When a person wants to buy a risk free investment, which is the best investment vehicle? Government bonds will be the best choice. Why?

There are two reasons for it: (a) Government bonds are issued by the central government in India, (b) These bonds are regulated and managed by Reserve Bank of India (RBI).

What makes government bonds risk free is the security of the principal amount, and the certainty of the promised return. A person who wants to invest for long term, but wants to keep it risk-free, Government bonds are the best option.

[Check this mobile app to buy Government Bonds:]

1. Government Bonds

What are bonds and T-bills? These are Securities (G-secs) issued by the government of India to borrow money from investors. Who are investors?

- Big Investors: Banks, insurance companies, mutual funds, trusts, corporates etc. These are called big because their size of investment (in G-Secs) are large compared to small investors. Know more about mutual funds.

- Small Investors: HNI’s, NRIs, HUF members, individuals etc. In this group of people, ‘individual investors’ are the ones where we common men are placed. Read more about Peter Lynch a big HNI investor.

Government borrows money from these investors by offering them G-secs through “auctions“. How the auction is done? Through “competitive bidding” process. We will read more about it below.

In good old days, G-sec market was dominated by big players like banks, insurance companies, mutual funds etc. Small investors stood away from investing directly in bonds. Why?

- First because of the difficult process of investing in bonds. A common man just did not knew how to buy government bonds. The ease with which they can buy stocks, mutual funds etc, Government bonds purchase was not as simple. Read more about how to buy stock online.

- Secondly, because the big players used to deal in much larger volumes, individuals just could not compete with them in the “auction” process. Know if small investors shall invest in debt funds.

2. Government Bonds – Process of Purchase

Before Nov’2017, Government Securities (G-Secs) like bonds and T-bills were virtually non-accessible for common men (small investors). But then RBI started the “Non-competitive Bidding Facility“. This made G-secs more accessible for common men.

Lets understand more about competitive and non-competitive bidding process:

- Competitive bidding: Example: Government issues a bond of Face Value of Rs.1,000, offering an interest @8.0% p.a. In the competitive bidding process (auction), “investors” will quote a price higher than the face value (Rs.1,000). Suppose based on all bids, RBI accepts a cut-off price as Rs.1,060. In this case everyone who has quoted Rs.1,060 or more will get their quoted lot of the bond. [Note: In this case, their yield will be lower than 8.0%. How much lower? 7.54% (=8.0% / 1,060 * 1000)].

- Non-competitive bidding: RBI’s “non-competitive bidding facility” for retail investors like me and you. Small investors just need to access the mobile and web app of NSE.

Know more about this mobile and web-app in Sl #3 below.

3. How common men can buy government bonds?

Small investors like me and you can buy government bonds in India using a mobile app or a web based app of National Stock Exchange (NSE). This app is called “NSE goBID“. Either of these two apps can be used to buy the following:

- Long-dated government bonds: holding time: 5 to 40 year.

- Treasury bills (T-bills): holding time less than 1 year.

Before one can go ahead and buy the government bonds using NSE goBID, the “process of registration” must be completed. But do not worry, everything is online.

To get a better perspective of how/why a common man can invest in bonds, let’s understand why rich and wealthy like bonds.

4. Why wealthy prefer bonds?

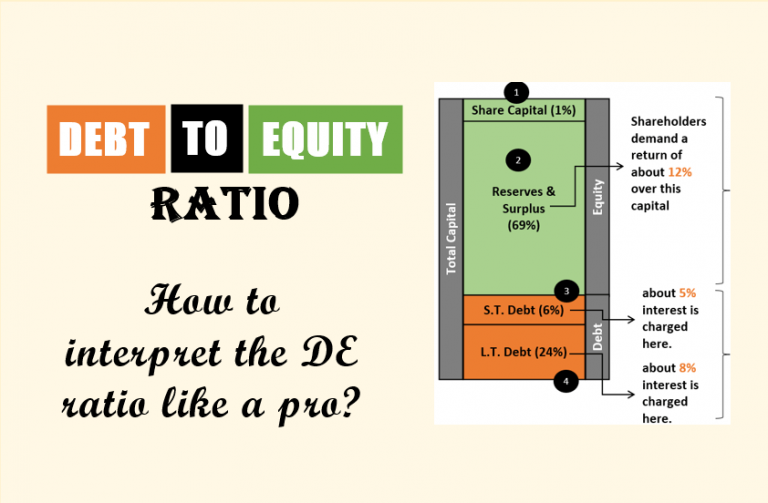

The way high net worth investors think investment is slightly different than majority. They invest money in a backdrop of a condition where they have excess of it (money). How does it make a difference?

As they have money in excess, they can afford to buy bonds and not need it easily for next 10-15 years. This money can stay invested for prolonged period of time, and yield low returns (like 8% p.a.). Wealthy people do not mind it. They invest money mostly for wealth protection.

In the process of wealth protection, if their investment can yield even 8% p.a. odd returns, it is like icing on the cake. Moreover, the returns of the government bonds are almost guaranteed. How? Because they are backed by the Indian government.

