There are several alternatives available for investing money in India. But the problem is that, investment after retirement must be done in a specific way.

Hence, the composition of ‘investment portfolio’ of a retired person is different from other people. What is the difference?

A retired person plans to include those assets in portfolio which generates regular income as returns. Read more on how to build assets.

The priority of a retired person is dominantly income generation. This priority supersedes the need for capital growth.

Before & After Retirement

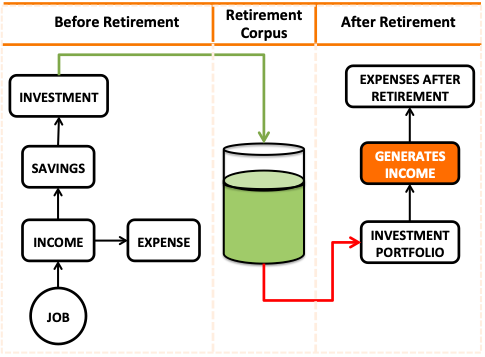

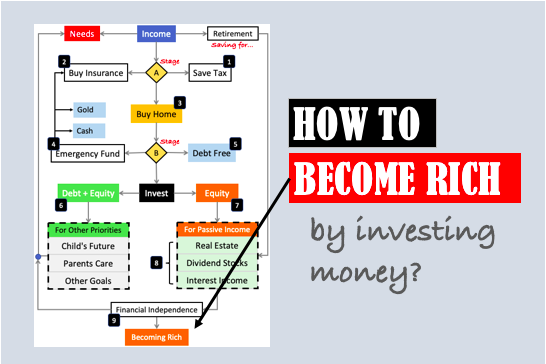

The below infographics explains the difference in priority of a retired person from others.

Clarity about this difference is essential before investing. Why? Because in absence of it, people often take wrong investment decisions. So, let’s understand the difference:

- Before Retirement: The priority at this stage of life is “building retirement corpus”. In this phase, the person is doing job to generate income. The person is also investing systematically in growth based options. Why growth? Because the risk is less (job security), and also the available time horizon is longer. Check this retirement planning calculator.

- After Retirement: The priority at this stage of life is “building a stable income source”. What can be the source? A well built investment portfolio. The portfolio of a retired person consists of such investment options which can generate stable income. Read more about investing for monthly income.

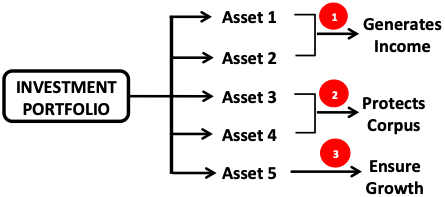

The first priority of a retired person is always income generation, but his/her ideal mix of priorities can be as shown below. This range of priorities ultimates shapes his/her investment portfolio.

Portfolio Building

A well built investment portfolio can take care of the above three priorities of a retired person.

But before we dig deeper into the composition of investment portfolio, let’s pause and ask a basic question. What an investment portfolio means for a retired person?

This portfolio has a mix of different assets. What is ‘asset mix’? Proportions in which the retirement money is distributed among various investment options.

A retired person should not only know where to invest funds, but he/she should also know “how to spread the money among different assets”.

Why to spread the money? For the sake of diversification. It is a must. There is no hard and fast rule of diversification. An individual must do it based on his/her comfort and requirement. Confused?

Lets understand the thought process, it will surely clear some cloud…

The Thought Process…

The thought process that goes into the selection of assets, varies from family to family. Why? Because every family is unique. They give different weightage to priorities.

It is the identification of right priorities, and giving correct weightage to it, ultimately decides the composition of ones portfolio.

Different people will invest their ‘retirement corpus’ differently. The difference will be due to the weightage they gives to the three priorities.

For some, the protection of corpus will be more important. There’ll be some for whom the priority will be corpus growth. Lets see few examples:

- Example 1 – When size of corpus is too small: This is a retired person who has no other asset except for the retirement money (not even a home). How this person will invest? He will first buy a home. Then, whatever money is left, will be used only for income generation. His priority matrix will look as below. He can invest in only “low yield, debt based” plans, which can generate regular income. Read more about passive income.

- Example 2 – When size of corpus is moderate: This is a retired person who has no liabilities to take care after retirement. How this person will invest? As he has spare money, this person can also afford to think about corpus protection (inflation hedge). His priority matrix looks as below. He can invest in debt for income generation, equity (like balanced funds) for corpus protection. Read about inflation & dosa economics.

- Example 3 – When size of corpus is big: This is a retired person who has a retirement corpus, and also a rental property which takes care of his 50% monthly expenses. How he’ll will invest? He is only 50% dependent on retirement corpus. Hence, he can do a bit more with his funds. His priority matrix looks as below. His choice can be debt, hybrid, and full equity. Read more about types of mutual funds & their potential returns.

Now we are ready to discuss about, what shall be the portfolio constituents of a retired person. But before that, let’s read a “caution note”.

Handle Funds with caution…

After retirement, people should not speculate or experiment with their money. How to ensure it? Prepare your priority matrix.

Wealthy individuals who retire rich, for them fixed income is not a priority. They can afford to talk about investment diversification, capital appreciation, equity, growth etc. But this article is not for such wealthy individuals.

Majority of retired men in India has only handful of savings. Moreover, they are also not conversant with investment options, and risks associated with investing. For such people, it is better to handle retirement corpus with care.

Preparation Before Investment

Though a separate article is necessary to discuss about the preparations required before retirement, but considering its importance, lets touch this topic briefly:

- Collect Funds: Collect all savings (like EPF, Gratuity, PPF etc) that has been accumulated while in job. Read more about online EPF withdrawal process. Lets look at the total saving of a typical retired person in India:

- Provident fund – Rs 30Lakhs,

- Gratuity – Rs 15 lakhs,

- Fixed Deposit – Rs 5 Lakhs,

- Share – Rs 3 Lakhs,

- Endowment plan – Rs 3 Lakhs, and

- Cash – Rs 2 Lakhs.

- Total: Rs.58 Lakhs.

- Estimate Expense: Count all expense requirements. Idea of doing this exercise is to know exactly how much one need to dig into the retirement corpus each month to manage expenses. No matter how low is the expense, withdrawing money regularly from retirement fund will ultimately exhaust it. Hence, investment is necessary to make the corpus grow fast enough, so that regular withdrawals are possible without depleting the corpus (as far as possible). Read more about calculating daily expense for self. Here is a typical expense of a retired person in India:

- Household expense: Rs.21,000/ month.

- Health: Rs.5,000/month.

- Other expense: Rs.5,500/month.

- Total: Rs.31,500/month.

- Quantify Required Returns: In our example, retirement savings is Rs.58 Lakhs, and monthly expense is Rs 31,500. In order to generate income of Rs 31,500 per month, a return @ 6.5% p.a. will be necessary (=31500×12/5800000). In India, a return of 6.5% is not a difficult to generate.

Where to invest retirement money?

The person shall try to divided the retirement corpus into eight parts as shown below:

- Current A/c

- Savings A/c

- Fixed Deposit

- Post Office – Monthly Income Scheme (PO-MIS)

- Post Office – Senior Citizen Savings Scheme (PO-SCSS)

- Pradhan Mantri Vaya Vandana Yojana (PMVVY)

- MIP offered by Mutual Funds – monthly dividend plan (MF-MIP)

- Balanced Mutual Fund – for capital appreciation

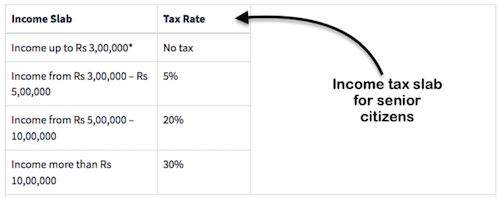

[P.Note: For senior citizens, no income tax is applicable if annual income is less than Rs.3.0 lakhs. But TDS will still be deducted. In this case, while filing the income tax returns at the end of the month, income tax refund should be claimed. It is also important to keep all TDS certificate handy while filing the income tax returns.]

Lets discuss few options in details…

- Savings A/c: Parking all retirement money in savings account is best. But its yield is too low (3.5% p.a. & we need 6.5%). Hence, better is to keep only 12 months worth expense in savings a/c (for liquidity). Let’s explore other investment options to meet priorities. [In our example – see the above infographic, fund allocation to savings account is limited to 1.7% only]. Read about best alternative to savings a/c.

