When a ‘capital asset‘ is sold for profit, income tax must be paid by the seller. We all know this, right? But the bigger question is, how to save tax on sale of real estate property.

The answer lies within Section 54 of the income tax act.

But section 54 is applicable only for long term capital gains (LTCG). There is no way one can save tax on short term capital gains (STCG).

I will try to explain the utility of section 54 by narrating a story. I was the witness to this, as one of my close friend happen to avail the benefit of section 54 in year 2016.

Background story…

My friend Raj owned a 1 BHK flat in Bangalore. It was his self occupied, ‘loan free’ home. Friend bought it in year 2010. The cost of purchase was Rs.23 lakhs.

After lapse of 5+ years (in 2016), my friend went the family way and he needed a bigger house. His requirement was of a 2 BHK flat.

He planned it perfectly. He will sell his 1 BHK flat, and use the sale money to buy the bigger 2 BHK flat. In year 2016, the sale price of his 1BHK flat was Rs.40 lakhs.

The 2 BHK house that Raj selected to acquire was costing him Rs.68 lakhs. So the funding of 2BHK home will work out like this:

- Rs.40 Lakhs – From sale of 1BHK flat.

- Rs.28 Lakhs – As bank Loan.

The need to save tax…

It occurred to Raj that, the net profit of Rs 17 lakhs (Rs.40 – Rs.23) from sale of property will be taxable. The profit will be taxed at rate of 20%.

This will eventually reduce the funding contribution from sale of his 1BHK flat. How much the funding will reduce? It will be reduced by Rs.3.4 Lakhs. How?

- Profit: Rs.17 Lakhs (Rs.40L – Rs.23L)

- Income tax: Rs.3.4 Lakhs (20% x Rs.17L)

- Reduced funding: Rs.36.6 lakhs (Rs.40L – Rs.3.4L).

This way my friend will have to take a larger bank loan of Rs.31.4 Lakhs (Rs.28L+Rs.3.4L) to fund his 2BHK flat purchase.

Hence he started thinking about how to save the tax outgo of Rs.3.4 Lakhs. He approached me, and together we started our research.

Here are our findings…

#1. Which tax is applicable, LTCG or STCG?

The first question that we had to answer about Raj was, whether he is required to pay tax on LTCG or STCG.

- STCG: Short Term Capital Gain.

- LTCG: Long Term Capital Gain.

STCG is applicable when property is sold on or before 36 months from the time of its purchase (property registration).

LTCG is applicable when property is sold after 36 months from the time of its purchase (property registration).

In case of Raj, he was selling the property after 5.5 years (year 2010 to 2016). Hence LTCG Tax was applicable for him.

#2. How much is the capital gain?

Once we were convinced that Raj will have to pay LTCG, we started to calculate the quantum of LTCG (profit).

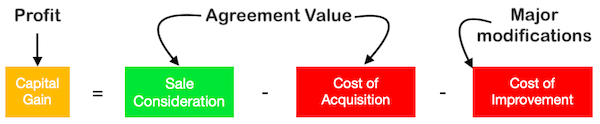

Income tax is chargeable only on the capital gain (profit). But how to calculate the capital gain? One can use a general formula (shown below):

Sale consideration: Agreement value mentioned at the time of property registration, minus the allowable ‘selling expense’. Selling expenses can be as listed below:

- Brokerage.

- Advocate fees.

- Stamp duty charges.

- Travelling (related to sale) expenses etc.

Cost of acquisition: Agreement value mentioned at the time of property registration, minus the allowable ‘purchasing expense’. Purchasing expenses will be same as listed above.

Cost of improvement: Major modifications done in the house will account for the cost of improvement. Examples of such modifications could be as listed below:

- Major civil re-work.

- Electrical circuit overhaul.

- Major wood-work.

- False ceiling.

- Painting etc.

In case of LTCG, one can use the “indexed cost of acquisition and improvement” to lower the capital gain.

#2.1 What is indexed cost?

Indexed cost is nothing but the “inflation adjusted” cost of acquisition (purchase).

Indexation allowed on the cost of purchase is a benefit offered by the government to investors.

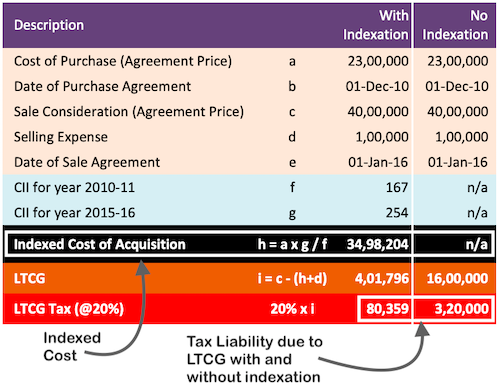

A comparison between capital gain ‘with and without indexation‘ is shown below:

So you can see from the above tabulated information that, with indexation the cost of purchase is increased to Rs.15 lakhs (from the original Rs.10 lakhs). This eventually lowered the capital gain down to zero (from the original Rs.5 Lakhs).

How to calculate the indexed cost of acquisition? This can be done by using the “Cost Inflation Index (CII) chart” published each year by the government of India.

A simple working for same has been shown in the below infographics. This infographics has been shown as an example with respect to Raj.

- Raj’s purchase cost (1BHK): Rs.23 Lakhs.

- Raj’s selling price (1BHK): Rs.40 Lakhs.

- Holding time: 5.5 years.

What is evident from the above infographics?

- Tax Payable by Raj (with indexation): Rs.80,359.

- Tax payable by Raj (without indexation): Rs.3.2 Lakhs.

Cost Inflation Index (CII) Chart 2018-19

| SI. No. | Financial Year | CII |

| 1 | 2001-02 | 100 |

| 2 | 2002-03 | 105 |

| 3 | 2003-04 | 109 |

| 4 | 2004-05 | 113 |

| 5 | 2005-06 | 117 |

| 6 | 2006-07 | 122 |

| 7 | 2007-08 | 129 |

| 8 | 2008-09 | 137 |

| 9 | 2009-10 | 148 |

| 10 | 2010-11 | 167 |

| 11 | 2011-12 | 184 |

| 12 | 2012-13 | 200 |

| 13 | 2013-14 | 220 |

| 14 | 2014-15 | 240 |

| 15 | 2015-16 | 254 |

| 16 | 2016-17 | 264 |

| 17 | 2017-18 | 272 |

| 18 | 2018-19 | 280 |

#3. Tax rates applicable on capital gain…

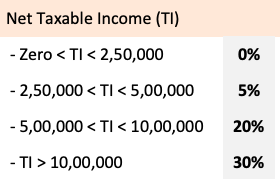

Different tax rates are applicable for STCG and LTCG:

In case of STCG: The applicable tax rate is ones marginal tax rate. Means, STCG will be added to the net taxable income (say from salary). Then the total value so obtained will be taxed as per the applicable tax slab.

Current tax slabs are as below:

In case of LTCG: The applicable tax rate is a flat 20%.

In case of Raj, a flat 20% tax rate will be applicable as he is paying LTCG.

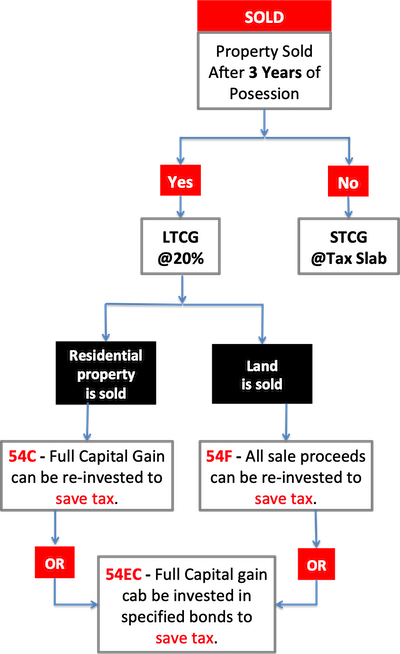

#4. Application of Section 54…

What we have seen till now is this:

- Tax Payable by Raj (with indexation): Rs.80,360.

- Tax payable by Raj (without indexation): Rs.3.2 Lakhs.

By application of Section 54, even the payment of Rs.80,360 as tax can be saved. How? In following two ways:

- If Raj uses the capital gain from sale of 1BHK flat, to buy a residential property within next 2 years.

- If Raj uses the capital gain from sale of 1BHK flat, to construct new home for himself within next 3 years.

Note: Property purchased 1 year before the sale of 1BHK flat is also eligible under section 54.

Important points to remember about Section 54:

| Description | U/s 54 | U/s 54F |

| Condition 1 | LTCG must be reinvested to save tax | Full sale amount must be reinvested to save tax |

| Condition 2 | In case only partial LTCG is reinvested, tax must be paid on the balance LTCG | In case only partial sale amount is reinvested, tax must be paid on the LTCG in proportion to the money reinvested. |

| Condition 3 | Property bought upon reinvestment must be held for at least 3 years | Property bought upon reinvestment must be held for at least 3 years |

| Reinvestment must be done on ? | Residential Property | Residential Property |

#4.1. Utility of ‘Capital Gain Account’.

Raj sold his 1BHK Flat in Sep’2016. Hence his account was credited with the sale proceeds (Rs.40 lakhs) in September.

As per the rules of Section 54, Raj must reinvest the money within next 2/3 years. This is understood. But what about the income tax filing in July’17?

To save tax on this money, Raj must do either of the following:

- Buy his 2BHK home before Mar’17 (for which return is filed on Jul’17).

- Else, park the money in capital gain account.

Once the money (LTCG u/s 54, and ‘full sale proceed’ u/s 54F) is parked in capital gain account, no income tax will be charged for next 3 years on this deposit.

But after the lapse of 2/3 years, if the money has not been reinvested as stipulated, tax must be paid on it.

- Section 54: Tax payment as per ones marginal tax rate.

- Section 54F: Tax payment @20%.

In case of Raj, he was able to buy 2BHK flat within the first 3 months from the sale of his 1BHK flat. Hence he did not care about parking his money in capital gain account.

#4.2. Utility of ‘Capital Gain Bonds’ (Sec 54EC).

Though this case was not applicable for Raj, but I would like to explain it for my readers.

There may be a case when the person do not want to reinvest the money in real estate property. What else can be done?

As per Section 54EC, one is allowed to reinvest the money in “capital gain bonds“. Which are the allowed capital gain bonds?

- Bonds issued by the NHAI, or

- Bonds issued by the REC.

The money invested in “capital gain bonds” must stay invested for at least 36 months. After lapse of 36 months, the bonds can be redeemed, and no tax is payable on it henceforth.

Limitation of Section 54EC:

- (A) The LTCG/Sale proceeds must be invested in capital gain bonds within the first 6 months of the sale of the property.

- (B) The maximum LTCG/Sale proceeds that can be invested in capital gain bonds is Rs.50 lakhs.

Conclusion…

To save tax on sale of real estate property, it is important for Raj to follow these three rules:

- Property to be sold after 36 months, to utilise LTCG taxation.

- Must use the cost indexation to reduce net taxable income.

- Reinvest money using section 54.

Once the above three rules are followed, Raj will be eligible for zero tax payment.

Many thanks for the efforts you put in to explain this topic in such simple language.Many are experts but few can put it up so clearly, in fact the questions which arose during the reading were answered – very rare indeed. Very useful .

Could you post something similar on STCG/LTCG on stocks pl.

Thanks for your appreciation.

I will try posting a new article on STCG/LTCG on equity (stocks and mutual funds).

For the moment I will request you to read my article on “everything about income tax planning“.

Thanks again for taking time to post your comments.

One question if i take loan on rajs property lets consider its mine and keep those money in my pocket the sell that property so technically i m in debt so still i have to pay the tax

Very precise. Nicely described the topic using a story.

Thanks for posting the feedback. It means a lot.