A majority of my blog readers have a long-term investment mindset. Hence, I often get this type of question that says, how to invest large sums of money for a long-term horizon? I’ll try to answer this query from my perspective. I’ll speak as if I’ve to walk the talk. I also realize that not all of my readers are as inclined to direct stock investing as me, so I’ll write with a wider perspective.

Investing large sums of money can be a daunting task, especially when the investment horizon is long-term, like 15 years or more. It requires a lot of research, an understanding of market trends, and patience.

However, investing wisely can help one achieve financial security and meet long-term financial goals.

In this quick guide, we will read how to invest large sums of money for a long-term horizon.

Point #1: Risk Analysis and Management

Risk analysis is the process of identifying potential risks that may affect the investment portfolio. There are several types of risks, including market risk, inflation risk, credit risk, liquidity risk, and geopolitical risk. It is important to understand these risks and manage them effectively to minimize potential losses.

Knowing about all these risks can be intimidating for retail investors. Hence, the easiest way to manage the majority of these risks is through portfolio diversification. Diversification means spreading your investment across different asset classes, such as stocks, equity funds, debt funds, gold, cash, real estate, etc. Diversification helps to reduce the risk of loss, as different asset classes may perform differently under different market conditions.

Another way to manage risk is to allocate assets based on risk tolerance. Risk tolerance refers to the level of risk that an investor is willing to take. It is important to determine your risk tolerance before investing to avoid taking on too much risk or too little risk.

Determining Risk Tolerance

A retail investor should determine his/her risk tolerance before investing. Risk tolerance refers to one’s ability and willingness to take on risk in your investments. A person’s risk tolerance helps to determine the right mix of investments for the portfolio, and how much one should allocate to each asset class.

Here are some steps to determine the risk tolerance:

- Assess the financial situation: Before investing, it’s essential to assess the financial situation of a person. It will include income, expenses, debts, and savings analysis. This will help to understand the financial goals and how much risk one can afford to take.

- Evaluate the investment goals: Consider the investment goals, which include the time horizon, liquidity needs, and desired returns. The investment goals help to determine the right mix of assets for your portfolio.

- Understand the risk tolerance: Your risk tolerance is determined by several factors, including your age, income, investment experience, and personal preferences. Some investors may be comfortable taking on more risk, while others may prefer a more conservative approach.

- Take a risk tolerance questionnaire: One can also use questionnaires that can help to determine one’s risk tolerance. These questionnaires ask a series of questions about your investment goals, financial situation, and risk preferences to provide a risk profile and suggested portfolio allocation. This is one of the most accurate free risk analyzers you can try.

Point #2: Asset Allocation / Portfolio Composition

Once a person determines his/her risk tolerance, asset allocation can start based on the risk appetite.

Here are some general guidelines for asset allocation based on risk tolerance:

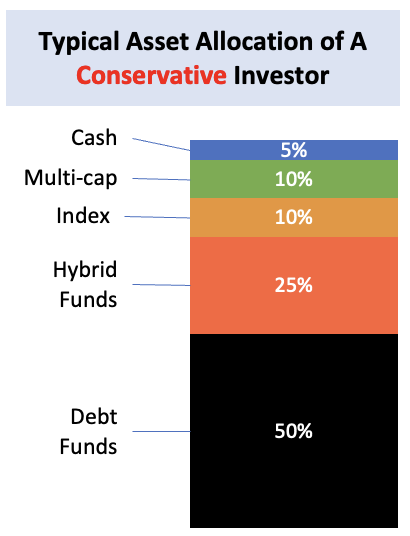

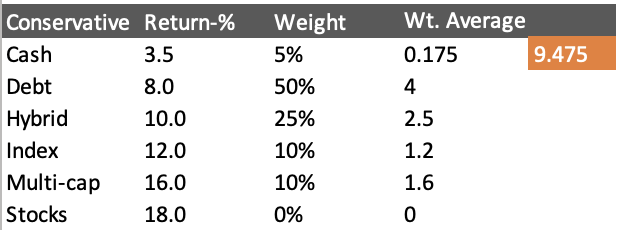

Conservative

Investors with a low-risk tolerance may prefer a portfolio that is heavily weighted towards fixed-income investments, such as bank deposits, debt funds, bonds, etc. As a conservative investor, my prime focus will be on income generation and not on capital appreciation. My portfolio allocation would be about 50% in pure debt funds & FDs, 25% in hybrid funds, 10% in index funds, 10% in multi-cap mutual funds, and 5% in cash.

Based on this asset allocation, my estimate is that the average yield of this diversified portfolio will be about 10% per annum.

