Summary Points:

- India’s manufacturing PMI jumped to 58.1. It the highest in the last eight months. Sign of a strong growth.

- New orders and production grew at the fastest pace since July 2024. The growth was driven by domestic demand.

- Export growth is a bit slower.

- Finished goods stocks dropped at the quickest rate in over three years. Reason? High demand.

- Input costs rose, but companies kept price hikes low. They are balancing sales over margins.

- Hiring slowed slightly, yet the sector remains optimistic with 30% of firms expecting higher output next year.

Introduction

Today we’ll talk about the latest HSBC India Manufacturing PMI report, released on April 2, 2025. I’ve been following these reports for the past six months, and let me tell you, this one has some exciting updates. As a stock investor, I’m curious about how our factories are doing. Generally, it is a short two page report which I try to glance as it gets released each month. Though it is a simple report but I’ll anyways declutter it for your quick reference.

What is this PMI Report?

PMI is an acronym for “Purchasing Managers’ Index.”

This report is like a monthly health check-up for India’s manufacturing sector.

It’s put together by S&P Global, with HSBC as the sponsor. To prepare this report, they survey around 400 manufacturing companies across India. They ask questions like, “Are you getting more orders? Are you making more stuff? Are your costs going up?” Based on the answers, they give a score.

If the score is above 50, it means the sector is growing. Below 50, and it’s a sign of trouble.

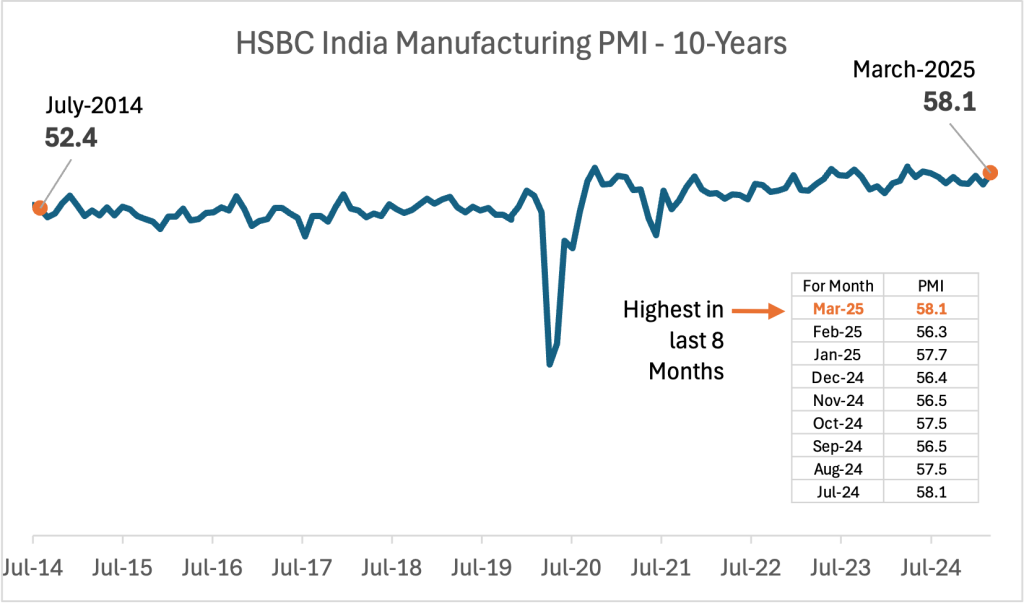

The last 10-Years historical “Purchasing Managers’ Index for India is as below:”

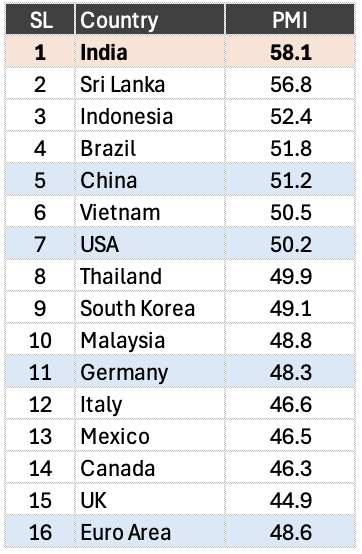

The April 2025 report tells us about what happened in March 2025. The PMI score for March was 58.1.

That’s a jump from February’s 56.3. In fact, it is the highest score in eight months.

To give you some context, I’ve been tracking the past five reports, November 2024 to March 2025, and the PMI has been hovering between 56.3 and 58.1. Back in December 2024, it dipped to 56.4. It was the lowest PMI in that year. But then January 2025 data came in and it was strong at 57.7. Now March 2025 data is even higher (58.1).

What does this tell us?

