Summary:

- This article outlines a simple, step-by-step plan to build a substantial retirement corpus using mutual funds, emphasizing the power of early investing, compounding, and disciplined SIPs to achieve financial freedom. See calculator#1, and calculator#2.

Introduction

Why mutual funds are ideal for retirement?

Imagine a situation like this, you’re on a south Goa beach side resort sipping a cool lemonade drink. Its been your first visit to Goa hence you are also exploring the fantastic city (from Morjim to Agonda). You are spending a quality time with family. You are doing all this without worrying about money. Sounds perfect, right?

That’s the dream a smart retirement plan can help you achieve, and mutual funds can be your best friend who can take you on this journey. For me, since last 15-years, my companion has been stocks, but for most people, mutual funds will be a wiser pick.

Why mutual funds? Because they offer three powerful advantages:

- Diversification (your money isn’t stuck in one place),

- Professional management (experts handle the tough decisions),

- Potential for higher returns (better growth than traditional savings or gold over decades).

And let me tell you about the secret weapon, Starting Early. It will make a huge difference.

Effect of Compounding & Inflation

Even small steps, like a Rs.5,000 monthly SIP in your 20s, can snowball into a massive retirement corpus by 60. How this happens? It happens thanks to the magic of compounding. Money grows on money, and time becomes your greatest ally.

For example, starting today, you invest Rs.5000 per month for next 35 years (year 2060). At 18% per annum return, your corpus will be Rs.17.3 Crores. Start only 3 years late, in year 2060, you corpus will be only Rs10.1 Crore.

Only compounding (growth) is not in action, inflation is also at work. It is making our money weak every passing year. To negate this negative effect of inflation, we need compounding for which we must invest in equity (in mutual funds, stocks, REIts, etc).

Let’s me explain to you the effect of inflation. Suppose you sleep today with Rs.100 in your pocket. You work up from sleep after 25 years. During this period, the average inflation in your country was say 6% per annum. After you woke up, the Rs.100 in your pocket will only be as strong as Rs.21.3.

This is why I say, investing in equity is not an alternative, it is a necessity.

So, if you’re dreaming of a future where you live life on your terms, here’s the good news:

By setting a goal, picking the right funds, and staying disciplined, you can build a big enough retirement fund. How to get there?

Let’s dive into the step-by-step plan.

Table of Contents

Step 1: Define Your Retirement Corpus and Timeline

Let’s start with a simple truth: you can never hit the target if you haven’t set it in the first place.

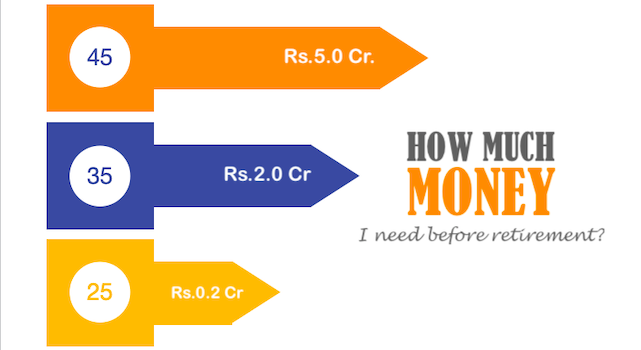

When planning for retirement, your first (and most important) task is figuring out how much money you’ll need, this is called your retirement corpus. Read this article on how much money do I need to retire from job now.

Think of it as a big pot of money that replaces your salary. This is the pot that will let you continue living comfortably (after retirement) without worrying about salary.

1.1 How to Estimate Your Corpus

Start by asking: “If I retired today, how much would I need every month to cover my lifestyle?”

Maybe it’s Rs.50,000 today for essentials like groceries, utilities, healthcare, outings, and a few miscellaneous expenses. Multiply that by 12 to get your annual expenses: Rs.50,000 × 12 = ₹6,00,000.

Now here’s where it we also need to factor the reality of inflation.

Because of inflation, prices of the things we buy rise every year. It means, Rs.50,000 today might feel like Rs.1,00,000 or more by the time you actually retire in 20–30 years. At an average 6% inflation rate, your Rs.6 lakh annual need could double in about 12 years, and quadruple in 24 years.

Quick Tip: Use a simple Excel sheet to plug in numbers. It’ll factor inflation for you. You can also use the below calculator:

Future Expense Calculator

Rule of Thumb for Corpus Size

Let me give you a handy shortcut. Plan for 25–30 times your expected annual retirement expenses.

If you think you’ll need Rs.12 lakh per year by retirement, your target corpus should be around Rs.3–3.5 crore.

This amount is designed to last you 20–30 years post-retirement, while your investments continue to grow (even after you start withdrawing).

1.2 Define Your Timeline

Next, set your retirement age. Commonly, people aim to retire by 60, but it could be earlier or later based on your dreams.

Suppose you’re 30 now and plan to retire at 60. It means, you have 30 years to build your corpus.

This “investment horizon” (years you’ll stay invested) is critical because it influences how much risk you can take and what type of mutual funds you should pick later.

Factor in Lifestyle Goals

Your expenses may not stay static. Think deeply about your future lifestyle needs and plans. New expenses may come-up when you are old and your kids are young.

- Future travel plans.

- Supporting children’s education.

- Healthcare costs (which rise faster than general inflation)

- Dream hobbies (gardening, art, writing, etc.)

All these need to be factored in while estimating expenses.

So Wha is the Outcome of Step 1:

By the end of this step, you should have:

- A target corpus (e.g., ₹3 crore)

- A clear investment timeline (e.g., 30 years)

This two numbers are your goal. They will decide everything that will come next. The’ll guid every investment decision you make from here.

Step 2: Calculate How Much to Invest Monthly

Now that you have your magic number (your retirement corpus) and your timeline, it’s time to answer the big question, “How much should I invest every month to reach that corpus?”

The good news? You don’t need to be a math genius. A simple formula, and the power of compounding, can do most of the heavy lifting.

2.1 How to Find Your Monthly Investment Amount

You’ll need three things:

- Target corpus (from Step 1): Example: ₹3 crore

- Expected annual return from your investments: Reasonable assumption for equity mutual funds: 12-14% post-tax returns over the long term.

- Years left until retirement: Example: 30 years

Now, use a SIP (Systematic Investment Plan) calculator online like below

SIP Calculator

Here’s a simple thumb rule. Approx. Monthly SIP Needed to Reach Rs.1 Crore, assuming the following returns:

| Years to Invest | 12% p.a. | 14% p.a. | 16% p.a. | 18% p.a. |

|---|---|---|---|---|

| 10 years | Rs.43,400 | Rs.38,600 | Rs.34,100 | Rs.30,200 |

| 20 years | Rs.10,100 | Rs.7,700 | Rs.5,800 | Rs.4,350 |

| 30 years | Rs.2,850 | Rs.1,850 | Rs.1,150 | Rs.710 |

So, if you need Rs.3 crore in 30 years, you’ll need to invest just Rs.2,130 per month today (because Rs.710 × 3 = Rs.2,130) at 12% per annum return.

That’s the magic of starting early, Small investments + lots of time = big results

Important: Adjust for Inflation

If you don’t increase your SIP over time, you might fall short. That’s why you should step-up your SIP every year by 5–10%—basically, as your salary increases, your investments should too. I'll sugggest you to read more about Step-Up SIP here. You'll also get a step-up SIP calculator there.

Example:

- Start at Rs.2,130/month now → increase it by Rs.200 next year → ₹2,330/month → and so on.

- This simple habit can boost your corpus by 50–70% over 30 years without any extra strain.

So, what is the Outcome of Step 2? You’ll know what's that monthly amount you must start investing.

Step 3: Pick the Right Mutual Funds

You now know how much you need to invest every month. The next step is choosing the right mutual funds to grow your money safely and steadily.

Don’t worry, you don’t need to become a stock market expert. Just follow a few smart principles, and you’ll be way ahead of the crowd.

3.1. Choose the Right Fund Category for Long-Term Wealth

Since retirement is usually 10, 20, or even 30 years away, you want growth, not just safety.

So, the best category for long-term retirement goals is definitely "Equity Mutual Funds" (especially diversified ones)

Avoid being overly conservative (like only investing in debt funds). If you have 10+ years to invest you need not play safe. This is a very long investment horizon, and the worst return you can expect for quality equity funds in this period is 12%. So, do not bother, go for equity.

Why? Because equity, despite short-term volatility, has always beaten inflation and grown wealth in the long term.

3.2. Stick to These Types of Equity Funds

Here’s a simple, no-stress portfolio:

| Fund Type | Plan Type | Allocation | Why |

|---|---|---|---|

| Index Funds (Nifty 50, Nifty Next 50) | Direct (not Regular) | 50–70% | Low cost, market-matching returns |

| Flexi-Cap Funds | Direct (not Regular) | 20–30% | Active management across large/mid/small caps |

| Mid-Cap Funds | Direct (not Regular) | 10–20% | Higher growth potential (with some volatility) |

Optional add-ons (once you're confident):

- International funds (up to 10%): for global exposure

- Small-cap funds (up to 5%): only if you can handle high ups and downs

3.3. How to Actually Pick Funds

What I look into funds (schemes) when I'm in a look out for one:

- 4-star or 5-star ratings (from platforms like Value Research or Morningstar)

- 7+ years of consistent performance

- Low expense ratios (compare and pick the fund with lowest expense ratio)

- Big fund size (at least Rs.500 crore AUM)

What To Avoid:

- Fancy "themed" funds unless you understand them deeply

- Chasing last year’s top performers

- Funds with frequent 'Fund Manager' changes

3.4. Keep It Super Simple

You don’t need 10–15 funds. Just 2–3 well-chosen funds can create all the diversification you need.

Example Simple Portfolio:

- Nifty 50 Index Fund – 60%

- Flexi-Cap Fund – 30%

- Mid-Cap Fund – 10%

Set up SIPs in these, and you’re good to go.

