I was about to leave my office one Friday evening, and this thought came to my mind that, How to plan and invest Rs.5000 per month for next 20 years? The objective was to start investing in general as a good habit, which eventually can also build a corpus.

The time horizon was long, so I decided to consider ‘equity’ as my asset class. Considering that I had to invest each month, ‘mutual funds’ seemed a better option. Anyways mutual fund route is always better for casual investing.

But before proceeding ahead, there were few important questions that needed answering:

- How much corpus can be built by investing Rs.5000 per month?

- How to reduce the risk of loss when dealing with equity?

- Which mutual funds will be good for me?

Though I was investing only casually but still I decided to do a bit of research before venturing ahead. Here are my findings…

How much corpus can be built by investing Rs.5000 per month?

To answer this question, I needed three data:

- Investment per month.

- Time horizon.

- Expected Rate of Return.

Investment per month and time horizon is known (Rs.5000 & 20 years). The unknown entity was expected rate of returns. How to find it?

As I was investing in ‘equity’, my search for expected returns narrows down a lot. But still, from where to get the value?

I decided to look at the performance of S&P BSE 200 index in last 20 years. Why S&P BSE 200 index?

Because I was investing in equity based mutual funds. These funds has a diverse mix of stocks in its portfolio. S&P BSE 200 index’s constituents is likely to closely resemble a typical mutual fund portfolio.

So how the S&P BSE 200 index performed in last 20 years?

| Year | S&P BSE 200 Index (NAV) | Year | S&P BSE 200 Index (NAV) |

| 1999 | 592.39 | 2009 | 2,180.25 |

| 2000 | 437.15 | 2010 | 2,533.90 |

| 2001 | 341.25 | 2011 | 1,850.89 |

| 2002 | 394.04 | 2012 | 2,424.38 |

| 2003 | 766.31 | 2013 | 2,530.58 |

| 2004 | 886.55 | 2014 | 3,428.09 |

| 2005 | 1,186.23 | 2015 | 3,377.51 |

| 2006 | 1,655.74 | 2016 | 3,511.05 |

| 2007 | 2,656.52 | 2017 | 4,678.86 |

| 2008 | 1,156.59 | 2018 | 4,653.68 |

From the above table we can see that, S&P BSE 200 index has appreciated from 590 levels in 1999 to 4,650 levels in 2018. This is an annualised growth rate of ~11% per annum.

Hence it will be safe to assume an average “expected rate of return” of 11% from mutual fund portfolio in next 20 years.

So how much corpus can be built by investing Rs.5000 per month, for next 20 years, at expected return of 11% p.a.? To compute this, I will use my SIP return calculator.

The corpus which can be built by investing like this will be Rs.43.67 Lakhs.

Even a fraction change in rate of return will greatly alter the expected corpus. An example of this is shown in the below table:

How to reduce the risk of loss when dealing with equity?

As an equity investor, managing the risk of loss is not as difficult as it has been portrayed. If we can follow few basic rules, risk mitigation will not be as difficult.

My research told me that, if I can do the following three things I should be through.

- Stay invested for long term.

- Keep a diversified portfolio.

- Invest in quality mutual funds.

Long term…

For a common man who does not have a lot of knowledge about stocks, fundamental analysis etc, staying invested for long term works like a Bramhastra of risk management.

Experts say that, just stay invested for more than a period of 5+ years, and the possibility of negative returns comes down to almost zero. The longer is the investment horizon better will be the returns.

In my case, the time horizon was long enough (20 years). Hence unless the economy falls to peril, the possibility to encountering loss was almost negligible.

Diversification…

How to diversify my investment? In my case I was about to invest in mutual funds through SIP. So how to diversify?

Mutual funds portfolio is anyways well diversified. But experts say that, further diversification will be even better. How to do it? By investing in different types of mutual funds.

For a longer time horizon like 20 years, one can select sector funds, thematic funds, focused mutual funds etc. But I decided to go for a more defensive approach.

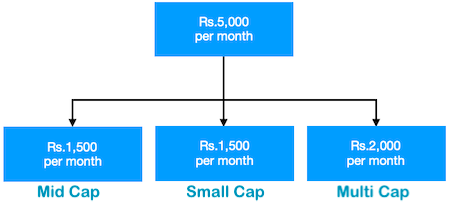

How I did it? I decided to spread my money in the following three types of mutual funds:

- Mid cap fund.

- Small cap fund.

- Multi cap fund.

Why these funds? Because they will help me cover all quality-stocks available in the stock market. This way I can have a near perfect diversification. All ‘good stocks’ will be in my basket.

Moreover, these type of mutual funds will also help me to earn a yield better than average 11% p.a. (as assumed above).

In one of my earlier blog posts, I have written extensively on type of mutual funds and their potential returns. As per my own research, these type of mutual funds can generally yield better returns in long term:

- Multi cap fund (15% p.a.)

- Mid cap fund (18% p.a.)

- Small cap fund (16% p.a.)

Hence I decided to spread my investment in the following proportion between these mutual funds. This diversification will help me with a yield of 14%+ per annum.

Please Note: By investing Rs.5000 per month, for 20 years in an investment vehicle which generates an average return of 14% per annum, can build a corpus of Rs.65.8 Lakhs.

Which mutual funds will be good for my goal?

This was the last step of my investment plan. The idea was to pick the best mutual fund operating in mid-cap, small-cap, and multi cap category.

But the tough part was, on what basis I will screen my mutual funds. I decided to operate in the fail-safe mode. I used the following screening criteria:

- Low expense ratio.

- High sharpe ratio (must read this…).

- Modest Asset Size.

- Four or Five Star rating from VRO or CRISIL.

Before we apply the screener, experts strongly suggest long term investors to invest in direct plans of mutual funds. Why? Because direct plans has lower expense ratio than their regular plans.

Hence I decided that whichever mutual funds I will shortlist for myself, I will not go for their regular plans. Instead, I will opt for their “Direct Plans“.

Following are the funds which has high VRO Rating:

Top Mid-Cap Funds

| Mutual Fund | VRO Rating | Launch | Expense Ratio (%) | Return (5Y) % | Return (10Y) % | Net Asset (Rs.Cr.) |

| L&T Midcap Fund (Regular) – G | 5 Star | Aug – 2004 | 2.14 | 22.79 | 23.85 | 3,665 |

| L&T Midcap Fund (Direct) – G | 5 Star | Aug – 2004 | 0.93 | 23.85 | – | 3,665 |

| Kotak Emerging Equity Fund (Regular) – G | 5 Star | Mar – 2007 | 2.16 | 22.41 | 20.96 | 3,425 |

| Kotak Emerging Equity Fund (Direct) – G | 5 Star | Mar – 2007 | 0.8 | 23.97 | – | 3,425 |

Top Small Cap Funds

| Mutual Funds | VRO Rating | Launch | Expense Ratio (%) | Return (5Y) % | Return (10Y) % | Net Asset (Rs.Cr.) |

| Franklin India Smaller Companies Fund (Regular) – G | 4 Star | Jan – 2006 | 2.04 | 20.67 | 24.6 | 6,859 |

| Franklin India Smaller Companies Fund (Direct) – G | 4 Star | Jan – 2006 | 0.88 | 22.2 | – | 6,859 |

| Reliance Small Cap Fund (Regular) – G | 4 Star | Sep – 2010 | 2.3 | 24.91 | – | 7,260 |

| Reliance Small Cap Fund (Direct) – G | 4 Star | Sep – 2010 | 1.15 | 26.23 | – | 7,260 |

Top Multi Cap Funds

| Mutual Funds | VRO Rating | Launch | Expense Ratio (%) | Return (5Y) % | Return (10Y) % | Net Asset (Rs.Cr.) |

| Mirae Asset India Equity Fund (Regular) – G | 5 Star | Apr – 2008 | 2.05 | 18.41 | 23.13 | 10,343 |

| Mirae Asset India Equity Fund (Direct) – G | 5 Star | Apr – 2008 | 0.79 | 19.4 | – | 10,343 |

| ABSL Equity Fund (Regular) – G | 5 Star | Aug – 1998 | 1.97 | 18.36 | 19.09 | 10,035 |

| ABSL Equity Fund (Direct) – G | 5 Star | Aug – 1998 | 1.07 | 19.54 | – | 10,035 |

[Please note the difference in expense ratio and returns between Regular Plans and Direct Plans]

Conclusion

Systematic investment plans (SIP) offered by mutual funds can be a great investment choice. For people who desire to invest for long term, shall consider investing in equity based mutual funds through SIP route.

SIP’s are best for investors who desire to keep their investment plan on auto-pilot. This way the person has least to bother about. Just start your SIP in a “good mutual fund” and balance will follow.

But the main problem is that, the phrase “good mutual fund” is too general. How a common man can screen good funds from others?

This is what this blog post is all about. If you also want to invest like Rs.1000-5000 per month for long term, follow the below steps elaborated in this article:

- First, select the right “asset class”.

- Estimate the quantum of corpus that can be built using SIP.

- Formulate a plan of how to reduce your risk of loss.

- Select a ‘good mutual fund’.

Have a happy investing.

investment kese hoga

What about Axis small cap (D) Growth in small cap since it has better returns and overall less Expense ratio.

your articles are well researched and analytical. It is explained in simple terms . i had missed it for long years . keep up the good work. all the very best your continued growth . god bless

Thanks a lot

Absolutely perfect article for investment direction

Thanks for liking.