If we can invest risk free and earn high returns, wouldn’t it be an ideal scenario? Sure it will be, but how to do it? This is what we will discuss in this article. But allow me to first confess a thing.

This blog post is not about the “traditional” write-up on risk free investment options.

What I will be sharing here is my idea of handling high-risk high-return investment options in a way that makes them “almost” risk free.

Why I say almost? Because an element of uncertainty will always be there as soon as we lend our money in others hands (like for investing).

What I will share here is my personal experiments with investments. Why I’m calling it experiments? Because these are trials using which I have tried to make even the riskiest investments, risk-free.

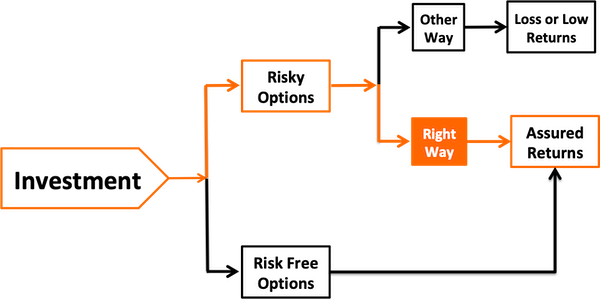

What is risk free investing?

Investing in a “way” that the risk of loss is negligible, leading to assured returns.

I am sure not may will agree with this simplistic definition of risk free investing, but even its critics will not say that “it is wrong“. My ex-boss used to say, when something is right, it is right.

But this is only the introduction. The devil often hides in the details. There is no exception here.

When one is dealing with high return investments, eliminating the risk of loss is a challenge. Investment bankers may do it, but for us, it does not come naturally.

So how we common men can invest risk free and earn high returns?

This can be done by investing in a right way. Period.

What is the right way?

When one is investing in a right way, risk of loss automatically gets minimised.

The best example of a practitioner who does it the right way is Warren Buffett. He deals with stocks, where the risk of loss is high. But he still makes billions. How? Because he knows the ‘right way’ to handle stocks.

Some might say that Warren Buffett is different, we common men cannot duplicate his success. I will not disagree.

But there are few rules which can be followed by we common men. Using these rules, we can formulate our own right ways of investing.

Before I go into the “right ways”, allow me to repeat an information which we already know. But repeating it here will help me to make a point.

#1. The concept of minimum return.

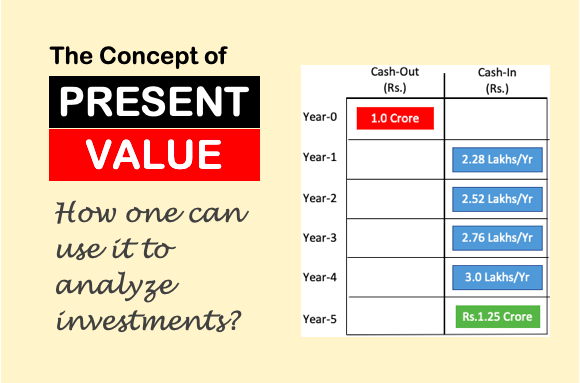

Here I am considering an investment time horizon of 10+ years in future.

In this time period, fixed deposits offered by the banks can earn a return of 7.0% per annum. Even debt based mutual funds (like income funds) can yield a return of 7.2% p.a.

Why I am mentioning it here?

Suppose there is a person who wants to invest money for next 10 years. If he decides to invest in a bank’s FD, he will earn a return of at least 7.0% per annum (risk free).

So let’s call 7.0% p.a. as minimum return.

If someones investment earns a return of less than 7.0%, its a bad investment. If the investment earns a return more than 7.0%, it’s a good investment.

Moreover if one can earn returns over and above 7.0% per annum consistently for next 10 years, I will call it “high returns”.

Earning consistently even a fraction percentage points above the ‘minimum returns’ is a challenge. But for sure, the higher will be the difference the better.

#2. The right way of investing

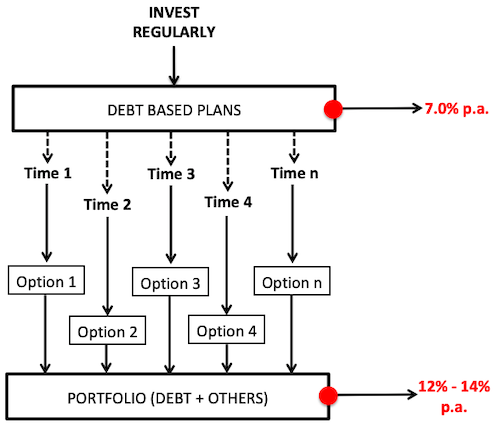

The first criteria of investing in a right way is to have a plan. My investment plan looks like this:

- Invest Regularly: It all starts from here. Putting our investment on autopilot is the right strategy. How to do it? Recurring deposit and SIP in mutual funds is a good starting point.

- Debt Plans: As soon as our money leaves our bank account, it must land into a debt based plan. Which are these plans? Bank deposit, or debt based mutual fund. Why? Because they yield fixed returns.

- Time the Market: Till this stage, our money is sitting on “traditional” safe plans. From this point forward, our money will get invested in high return options at “right times”. What is the right time? We will discuss it further…

- Buy High Return Options: The money has been programmed to switch from “debt” to a “high return plan”, at specific moments of time. Which are these high return plans? We will discuss it further.

It is the combination of “market timing” and a “basket of high return investment options” that can yield high returns.

So what is the utility of investing in debt based plans? Money parked in debt based plans works like an “investment fund“. It is like deposit where our money is safe, and is also earning returns more than savings account.

Whenever opportunities comes, we will redeem from our ‘investment fund’ and buy a right “high return” option.

Which are the high return options, and how to time their purchase?

How I do it? I generally keep aside my savings by using recurring deposit (RD). Using the RD, I start with investing a fixed amount of money each month.

The recurring deposit yields at least 7% p.a. return. But the challenge is to earn a return higher than this. How it can be done?

I keep observing the market, and when I see the opportunity, I break a part of my deposit and invest the redeemed amount into suitable “high return” options.

Which are the investment options I am talking about? How I evaluate the opportunity (timing)? This is what we will discuss now…

#A. Value Stocks

Most of the time, my money parked in recurring deposit is waiting to be invested in value stocks. How I identify value stocks? In three steps:

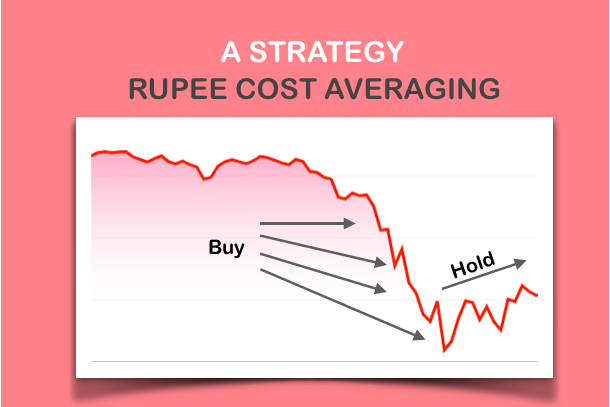

- Step 1: I prepare my own list (in MS Excel) of preferred stocks. These are basically high cap blue chip stocks. I try to keep this list as short as possible. At a given moment of time, this list does not contain more than 10-12 number stocks.

- Step 2: I use my stocks analysis worksheet to estimate the intrinsic value of these stocks. I add these estimated intrinsic value in a column just beside the current market price. This way it becomes easy to compare current price vs intrinsic value.

- Step 3: In this step, most of the time I am only watching. As soon as the current market price of my stocks falls below its intrinsic value, it’s a buying opportunity. I break a part of my FD, and use the money to buy the value stock.

Though these 3 steps look simple, but the difficult part here is “waiting time”. Most of the time my selected stocks trade a price levels much above its intrinsic value. Hence the waiting time sometimes are extend in years.

But I have given myself a small breather here. Whenever the price of these stocks fall by more than 10%, I consider it as buying opportunity.

I have also observed that, if my list of stocks contains quality mid cap stocks, then I get buying opportunity more often.

My estimate is that, a value stock can yield a return of more than 15% per annum in long term.

#B. Buy Sector Funds

In stock market, there are always some sectors which are not performing well in a given moment of time.

Like at present, real estate, power, metals are sectors which looks weak as compared to others.

I like to systematically invest in these sectors. How I do it?

If there is a mutual fund (or ETF) which specifically invests in the sector I am targeting, I will start a SIP there.

