In Union Budget presented in Feb’2020, a new tax regime has been proposed. The income tax slabs has been altered. Compared to 2019 the new tax rates are lower.

But the lower tax rates will not necessarily reduce the tax liability for everyone.

Who will benefit? Some will benefit from the new lower tax rates. These are people who do not claim high income tax “deductions“. They will pay less tax in the new regime (2020).

Who will not benefit? Some will also pay more tax in the new regime. These are people who currently claims high income tax deductions. If these people opt for the new tax rates, they will pay more income tax.

Topics

- New Tax Slabs Vs Old.

- Why lower rates but high tax liability?

- Removed Deductions.

- New tax regime is optional.

- New tax regime (2020) vs old regime (2019).

- Minimum deductions making old regime at par with new.

- Example: Income tax calculation.

- Conclusion.

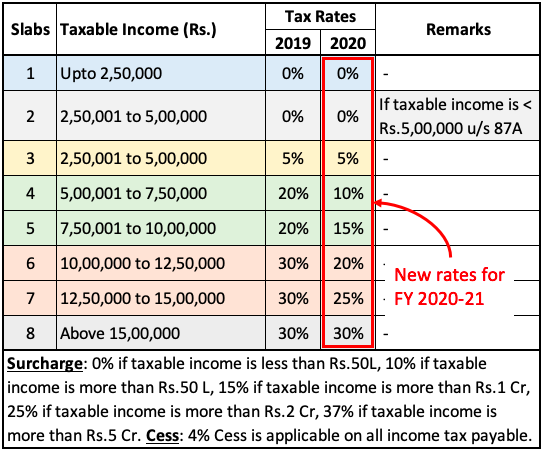

New Income Tax Slabs / Rates (2020 vs 2019)

The new tax slabs has more income subdivisions than before. A detailed subdivision has allowed the Finance Minister to pass on better tax rates for “lower income earners”. Let’s see a comparison of new tax slabs (2020) with an old one (2019).

By looking at the above tax rates it looks like 2020 rates are lower, right? But this conclusion can be erroneous. Why? Because even with lower tax rates some people will end up paying more income tax.

Let’s know more about this ambiguity…

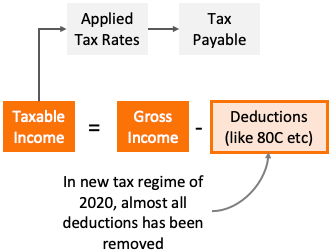

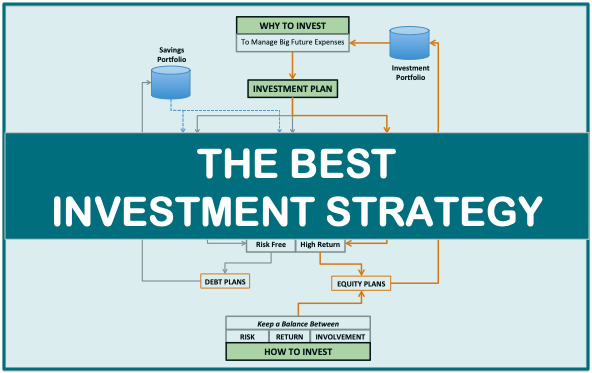

Lower tax rates – but high tax liability, why?

What is the reason for ‘lower tax rates’ not converting into ‘lower tax liability’? This happens because the deductions allowed till 2019 has been removed in 2020 (if one opts for the new regime).

Tax liability is calculated based on ones taxable income. Gross income minus deductions is taxable income. If one cannot claim deductions, taxable income will increase. Hence even with lower tax rates, people might end-up paying higher taxes. Check this on my new tax calculator.

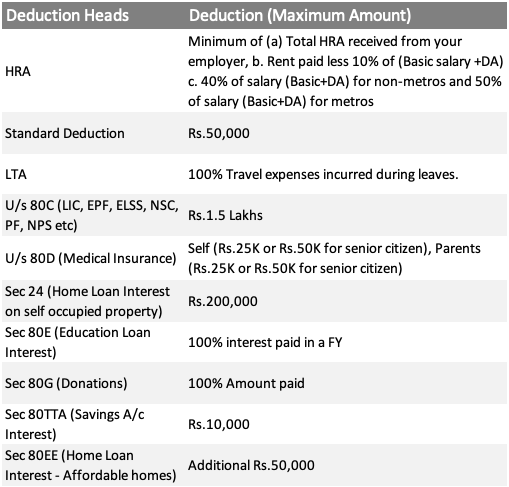

Which deductions has been removed?

Almost everything has been removed. See a list of few common deductions applicable for 2019 tax regime, but removed from 2020 regime:

- 80C/80CCC (Rs.1.5 lakhs)

- Life Insurance Premium

- PPF (Public Provident Fund).

- EPF (Employees’ Provident Fund).

- FD (Taxi saving fixed deposits).

- NSC (National Savings Certificates).