Whereas when we (common men) invest money for time horizons like 10-15 years, we think about growth. For such prolonged horizons we will instead invest in equity. Why? Because our objective is wealth creation. Read more about where to invest money for high returns.

So what does this tell us about bonds? It is only for rich and wealthy, right? But there are conditions where bonds may become good investment option for common men as well. Let’s see how…

5. When bonds are useful for common men…

Generally speaking, when common men invest money, they do it for wealth creation. Hence, they often invest with a long term perspective (5+ years). Equity based investment options can give much higher returns than bonds.

In India, a government bond will yield returns between 7-8% per annum even in long term. But a good equity based plan can easily give 14% p.a. in a time horizon of 5+ years. Read more about types of mutual funds and their potential returns.

Hence, there are less takers of Government bonds when it comes to retail investors. But over last decade, even common men have started building their investment portfolio. They are buying range of securities to keep their portfolio well diversified.

On one side when there is equity, there can be no better investment diversification alternative than government backed securities. This is where common men must consider investing in T-secs and government bonds.

Read more about these:

- How common men can pick stocks?

- Best Investment plan for middle class.

- Financial intelligence for common men.

- What financial gurus recommend for common men?

- Investment basics for beginners.

6. What type of Bonds are best for common man?

If common man decides to invest in bonds for income generation, best alternative will be tax free government bonds. Why? Because the interest income generated from such government bonds are free of income tax.

This becomes specially lucrative for those people who are in the maximum tax bracket (30%+).

Suppose there are two bonds available for investing. One is tax free bond, and the other is non-tax free bond. Generally the yield of tax free bonds is less than non-tax free bonds. Which one must select? The decision making should be done based on the following formula:

Net Yield = Bond yield * (1 – your tax rate)

Suppose there is a person’s whose tax rate is 30%. For tax-free bonds, Net yield = bond yield. For non-tax free bonds, net yield = bond yield * (1 – 0.3) = bond yield * 0.7. Example:

- Tax Free Bond

- Yield = 8%

- Net Yield = 8%

- Non Tax Free Bond

- Yield = 10%

- Net Yield = 7%

7. Where to find a list of tax free bonds in India?

On the NSEgoBID app’s dashboard, list of government bonds will be available. Generally all government bonds are of tax free in nature.

Apart from government bonds, there are also corporate bonds. We also know corporate bonds as Company Deposits.

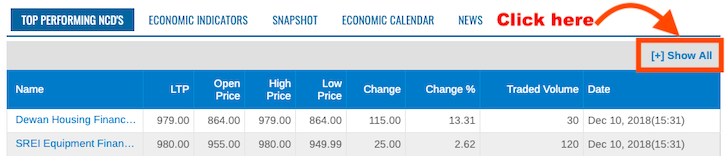

One of the reliable sources to get a list of all tax free bonds is karvy. By default this list is sorted for top performing bonds. Make sure to click the “[+] show all” options to get the list of all bonds.

Following informations of bonds are easily accessable from this list (click on each bond to see the details): Example: Indiabulls Housing Finance Ltd:

- Face Value: Rs.1,000

- Coupon rate (interest): 8.55% p.a.

- Credit Rating: CARE AAA

- Last Price: Rs.1.040

- Allotment Date: 26-Sep-2016

- Redemption Date: 26-Sep-2019.

- Tenor: 36 months (3 Years).

- Trading volume: 20

8. How to sell government bonds?

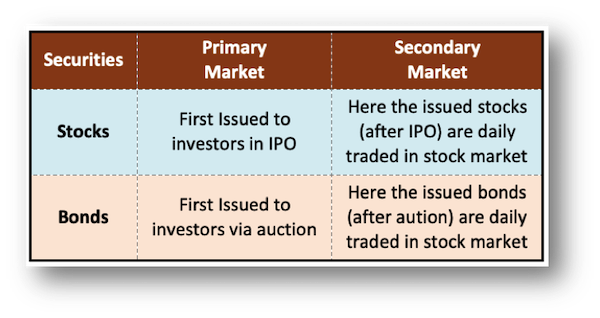

Before we discuss how to sell bonds, let’s understand a close analogy between stocks and bonds.

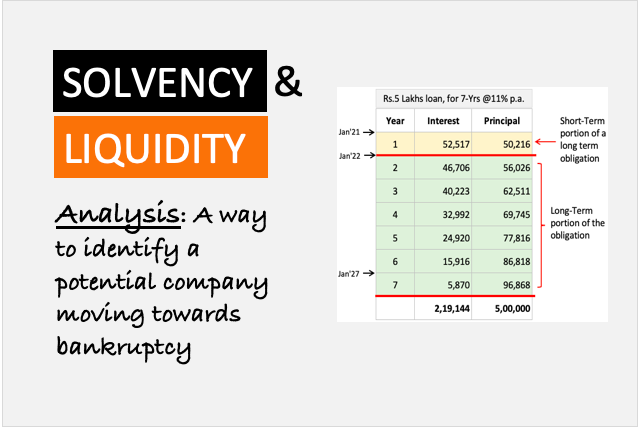

Most of the government bonds are listed in stock exchange (secondary market) for trading. In normal circumstances, a person should buy a government bond, and hold it till its full tenure (example 5,10,15, 20, 30 years as applicable).

