Starting the journey of stock investing presents a crucial decision for beginners. Either one can rely on expensive expert advice or can master the art of Do-it-yourself (DIY) stock investing. The appeal of experts is often limited by their high costs and the difficulty of finding trustworthy guidance, especially for people investing small amounts each month.

Think about the three main concerns: cost, availability, and reliability when seeking expert advice. The conclusion becomes apparent—DIY stock investing stands out as the more viable and empowering option. In this article, I’ll try to unravel the intricacies of identifying promising stocks without depending on external experts.

While there are online tools like Stock Engine available that can do stock analysis, this guide takes a step back. It will emphasize the essence of recognizing good stocks. We’ll learn how to identify good stocks by looking at by focusing on the fundamental aspects that truly matter.

A person who can learn this will need no elaborate tools. We’ll learn a straightforward approach to understanding a company’s potential by dissecting its key indicators.

Let’s demystify the process of stock picking. We’ll explore the simplicity behind identifying stocks poised for growth. In the following sections, we’ll delve into the core parameters that define a good stock.

Point #1. The Need To Identify Good Stocks By Oneself

In stock investing, the pull for expert advice often collides with practical challenges associated with it. With experience in the stock market, I can say that stock investing is not always smooth sailing. To negate this risk of the stock market, people take the help of experts, but it comes at a cost. Financial advisors charge fees, and not many of us would like to spend much on it, right?

For individuals investing modest sums monthly, these costs can significantly eat into potential returns. It’s a financial reality that demands attention.

I have experienced the pitfalls associated with relying on external experts. This is why embracing a do-it-yourself (DIY) approach holds undeniable advantages.

Beyond the monetary aspect, there’s also an issue of availability. Experts, renowned as they may be, might not always be accessible to everyone. Their time is a valuable commodity, and not all investors, especially those starting with smaller amounts, can secure personalized advice. The disparity in accessibility creates a gap, leaving many investors without the tailored guidance they seek.

Another challenge is the reliability of expert recommendations. I’ve seen so-called stock advisors who find it hard to even read the financial reports of companies. As market dynamics are unpredictable, relying solely on such experts can leave us vulnerable. When I started investing in stocks in 2008, I made a point to do stock analysis and stock pickings myself. Hence, through my blogs, I promote the concept of DIY stock investing.

What is the solution?

Enter DIY stock analysis and investing – a pragmatic solution.

By learning to identify good stocks independently, investors can bypass the costs associated with expert advice. This way we can also overcome the challenges of availability and potential reliability issues.

DIY investing is a both practical and cost-effective approach. Once we get trained to practice DIY investing, we can make decisions based on our research and understanding. The internet also gives us access to financial information making stock analysis comparatively easier. We can empower ourselves to identify good stocks on our terms.

Practical tips for successful DIY investing include conducting thorough research on a company’s fundamentals, understanding its competitive landscape, and keeping an eye on market trends.

Diversification and a long-term perspective can also be crucial for weathering market fluctuations.

Point #2. Basics of DIY Stock Analysis To Find Good Stocks

Stock investing becomes multiple times easier if one can get access to an online stock analysis tool. These tools can offer a quick overview, acting as a compass in the vast sea of stocks. However, it’s crucial to emphasize that while tools can be supportive, the essence lies in understanding the fundamentals of the business behind the stocks.

With my experience in the stock market, I’ve found that relying solely on tools can sometimes lead to a superficial understanding. Hence, the emphasis remains on grasping the fundamentals. Tools can provide data, ratios, trends, etc. But it’s the investor’s comprehension of concepts like growth, profitability, and management quality that truly sets the stage for successful DIY investing.

Recognizing good stocks doesn’t necessitate delving into complex jargon. Instead, it’s about developing a straightforward approach around understanding a company’s core numbers. By focusing on parameters like growth, profitability, and management efficiency, investors can sift through the noise and identify stocks with potential.

While tools may offer a quick glimpse, the real power lies in comprehending why certain stocks stand out.

