Homeownership is an exciting yet complex venture. Many individuals, eager to secure their own self-owned living space must opt for home loans. Now, If there is a situation where one took out a 20-year home loan but wishes to clear it off in just two years, is it advisable? The question is, will one end up paying the full interest of the loan? Let’s unravel this financial puzzle for a beginner.

No is the quick answer to this question. But to get a better understanding of bank loans, especially home loans, allow me to explain the reason behind the “No” in more detail.

I can assure you that people who are new to the concept of bank loans will learn a few things new from my detailed answer. So please keep reading.

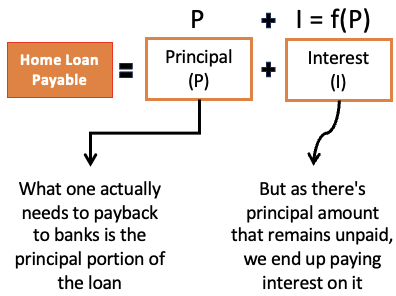

Two Parts To Home Loans

When we borrow money from a bank, we are only taking the principal. So, when we say loan repayment, it essentially means paying back the principal portion of the home loan.

But because we have taken a loan, the borrowers also charge interest on the borrowed money.

So, mathematically we can say that interest is a function of the principal [I = f(P)]. If the principal becomes zero, the interest amount will also become zero.

Let’s relate this with a real-life example. Suppose you took a loan on the 10th of March (Rs.10 Lakhs). On the 10th of April, you paid back the whole Rs.10 lakhs back to the bank. It means, that on the 11th of April, your loan balance is zero. So, from 11th April onwards, your interest payable will also become zero.

In this example, what will be your total loan payable?

Total Loan Payable = Rs.10 Lakhs (Principal) + One Month Interest

Understanding Home Loans: A Brief Overview

Before delving into more details of loan repayment, let’s grasp the basics of home loans.

When you take a home loan, you’re essentially borrowing money from a bank to purchase a residential real estate property.

The loan amount is called the principal of the loan. On this principal amount, the bank charges an interest. The principal along with interest, is repaid over a specified period. The repayment is done in the form of loan EMIs (Equated Monthly Installments). Read more: Start loan repayment (EMIs) only after taking possession.

In India, home loan tenure usually ranges between 10 to 30 years. Most people take loans for a 10, 15 or 20-year periods.

Let’s understand home loans using an example.

Suppose, you took a Rs.60 Lakhs loan for a period of 20 years. Assuming that your loan EMI is Rs.60,000 per month. In this case, your total repayment amount is Rs.144 crore [Rs.60,000 * (12 x 20)]. Out of these, Rs.60 Lakhs is the principal, and the balance of Rs.84 lakhs is the interest. Use the EMI calculator here.

Interest and Loan Tenure

One key factor that influences the total repayment amount is the interest portion of the loan.

In a traditional home loan structure, the interest is front-loaded. It means you pay a significant portion of the interest in the initial years. Read more about the front-loaded concept: The reducing balance method of interest calculation.

As you progress through the loan tenure, the portion of your loan EMI that goes towards payment of the principal amount increases. It means the loan balance (principal) portion is reducing faster.

Early Repayment

Now, let’s address the scenario where you wish to clear your home loan after just two years of a 20-year tenure. This is a situation where you’ve received some funds in bulk and you want to use it to clear your loan outstanding.

Let’s understand this using an example. Imagine you took a home loan of ₹40 lakhs for 20 years. The bank charges an 8% interest rate on it. Now, over the 20-year period with the bank, the total interest you’d pay would be about ₹40.29 lakhs. For this tenure and interest rate, your loan EMI will be about ₹33,458 each month.

Now, let’s assume that after two years from loan disbursal, your father offered you some money as a gift. You have also added some money to it and made it a substantial amount. Now, the amount is so big that it can clear all your loan outstanding.

In these two years, you’ve faithfully paid all your 24 EMIs. In total, you have paid about ₹8,02,992. Out of this, only ₹1,76,111 went to pay the principal. The balance ₹6,26,881 was used to pay the interest.

Now, if you decide to cut ties with your bank after two years, you won’t have to pay the balance ₹34.02 lakhs (Rs.40.29 – Rs.6.27 Lakhs) of interest that was initially planned for the full 20 years.

You can just clear the balance loan outstanding ₹38.24 Lakhs (₹40 Lakhs – ₹1.7612 Lakhs) and become debt-free. This process of loan clearing is called loan prepayment.

So you can see, just because you have pre-paid your loan in just 2 years, you have saved ₹34 lakhs in interest. Read this detailed guide on home loan pre-payment.

Strategies for Early Clearing of Home Loan

If you’re committed to clearing your home loan ahead of schedule, consider adopting these strategies:

- Increase EMI: If your financial situation allows, consider increasing your monthly EMIs. This can help you pay off the principal faster and reduce the overall interest paid.

- Make Periodic Lump Sum Payments: Whenever you have additional funds, such as a bonus, etc, consider making lump sum payments towards your home loan. This can have a significant impact on reducing the outstanding principal.

Conclusion

So, if you have taken a Home Loan For 20 Years and want to pay it off only after two years, you will be asked to pay the interest for the first two years only. You will not be asked to pay the full interest.

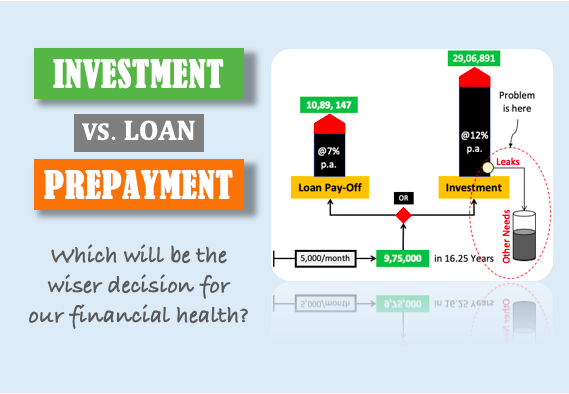

Paying the home loan early (in fact any type of loan) is one of the best financial decisions one can make in one’s lifetime.

If you are considering buying a home for yourself, consider reading this detailed article on the Rent vs buy house decision: Explained.

Have a happy investing.

Suggested Reading:

![Home Construction Loan: What is The Process To Get Such Loans [India]](https://ourwealthinsights.com/wp-content/uploads/2013/08/Home-Construction-Loan-image.jpg)