sign. On the other hand, repeated misses in earnings estimates or shrinking profit margins may warrant is an indicator of headwinds for the company or the sector/industry as a whole.

- Corporate Actions and News: Stay updated on corporate actions like mergers, acquisitions, or management changes. These actions can significantly impact a company’s future growth. For example, a merger that expands market reach or a change in management that brings in fresh strategy can be positive. Conversely, bad news or regulatory issues may indicate potential problems.

1.4 Focus on Future Growth Potential

When building the watchlist, prioritize stocks with strong growth potential. This means selecting companies with solid fundamentals, such as revenue growth, healthy profit margins, and sustainable business models.

- Revenue and Profit Growth: Focus on companies that have demonstrated consistent revenue and profit growth over the past 3 to 5 years. Strong revenue growth indicates good demand for the company’s products or services. Profit growth, particularly with expanding margins, suggests efficient management and operational excellence. Read about Stock Engine’s Growth Scoring Method.

- Competitive Advantage: Look for companies with a competitive edge, such as a unique product, market dominance, or technological superiority. This advantage helps sustain long-term growth, even during tough market conditions. Companies with strong moats are more likely to generate above-average returns.

- Return on Equity (ROE) and Return on Capital Employed (ROCE): High ROE and ROCE are indicators of a company’s ability to generate profit from shareholders’ equity and employed capital. Prioritize stocks with ROE and ROCE above 15-20%. Consistent high returns suggest effective management and strong growth potential.

- Debt Levels: Companies with low debt levels are generally safer investments. High debt can erode profits due to interest payments and may pose risks during downturns. Focus on companies with a debt-to-equity ratio of less than 0.5, which indicates manageable debt levels.

- Sector Outlook: Consider the growth prospects of the sector to which a company belongs. Industries like technology, renewable energy, and healthcare often have higher growth rates. Companies in these sectors might have better chances of delivering higher returns.

Building a focused stock watchlist is the first critical step toward achieving the target of ₹10 Crore in 15 years. It starts with selecting quality stocks from major indices, considering factors like stability, liquidity, and growth potential.

2. Identifying Value Buys Using Momentum Analysis

2.1 Tracking Price Movements

To achieve a 25.5% CAGR, we must buy stocks at the right price.

How to start?

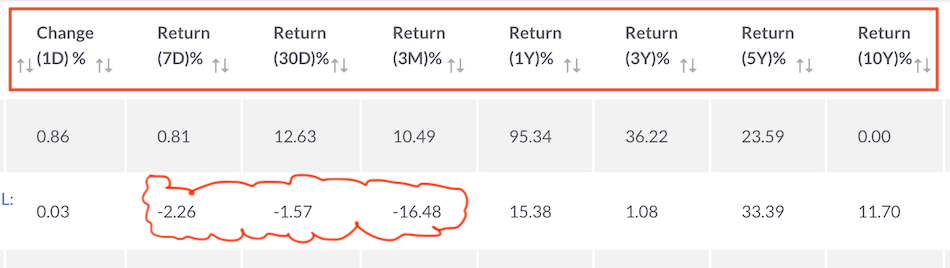

By tracking price movements of the stocks in your watchlist over different periods:

- 1 day (1D), 7 days (7D), 1 month (1M), 3 months (3M), 6 months (6M), and 1 year (1Y).

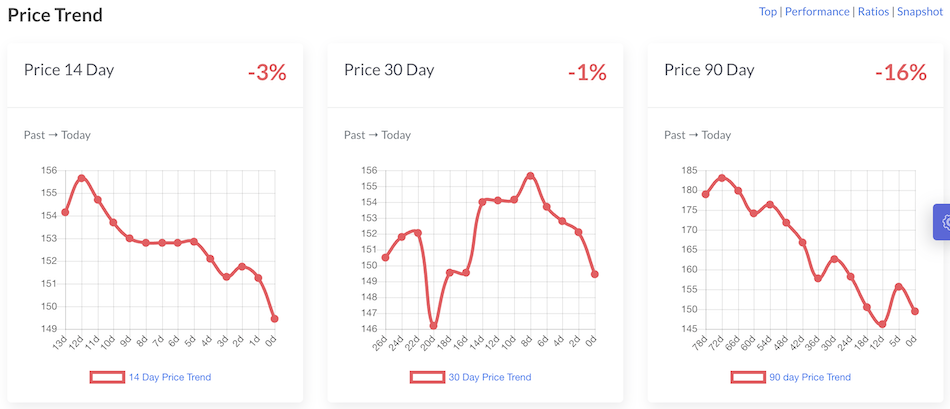

Look for consistent price corrections over these periods. For example, if a stock shows a declining trend across multiple time frames say like -2.26%, -1.57%, and -16.48% in the last 7 days, 30 days, and 3 months respectively, it could signal a potential buying opportunity.

This approach helps identify stocks that are temporarily out of favor. As these stocks are from our watchlist, their solid fundamentals are also verified (read about watchlist preparation).