2.1 Which are good stocks?

A growing and profitable company run by able managers, does it make a good buy? No, the stocks of the company must also be available at a discounted price. Only then, it’s a good buy.

So for us, there are six parameters to focus on:

- How fast the company will grow?

- How profitable is the company’s business?

- Is the company run by able managers?

- The company’s stock is undervalued or overvalued?

- Is the financial health of the company sound enough?

- Does the company enjoy a competitive moat?

The answer to these four questions can help us identify good stocks. We will see how to give answers to these four questions. However, there is a hurdle related to the practical application of this knowledge. We will learn more about it later and how I manage this issue.

But before that, allow me to explain the parameters based on which we can identify good stocks.

Point #3. Parameters for Identifying Good Stocks

I believe that the foundation of any stock is based on the following six parameters of its underlying business. It starts with the growth prospects, quality of its management, profitability of its business, the financial health of the company, and its economic moat. When all these five factors are in place, and its share price valuation is also favorable, it makes the stock worth considering for investment.

When I was coding the algorithm of my Stock Engine, I was sure that I would include these six characteristics to develop an Overall Scoring system for all of my stocks.

The overall score is a comprehensive evaluation derived from six crucial aspects of a business. Each component is individually quantified using a scale of zero to five, with zero being the lowest and five being the best score. The scores are then amalgamated using an algorithm to produce an overall score ranging from 0% to 100%. An overall score of 75% or higher, coupled with undervaluation, is considered indicative of a good stock.

The holistic nature of this scoring system aims to provide users with an “easy to comprehend” assessment of a company’s fundamental strength compared to its peers.

Let’s discuss the six parameters in more detail.

#3.1 Future Growth Prospects

How fast can a company grow on its own? The answer is in the term called self-financeable growth rate (SFG). It is a growth rate at which the company will not need external financing to fund its growth. To know more about it, check this post on SFG.

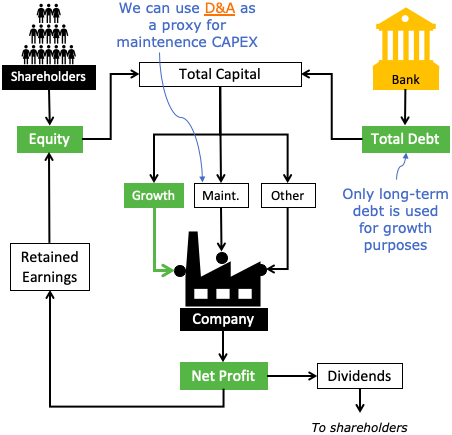

In this article, I’ll keep it simple. Generally speaking, companies need capital to grow. But from where the capital will come? There are two sources, net profit (equity) and borrowed money (LT debt).

The infographic shown above tells us about the portion of the profit (PAT) available for the company’s growth. The company can’t use all of the PAT for its growth. Why?

The company will pay dividends to its shareholders. It will also need capital to do the necessary, working capital management, maintenance, and replacement of buildings, machines, etc. The funds are also required to make the company grow over time. We can use D&A (Depreciation and Amortization) as a substitute for the Maintenance Capex.

The profit available for growth (Pg), also can be called free cash flow (FCF), is shown below:

Pg = Net Profit – Dividends – Maintenence Capex (D&A)

What is Pg or free cash flow (FCF)? The residual profit remains in the company’s hands after making the necessary cash adjustments for dividend and maintenance capex.

The residual profit (Pg) gets added to the company’s total capital. The higher the Pg (or FCF), the more is capital available for future growth. The percentage of the Pg that gets added to the company’s capital depicts a company’s future growth rate.

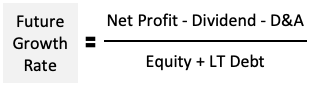

We must also remember that only long-term debt can contribute to the future growth of the company and not the short-term debt. In terms of formula, the future growth rate can be expressed as below:

Future Growth Rate = Pg / (Equity + LT Debt)

#3.2 Quality of Management

We can consider a company’s management doing quality work if the following three things are happening in tandem:

- (a) Sales Growth: Open the last 5 years’ P&L accounts of a company and check its sales numbers. You would like to see a growing trend. Growing sales over the long term is not an easy task. It takes a lot of initiative from the top management of a company to achieve it.