What is the Outcome of Step 3: You’ll have, a simple, balanced retirement portfolio that grows steadily over time. You are investing in a a shortlisted right types of funds for your goal (retirement for which you have about 10-30 years time).

Step 4: Automate and Forget (SIP Setup)

You’ve picked the right mutual funds. Now it’s time to make investing automatic so that you can build wealth without even thinking about it (in auto mode).

The easiest way? Set up a SIP in your selected mutual fund scheme.

4.1. What Is a SIP?

A SIP is like setting up a monthly subscription, but instead of paying for Netflix, you’re paying to a mutual fund house. These funds houses takes your money and accumulate units of your mutual fund. Every month, a fixed amount gets auto-invested into your chosen mutual funds.

- No manual work.

- No timing the market.

- No forgetting or skipping.

Result: Your money grows steadily, month after month.

4.2. How to Set Up a SIP

Here’s the quick 3-step playbook:

- Choose Your Platform:

- You can invest directly with AMC websites (e.g., HDFC, ICICI, etc.)

- You can also invest through your apps (Groww, Zerodha Coin, Paytm Money, etc.)

- These days, our bank’s investment portal can also help us buy mutual fund schemes.

- Select Your Funds:

- Pick the 2–3 funds you shortlisted in Step 3.

- Set Up Monthly SIPs:

- Enter the SIP amount for each fund (based on your Step 2 goal).

- Choose a date, ideally it should be just after your salary credit date.

- Enable auto-debit from your bank account.

Note: Always, set the SIP date 3–5 days after your salary date to ensure you always have enough balance.

4.3. Start Small If Needed, But Stay Consistent

If you’re feeling tight on cash, start with a smaller SIP (even Rs.1,000 per fund is fine). You can increase it every year (we’ll talk about that in the next step!).

What matters most is starting, and letting the power of compounding do its thing.

4.4. Why Automation Wins

- You can avoid procrastination.

- You invest regularly — in good and bad markets.

- You stay emotionally detached (no panic selling!).

- You build serious wealth with ZERO stress.

It’s truly "set and forget" wealth building.

So, what is the outcome of Step 4? You’re officially on autopilot. If you stay invested, your journey to build a big retirement corups has started. Your SIPs are live. Money is working for you silently, month after month.

Step 5: Increase Your SIP Every Year

You’ve set your SIPs. You’re investing automatically. Now, here’s how to supercharge your wealth-building — without feeling any pain. It’s called a SIP Top-Up (or Step-Up SIP).

5.1. What’s a SIP Top-Up?

A SIP Top-Up is simply increasing your monthly investment every year, as your income rises.

Let's understand it using an example:

- This year: Rs.5,000/month SIP

- Next year: Rs.5,500/month SIP (+10%)

- Year after: Rs.6,050/month SIP (+10%)

…and so on.

Small increases → Massive wealth over time. In this case, not only the returns are making your capital grow, you yourself are contributing more each year. This way, you are turbo-charging your wealth compounding speed.

5.2. Why Top-Up Your SIPs?

- Your salary usually goes up every year.

- Your expenses also grow — but so should your savings.

- Small, regular bumps in SIPs multiplies your final corpus dramatically.

Example:

- Rs.5,000/month SIP for 20 years @12% returns → Rs.50 lakh

- Rs.5,000/month SIP + 10% increase every year → Rs.1.1 crore

Just by increasing a little every year, you can more than double your wealth.

5.3. How to Set It Up

Most platforms today allow you to auto-top-up your SIPs at the time of starting them. When setting up your SIP, look for the option:

"Enable SIP Top-Up" or "Increase SIP amount annually"

Then simply choose:

- Top-Up Amount: Fixed Rs.500/Rs.1,000 OR

- Top-Up %: 5%, 10%, 15% per year (recommended: 10%).

If your platform doesn't support auto-top-up, just set a calendar reminder once a year (on your birthday, salary increment month, etc.) to manually increase your SIPs.

5.4. Keep It Sustainable

Don’t overcommit. Top-up only by an amount that feels easy, so you don't ever feel the pinch. Even a 5% annual increase can have a big effect. Remember, consistency can beat aggression over time.

So, what is the outcome of Step 5?

- Your SIPs now grow automatically year after year.

- Your investments stay ahead of inflation.

- You reach your financial goals faster — and bigger!

That's the final key — now your retirement plan is simple, automatic, growing, and nearly unstoppable.

Conclusion

Retirement planning doesn't have to be complicated. You don’t need fancy degrees, market timing skills, or loads of money. You just need a simple, consistent plan, and you've built one.

- You've figured out how much you need.

- You've chosen smart, simple investments.

- You've automated your SIPs.

- You've added a Top-Up to supercharge your growth.

Now, your job is easy: Trust the process and stay consistent.

There will be market ups and downs. There will be new "hot tips" and scary news. Ignore all the noise.

The real secret? Time + Consistency = Wealth.

Let’s go build it.

"Money grows quietly when you stop checking and start trusting."