2.2 What can be our buying triggers?

The next step is to set clear entry criteria. A common approach is to look for a consistent price fall of more than 5%. This threshold acts as a buying trigger. When a quality stock corrects by 5% or more over a period, it can indicate a temporary dip rather than a fundamental problem. Use this trigger to make informed entry points.

However, a 5% correction alone is not enough. We need to combine this momentum analysis with fundamental analysis to ensure we are buying a stock with strong long-term potential.

2.3 Incorporate Fundamental Analysis

Momentum analysis tells you when to buy, but fundamental analysis tells you what to buy. Use key metrics like Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and Return on Equity (ROE) to evaluate stocks. A low P/E ratio may indicate that the stock is undervalued compared to its earnings potential. ROE helps assess the company’s profitability and management effectiveness. Combine these metrics with price movement data to find stocks that are both undervalued and have strong growth prospects. This method ensures that your investments are grounded in both market behavior and sound financial health.

2.3.1 Sector and Market Sentiment

Understanding the reason behind a stock’s price dip is also crucial. This it the part of a deep fundamental analysis. Idea is to check if the price dip is due to the fall in the fundamentals of the company. If yes, the next question we must ask is, is this a cyclical stock whose fundamentals fall periodically? If the fundamentals are falling and company is not cyclical, we must dig deeper in to the story causing the dips.

There are also cases where the fundamentals remain intact, but just due to negative sentiments, the price tend to fall. This is almost like a free gift that stock investors must grab. But of course, the quantum of correction and relative valuations must also be checked.

- For example, if the banking sector experiences a dip due to temporary economic data, this could be an opportunity to buy quality banking stocks.

- However, if the price drop is due to a fundamental problem, like declining profits or regulatory challenges, it might be wise to avoid the stock expecting further corrections.

Market sentiment often swings between extremes, creating opportunities for disciplined investors to buy quality stocks at discounted prices.

2.3.2 Examples of Successful Value Buys

Real-life examples help illustrate this strategy.

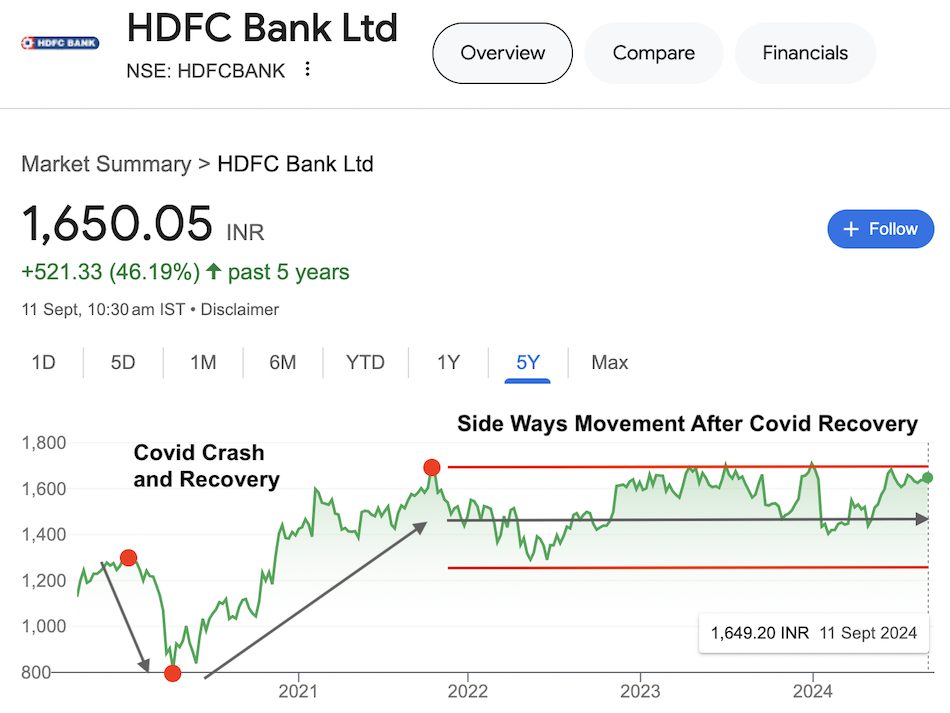

- Take HDFC Bank, for instance, in March 2020, during the pandemic, HDFC Bank’s stock price corrected by over 20% in a short period. However, the correction was due to temporary market panic rather than fundamental issues. Investors who recognized the bank’s strong fundamentals and growth potential could buy the stock at a discounted price. Over the next year (till 2021 end), HDFC Bank rebounded significantly. But since then (till 2024) the price movement is mostly sideways. For me, till 5-6 months back, HDFC Bank was in the buy range.

- Another example is Tech Mahindra. In December 2022, Tech Mahindra saw a price correction of about 40%. It happened due to concerns over the global tech sector slowdown. However, the company’s fundamentals, such as revenue, client base, and balance sheet, have recovered since them. Investors who analyzed the stock’s momentum and fundamentals found it as a buying opportunity then. The stock has recovered significantly (43%) since October’2023 after a prolonged sideways movement.