- (b) EPS Growth: Sales growth must also translate into benefits for the shareholders. It is less likely to happen if EPS is not growing. Now, if sales are growing and EPS is not growing, there are two reasons for it. Unproportional expense growth or liquidation of shares in the market. Good managers always keep both these parameters in firm control. The bigger purpose is to ensure shareholder value.

- (b) Profitability is Stable: The management has to work hardest to maintain or improve the company’s profitability. For me, one of the best indicators of the quality of the management is the stable or increasing ROIC and ROCE of a company.

#3.3 Profitability of The Underlying Business

The point of doing a profitability analysis of a company is to check if it is a value creator or value destroyer. How to judge it? By comparing the company’s profitability with its cost of capital.

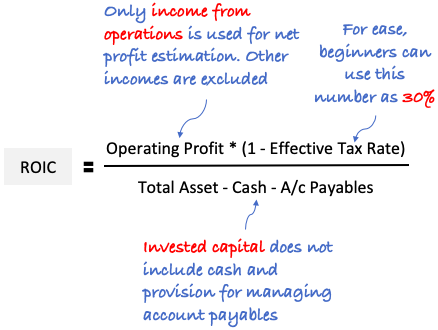

For a company to be a value creator, its profitability must be higher than its cost of capital. Which metric is best to judge the company’s profitability? For this purpose, one of the better ratios to be used here is Return on Invested Capital (ROIC).

The higher the ROIC (above the cost of capital-WACC) the better is the company for investment consideration. Why? Because it is a business that can be said to be investment-worthy.

#3.4 Financial Health

Analyzing the financial health of a company is a critical aspect of stock investing. It involves a comprehensive examination of key financial indicators. Let me share with you how it can be done by oneself.

- Firstly, open the balance sheet to assess the company’s liquidity, solvency, and overall financial position. Examine the current ratio and quick ratio to understand its ability to meet short-term obligations. A healthy balance between assets and liabilities is crucial.

- Second, open the profit and loss account to gauge the company’s revenue, expenses, and net income trends. Consistent revenue growth and prudent expense management contribute to financial stability. Assess the net profit margin to understand how efficiently the company converts revenue into profit.

- Thirdly, pay attention to the cash flow statement to evaluate the company’s ability to generate cash from its operating activities. Positive and growing operating cash flow is indicative of a robust financial position.

Consider the debt levels by analyzing the debt-to-equity ratio. A lower ratio signifies lower financial risk. Additionally, assess the interest coverage ratio to ensure the company can meet its interest obligations comfortably.

Incorporate these aspects into a holistic analysis of a company’s financial health. By understanding the correlation and impact of these key indicators, investors can make informed decisions. This way we can steer clear of companies with potential financial vulnerabilities.

Suggested Reading: Read about the Altman-Z score: A way to find potential bankrupt companies.

#3.5 Economic Moat

Analyzing whether a company possesses an economic moat is necessary. It involves a thorough examination of its competitive advantage and sustainability. My Stock Engine employs a multifaceted approach to assess the presence of an economic moat.

- Firstly, it investigates the company’s market share and dominance in its industry. A strong market share can be indicative of a competitive advantage. Consider how easily new entrants could challenge the company’s position. Possessing a unique product or service widens the moat of a company.

- Second, examine the company’s brand strength and customer loyalty. A recognizable and trusted brand can create a barrier to entry for competitors. Evaluate the customer switching costs – if it’s high, it fortifies the economic moat.

- Thirdly, assessing the company’s cost advantages can also give an idea about the moat. Whether through economies of scale, superior technology, or exclusive access to resources, companies can build a wide moat. The quality of leadership can act as a formidable moat.

- Fourth, we can analyze the regulatory environment, patents, or intellectual property rights associated with the company. Legal protections can create barriers for competitors, strengthening the company’s position.

By combining these elements, investors can gain insights into whether a company has a sustainable economic moat. A robust moat not only protects the company from immediate competition but also ensures long-term resilience and value for investors.