- Fixed Deposit: Bank’s fixed deposit is also a great option for income generation. But here too, the yield of FD is low (6.08% net of TDS & we need 6.5%). Hence, better is to keep only limited funds in FD. [In our example – see the above infographic, fund allocation to FD is limited to 17.2% only]. Read about how to earn high interest from FD’s.

- Post Office (MIS): Monthly income scheme (MIS) is a tailor made investment plan for retired people. It generates stable income. Its interest rate is high @7.6% p.a. But it also has limitations. The interest of MIS will be credited only into post office’s savings a/c (POSA). But POSA has no ATM & no online banking. Another limitation is related to maximum investment (Rs 9 lakhs in case of joint account with spouse). [In our example – see the above infographic, fund allocation to PO-MIS is limited to 15.5% only]. Learn more about Post Office Monthly Income Scheme (MIS) here.

- Post office (SCSS): Senior citizen savings scheme (SCSS) is another tailor made investment plan for retired people. But this too has a limitation. Maximum investment is limited to Rs.15 Lakhs (joint account with spouse). Banks also offer SCSS. The lock-in period in SCSS is 5 years. Interest rate is high @8.7% p.a, but net of TDS falls to 7.56% (paid quarterly). One can claim deductions for SCSS u/s 80C. [In our example – see the above infographic, fund allocation to PO-SCSS & SBI-SCSS is limited to 51.8% only]. Read about difference between SCSS and PMVVY.

- Mutual Fund (MIP): Mutual fund MIP’s with annual dividend payment option yields better. Gross return of MIP is good (8% p.a), but DDT of 28.84% makes its yield low. Net of DDT yield becomes 5.84%. [In our example – see the above infographic, fund allocation to MF-MIP is limited to 6.4% only]. Learn more about MIP’s offered by Mutual Funds.

- Equity (Balanced Hybrid Fund): There will always a temptation to invest for fast capital appreciation. Though for a retired person, it is not a number one priority. But to satisfy this urge, it’s better keep a provision. [In our example – see the above infographic, fund allocation to MF-Balanced is limited to 0.9% only]. Read about investing risk free & earning high returns.

Conclusion

In this article we saw, how to distribute ones retirement corpus so as to generate net returns of 6.5% per annum. This was done by distributing funds as shown in above infographics.

The wiser will be the fund distribution (low risk, just-enough returns), more peace will be bestowed on the retired person.

It is important to lock our savings. Why? To prevent it from getting spent needlessly. How to lock it? By investing and not keeping it free in savings account. But in the spirit of investing, one must not take unnecessary risks.

Have a happy investing.

Superb and informative post. Thanks Mani.

Hello. Myself aged 42. Has two kids. studying 6th and 1st std. I have 3 crores in Mutual funds, 50 lakhs in shares, 1 crore in FD, 1 crore worth Real estate (Land), Own house, Rental 12,000 per month. Have a Term insurance and Medical health insurance. Not a lavish spender. Approx. 60 to 80k per month. That’s what I am expecting. As I am returning from abroad, I am not sure about the exact living expense and the education expense for the kids. Have I reached FIRE or I am missing some thing. The inflation part I am not sure of.. Any thoughts/comments.. open to receive feedback.

Hi Mr. Mani(sh),

Very illustrative article.

You have mentioned about the current account – which is 1 year liquidity and not for income. I am bit confused on this. Is it not wise to have this portfolio too as income generation instead of just the amount lying in the current account without any income and only for emergencies?

Please keep up the good work. God Bless.

Very well written, Mani… tremendously useful!

Excellent blog Mani..Keep going

Very helpful article Mani. My father is a Govt Employee and will be retiring soon.He will be getting monthly pension which will more or less suffice his monthly expenses. PMVVY and SCSS will take up 30L. We are yet to finalise on allocation of balance 50L (excl Emergency/Liquid Fund). Your suggestion will be highly solicited.

V good article. But one point is unanswered. The upper cap of scss is not increased for more than 15 years, but the limit of gratuity forming part of 40% of any retirement corpus had seen upward revision of 20 lacs. Thus the limit of scss, which has high safety and ROI. If you take it up with appropriate authorities to increase the limits upto 35 lacs, it would help so many seniors to avoid chasing various inv options and land in trouble at a later date. Hope you would takeup the issue on general wellbeing of so many seniors.

