Suppose, a person earns an income of Rs.35,000 per month. The question is, can he build a crore portfolio from his income streams? The short answer is ‘yes.’ Is it difficult? Yes, but with some rules and discipline the end result is easily achievable. So, a person who is ready for this journey, even with a monthly salary of Rs.35,000 can build an investment portfolio of one crore. Read this article for more details. You can also use this calculator for quick answers.

How much time will it take for such a person to build a crore? With my assumptions, it will take around thirty (30) years. But before you lose interest reading this article seeing the 30-year time horizon, here is a positive disclaimer. In 30 years, the person will make Rs.6.6 Crore and not only Rs.1. Crore.

Why we are talking about Rs.6.6 crore, the requirement was only Rs.1.0 crore, right? Because the present value of Rs.6.6 crore after 30 years will be equivalent to Rs.1 crore as of today. Why the present value must be applied in our calculation? I’ll explain that in short, but to know more details about the present value concept, read this piece.

Present Value

The rupee loses its value over time due to inflation. This is the basis of the present value concept. The purchasing power of our Rupee goes down with time. Today (2023), if we buy a liter of toned milk at Rs.54, in 2013 Rs.54 would have bought us about 1.4 Litres. So the same Rupee is buying less. In milk terms, a person sitting in the past (2013) will say, the present value of Rs.54 today is Rs.38 (=54/1.4).

We are doing this calculation today (2023) for a person who is earning Rs.35,000 per month. This person wants to have Rs.1.0 crore as of today’s value. But he is not going to make a crore today. Say, it will happen after 30 years.

So, one crore after 30 years will not be enough, he will need more to get today’s equivalent of a crore. Rupees 6.6 crores, after 30 years, is equivalent to Rs.1 crore as of today.

With the basis of the present value concept now understood, allow me to explain how a person with a Rs.35,000 monthly salary can make one crore.

We’ll use the concept of consistent and regular investing to reach the goal. In India, we better know this method as systematic investment plans (SIPs).

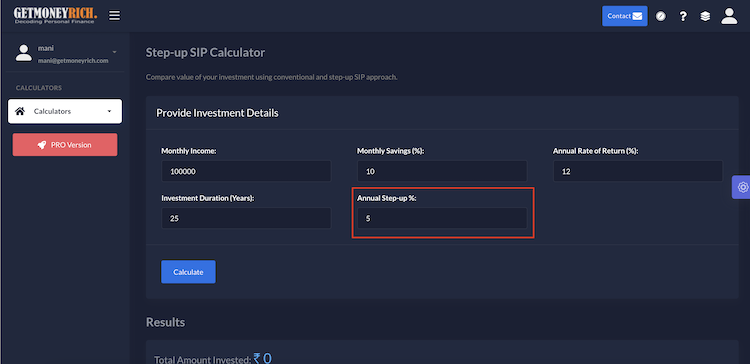

Calculator: How To Build A Crore

Systematic Investing (SIP)

Let’s check the details about how a person with a monthly income of Rs.35,000 can build a corpus of one crore. The person should start investing a part of his income in equity. This process of investing should continue, without a pause, for a very long time.

So, here are the specifics of the investment. The following are the things the person should do to reach the goal:

- Step#1: The starting point should be, investing 5% of the monthly income using SIP.

- Step#2: The SIP should continue undisturbed for the next 30 years.

- Step#3: The SIP should be on an equity fund yielding a return of 16.2% per annum.

- Step#4: The SIP amount should grow (Step-Up) at a rate of 6% per annum.

This way, a person who earns Rs.35,000 per month can build a corpus of about Rs.6.61 crores (equivalent to today’s Rs.1.0 crore) in the next 30 years.

- Rules: First, the person must invest at least 5% of his monthly income (SIP). Second, the SIP amount must grow at 6% each year. Third, selecting the right equity fund that can yield a return of 16.2% in 30 years (which is not so difficult).

- Discipline: The SIP must continue for the next 30 years, non-stop.

How soon a high-income earning individual can become a crorepati?

In our earlier example, we’ve considered an example of a person whose monthly income is Rs.35,000. Suppose the person earns Rs.45,000, how soon he will become a crorepati?

The rules for this person will be the same:

Rules: First, the person must invest at least 5% of his monthly income (SIP). Second, the SIP amount must grow at 6% each year. Third, selecting the right equity fund that can yield a return of 16.2% in 30 years (which is not so difficult).