But those bonds which are listed in secondary market, can be sold to the interested buyers. What we can understand from this?

- A person can buy bonds both in primary market or in secondary market.

- A person need not hold the bonds for its full tenure. It can be sold in between, to another buyer in secondary market.

Read more about how to make money in stock market.

So this becomes as good as stocks right? Not really. Why? Because of the low trading volumes of bonds in the secondary market. So what? This means, even if one wants to buy/sell bonds in secondary market, there will be less traders available for it.

Low trading volumes are due to low demand for bonds. Moreover, real bond investors generally buy bonds (like tax free, long dated government bonds) for very long holding times. They do not like to sell mid-way. See how low trading volume of ETFs is not a problem.

9. Taxation on tax free bonds?

Yes, income tax may be applicable even on tax free bonds. How? Interest income generated from tax free bonds are tax free. But capital gain from such bonds are still taxable. How there will be a capital gain?

When someone sells their bond holdings to other, in secondary market for profit, this will be treated as capital gains. Example: Buying a bond at Rs.1,000 and selling it in secondary market (before maturity) for Rs.1,050. The capital gain so earned in the hands of the seller is taxable. Read more about income tax planning.

The applicable tax rates are as below:

- Short Term Capital Gain Tax: Income tax will be applicable as per ones tax slab.

- Long Term Capital Gain Tax:

- 10% : Listed Bond with No indexation benefit.

- 20% : Listed Bond with indexation benefit.

- 20% : Unlisted bond & no indexation benefit.

If I buy a sovereign gold bond which is 1yr old from exchange will I get the 2.5% bond interest and if yes on what amount will I get it on market price which I bought or the issue price of the bond. Since it’s gold bond it’s confusing. Could you give some clarity on secondary market purchase. Thank you.

Interest is paid on the issue price. Please note, RBI comes out with Sovereign Gold Bonds Issue every month. This discourages people to buy it in the secondary market unless the bond is available at a discount to the RBI’s issue price.

i wanted to invest in bonds, and i wanted interest in monthly, or quartely, half yearly or yearly which is giving higher interest rate on this i want to invest in govt. bonds, can you pls help me

Tax is part of 80c

If the issuer of corporate Bond is restricted to retailers in primary market, then does the same apply for secondary market

Hello Sir, If I buy a bond trading at 9000 in Secondary Market whose Maturity value is 10000 in 6 months, so in layman terms I will make around 1000 in 6 months time frame holding it till maturity, assuming no credit risk etc?

Buying bond @9,000 which matures @10,000 after 6 months will mean a 1,000 gain. No problem. But bonds are not like stocks. You must ask why a bond is trading at value below its maturity value (issue price)? There can be two main reasons: (1) risk of default by the issuer. (2) lowering yield. According to me, lowering yield will not take the bond price so low. But risk of default is scary. If a company goes bankrupt, bonds holders gets nothing back (no principal, no yield).

I thought if company does get bankrupt, bonds holder get the first share of the company’s liquidated assets. SO we won’t loose all of the money. Correct ???

Yes, lenders get paid before shareholders.

Hello, I want to invest in bonds. Can someone help me with that. My mobile no. is 9820036783

Please write article on How to buy bank bonds ? Is it safe like Government bonds?

Why I am not getting the bonds even applying on the opening date. I am a retired person & is applying for about 10 yrs. Reason for not getting. Any spec is required for allotment. I want the same as investment and not for secondary sale.

I want to buy some bonds for regular income.I m retired person & invest my corpus for safe and regular income for day to day expenses.will you guide.

Suggest some good taxable bonds.

How to invest in government bonds

How to know which bonds payout dividends i.e. interests? Or does all bonds pay out interest?

Yes, bonds pay interest.

hi

how to invest in bank bond, (private placements) where interest rate is more than 11%

Could you please share details about other money market instruments like Treasury bills, Call money, certificate of deposit etc.

I guess we can buy bonds using dmat account as well so please explain the difference between dmat account site and NSE go bid?

Thanx a ton Mr Mani, your articles are so filled with knowledge and so easy to understand that any one can understand any financial topic after reading you. You are so much convincing. It’s a great knowledge gaining experience every time I read your articles. Thanx again.

can a foreigner participate in buying bonds In India or any other country using the above mentioned app or Any other platform??

Sir

I’m Undergraduate Student I want some details.

Can I buy gov bonds ?

Retail investors above 18 years of age shall be eligible…Thanks for posting your query.

very crisp and clear article …. great ….

How does this rule of tax free bonds and non tax free bonds apply for NRIs — Can they also buy bonds ??? Please do clarify

I will request you to read this blog post for more details on your query…https://wp.me/p2j0Hh-aU

Thanks for posting your comment.

Your point on why wealthy people invest in bonds is spot on. Thanks for the awesome post.

Thanks for reading and posting your comment. I really appreciate.

Such a wonderful blog.

What ran in my mind as questions, you asked and answered