Have you too been swept up in the whirlwind of excitement surrounding artificial intelligence (AI) lately? It’s hard not to be, AI is everywhere. And as an investor, you’ve likely noticed how AI stocks, like Nvidia or Microsoft, have been grabbing headlines and spiking portfolios. But here’s the thing, while jumping on the AI stock bandwagon can feel like a no-brainer, it’s not the only way to play this technological revolution. Today, I want to share with you about some investment alternatives that AI-curious investors might want to consider.

Knowing about these options can have multiple benefits. They can diversify our portfolio, hedge against risks, and still keep is in the game as AI reshapes the world.

Table of Contents

Why Look Beyond AI Stocks?

Before we get into the alternatives, let’s talk about why you might want to broaden your horizons.

AI stocks are hot, there’s no denying it. Companies like Nvidia, with its jaw-dropping growth in the chip market, or Alphabet, pouring billions into AI research, are tempting picks. But here’s the catch, they’re also volatile. Just last week, I was reading about Nvidia’s -9.76% YTD returns. After its guidance disappointed Wall Street, the stock went into a spiral. That’s a reminder that betting big on individual AI stocks can feel like riding a rollercoaster, thrilling, but not always stomach-friendly.

Plus, the AI hype can inflate valuations.

As everyone is so excited about the AI-boom, it has made the AI-stocks feel overpriced.

So, while I’m not saying ditch AI stocks entirely (I’ve got a few in my own portfolio!), I do think it’s smart to explore other ways to ride the AI wave without putting all your eggs in one basket.

Let’s check out some practical alternatives that could balance your risk and reward.

1. AI-Focused Exchange-Traded Funds (ETFs)

If you’re sold on AI’s potential but nervous about picking the “right” stock, ETFs might be your new best friend.

These funds bundle together a bunch of companies, some pure AI plays, others just AI-adjacent, giving you broad exposure without the stress of betting on a single winner.

Take the Global X Robotics & Artificial Intelligence ETF (BOTZ), for example. It’s packed with companies like Intuitive Surgical (think robotic surgery) and, yes, Nvidia. But it also includes lesser-known players in robotics and automation. Or there’s the ARK Autonomous, managed by the visionary Cathie Wood, which mixes AI with autonomous vehicles and 3D printing.

These ETFs let you dip your toes into AI without sweating over whether one company’s earnings will tank your whole investment.

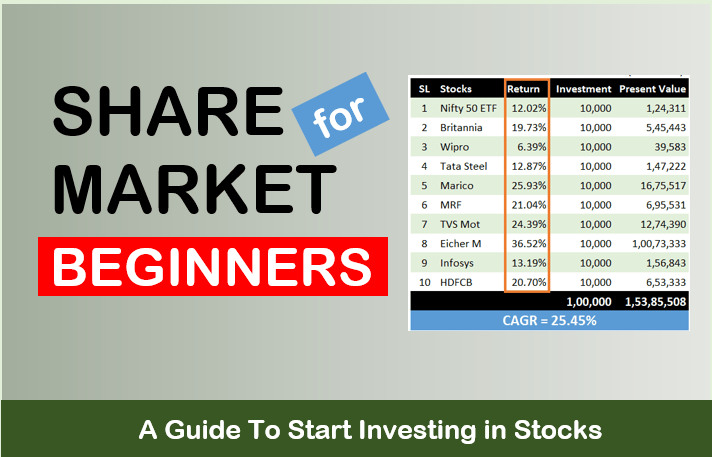

Top 10 Holdings of BOTZ are as below:

| SL | Name | Market Price ($) | % Holding |

|---|---|---|---|

| 1 | NVIDIA CORP | 124.92 | 12.21 |

| 2 | INTUITIVE SURGICAL INC | 573.15 | 11.49 |

| 3 | ABB LTD-REG | 53.54 | 8.95 |

| 4 | KEYENCE CORP | 394.24 | 6.51 |

| 5 | DYNATRACE INC | 57.25 | 5.02 |

| 6 | SMC CORP | 358.34 | 4.6 |

| 7 | DAIFUKU CO LTD | 25.84 | 4.35 |

| 8 | FANUC CORP | 28.59 | 4.26 |

| 9 | PEGASYSTEMS INC | 78.51 | 2.92 |

| 10 | YASKAWA ELECTRIC CORP | 26.76 | 2.85 |

Why it’s relatable? I remember when I first started investing, I agonized over picking stocks. ETFs were a game-changer, they gave me peace of mind and let me sleep at night, knowing I wasn’t all-in on one horse.

