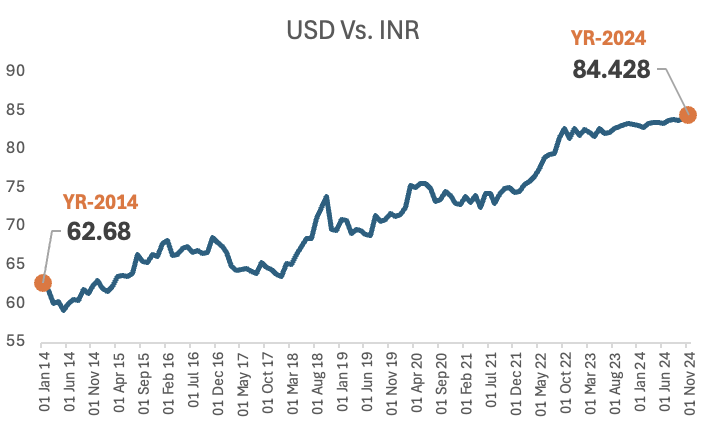

In November’2024, the Indian Rupee has plummeted to a record low against the US Dollar. It marks a significant moment for India’s economy. On November 7, 2024, the rupee was valued at an unprecedented 84.29 against one dollar. It reflects a confluence of domestic and global economic situation prevailing around us. This depreciation is not just a number on the financial charts but has tangible effects on India’s economics. It will influence our import costs, inflation rates, and the overall economic sentiment.

Topics

1. Past Rhetoric

In the past, our now PM used to taunt our then PM (Mr. Manmohan Singh) over the weakening of Indian Rupee before the 2014 regime. During the time, Manmohan Singh was often criticised by our present PM taking dig at the weakening Indian Rupee. How was our Indian Rupee valued at during 2013-2014 years? It was at Rs.63 levels. Where is the Indian Rupee now? On 07-November’2024, it touched Rs.84 levels. It means, since 2014, our Rupee has devalued by over 30%.

Here were a few political stance taken by our present PM back in Year 2014 on the weakening Indian Rupee:

- PM Modi used to link the depreciation of the rupee to national pride. He used to suggest that when the rupee falls, so does the prestige of the country. This rhetoric was used to critique the economic handling by Manmohan Singh’s government.

- PM Modi would often highlight how the rupee had weakened against the US dollar. He used to imply a direct connection between the currency’s value and the effectiveness of the leadership. He used to mention that during PM Singh’s tenure, the rupee value had significantly deteriorated, which he portrayed as a sign of economic mismanagement.

This narrative was part of PM Modi’s campaign strategy. His idea was to underline economic instability under Manmohan Singh’s leadership.

Assuming what he (PM Modi) said during that time was true, then today, after 10-year of his being in the helm of affairs, our Indian Rupee has further devalued by another 30%.

What we, common citizens of India, should learn from this story? This is what I’ll blog about today in this article.

2. Why Indian Rupee is Getting Devalued?

The primary forces behind this depreciation are multifaceted.

#2.1. FIIs Selling

Firstly, there has been a notable exodus of foreign capital from Indian equities. Foreign investors have been pulling out substantial sums from the Indian stock market.

Is it happening because of the fault of the Indian Government? Not at all.

Reports indicates that over $8.4 billion have been withdrawn from the Indian stock market in the recent period. This outflow is largely due to heightened global economic uncertainties. Read about why the stock market is falling.

#2.2. Donald Trump Factor

Even the outcome of the recent US elections, which has seen Donald Trump return to office, is also influencing the USD/INR balance. Donald Trump’s comeback is potentially signalling more aggressive economic policies that favor the US dollar.

If the new President will take steps to strengthen the USD, a further comparative INR devaluation is on the cards. Read about how US elections will impact the Indian stock market.

#2.2.1 USD Dollar

Another contributing factor is the strengthening of the US dollar itself.

The dollar index, which measures the greenback’s strength against a basket of major currencies, has seen an uptick. It is driven by expectations of US economic policy changes.

People are expecting that potential tariff impositions will take place. Under Donald Trump’s presidency, there will a shift in monetary policy from the Federal Reserve.

These developments have made the dollar a more attractive investment option. The demand for the USD has increased and hence its value against other currencies like the Indian Rupee.

In a way you can say that, Indian Rupee is not weakening, USD is becoming stronger.

#2.3. Inside India Factors

On the home front, India’s economic indicators have shown mixed signals.

While there have been inflows into the debt market, particularly with India’s anticipated inclusion in JPMorgan’s Emerging Market Bond Index (read more), the equity market has not seen similar confidence.

The domestic equity market have been under pressure due to these capital outflows, which in turn pressures the rupee.

The Reserve Bank of India (RBI) has traditionally played a pivotal role in managing currency volatility. The RBI’s interventions in the forex market by selling dollars have been noted. RBI does it particularly when the rupee approaches these historic lows.

However, recent observations suggest a strategic withdrawal from aggressive intervention.

Possibly, RBI is doing it to allow the Indian Rupee to find its natural level. On positive side, this might help Indian exporters to maintain competitiveness in exports. But there is also a downside to it, importers will have to face higher import costs for essentials like oil.

3. What are the Implications of The Weak Indian Rupee?

The implications of this record low are significant.

- For consumers, weak Indian Rupee means higher prices for imported goods, from electronics to crude oil, which could further stoke inflation.

- For businesses, especially those reliant on imports, costs have escalated. It squeeze the margins of the companies. Conversely, this scenario will benefit the exporters. It will make Indian goods cheaper abroad. Although it is also true that as global demand conditions are not upbeat, the positive effect of weak Rupee will get offset by it.

The rupee’s devaluation reflects broader trends affecting emerging market currencies. In Asia, where currencies like the Chinese Yuan have also weakened, the impact of a strong USD is being felt all over.

This regional currency depreciation trend underscores the interconnectedness of global markets. Policy shifts in one major economy can reverberate across continents. So, henceforth, whenever we see our Indian Rupee getting weaker, we must look around and see what is happening around the world.

No matter what Narendra Modi’s, Rahul Gandhi’s, and Donald Trump’s of the world might say, we must remember that strength of Indian Rupee is also influenced by external factors.

Conclusion

As India navigates this economic crisis (if we can call it so because our present PM has called it like that in past), the focus will likely be on how the RBI manages this situation.

While a weaker rupee can stimulate export-led growth, excessive depreciation could lead to capital flight and undermine investor confidence.

The government’s fiscal policies, alongside RBI’s monetary maneuvers, will be crucial in stabilizing the currency without stifling economic growth.

The Indian Rupee’s journey to its lowest ever value against the US dollar is a complex interplay. We must see this phenomenon is a more mature way. Political parties in the opposition will not help us by rationalising the facts, we must do it ourselves.

Domestic economic policies, global financial trends, and geopolitical developments, all have an effect on our currency.

As India continues to integrate into the global economy, these fluctuations will be watched closely for their long-term impact on the country’s economic health and the everyday lives of its citizens.

Have a happy investing.