- ELSS (Equity Linked Saving Schemes).

- Repayment of Home Loan Principal.

- Tuition Fees (for child).

- SCSS (Post office Senior Citizen Savings Scheme).

- NPS (National Pension System).

- Stamp duty charges for purchase of a new house.

- Contributions made to annuity plans.

- 80CCD(1b) (Rs.50,000):

- Contributions to NPS. (over Rs.1.5 Lakhs).

- 80D (Rs.25K+30K):

- Sec 24 (Rs.200,000):

- Interest paid on home loan of self occupied property.

- 80EEE (Rs.50,000):

- Interest paid on home loan for first time home buyer.

- 80TTA (Rs.10,000):

- Interest income generated from savings account.

- 80GG:

- HRA received from employer.

- 80G:

- Contributions make to charity.

- 80E:

- Interest paid towards repayment of education loan (self, spouse, child).

- 80GGC:

- Contributions made to a political party.

There are few deductions which still remains under the new tax regime:

- Sec24: Home loan interest deduction on let out property Upto Rs.2.0 Lakhs. [P.Note: interest deduction on self occupied property is not allowed].

- 80CCD(2): Companies contribution to NPS of an employee (Max: 10% of Basic+DA).

New Tax Regime is optional?

Yes, the new tax regime of 2020 is optional. It means, it is on the discretion of the taxpayer to continue paying tax as per old regime (2019).

The taxpayer can choose between the old and new tax regime depending on which is best suited for him/her.

How to know which tax regime (old or new) is more apt for us? This is what we will discuss in this article.

But to make the understanding easier, I suggest you to use my income tax calculator for comparison. The calculator will show results in a comparative form between old and new tax regime. It will make the decision easy.

New Tax Regime (2020) vs Old (2019)

Tax rates proposed in new tax regime are lower. But with these lower tax rates ‘tax saving deductions‘ cannot be applied. This makes the new regime tricky for people. Generally speaking “old tax regime with deductions” is better than new tax rates of 2020.

There are two sets of people who pay’s tax.

- First: are those people who have just started a job. These people have invested less or nothing in tax saving options. Hence they cannot claim income tax deductions. For such people new tax regime is better.

- Second: are people who have matured and have handsomely invested in tax saving options. These people claim high deductions in their tax returns. Hence their taxable income is comprehensively lower than their gross income. For such people old tax regime is better.

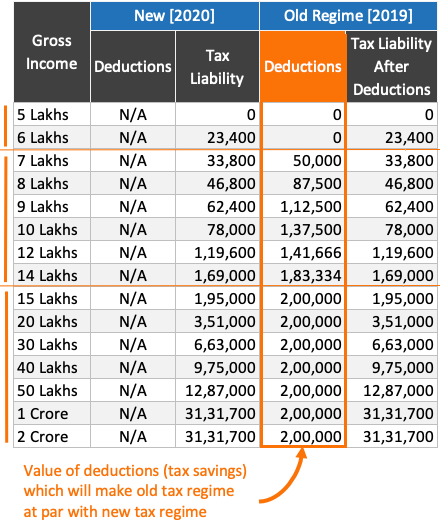

I would like to elaborate a bit more for people falling in the second category. Check the below infographics:

Deductions Making New & Old Tax Regime at Par

The above infographics highlights the value of minimum deductions that will make old and new tax regime at par. What does it mean? To understand this, let’s see following examples:

- Gross Income = 6 lakhs: When income is say six lakhs, the total tax liability in both the case is Rs.23,400. People opting to stay with old tax regime need not claim any deductions. Check the tax calculator.

- Gross Income = 7 lakhs: Suppose there is a person who pays premium (Rs.50,000 p.a) on life insurance policy. The person can claim a deduction of Rs.50,000 u/s 80C. For this person, after claiming the said deduction, old and new tax regime will yield the same tax liability (of Rs.33,800). If value of deduction will increase, tax liability in old tax regime will further go down. Check here for the available deductions.

- Gross Income = 14 lakhs: Suppose there is a person who claims a deduction of Rs.183,334 p.a. on account of interest paid on home loan (u/s 24b). For this person, after claiming a minimum deduction of ~Rs.1.84 Lakhs, old and new tax regime will yield the same tax liability (of Rs.1,69,000). Read more on home loan prepayment.

- 15 Lakhs < Gross Income < 2 Crore: For this group of people, they need to claim a minimum deduction of Rs.2,00,000. Post claiming the said deduction, the tax liability of old and tax regime will become the same. Use the tax calculator to verify the values yourself.

[P.Note: Please note that the deductions highlighted in the above table are the minimum values. If value of deduction will increase, tax liability in old tax regime will further go down.]