2.4 Combining Momentum and Fundamentals for a Winning Strategy

By combining momentum analysis with fundamental analysis, we create a powerful strategy to identify value buys.

- Momentum analysis will help us catch the price dips.

- Fundamental analysis will ensure that we are buying quality stocks.

This combination is key to achieving high returns over the long term. Remember, the goal is to find stocks that are temporarily undervalued due to market sentiment but have the potential to grow consistently over time. This approach of tracking price movements, and focusing on strong fundamentals, can fetch us the 25.5% CAGR needed to reach our financial goal.

3. Strategy to Achieve 25.5% Annualized Return

3.1 Diversified Allocation Approach

To aim for a 25.5% annualized return, diversifying our portfolio is crucial.

- Step#1: We must Start by allocating 50% to large-cap stocks. These companies are stable, have strong market positions, and offer consistent returns. They help in minimizing risk.

- Step#2: We can then allocate 30% to mid-cap stocks. Mid-caps often have higher growth potential compared to large-caps. They are less volatile than small-caps but can offer better returns.

- Step#3: Finally, the allocation of 20% to small-cap stocks can be done. Small-cap companies can deliver exceptional returns but comes with higher risks (price volatility & fundamentals can also switch as macros change).

This diversified allocation (50-30-20) balances risk and potential returns. I believe, it will give our portfolio a higher chance to meet the target of 25.5% CAGR in a 15 years time horizon.

3.2 Timing the Market vs. Time in the Market

Many investors try to time the market by buying low and selling high. However, timing the market is extremely difficult. It often leads to missed opportunities and emotional decisions.

Instead, focus on “time in the market.” This means holding your investments for the long term, even during short-term market fluctuations.

Historically, equity markets have always rebounded over time. The longer you stay invested, the better your chances of earning a high annualized return.

For example, if you bought a stock during a dip but held it through market cycles, you would likely benefit from its long-term growth. For me, it does not make sense to first take the effort to buy a quality stock during dips and then sell it only after 30-40% absolute gains.

Instead, our goal should be to earn about 25% CAGR over a 15-20 years time horizon (25% in 15 years makes our investment 28x). Read about timing the market and time in the market.

3.3 Portfolio Rebalancing

To achieve a 25.5% return, we must also regularly review and rebalance our portfolio.

This is necessary to ensure that our allocation remains aligned with our strategy. For example, say a small-cap stock has grown significantly, it has exceed the desired 3x landmark (multi-bagger). In such cases, we might ask ourself that are the current price levels sustainable? Are the fundamentals of company still strong enough to support the price levels? If the answer is No, consider rebalancing by selling a portion or all of the holdings.

But while judging the fundamentals, we must consider the long-term fundamentals of the company. We must not worry about temporary dip in fundamentals (as it happens with cyclical stocks).

In case we decide to sell the holding, the sale proceeds shall be them reallocated to large-caps or mid-caps or a new small-cap stock.

- Rebalancing helps maintain the risk level of our portfolio.

- It also locks in gains and takes advantage of different market cycles.

Regular rebalancing, annually or semi-annually, is a strategy followed by mutual funds and PMS. We individual investors, who practice value investing, need not do the same. We can wait for 3 years at least before considering rebalancing.

3.4 Focus on High-Growth Sectors

Identifying sectors with high growth potential is key to achieving high returns.

- Technology: In the coming years, technology will likely continue its rapid growth. Companies in digital services, cloud computing, and AI are expected to perform well.

- Renewable energy is another promising sector, driven by global demand for clean energy. Companies in solar, wind, and electric vehicles could offer high growth potential.

- Healthcare is also a strong sector due to aging populations and increased health awareness. Companies focusing on biotech, pharmaceuticals, and medical technology may see substantial growth.

- FinTech: It is rapidly expanding due to the increased adoption of digital payments, online lending, digital banking, and the growth of financial inclusion initiatives. A large unbanked population, government support for digital financial services, and the increasing penetration of smartphones and the internet are driving this sector’s growth.

Investing in these high-growth sectors can help boost your portfolio’s return.

Conclusion

To build a corpus of ₹10 crore in 15 years with a monthly SIP of ₹50,000, a focused equity investment strategy is key.

- Start by selecting high-quality stocks with strong growth potential.

- Use tools like the “Big Screener” of the Stock Engine to filter stocks based on metrics such as revenue growth, profitability, and competitive advantage.

- Opt for a diversified portfolio that balances both growth and stability. We can consider sectors with long-term potential, such as technology, finance, and consumer goods.

- Regularly review and rebalance the portfolio to stay aligned with market conditions and company performance.

Compounding plays a crucial role, so staying disciplined and invested through market fluctuations is essential.

Remember, the journey to ₹10 crore isn’t just about the initial investment but about consistently investing, staying informed, and making data-driven decisions. By following this approach, reaching your financial goal becomes a realistic and achievable target.

Have a happy investing.

Suggested Reading:

![Stock Investment For Beginners – A Detail Guide [India]](https://ourwealthinsights.com/wp-content/uploads/2010/11/Stock-Investment-for-Beginners-image.png)