#3.6 Price Valuation

A growing and profitable company run by able managers might sound impressive, but more is needed to make it investment-worthy. Everything has a fair price. Onions cost about Rs.20 per kg (normally), and gold’s price is about Rs.62 Lakhs per kg. Even though onion has its utility, no one will buy onions at gold’s price, right?

Similarly, a company’s stocks may look impressive upon fundamental analysis, but it is not purchasable if they are trading at overvalued prices. How to check if the company’s stock is undervalued or not?

We can follow a three-step approach:

- Step#1: Calculate the stock’s P/E and PEG ratio. If the stock’s P/E ratio is between the 15-20 range, it may not be overvalued. But a surer indicator of undervaluation is a PEG ratio is 1.2 or below.

- Step#2: Plot a five-year PE chart. As shown in the example, the PE of the company grew from 20 levels to 40 levels in the last 5-Yrs. Rising PE is a clear sign of potential overvaluation. As an investor, we must always be wary of such fast-rising PE charts.

- Step#3: In this step, we will compare the PE ratio of peer companies. This exercise will give an approximate idea of the current PE levels of the industry. In my Stock Engine, stocks of similar companies in the sector are compared. Comparing PE like this gives a fair idea of the relative price valuation of the stock in consideration.

What experts do extra is the estimation of the intrinsic value of the company. Various valuation models can be used to estimate the fair price of a company’s stock price. My Stock Engine algorithm uses a few models like the DCF model, Net Current Asset model, absolute PE method, etc. Comparison of stock price with its intrinsic value is the most reliable way to judge a company’s price valuation.

However, not many have the know-how to do this calculation, so the above three steps are reasonable alternative solutions.

A Practical Hurdle

Analyzing the vast sea of stocks poses a practical hurdle for any investor. In the Bombay Stock Exchange (BSE) there are about 5000 number stocks. Even the best of software will find it hard to analyze the historical data of all 5000 stocks.

So, the challenge lies not just in identifying good stocks but in doing so from a pool of thousands of stocks. My strategy involves the use of a suitable stock screener. In stock investing, they are indispensable tools that efficiently narrow down the list of potential stocks based on specified criteria. Stock screening is a way to focus on a manageable watchlist.

As a process, I begin by defining specific parameters aligned with my investment psychology. This includes key metrics like growth, price valuation, strong fundamentals, etc. In my Stock Engine, I’ve built pre-built screening themes that help me to rapidly screen my stocks.

The screener stock goes into my watchlist.

Once I have this initial watchlist, I try to do an in-depth analysis of each. This involves scrutinizing the company’s financial reports, understanding its industry position, and evaluating management effectiveness. It’s a meticulous and time-consuming process. But again, my Stock Engine makes things easier for me estimating the intrinsic value, calculating the overall score, plotting price charts, answering a few fundamental questions about stocks, etc.

My approach to overcoming the practical hurdle involves leveraging technology to swiftly narrow down the field. My Stock Engine isn’t a replacement for thorough analysis but rather a strategic tool. It tends to enhance my efficiency in identifying stocks with the promise of long-term value.

Conclusion

In our endeavor to identify good stocks, we must realize that this process is not as complicated as we think. But the only challenge is to gain the right know-how first before buying stocks. I encourage my readers to go for their judgment and embrace the power of DIY stock analysis.

Our ability to evaluate a company’s growth, profitability, management, and price is a skill that evolves with each investment. Trust the process and understand that learning from both successes and setbacks is integral to growth in the stock market.

We must always consider maintaining a watchlist of potential stocks based on unique criteria. We can use tools like a stock screener wisely. This way we can let it guide us in the initial selection. However, we can never underestimate the value of delving into the nitty-gritty of a company’s performance.

Have a happy investing!

Your unique perspectives can contribute to the collective wisdom of this blog. So, kindly share your point of view in the comment section below. Don’t forget to explore other related articles on our site, where you’ll find more practical tips, in-depth analyses, and valuable insights.

Suggested Reading: