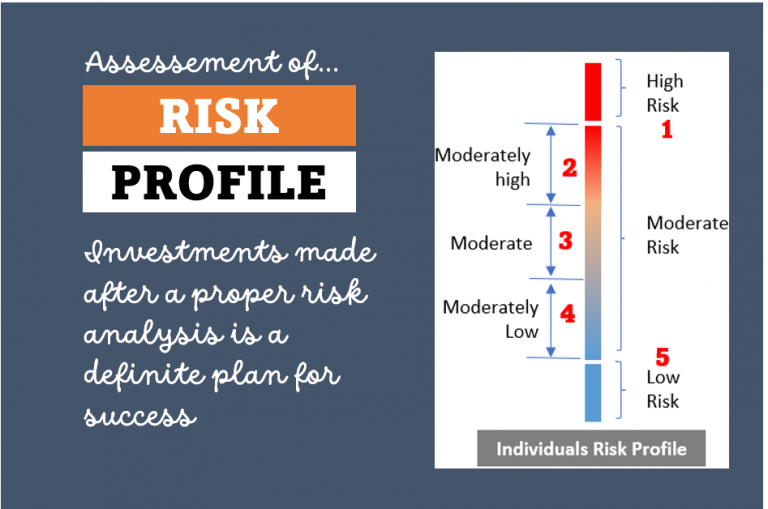

How to invest 10 lakh rupees in India? We are dealing with a big lump-sum amount here. Hence, it is better to proceed with caution. Idea should be to generate the ‘expected returns‘ with a “reasonable risk of loss” associated with it.

It is important to understand the following concepts before proceeding:

- Expected Returns: Example: when ones expectation (need) of returns is only 8%, why to invest in equity. Similarly, when expected return is 12%+, without equity it is not possible. Hence before investing, knowing ones ‘expected return’ is necessary. Be wise in taking the call. Do not be too defensive, or greedy.

- Reasonable Risk of Loss: When expected returns are higher, one must resort to risky investment options (like equity). As an investor, we must know how to invest wisely to manage the risk of loss.

[Know about ‘where to invest money for higher returns’]

Thought Process…

It is necessary to build a thought process before investing. This specially becomes true when we are dealing with lump-sum investing.

What should be the thought process? I have tried to represent it in the below process chart:

What is represented in the above process chart? When our return expectations are lower, selecting a right investment option is rather simple. How?

- Inflation: In India, the average inflation rate in next 5+ years will hover around 7-8% p.a. Presently it is low, but when GDP growth will be faster, inflationary pressure will also creep in.

- Debt Based Funds: When our return expectation is 8% or below, debt based plans can yield 8% p.a. easily. Debt based plans are also risk free. Hence for people whose return expectation is lower, debt based mutual funds becomes an automatic choice.

- Balanced Funds: When our return expectation is slightly higher than 8% (say 10%), a good balance mutual fund can easily yield this return. These funds have limited exposure to equity. Hence 8%+ returns becomes possible.

The only care one must take while dealing with ‘balanced fund’ is the ‘investment holding time‘. My personal guess is that when dealing with balanced funds, invest holding time should be at least 3 years.

How to invest 10 lakh rupees to earn higher returns?

The decision making becomes tougher when ones expected investment returns becomes higher (like 12%+ p.a.).

Which investment option will be suitable for investing a lump sum amount like 10 lakhs, and also generate 12%+ returns?

In this case the right investment idea will be to invest in Equity. But this does not mean that we go ahead and start buying any stocks and equity based mutual funds.

Here it is most important to take calculated steps. How to do it? Start with answering the following question.

Is it the right time to invest in equity?

Why to ask this question? Because while dealing with equity, we cannot afford to invest when equity market is overvalued.

What is the problem? Overvalued equity is more likely to generate negative returns over time.

How a common man can judge if the equity market is overvalued or undervalued?

By looking at the last 3 months trend of “BSE 500 Index”.

When it’s a falling trend, it is a hint that the equity market may be undervalued.

When it is a rising trend, it is a hint that the equity market may be overvalued.

How to deal with equity when market is undervalued or overvalued?

When market is overvalued, a good investment idea will be to follow a systematic transfer plan (STP) offered by mutual funds.