A practical tip tip. Check the expense ratios (BOTZ is around 0.68%, ARKQ closer to 0.75%) and peek at the holdings to make sure they align with your AI interests. You can buy these through any brokerage account—Robinhood, Fidelity, you name it.

2. Real Estate Investment Trusts (REITs)

It is the backbone of AI infrastructure.

Okay, hear me out, this one might sound offbeat, but it’s sneaky-smart. AI doesn’t run on magic; it needs massive data centers, power grids, and physical infrastructure. That’s where REITs come in. These are companies that own and operate real estate, and some are perfectly positioned to cash in on AI’s growth.

Look at REITs like Equinix (EQIX) or Digital Realty Trust (DLR). They own data centers that house the servers powering AI applications. As companies like Amazon and Google ramp up their AI spending, demand for these facilities is skyrocketing. I saw a stat recently that U.S. data center power capacity might need to triple by 2027 to keep up with AI. That’s a goldmine for REITs.

REIT investing is like, you’re not betting on the tech itself but on the stuff that makes it possible. Plus, REITs often pay juicy dividends, Equinix is hovering around 2-3% yield, which is a nice bonus.

Practical tip: You can grab shares of these REITs or look into an ETF like the Pacer Data & Infrastructure REIT ETF (SRVR) for broader exposure. Just watch out for interest rate hikes, they can ding REIT prices.

3. Venture Capital Funds

Get in early on the next big thing.

Now, if you’re feeling a bit adventurous and have some cash to play with, venture capital (VC) funds could be your ticket to the AI startup scene. These funds invest in early-stage companies, think the next OpenAI or DeepMind, before they go public or get scooped up by a tech giant.

The catch? VC investing usually requires deep pockets and connections.

But here’s the good news, platforms like Fundrise are democratizing this space. Their venture arm lets everyday investors put money into private AI companies with as little as $10. I was chatting with a buddy who invested in Fundrise’s VC fund, and he’s stoked about backing a design startup called Canva, which might IPO soon.

It’s risky, sure, but the upside could be massive if one of these bets pays off.

This way, you’re getting in on the ground floor, something most of us can only dream about with public stocks. It’s a long game, though, so patience is key.

How to do it? Start small, diversify across a few funds, and treat it like “fun money” since liquidity is low, you might not see returns for years.

4. Commodities

What’s powering the AI revolution?

Let’s talk raw materials. AI needs hardware, lots of it, and that means metals like copper (for wiring), lithium (for batteries), and rare earths (for chips). Investing in commodities might not scream “AI,” but it’s a quiet way to profit from the tech boom.

Copper, in particular, is having a moment. Data centers and AI hardware guzzle it, and with supply struggling to keep up, prices could climb. You could buy commodity ETFs like the iShares Copper and Metals Mining ETF (ICOP) or even stock in miners like Freeport-McMoRan (FCX).

In the past, people used to invest in gold as a “safe haven,” and I see commodities like copper as the modern twist, tied to tech instead of tradition.

Commodities can be a wild ride, so pair them with steadier investments. Check futures markets or ETFs on platforms like Schwab or Vanguard.

5. Dividend-Paying Tech Giants

If you want a mix of stability and AI exposure, consider big tech companies that are already household names, and pay dividends to boot.

- Microsoft (MSFT) is a prime example. With its $13 billion stake in OpenAI and AI-powered tools like Copilot, it’s deep in the game. Plus, it offers a dividend yield of about 0.7%.

- IBM (IBM) is another contender. Its Watson AI platform is making waves, and it pays a hefty 3-4% dividend.

These are the “boring but beautiful” picks, less flashy than a startup, but they’ve got cash flow and staying power. People have got MSFT in their Roth IRA. Those dividends feel like a little high-five every quarter.

The tip is to reinvest those dividends to compound your gains, and buy on dips if AI hype cools off temporarily.

Conclusion

So, where does this leave us?

AI is a once-in-a-generation opportunity, but you don’t have to chase every hot stock to win.

Whether it’s spreading your bets with ETFs, banking on data center REITs, swinging for the fences with VC funds, riding the commodity wave, or leaning on dividend-paying tech titans, there’s an alternative that fits your style.

For me, it’s about balance, I’ve got a chunk in BOTZ, a little in Equinix, and I’m dabbling in Fundrise’s VC fund because, why not?

I hope this post could give you some food for thought about diversifying your AI-focused stocks portfolio. Tell me in the comments section how you liked the five ideas.

Have a happy investing.