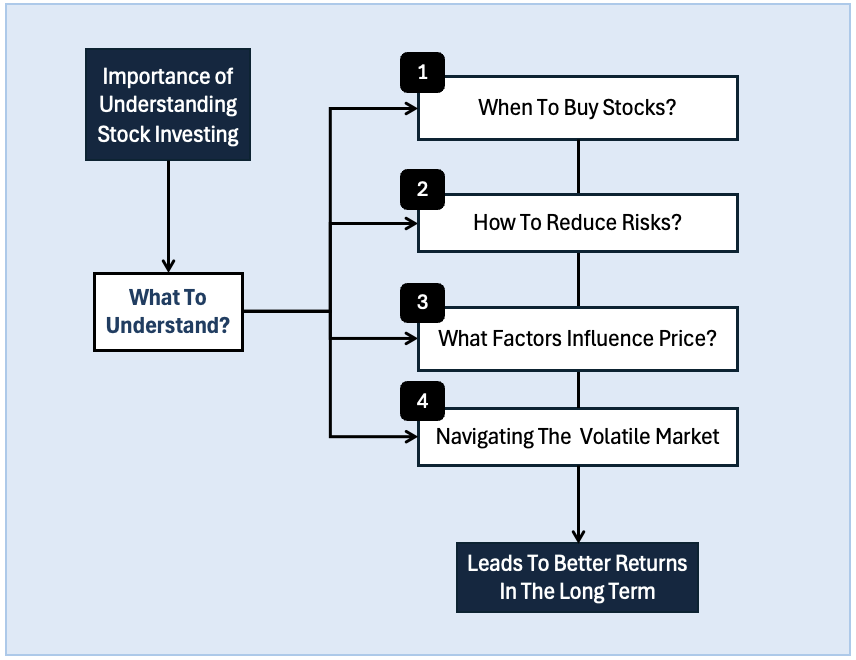

The Indian stock market is a powerful tool for growing our wealth. But just like any investment, understanding how it works is essential. By learning the basics of stock investing, you’ll gain the knowledge to make better decisions about buying and selling stocks. This kind of understanding can help one manage risks and potentially increase his/her profits.

Imagine you’re shopping for a new phone. You’d probably research different features, prices, and brands before making a choice, right? In the same way, understanding stocks helps you research companies before investing in them. You’ll learn about their financial health, what they do, and the source of their cash flows. This knowledge can help you choose stocks with a higher chance of performing well.

Understanding stock investing also helps you manage risk. The stock market can go up and down and some companies are naturally riskier than others. By learning about stock investment strategies, we can create a portfolio that aligns with our risk tolerance. This way, people can ride out market volatility and potentially earn better returns in the long run.

Topics:

Point #1: The Basics Understanding of Stocks

Ever wondered how to own a piece of a big company? Stock investing lets you do just that. Stocks are essentially tiny ownership certificates in a company. When you buy a stock, you become a mini-owner, sharing in the company’s success.

Imagine yourself as a part owner of a successful restaurant chain in your town. As its profits rise, the value of your slice (the stock price) will also grow.

Similar to how we buy groceries at a market, stocks are traded on marketplaces called stock exchanges.

The price we pay for a stock fluctuates. The fluctuations happen based on factors like company performance, industry trends, and overall market sentiment.

A company releasing a popular new product might cause its stock price to rise. While a negative financial news could cause it to dip.

Understanding what can cause stock prices to rise and fall is the foundation of successful stock investing.

Point #2: When To Buy Stocks

Think about buying a box of biscuits for Rs.10 today, knowing you can sell it for Rs.12 tomorrow. That’s the basic idea behind profiting from stocks. But unlike biscuits, stock prices fluctuate based on complex factors. Understanding the price fluctuations is crucial because it can lead to success stock investing.

So, how do you know when to buy that biscuit (stock)?

- Decoding Market Trends: The stock markets are influenced by various trends. Understanding these trends can give you valuable insights. For example, if the government announces a policy favouring a specific industry, like Automobile, stocks in that sector might see a price rise. Keeping an eye on economic indicators, news events, and industry reports can equip us to anticipate market movements.

- Analyzing Company Performance: Not all companies are created equal. Its is a crucial step is researching companies (stocks). Look at their financial health, track record, and future growth prospects. A company with consistent revenue growth, strong management, and a clear vision for the future is likely a more promising investment than one struggling financially. It is also essential to analyze the stock price (using P/E ratio, etc), to judge a stock’s relative valuation.

A Case Study: Let’s take Hindustan Unilever (HUL) as an example. By following news and company reports, you might discover they’re launching a popular new product line. This could indicate future growth and a potential stock price rise. Conversely, negative news or declining sales might suggest a price dip. Analyzing such factors helps you decide the right time to buy or sell HUL stock.

Stock markets are dynamic, and unforeseen events can occur. While taking calculated risks can increase your chances of success, there’s always an element of risk involved. That’s why consider starting with smaller investments and diversifying your portfolio across different sectors to mitigate risk.

Point #3: Reducing Risks

The thrill of potential profits in the stock market is undeniable, but so is the inherent risk. However, fear not. By employing smart strategies, one can significantly reduce these risks. Let’s explore diversification, a powerful tool in your Indian stock market arsenal.

Imagine placing all your eggs in one basket. If you drop that basket, all your eggs break. Diversification is the opposite. It’s about spreading your investments across different types of stocks (assets), creating a more balanced portfolio. Here’s how it works:

- Industry Diversification: Don’t put all your eggs (money) in one industry basket. The Indian economy is a vast landscape. Invest in stocks from various sectors like technology, healthcare, consumer goods, banks, etc. This way, if one sector experiences a downturn, others might perform well, potentially minimizing your losses.

- Company Size Diversification: Stocks can be broadly categorized as large-cap (established companies), mid-cap (medium-sized companies), and small-cap (growing companies). Each category has its own risk-reward profile. Large-cap stocks offer more stability, while small-cap stocks have the potential for higher growth (and risk). A balanced mix across these categories can create a more resilient portfolio.

- Asset Class Diversification: Stocks are just one piece of the investment pie. Consider including other asset classes like gold, bonds, deposits, etc in your portfolio. Bonds generally offer lower returns but are typically less volatile than stocks. This diversification helps smooth out market fluctuations and potentially reduce overall risk.

Diversification doesn’t guarantee complete protection from losses, but it’s a powerful strategy for risk management. By spreading your investments across different sectors, company sizes, and asset classes, you create a more robust portfolio, Such a portfolio can weather market storms.

Point #4: Factors That Influence Price

The stock market is our tool that can make our money grow and hence accumulate wealth over time. But how do you unlock its full profit potential? Knowledge is key. By understanding the factors that influence stock prices, you, the informed investor, can make smarter decisions and potentially increase your returns.

Imagine you’re a weather forecaster, you will look for indicators and pre-empt the future wealth behaviour. Similarly, there are indicators for the stock market. By analyzing key factors, we can predict price movements and invest strategically.

Here are some key indicators to watch:

- Company Sales & Profit: A company’s financial health is a major driver of its stock price. When a company like Hindustan Unilever (HUL) reports strong profits, exceeding analyst expectations, it indicates profitability and growth potential. This often leads to a surge in investor confidence, pushing the stock price upwards. Conversely, weak sales and profit reports can trigger a price drop.

- Economic Conditions: An economy is a complex ecosystem. Factors like interest rates, inflation, and government policies all influence the stock market. A booming economy often leads to rising stock prices. While recessions can cause them to plummet. Keeping an eye on economic indicators helps you anticipate these trends and make informed investment decisions.

- Investment Cycles: The stock market is subject to trends and moves in cycles. Understanding these investment cycles can be immensely valuable. For example, an election of a particular political party can cause an euphoria in the stock market. By analyzing current market news & events, we can position ourself to capitalize on these opportunities.

Predicting stock prices with absolute certainty is impossible. However, by understanding the factors that influence them, you can make our somewhat easier. Conduct thorough research and stay updated on economic news.

By mastering the art of analyzing these factors, you can be well on your way to unlocking the true profit potential of the stock market. Remember, knowledge is power, and in the world of stocks, informed investors are more likely to reap the rewards.