#1. When Equity is Overvalued – Try Systematic Transfer Plan (STP)

I have a written a detailed blog post of systematic transfer plan (STP). I will request you to read that blog post for more insights on STP.

Here, let me give only a small introduction about STP plans.

Systematic Transfer Plan (STP) is a tailor made investment plan for investors who intend to invest in equity in lump-sum. But the money is not directly invested in equity. It follows the below steps:

[Read more about direct equity investment]

- Step 1: Person builds a healthy savings (Rs.10 Lakhs). He/she intentionally accumulates these savings to take advantage of lump-sum investing. Read more about how recurring deposit can make one a millionaire.

- Step 2: When the person is ready to invest money, he finds that the equity market is overvalued. Hence he decides to invest Rs.10 Lakhs in lump in a liquid fund.

- Step 3: But as liquid funds can yield only low returns (5.5% p.a.), he gives a mandate to the mutual fund to systematically redeem his units (say worth Rs.25,000 per month) from liquid fund. The money so generated from redemption is immediately re-invested in a selected equity based mutual fund.

The above process will continue till all Rs.10 Lakhs gets transferred from a liquid fund to equity based fund.

Why the investor is investing like this? There are two important questions to ask here:

Why the investor did not start SIP directly in equity?

Investor wanted to invest the lump-sum money (Rs.10 lakhs) immediately. He did not want to hold the money in his savings account. There may be a fear that the hard earned savings may get spent elsewhere.

Why the investor chose only liquid fund?

As the investor wanted to invest in lump-sum at a time when equity market was overvalued, he had only two choices:

- Invest in a traditional debt based fund.

- Invest in a liquid fund.

He chose liquid fund as its expense ratio is lower, and are also more secure than traditional debt based funds.

#2. When equity is undervalued – Try Mid-cap and Multi-Cap Funds

When market in undervalued, it is better to invest directly in equity based products. But as one time investment corpus is large (Rs.10 Lakhs), it is better to spilt the amount between debt and equity:

- Debt Based Mutual Funds (20%): A ‘good bond fund’ in India could give a return close to 9-10% per annum. Investing a portion of ten lakh rupees (20%) in such funds will be good. Here the money will not only be safe, but will also yield a fixed return. Read more about debt funds here.

- Mid Cap Fund (50%): When investment time horizon is longer than 5 years, good mid cap funds can easily yield 15%+ returns. Example: L&T Mid Cap Fund has generated a return on 22% p.a. in last 5 years. Read more about mid cap funds here.

- Multi Cap Fund (30%): Mid Cap Funds can give best returns in time horizons like 5+ years. Then why we are going with multi cap funds? Because diversification is also necessary. But considering that the equity market is undervalued, too much diversification may not be necessary. Hence a good multi cap fund is be more than enough. Example: Mirae Equity Fund has generated a return of 18%+ p.a. in last 5 years. Read more about capture ratio to pick good mutual funds.

Conclusion

As it is important to invest money with a plan, there must also be a plan to book profits. What should be the plan?

[Note: Timely profit booking is specially necessary in case of equity based investments. For debt based plans, we can afford to let the money stay invested without caring much about profit booking.]

As soon as equity investments start to yield the desired returns, I will not delay to book profits.

But the issue of profit booking will come only at the end. Important is to start with a right approach. What is the right approach?

- Finalise the ‘expected returns’.

- Invest in equity ‘only if’ the expected returns are high.

- When equity is overvalued, invest via STP.

- When equity is undervalued, I would pick a good ‘mid-cap and multi cap fund‘ for myself.

Another useful and well explained article, thanks a lot bro!

good article , i would have to read this article before 2 years to save atleast 10% of my wealth.

thanks and best wishes

One of the best articles i have ever read. Simple and easily explained. Thanks a lot.

Thanks for posting your comment.

Hi, So even if the market is overvalued, should he choose, is it also a better option for him to invest his 10lakhs in a sip split between 70% equity and 30% debt?

In overvalued market STP offer by mutual funds is better.

http://ourwealthinsights.com/systematic-transfer-plan-stp/

Hi.good presentation!!Which books can i go through for building my finance ; stock and markets investing knowledge thoroughly.

Thanks

Hi, thanks for asking. You can check a list of books here.

your presentation is good and useful

Nice one