A valued reader recently reached out to me with a question: “Should I sell my stocks to meet a personal financial need.” This dilemma is one that many investors face at some point in their investment journey. The decision to sell stocks, especially those acquired at a low cost like blue-chip companies, can feel particularly difficult. On one hand, there’s the immediate need for funds, but on the other hand, there’s the fear of losing the accumulated wealth and future growth potential.

It’s a tricky balance, deciding whether to liquidate investments for short-term needs or find alternative ways to manage without disrupting your long-term financial goals.

In this post, we’ll explore how to approach this decision thoughtfully, drawing on both personal experience and practical insights.

Topics:

1. The Readers Question

A valued reader, Prasad, recently shared his concern with me: “I’ve been following your blog and using the Stock Engine since 2019. I’ve made good profits from my investments. Now, I need money for a personal reason, and I’m getting confused. If I sell my stocks, I’m worried that I won’t be able to repurchase them at the same price, especially my blue-chip holdings like Infosys (INFY), which I bought at an average price of ₹700. What should I do?”

Prasad’s concern is something many investors struggle with. There is a the fear of losing future gains by selling profitable stocks. The worry is that selling now might mean missing out on the opportunity to buy back high-quality companies at lower prices in the future.

It’s a valid concern, especially when it comes to blue-chip stocks, which tend to grow steadily over time.

This decision can feel like choosing between two priorities, “short-term liquidity needs” and “long-term compounding required for wealth building.”

2. Understanding the Dilemma

The decision to liquidate investments, to take care of immediate needs, can be both emotionally and financially challenging.

- On one hand, there’s the immediate need for cash. Whether it’s for an emergency or personal requirement, at that moment, selling feel like the only option.

- On the other hand, there’s the emotional tug-of-war happening in the mind. Letting go of stocks that one has accumulated since many past years is not easy. Stock that have performed well, especially blue-chip companies purchased at attractive prices, selling them is not psychologically as easy.

The fear of regret is real. What if I sell now and can’t buy back at the same price?

This thought often haunts long-term investors. When stocks are bought at lower prices and have since appreciated, it is particularly hard to sell these stocks.

It’s difficult to part with assets that have shown strong growth. Why? Because we know that in the future, these same stocks might not be available at those prices again (ever).

This situation isn’t unique to one investor. Many long-term investors face this dilemma at various points.

Whether it’s due to financial urgencies or a shift in priorities, all investors face this dilemma at some point or the other. The struggle to balance present needs with future wealth accumulation is something most will experience at some point in their investing journey.

3. Assessing the “Criticality” of Your Need

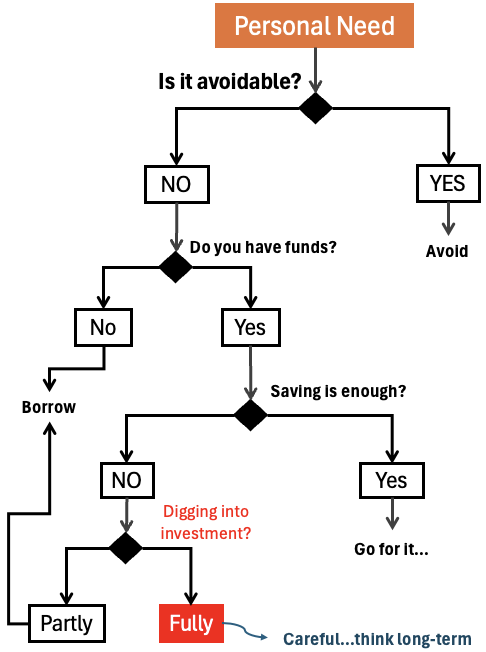

When faced with the decision to sell stocks for personal reasons, the first step is to assess how critical the need is.

Not all financial needs are urgent. They can be delayed or managed in other ways. Understanding the urgency of the situation will helps to take a wise decision. In our mind, we must know which need is uncompromisable and which can be avoided or can be met in other ways.

Once this clarity in in place, we need to then decide about whether to liquidate our investments or find an alternative solution.

Quick tip, ask yourself these key questions:

- Can I delay this need or manage it in other ways? Consider whether there are other ways to meet the need, such as finding a temporary income source or reducing non-essential expenses. This may help you avoid selling investments that are intended for long-term growth.