Well, our manufacturing sector is not just growing, it’s picking up speed again after a slight slowdown in February.

Reasons For PMI Growth?

One of the biggest reasons for this jump is the rise in new orders.

The report says that total sales grew at the fastest pace since July 2024. It was due to a strong customer interest, good demand, and some smart marketing by companies.

Consider this that you run a small factory making steel utensils. Suddenly, more shops are calling you to place orders because people are buying more for their homes. That’s what’s happening across India, people are buying, and factories are working more to keep up.

This pushed production levels up too. The report notes that output increased at the sharpest rate in eight months. It’s the end of the FY24-25 fiscal year, and it looks like manufacturers wanted to finish strong.

Slowing Export

While overall orders are up, the growth in export orders slowed down a little in March.

It’s still growing. Companies are reporting sales to places like Asia, Europe, and the Middle East, but the pace of growth dropped to a three-month low.

If you look back at January 2025 report, export orders were growing at their fastest in nearly 14 years. So, this slowdown in March isn’t a red flag, but it’s something to keep an eye on.

I wonder if global demand is cooling off a bit. Maybe some countries are tightening their budgets?

Still, the fact that domestic demand is so strong is a good sign for us. It means our own people are driving this growth. It gives a feel of sustainability, right?

Finished Goods Inventory

The report says that companies saw the fastest drop in their finished goods stocks in over three years, since January 2022, to be exact.

What does this mean?

Well, finished goods are the products that are ready to be sold. It could be items like cars, clothes, or gadgets sitting in a warehouse of the manufacturing companies.

Because demand was so high, companies used up their ready stocks to meet orders. It is the step companies take as they are a faster way than they could make new stuff. This has been happening for four months in a row, and it’s the sharpest decline (in finished goods inventory) in a long time.

On one hand, it shows how strong the demand is, people are buying so much that stocks are running low. On the other hand, it could be a problem if companies can’t keep up with production.

To tackle this, manufacturers do future planning.

They started buying more raw materials, like steel, cotton, or chemicals, at the fastest pace in seven months. The report calls this “input purchasing,” and it was above the long-term average.

They also built up their pre-production inventories. It is basically the raw materials they keep on hand before making products. This inventory built-up is at the quickest rate in five months.

This shows that companies are preparing for more demand, which is a positive sign.

The report also point that, the suppliers were able to deliver these materials on time. The lead times are shortening for the 13th month in a row.

Input Costs (Inflation)

But when demands goes up something else happens which is not so pleasant. The input costs goes up.

The report mentions that input costs went up in March, with prices for things like copper, electronic items, leather, LPG, and rubber increasing. In fact, the rate of cost increase was the highest in three months.

If you’re a manufacturer, this means your expenses are going up. It’s like when the price of petrol or vegetables suddenly shoots up.

But there is the good part here too. Even though the costs went up for companies, they didn’t pass all of it on to customers. The rise in selling prices was softer. Actually the weakest in a year. This tells me that manufacturers are being careful. They know demand is strong, but they don’t want to scare customers away by raising prices too much.

It’s a delicate balance and the market is such that, I think, the manufacturer are prioritising sales over margins. It is a good sign for a market recovery.

New Jobs?

The reports point to another thing. The hiring slowed down a bit in March.

The report says employment still grew at a solid rate, but companies “reigned in” their recruitment drives because capacity pressures were mild. They didn’t need to hire as many new workers because they could handle the workload with their current team.

If you look back at January and February, hiring was at record highs. So, this slowdown in March isn’t a bad thing; it just means things are stabilizing.

The report also tells that the backlogs (pending work) grew at a slower pace than in February. So factories aren’t feeling too overwhelmed.

Conclusion

Going back to November 2024, the manufacturing sector has been on a steady path. Sure, there were small dips, like in December 2024 and February 2025, but the overall trend is upward.

The PMI has stayed above 56 for these six months, and now at 58.1.

The PMI is well above the long-run average of around 54. That’s a good performance, especially when you consider how global uncertainties are troubling everyone.

There are couple of charts in the April report. They show that since the big dip in 2020 (COVID days), the PMI has mostly stayed above 50.

Just for context, here the the PMI for the following countries (regions) for March’2025:

What does all this mean for we retail investors?

This report is a reason to feel hopeful.

Our factories are buzzing, demand is strong, and companies are preparing for more growth.

There are also challenges, like rising costs and a slight dip in export growth. But the fact that domestic demand is driving this boom should make us feel more secure.

For long term investors, this could be a good time to look at manufacturing-related stocks or sectors. Quality companies making consumer goods or industrial products could be our pick.

But as always, keep an eye on the next few reports to see if this momentum holds.

What do you think about this report? I would like to know your views in the comment section below.

Have a happy investing.