We can apply these numbers to our Crorepati calculator to get the answer. A person with a Rs.45,000 monthly income can accumulate today’s equivalent of a crore of today in 28.5 years.

Similarly, here are the number of years taken to reach today’s equivalent of a crore with the following income levels:

| Income (Rs./Month) | SIP (% of Income) | Return (p.a.) | SIP Step-Up (%) | Investment Duration (Yrs) |

| 35,000 | 5% | 16.20% | 6% | 30.0 |

| 45,000 | 5% | 16.20% | 6% | 28.5 |

| 55,000 | 5% | 16.20% | 6% | 27.2 |

| 65,000 | 5% | 16.20% | 6% | 26.1 |

| 75,000 | 5% | 16.20% | 6% | 25.2 |

| 85,000 | 5% | 16.20% | 6% | 24.5 |

| 95,000 | 5% | 16.20% | 6% | 23.7 |

| 1,00,000 | 5% | 16.20% | 6% | 23.4 |

| 1,25,000 | 5% | 16.20% | 6% | 22.0 |

| 1,50,000 | 5% | 16.20% | 6% | 20.9 |

| 1,75,000 | 5% | 16.20% | 6% | 19.9 |

| 2,00,000 | 5% | 16.20% | 6% | 19.0 |

As compared to a person who earns Rs.35,000 per year, a person who is earning 5 times his income (Rs.2.0 Lakhs per month) also takes about 19 years to reach the goal.

So, the point is, that reaching the goal of a crore portfolio takes time. It is also not so easy for a person who is earning five times our income. For example, a person who earns about Rs.10 Lakhs per month will also need about 9.5 years to build a Crore portfolio.

How To Build A Crore Portfolio Faster?

Our monthly income in a way is not in our control. I mean it is kind of constant, not a variable. It can grow with time, but probably only once at the end of the year. So, if one’s objective is to become a crorepati faster, he/she cannot do so by increasing the income. Other things must be tried to get to the goal earlier.

What are the other things? If we look at the variables of our Crorepati calculator we’ll get the answer. Following things we can do to become a crorepati faster:

- Invest More Each Month: In our earlier example, we have assumed investments as only 5% of the monthly income. As per my experience, practically this number can go as high as up to 8%. This is true for investors in the age bracket of 20 to 40 years of age. For people above this age, the person can go beyond 10%.

- Grow the SIP Faster (Step-Ups): In our example, we’ve assumed the Step-Up percentage as only 6%. I’ve selected this number taking reference to the average inflation rate that prevails in India. But for most of us, step-ups up to 7.5% each year is practically possible.

- Invest Aggressively in Equity: In our example, we’ve assumed an average rate of return in the long term as 16.2%. With the time horizon we are speaking about (above 10 years), this value can go up to 18% per annum. Investing in direct stocks can fetch higher returns. One can also invest in quality flexi-cap or small-cap mutual funds to yield higher returns.

With these three variables in our control, we can get to our goal of becoming a crorepati faster.

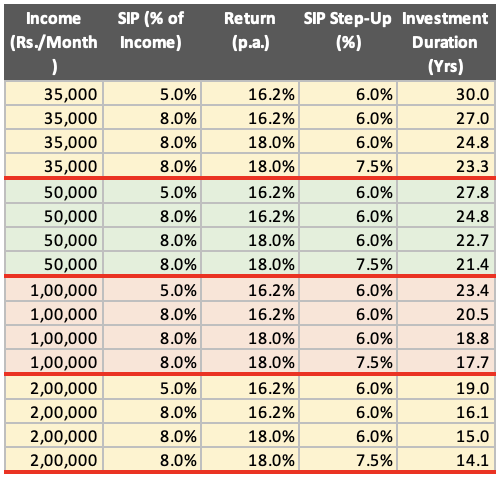

Check the below table that highlights how fast a person with a Rs.35,000 monthly income is able to build a core portfolio by altering a few variables. For example, if the person decides to invest 8% of monthly income at 16.2% with a step-up of 6%, he will achieve the goal in 27 years (instead of 30 years).

Similarly, by investing 8% of monthly income (Rs.35,000) at 18% with a step-up of 7.5%, he will achieve the goal in only 23.3 years.

A person whose monthly salary is Rs.50,000 can build a crore portfolio in 27.8 years by only investing 5% of income at 16.2% returns with a SIP step-up of 6% each year. If the same person decides to invest 8% of income at 18% with a SIP step-up of 7.5%, he will build a crore portfolio in only 21.4 years.

Have a happy investing.

Suggested Reading: