I know this topic keeps a lot of you up at night: health insurance. Specifically, the dreaded question: does health insurance go up after a claim? Or, to put it another way, does health insurance premium increase after claim? Look, we all get health insurance for peace of mind, right? To protect us when those unexpected medical bills come crashing down. But the moment you actually use it, that little voice in the back of your head starts whispering, “Uh oh… how much is this gonna cost me next year?”

I get it. I’ve been there. Let’s decode this question, seeing this issue from our Indian perspective. I’ll keep it real using examples we can actually relate to.

The Straight Answer

The answer is a bit complicated.

Yes, your health insurance premium can increase after you make a claim. But it’s not a guaranteed thing. It’s not like you break your arm and suddenly your insurance company doubles your premium overnight. It’s more nuanced than that.

Consider this, insurance companies are in the business of managing risk. If you’re constantly filing claims, they see you as a higher risk. It’s like if you keep bumping into things while driving, your car insurance might go up.

Why the Increase Happens: The Fine Print Decoded

Here’s what’s happening behind the scenes:

- Risk Assessment: Insurers look at how often you claim and how much each claim costs. If you’re claiming for minor things now and then, it might not be a big deal. But if you’re claiming frequently or for serious illnesses, that’s when they start to worry.

- Medical Inflation: Let’s be real, healthcare costs in India are rising faster than the Sensex sometimes. Insurance companies have to factor this in, so premiums are going to increase regardless.

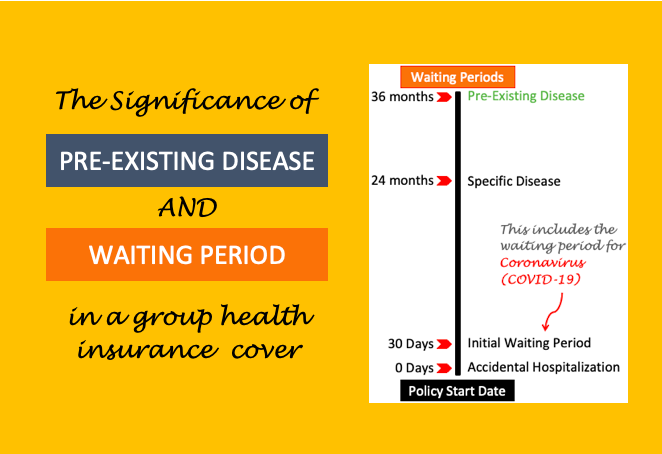

- Policy Terms: This is crucial. Every insurance company has different rules. Some might be more lenient, while others are quick to raise premiums. Read your policy document carefully.

A Real-Life Story

So, my friend Rohan…He had this health insurance policy, decent coverage, nothing too fancy. He decided he was going to get the absolute most out of it. Every single ailment, no matter how trivial, was going to be a claim.

Now, Rohan’s a bit of a hypochondriac anyway. He’d get a slight sniffle and immediately assume he had some rare tropical disease. Add that to his desire to “maximize” his insurance benefits, and you had a recipe for disaster.

It started innocently enough. He got a minor fever – you know, the kind you usually just sleep off with some adrak chai and rest. But Rohan? He booked an appointment with his family doctor, got a full check-up, and then promptly submitted the bill to his insurance company.

Cost to insurance company? Maybe ₹1500 after the consultation and basic blood tests. No big deal, right?

Then came the small cut. Rohan was chopping vegetables, slipped, and nicked his finger. He cleaned it, put a Band-Aid on it, but then he remembered his insurance! Off he went to the clinic for a tetanus shot and a “professional” bandage. Another claim, another few hundred rupees.

This went on for months. A mild headache? Doctor’s visit and a prescription for paracetamol (which he probably already had in his medicine cabinet). A slight stomach upset after eating street food? You guessed it – another trip to the doctor and a claim.

Rohan even bragged about it! “Yaar, I’m getting my money’s worth! I’m paying for the insurance, so I’m going to use it!”

I tried to warn him. “Rohan, you’re overdoing it! They’re going to see you as a walking, talking claim machine!” But he wouldn’t listen. He thought he was being clever.

Then came renewal time. Rohan received the dreaded letter from his insurance company. His premium had increased by a whopping 50%! He was paying Rs.15,000 per year originally, and now they wanted Rs.27,500!

He tried to argue with the insurance company, but it was no use. They had his claim history right there in black and white. He had become a liability.

The worst part? Rohan didn’t even need most of those treatments. He could have easily managed them at home with some common sense and basic remedies. He ended up paying a much higher premium for years to come, all because he tried to be “too smart” with his insurance.

So, Can They Increase Premiums? Does IRDAI allow it?

Good news! The IRDAI (our Insurance Regulator) protects us from being completely at the mercy of insurance companies.

They can’t just deny your renewal because you made a claim.

However, they can increase your premium under certain circumstances, like the ones I mentioned above.

How to Protect Yourself

Alright, so what can you do to avoid those dreaded premium hikes? Here’s my advice:

- Choose Wisely: Look for policies with “no claim bonus” or “no claim loading” clauses. These mean your premium won’t automatically increase just because you made a claim. Read all those fine lines, friends.

- Higher Deductible: Consider a higher deductible (the amount you pay out-of-pocket before insurance kicks in). This can discourage you from making small claims and potentially save you money in the long run. It’s like saying to yourself, “For this Rs.10,00 medical expense, I’ll just pay myself.”

- Stay Healthy, Yaar!: This is the most obvious, but also the most important. A healthy lifestyle means fewer doctor visits and fewer claims. Exercise, eat well, and manage stress. Your wallet (and your body) will thank you.

- Negotiate: Don’t be afraid to talk to your insurance company before you renew. Explain your situation, ask for discounts, and see if they’re willing to work with you. Sometimes, a little conversation can go a long way. Though my personal experience here is negative. When I crossed the 45+ years age bracket, my insurance premium got up by about 60% in two years. No amount to discussion with my health insurance provided helped.

- Shop Around: If your insurer is being unreasonable, look at other options. Thanks to IRDAI portability rules, you can switch insurers without losing your benefits. Comparison is key, my friends! Use Policybazaar or similar websites to compare the policies. But here also my personal experience is not good. Insurance porting is allowed, but for patients with series pre-conditions are not covered.

- Split Coverage Across Policies: This is something that I have personally started doing. Instead of relying on one insurer, consider having multiple policies to distribute claims, reducing the impact on any single policy’s renewal premium. This works as an added layer of protection.

Conclusion

Does health insurance premium increase after claim? It is possible, but you can be smart about it. Understand how insurance companies work, read your policy carefully, and take steps to minimize your risk.

Remember, health insurance is there to protect you. But it’s also a financial product. The more you understand it, the better you can manage it. Stay healthy, stay informed, and stay savvy, my friends!

Now, tell me in the comments: What are your experiences with health insurance claims and premium increases? Let’s learn from each other!

FAQs

No way! IRDAI won’t let them. They can increase your premium, though.

Not necessarily. Small things are usually okay. It’s the big, frequent claims that raise red flags.

No-claim loading policies, healthy living, negotiating, and comparing policies are your best bets.

Absolutely! That’s your right. Thanks, IRDAI.

The answer to this question is not a name but a reason. If you are somebody who has a person carrying serious medical condition, premiums will go up eventually. Age, also plays a very important factor in premium hikes.

Hope this helps! Let me know if you have any questions in the comments below!