Point #5: Navigating Market Fluctuations

The stock market is an exciting but a very dynamic landscape. Stock prices can fluctuate rapidly, sometimes feeling like a rollercoaster ride. But fear not. Savvy investors understand these fluctuations and navigate them with a cool head.

Let’s explore how to stay calm and make sound decisions amidst market ups and downs.

Imagine the stock market as a busy marketplace where buyers and sellers are continuously negotiating the prices. This can cause the prices to change quickly based on the latest deals. Every time a new deal is made, it will cause the price to go up or down.

If sellers are dominating the market, the price will fall. If buyers are winning more deals, it will cause a bull run (stock price going up). The point is to understand when the sellers will dominate and when the buyers would rule. It depends on market news and related events.

For example, a company announcement about a product recall might cause its stock price to dip. An unexpected interest rate hike could trigger a broader market correction. The key is to not panic and make rash decisions based on temporary fluctuations.

Here’s how experienced investors handle market volatility:

- Stay Informed: Knowledge is power. Keep yourself updated on economic news, company announcements, and industry trends. By understanding the “why” behind market movements, you’ll be less likely to be surprised by fluctuations.

- Focus on Long-Term Goals: Don’t get caught up in the daily noise. The stock market is best viewed through a long-term lens. While short-term fluctuations can be unsettling, a well-chosen stock with strong fundamentals is likely to recover and potentially grow over time. Do do not panic sell when the prices are falling. In fact, that is the time to buy good stocks.

- Invest with a Plan: Have a clear investment strategy aligned with your risk tolerance and financial goals. Don’t chase hot tips or make impulsive decisions based on market panic. Stick to your plan and avoid letting emotions cloud your judgment. For example, commit to investing a fixed amount in diversified stocks every month regardless of market conditions.

Let’s say Hindustan Unilever’s (HUL) stock price dips due to a temporary market correction, not because of any company-specific issues. A knowledgeable investor might choose to hold onto their HUL stock, believing in the company’s long-term prospects. The investor is actually anticipating a price recovery as market conditions stabilize.

Market volatility is inevitable, winners of the stocks market use it as their advantage.

Point #6: Practical Tip For Beginners

The stock market offers a wealth of opportunities for its investors. But for beginners, it can also feel overwhelming. Here are some practical tips to equip you for your investment journey:

- Baby Steps Before Giant Leaps: Don’t dive headfirst with a large sum. Start small, with an amount you’re comfortable with. This allows you to learn the ropes, observe market movements, and gain confidence before venturing bigger.

- Research Before Buying: Before investing in any company, do your research. Read their financial reports, understand their business model, and track their past performance. This will help you assess their future potential and make informed decisions. Imagine you’re researching a new apartment – wouldn’t you want to know all about it before signing the lease? Stock research follows the same principle.

- Diversify – Always: Never put all your eggs in one basket. Diversification is a golden rule. Spread your investments across different sectors and company sizes. This way, if one stock performs poorly, others might hold steady, minimizing your overall risk. Think of it like building a portfolio fort – a variety of strong “bricks” (stocks) creates a more secure structure.

- Stay Updated, Stay Ahead: The stock market is constantly evolving. Make it a habit to stay informed about economic news, industry trends, and company announcements. This knowledge will help you anticipate market movements and make timely investment decisions. Financial news apps and websites can be your go-to resources (quick tip: Use google alerts)

- Patience is Key: Remember, the stock market is a marathon, not a sprint. Don’t expect to get rich overnight. Successful investing requires a long-term perspective. Focus on companies with strong fundamentals and growth potential. Short-term fluctuations are inevitable, but over time, a well-chosen portfolio can grow significantly. Buy stocks with a frame of mind that you are going to hold them for the next 15-20 years.

Following these practical tips and I’m sure that you can become a confident and informed investor.

Conclusion

The Indian stock market can be a powerful tool for building long-term wealth. By understanding the basics and employing smart strategies, you can navigate this exciting landscape with confidence. Remember, successful investing is a journey, not a destination.

Start small, prioritize knowledge, and focus on building a well-diversified portfolio. With patience and discipline, you’ll be well on your way to achieving your financial goals in the ever-evolving Indian market. Don’t be afraid to seek guidance from financial professionals who can help you chart your course towards a brighter financial future.