Hi,

Wonderful article. Seems to be i have found the solution for my problem.

looking for an expert to deliver a talk on “Financial planning with aging” in an event on 17th Nov in Faridabad. Its a one day event meant for senior citizens…expecting more than 5000 of them to attend it.

Please accept my invitation.

Sorry for inviting this way. Couldn’t find any other communication mean.

Thanks

Amazing article, with practical examples helped us in understanding the reality in a better way.

Really appreciate the efforts for making other people understand.

Thanks for the awesome feedback.

Thanks for wonderful artical. Great help to retired persons

Article is good, but you have not completely factored the affect of inflation on annual expense. If we take a 6% inflation the corpus required will be much higher.

Thanks for posting your comment.

Please check Step A#2, it has a factor called “Investment to hedge inflation”.

Iam retiring in 2 years and the thought is alarming Istay on the capital city and my son would not have completed even his graduation when I retire. Your article has calmed my mind. Feels like I can pull through .Thank you Sir.

Thank you sir for posting an awesome feedback. Best of luck for your future.

Excellent explanation and good thinking. It is very helpful. Please keep on update. I am sure you will make a way to all retired persons.

Wonderful article sir. I was searching some article to guide my aunt for making a retirement portfolio for her. Your article is exceptional. There cannot be a better guide than this for retiring people. Thankyou sir.

Thanks for your awesome feedback….

Awesome article !! Appreciated your efforts and giving right direction to retire people.. This article will definatly help me to prepare retirement portfolio for my parents . – Siddharth

Awesome Siddharth. Thanks for your comments.

How to build retirement corpus video i just saw, from where do we download

mani ji,

please suggest some MF categories for corpus protection and corpus growth separately.

I will suggest you to read this series on mutual funds…

http://ourwealthinsights.com/mutual-funds/

DEAR MANI JI,

I am retiring soon and would like to follow your example. it is very useful, since my corpus amount roughly equals the amount mentioned in your example(58 lakhs).

In your example, where is the allotment for corpus protection? what are the funds to be invested in for corpus protection? you talked about only income generation and corpus growth.

The investment options discussed above provide both income, and protects the principal from erosion. No separate allocation shall be necessary.

Sir please clarify the point. I have the same doubt.

Mani sir, shouldn’t we consider inflation rate while calculating the amount required for monthly expenses?

It is a must. It has been considered in my example. Please see step #A2. Thanks for posting your comment.

Dear Mr. Mani,

You have very nicely and elaborately explained all the points. I am in the verge of taking retirement and this will definitely guide me to invest my hard earned money. Thanks a lot for taking this trouble.

I just wanted to know that , in case one is having surplus money ( say for example more than Rs 58.0 Lakhs as explained ) what are the other alternatives there for a person beyond 58 years … a) can he continue the PPF account for some more time b) Can he continue the NPS account till 65 years of age c) can he continue in ULIP Policy d) Should he invest in ELSS for tax savings . This is with the situation where the person is having surplus to invest in the above a) to d) options after meeting the monthly incomes to run the family.

Best Regards,

Abhijit

Frankly speaking there are no fixed rules. So, how to decide? Define your priority. Put out all the numbers.

– How much is necessary as monthly income.

– How much corpus will be necessary to generate this income etc.

I will suggest you to read this article as well…How much is enough to retire in India.

Thanks for your awesome comment.

Very useful information.

Thank you for commenting. Nice that you liked the post.

very informative sir and also helpful

thanks for the write up sir

Nice that you liked the work. Thank you for taking time to post your feedback.

EXTREMELY GOOD ARTICLE FOR THE PERSONS WHO ARE RETIRIRNG.

Thank your posting your comment and liking the work.

Very good information about savings after retirement.

Thanks for posting your feedback.

Very good. It is indeed very informative and useful for retired persons like me. I am 70 years,retired and invested in all the categaries you have mentioned except the current account. All the other options I have availed. Only the prcentage differs. Now I shall try to correct myself to match your recommendations. It is very good and I thank you once again.

Thanks for the lovely comment.

The percentages indicated in the post can differ from person to person. The difference will come from two main things: (1) Corpus, (2) income need. So before you alter your portfolio composition, I will suggest you to open your Excel sheet and do the math of it.

Very nice article. one can clearly understand as the author has given lot of examples

Thanks for taking time to post your views on the article.