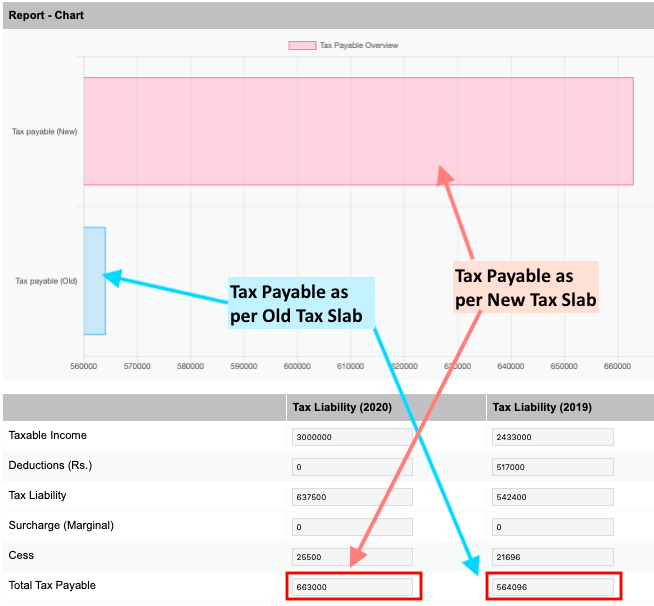

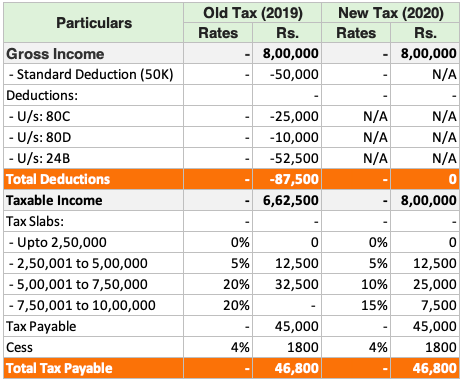

Example: Income Tax Calculation [2020]

This is an example of a person having gross income of Rs.8 Lakhs. In old tax regime, the person has an option of claiming standard deduction of flat Rs.50,000. In addition to this, he has also claimed deduction of Rs.87,500. This brings down his taxable income to Rs.6,62,500. This way he will pay the same tax as he would have paid in case he opted for the new regime.

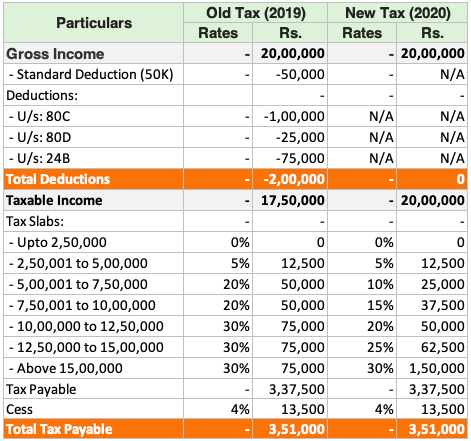

This is an example of a person having gross income of Rs.20 Lakhs. In addition to the standard deduction, he has also claimed an addition deduction of Rs.2,00,000. This brings down his taxable income to Rs.17,50,500. This way he will pay the same tax as he would have paid in case he opted for the new regime.

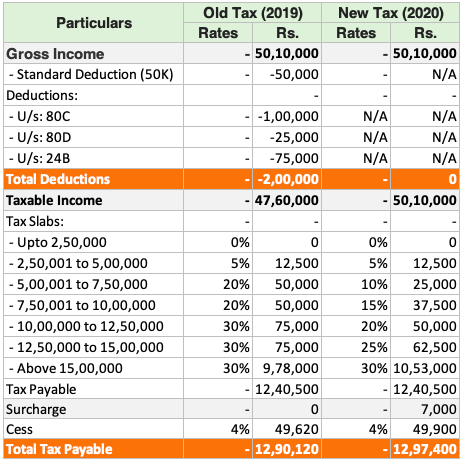

This is an example of a person having gross income of Rs.50.1 Lakhs. In addition to the standard deduction, he has also claimed an addition deduction of Rs.2,00,000. This brings down his taxable income to Rs.47,60,500. This way he will pay the same tax as he would have paid had he opted for the new regime.

Conclusion

New tax rates proposed in the union budget of 2020 shows lower rates. But in addition to the tax rate cuts, allowable deductions has also been removed (including the standard deduction of Rs.50,000).

In our country where most households invest money in tax savings options to reduce their tax burden, this move of our FM was unsolicited.

But not to cause a major disruption due to the proposed income tax rules, the new tax regime has been kept optional. This means that the old tax rates along with deductions will continue to exist.

So if the new regime is not tax friendly, who will opt for the new tax rates? Those people who currently claim nominal deductions will benefit from the new tax rates.

Further Reading:

Thank you so much. Very simple and clear explanation

Dear Author,

Thank you for writing this article, it is very informative and useful. As per my experience there is a vital difference between educated and being financial educated. The article written by you will make people financial educated.

Regards,

Abhishek

Thanks

Too good article. Thanks Mani for sharing it.

Thanks for liking & commenting.