- What are the long-term consequences of selling now? Selling investments could potentially disrupt your financial goals, especially if you’re liquidating stocks that have shown consistent growth. Think about how it will impact your wealth-building journey in the future. Could this decision affect your long-term financial security?

By carefully evaluating the urgency of your need and the potential consequences.

This way you can decide whether selling stocks is the best course of action or if there are other ways to manage the situation.

4. Personal Experience

Over the years, I’ve faced the difficult decision of liquidating a significant portion of my portfolio twice.

I starting building my stock portfolio from 2008. Since then, there were two instances where I had to sell a part of my portfolio holdings to manage my needs. Back then, it looked like an “uncompromisable” priority. Today, in the hindsight, I will say that I should not have sold. There were were other ways to manage the situation, but my immediate “attraction for cash” made me liquidate my investment.

Looking back, I can see how those decisions impacted the growth and hence the size of my stock portfolio. While I did manage to meet my personal requirements at the time, I often reflect on what could have been had I made a different choice.

The stocks I sold, some of which were quality companies, have given more than 10X returns since then. Had I kept them, my portfolio would likely be much more substantial today.

What I’ve learned from these experiences is that while immediate needs can feel overwhelming, it’s essential to consider the long-term effects of selling investments.

Quality stocks bought at right prices has a strong growth potential. If I could go back, I would have explored alternatives, and not sold by holdings.

Liquidating a portfolio can feel like a quick fix, but it’s not always the best long-term solution.

The key is to think carefully, weigh all options, and always keep your long-term financial goals in mind.

5. Balancing Immediate Needs with Long-Term Wealth

Protecting wealth accumulated over the past years is crucial for achieving financial independence.

One of the most powerful tools in wealth building is compounding.

Let’s consider an example: If you invest Rs.2 lakh today and achieve a 18% annual growth rate (CAGR), in 20 years. This investment, in these 20 years, would compound to become Rs.1.9 crores.

The longer we stay invested, the more compounding amplifies our returns.

Selling investments prematurely disrupts this growth, potentially costing us significant wealth over time.

Urgent needs can cloud judgment. At that time, even small-small urgencies make it easy to overlook the long-term impact of liquidating investments.

The pressure of immediate financial requirements can push us to choose short-term relief over future security.

Recognizing this bias is the first step toward making better decisions.

To strike a balance:

- One-way Traffic: Always build your stock portfolio with this mindset that whatever money goes into it will not come out. Whatever does inside, stays there for at least 20-25 years. Read: Timing the market vs time in the market.

- Evaluate Alternatives – Can you take a loan or manage the need through temporary adjustments?

- Partial Liquidation – If you must sell, consider liquidating only a small portion of your holdings.

- Emergency Fund – Build a fund for future emergencies to avoid selling investments abruptly.

Balancing today’s needs with tomorrow’s growth is key to sustaining long-term wealth.

Conclusion

Deciding whether to sell stocks for personal needs is never easy.

It’s a balance between addressing immediate demands and safeguarding long-term financial goals (financial freedom).

From my own experience, I’ve realized that while urgent situations can feel overwhelming, selling investments should be a carefully considered decision, not an impulsive reaction.

Often, the fear of missing out on future gains is valid, but it’s equally important to recognize when a financial need is genuinely critical.

It is more important for people like me and you have only learnt and built a consumer mindset. We’ve not been taught to think like a long-term investors. Had this been the cause, the choice between “immediate needs” and “financial freedom” would have been obvious.

We all want to become rich, but we do not realize that the path to reach there must pass through financial independence.

Ultimately, the decision boils down to clarity and foresight.

Assess the true urgency of the need, explore alternatives, and weigh the long-term consequences. Selling a part of your portfolio might be necessary at times, but preserving your wealth-building path should remain a priority.

Personal challenges are part of the journey. While it’s wise to protect your investments, it’s also important not to jeopardize your financial well-being if there are no other options. If you do sell, have a plan to rebuild those holdings once your situation stabilizes.

Remember, life happens, but your commitment to financial growth can still stay intact.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.

![Wealth Building: How To Build Wealth in 30s [Wealth Formula]](https://ourwealthinsights.com/wp-content/uploads/2010/07/Wealth-Building-Image.png)