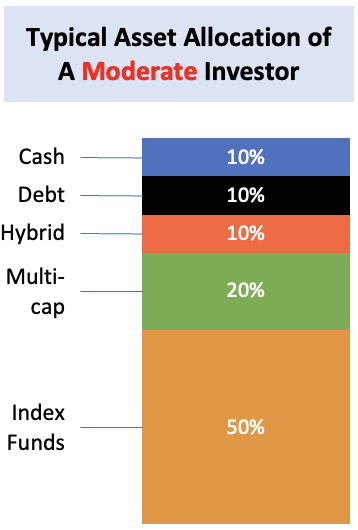

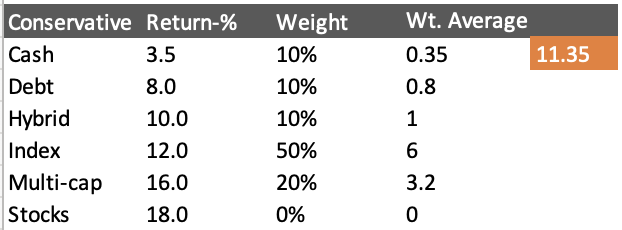

Moderate

Investors with a moderate risk tolerance may prefer a portfolio that is more balanced between fixed income and equities. As a moderate investor, my prime focus will be on capital appreciation but with return expectations not greater than average market returns. My portfolio allocation would be about 50% in index funds, 20% in multip cap funds, 10% in hybrid funds, 10% in debt funds & FDs, and 10% in cash.

Based on this asset allocation, my estimate is that the average yield of this diversified portfolio will be about 11.5% per annum.

Aggressive

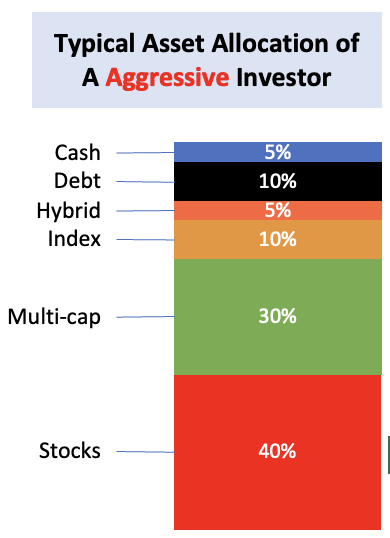

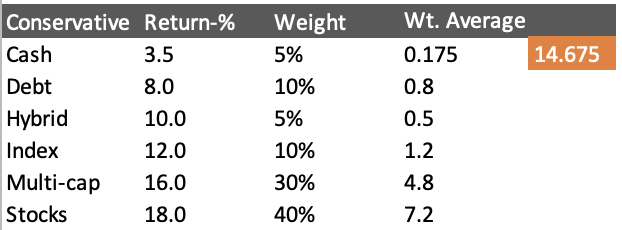

Investors with a high-risk tolerance may prefer a portfolio that is heavily weighted towards equities. As an aggressive investor, my prime focus will be on capital appreciation with market-beating return expectations. My portfolio allocation would be about 40% in stocks, 30% in multi-cap funds, 10% in index funds, 5% in hybrid funds, 10% in debt and bank deposits, and 5% in cash.

Based on this asset allocation, I estimate that the average yield of this diversified portfolio will be about 15% per annum.

It is important to remember that asset allocation should be reviewed regularly and adjusted as needed to ensure that it aligns with your investment goals and risk tolerance. By understanding your risk tolerance and allocating your assets accordingly, you can build a well-diversified portfolio that is tailored to your specific needs and preferences.

Point #3: Systematic Investing

A diversified portfolio allocation should be the target. It is important to invest large sums of money systematically to avoid the need to time the market. This will also ensure that one gets the best possible average price for the assets.

Here’s a suggested method for buying the assets in a phased manner (and not in one go).

The Method

- Determine The Investment Horizon: It is important to determine the investment horizon before investing. Since our time horizon is long-term, about 10-15 years, it is best to invest in a staggered manner over some time. It will reduce the impact of short-term market fluctuations.

- Create a Schedule: Once the investment horizon is determined, create a schedule to invest the money (assuming it to be in large sums like 10 lakhs) over the next 6-12 months. This will ensure that one is investing the money systematically and gradually, rather than investing all at once.

- Start with Smaller Allocation First: A conservative investor has a smaller allocation to equity and cash, so one must start from there. Similarly, an aggressive investor has a relatively small allocation to debt funds, and cash, so can start with these assets. Accumulating assets of smaller weights in the first 2-3 months should be a general strategy. But when it comes to equity allocation, make sure that the index is not currently at its peak.

- Gradually Add Other Assets: Once smaller allocations are done, one can start to add other assets to the portfolio. Spreading the investments in the remaining assets over the remaining months of the investment schedule should be the strategy.

- Monitor your portfolio: It is important to monitor the portfolio regularly to ensure that the asset allocation is in line with the investment goals and risk tolerance. Rebalancing the portfolio, from time to time, will be necessary to maintain your desired asset allocation. What is rebalancing? Reducing the overweighted assets, and putting the proceeds into underweighted assets.

By investing systematically over some time, one can avoid the risk of investing all money at once. This way one can benefit from the potential for long-term market growth.

Conclusion

Remember, investing requires patience and discipline, so it’s important to stick to your investment plan and avoid making impulsive decisions based on short-term market fluctuations.

Investing large sums of money for a long-term horizon requires careful analysis and planning. It is important to understand the risks involved and manage them effectively through diversification and asset allocation. A well-diversified portfolio with a focus on quality companies and bonds can provide a solid foundation for long-term growth.

Finally, systematic investing can help to build a disciplined investment strategy and reduce the impact of market volatility. By following these principles, investors can make informed decisions and achieve long-term financial goals.

This is very useful and informative blog, I really appreciate your hard work to make this topic easily understood by us.

Thank You

I found your article to be very helpful, I’m glad you wrote about this topic. It’s something that I’ve been thinking about a lot lately.