If there are no such funds or ETF’s, then I buy few top stocks from this sector. How I pick stocks? I pick the market leader depending on its market share.

In near term, the investment return in these sector will be negative. But when the sector recovers, return improves dramatically.

Hence investors who invest in weak sectors, must be ready to wait for long term (like 3-7 years) to see positive returns. It will happen. No sector can remain weak indefinitely.

My estimate is that, a sector fund can yield a return of more than 12% per annum in long term.

#C. Dividend Paying Stocks

There is a difference between high dividend “yielding” stocks and dividend “paying” stocks.

Dividend paying stocks may yield low dividends, but they have capability to pay dividends consistently year after year.

Investing in these stocks will assure that the dividends keep yielding, irrespective of the market conditions.

Timing the purchase of dividend paying stocks should be on the priority list of all investors.

Why it is so? Because dividend yield of good stocks will improves with time. When such stocks are held for long term, dividend alone can give the desired returns.

I have a list of my preferred dividend paying stocks. Whenever there is a price correction of more than 10% in these stocks, I try to grab them at those price levels.

Moreover, over a period of time the market value of these stocks also appreciates. This further adds to the returns.

My estimate is that, a good dividend yielding stocks can yield a return of more than 10% p.a. in price appreciation, plus dividend yield.

#D. Rental Property

Here I am talking about those real estate properties which the investor is buying for rental income.

It is important to locate such a property in a strategic location. The property should neither be in the heart of the city, not it should be too outside. Read more about property investment ideas here.

The criteria to pick the right property should be the following:

- Small Size (like 1BHK) – requires less capital.

- Rental Yield should be more than 4%

How to calculate rental yield? Yield = Annual Rent / Cost of Property.

Example: Suppose the cost of property is Rs.10 Lakhs. Possible rental income is Rs.40,000 per year. Rental Yield will be = 40,000/10,00,000 = 4%.

Please note that the rental yield is only one portion of the returns. Over a period of time, market value of the property will also appreciate. This will further add to the returns.

My estimate is that, a good rental property can appreciate in value at rate of 8-10% per annum, plus the annual rental yields.

#E. Index ETF’s

This is perhaps my most easy investment. Why? Because there are less parameters that needs to be checked before investing in it.

I have a rule, whenever the stock market index (Sensex/Nifty) falls by more than 10%, I make it a point to buy its ETF units.

My thumb rule is to follow this process for at least 5 years and then think of profit booking.

My estimate is that, consistent investments (as indicated above) in index ETFs can yield a return of 14% per annum in long term.

Conclusion…

As important it is to buy right investment options at right moment, it is equally essential to sell them at right times.

How I do it? I fix a target for each investment option. As soon as my investments are yielding returns more than the set-target, I redeem them. Here it is important to not get greedy and redeem immediately.

These are few of my personal strategies which helps me to channelise my money, and yield above average returns in long term.

I also like to invest in mid and small cap mutual funds through SIP route. In a time horizon of 5-7 years, this investment can hardly go wrong. But I do it separately. I try not to mix it with my above discussed investment plan.

I have missed to mention my most reliable investment strategy.

Investing in blue chip stocks during recession.

I believe, nothing can go wrong in picking stocks in these times.

This is by far one of the best articles on the site!

Mani, do you have any YT video when you actually walk through the entire process of analysing a stock? Im thinking~1hr long it something? Kinda like a Instagram live or YT live video? That way we can properly understand your entire process.. how did you come to know of the stock, what did you read in the annual p&l or balance sheet of the company, what did you search for on moneycontrol, which financial ratios did you look at, what intrinsic value did your excel calculate for that company, what we your thoughts along the way for the revenue, profits in the past 10yrs? Something similar to this video of teaching guitar….

Hi Mani , Being Self an Engineer appreciate, your journey from project management to blog.

Should there be any change in FD approach considering new 2021 amendment 5L guarantee from DICGC ? How safe keeping 5L in 3 to 4 small finance banks ? Will money be returned on immediate basis in case of bankruptcy ?

It is very easy to understand who wants a knowledge about investing.

Hi Mani,

I could not find any date associate with your article ( like when article is published ). it would be great if you could add that.

for example your article on aluminium price does not have date so could not figure out if this is old one or new one.

Yes Mayank, you are right about the dates. It has been removed on purpose as they were causing few SEO concerns. Thanks for posting your comment.

Nice article!! Get more share market information on…