An ideal investment portfolio mix must include different types of securities, linked to specific goals.

Just listing down few stocks and tracking its performance in Google Finance is not the ideal investment portfolio management style.

Tracking performance of these securities, with respect to its goals, will be ideal.

It gives a better realisation that, if the securities are performing as per our expectations or not.

Why to fix goals?

Example: Goals of young men, and goals of retired people are not same. A bachelor person in early 20’s can afford to fix a more aggressive goal than a family person in mid 30’s.

What does this mean?

We invest money to meet our financial goals. When goals vary, investment approach will also vary.

When investment approach is different, securities that will be purchased will also change.

Hence an ideal investment portfolio composition will vary from person to person.

Difference in type of goals will dictate what type of asset are included in portfolio.

Yes, this is an important realisation.

Investment goals will dictate what type of assets to be include in the investment portfolio.

People often go on buying stocks, mutual funds, insurance, gold, real estate etc like random hoarders.

This is a mistake. We cannot buy assets only because we have some extra cash for investing.

Attaching a clear goal to the purchased assets will make the investment more meaningful.

For investors it is essential to realise that, how each accumulated asset is helping them to reach the goal.

#1. Ideal investment portfolio is always need based

Aimless asset accumulation is not effective. Such assets often get liquidated one-day on meaningless things.

Random asset hoarding may look good initially, but over time it has almost zero utility.

It is like starting to do a physical training without fixing small-small milestones, and the ultimate goal.

Physical training is a part of self discipline. But why this discipline is required? What needs to be achieved?

Answering these questions first, and then starting will take the person long way.

Similarly, in financial matters as well, important is to be organised and goal/need focused.

The bigger purpose of building an ideal investment portfolio can be met only when we set clear goals.

The asset accumulation should start only after we are aware of the goals to be achieved.

Building a need based asset portfolio is of paramount importance.

#2. What should be the thought process…

Right thought process is essential behind building an ideal investment portfolio.

Let me give you an example.

One day I met my uncle who was nearing his retirement. I knew him as one of those people who follows market and business news very closely.

I knew that his investing intelligence is good.

That day when I met him I saw concern in his eyes. He told me that he was worried related to his investments.

As he is due to retire in coming months, he was not sure if the composition of this investment portfolio was good or not.

His investment portfolio was supposed to generate enough returns so as to support his cost of living after retirement.

His concern was genuine. Almost all retired people ponder on the issue of investing wisely their retirement corpus.

Hence we decided to dig slightly deeper into this issue.

We started with checking the composition of his investment portfolio. He had his investments mainly into stocks, mutual funds, real estate and gold.

He also had some cash reserve, safely parked in his bank’s fixed deposit.

He asked for my advice to know, if his investment portfolio mix was good or not.

Goal was to churn out sufficient income from this investment portfolio to support his standard of living, post retirement.

Though I do not consider myself an investment adviser, but together using our common sense, we decided to do some in-depth analysis. So we started with the basics.

#2.1 What are his financial goals?

- Regular Income– His number one priority was to generate regular monthly income (Rs 30,000/month). He will use it to manage household needs.

- Medical Emergency– His second priority was to be prepared for any unforeseen medical emergency. He wanted to keep some funds (Rs 500,000 lump sum) parked separately for it.

- Daughter’s Marriage– He had a daughter. She was doing her studies in medicine. My uncle wanted to get her married in next 6-12 months time. The estimated cost for marriage was also quantified (Rs 15,00,000 lump sum).

- Protection against inflation– My uncle was worried about the prevailing high inflation levels (average 6% for next 10 years). He wanted his investment portfolio mix to take care of his corpus erosion due to inflation.

It was a fact that there are no easy answers when it comes to such detailed personal finance planning. It becomes even more difficult for people nearing retirement.

Hence we decided to go slow.

I had an idea that could potentially remove the clouds dampening our though process.

I tried to use the analogy of my savings account management style to give him life-like example of portfolio management.

So first lets see how I manage my savings account.

This will give us a good head start to know how to approach the issue of building an ideal, need based investment portfolio.

I do this using a simple excel sheet. All of my savings are allocated to its specific needs.

Means, every penny knows it is meant to be spent for which activity.

How to do this? Starting point is to get aware of all expenses. Once all expenses are identified, bifurcate your savings to see if it is sufficient to meet all expense-demands.

#2.2 Example: Need based savings bifurcation

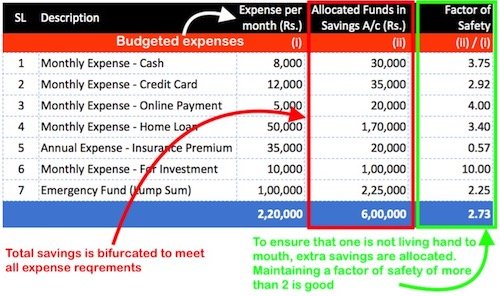

A typical needs based savings bifurcation is shown here:

Suppose, savings account shows an a/c balance of Rs.6,00,000. This total sum (Rs.6.0 lakhs) has been bifurcated among various expense-needs.

* Cash – Rs.30K allotted for payment of monthly cash expenses. The actual monthly cash expense is only Rs.8K. Hence, keeping a Rs.30K in savings means, having a factor of safety of 3.75. To manage house hold expense, keeping some extra cash is advisable.

* Home Loan EMI – Rs.170K has been allocated for this cause. The actual EMI is Rs.50K/month. Hence, here as well there is a factor of safety of 3.4. For an expense as uncompromisable as loan EMI’s, it is always better to have some surplus savings.

* Insurance Premiums – Only Rs.20K has been allocated for insurance premiums.The actual premium payment to be made each month is Rs.50. It means, insurance premium payment is not protected. In case of some shortcoming in monthly income, there is a high risk that the insurance payment will be missed.

What I am trying to point out here is that, if we only see the overall value of Rs 6.0 Lakhs savings, it will look impressive.

But when the same value is bifurcated and seen through a screen of need-based allocation, it is easy to realise that saving for insurance needs are nor sufficient.

In order to create a ideal investment portfolio, one must first get aware of all needs/goals.

The above is a simple example of how ones though process should work in creating a great portfolio.

#3. So, what will be the ideal investment portfolio for my uncle…?

Using the same logic lets see how we analysed my uncles requirement. What should be the composition of investment portfolio matching his needs?

#3.1 First Need – REGULAR MONTHLY INCOME OF Rs 30,000

| INVESTMENT | INVESTED AMOUNT | INCOME FROM INVESTMENT | |

| Regular Monthly Income | Target 30,000 | ||

| REIT | Rs 35Lakh | 23K / month | @8% Return, monthly income of Rs 23,000/month |

| MIP Scheme of Mutual Fund | Rs 10Lakh | 7K / month | @8.5% Interest, monthly income of Rs 7,000/month |

| Income From Dividends (Stocks) | Rs 10Lakh | 3.5K / month | @ 4.5% Dividend Yield of Portfolio, monthly income of Rs 3,500 |

| Rs 55 Lakhs | Rs 33,500 |

#3.2 Second Need – MEDICAL EMERGENCY Rs 500,000

| Fund for Medical Emergency | Target 500,000 | ||

| Fixed Deposit | Rs 500,000 | – | OK, Additional Mediclaim is also present |

#3.3 Third Need – CHILD’S MARRIAGE Rs 15,00,000

My uncle had thought of this priority from a very early age.

As a result, he was gradually accumulating gold coins since last 20 years.

Till now he already had close to 550gm of gold safely stacked in his bank locker.

Considering the present gold valuation of Rs.30,000/10 grams, gold saving was sufficient for the purpose.

| Fund for Childs Marriage | Target 15 Lakhs | ||

| Gold | Rs.16.5 Lakhs | – | @ Rs 30,000/10gm, 0.55KG worth of Gold |

#3.4 Fourth Need – INFLATION PROTECTION Rs 3,30,000

My Uncle had total wealth of Rs 55 Lakhs which he is using to generate monthly income. This is the fund that must withstand the erosing effect of inflation.

With time, monthly income requirement will rise due to inflation. There must be a mean which can provided those additional funds.

Inflation @6.0%, means Rs.55 Lakh will depreciate in first year by Rs.3.3Lakhs.

What can be a ideal asset that will not only generate these additional funds but will also grow to match inflation.

Nothing will be better here than a real estate property.

My uncle has a second residential property which was valued at Rs.1.2 Crore.

This property was currently generating a monthly rental income of Rs.28,000/month for him.

Each year, the rental income was liable for increase @6%-8%.

| High Inflation | Target Rs 3.3Lakhs | ||

| Real Estate Property put on Rent | 3.36 Lakhs/year | Rs 28,000/ month | Appreciation of this Rental income @6%-8% every year |

Conclusion…

From the above analysis, we reached a conclusion that my uncle will be safe with the above portfolio mix.

He will be able to manage all his below priorities:

- Monthly income generation & adjusting it for inflation.

- Maintaining a sufficiently big medical emergency fund.

- Getting his child married in next 6-12 months time.

In our pursuit of finding an ideal investment portfolio mix, we also noted that inflation protection was like touch and go.

In case the rental income growth doesn’t happen as expected, there may be slight problems.

He was marginally short of funds here.

We agreed on selling his second residential property, if possible, and opt for a Systematic Transfer Plan (STP) to invest this lump sump money.

STP’s can provide much better yield than our traditional real estate properties.

As because my uncle had surplus savings, I suggested him to try STP. Otherwise, for a normal retired person, STP may not be a the most preferred investment alternative.

Later on, the units accumulated through STP can continually redeemed to meet inflation protection needs.

Here, I have taken a typical example of a person who is nearing retirement.

It may be possible that you may not have liked the portfolio mix what is discussed in this article. That is ok.

But what is more important is to understand what thought processgoes into building an ideal investment portfolio.

Try doing the same with yourself.

Identify your financial goals. Then, quantify them. And try several permutations to see which portfolio mix is most suitable for your goals.

nice portfolio, but i think post office monthly income plan has higher limit i.e.4.5L for single and 9L in joint case