A person who wants to start investing money must be aware of the investment basics. For a beginner, these investment basics will work like a light-house. It’ll show direction, following which the investors will reach the desired goal.

These ‘basics’ are like ‘rules of investing’. By being aware of these rules, even a novice can make the right investment decisions.

It is the ‘set of right investment decisions‘ which makes a person a successful or unsuccessful investor. How to make the right investment decisions? By being aware of the ‘investment basics’.

So let’s start our study by knowing more about the process of investing. This process focuses more on building one’s own investing abilities than relying on others to make the right decisions. Suggested reading – Starter’s guide for the stock market.

Table of Contents

- The process of investing

- 1. What is Investment?

- 2. What are high returns?

- 3. Why invest money?

- – Small contributions will do

- – The power of compounding

- – Start early

- 4. Preparations before investing

- – 4.1 Eliminate costly debts

- – 4.2 Pay-yourself first

- 5. Where to Invest?

- – Diversification

- 6. Overcome the mental blocks

Process of investing successfully

We often concentrate too much on the end results (returns), and hence ignore the importance of knowing the whole process of investment. What is the process of investment?

- Reading: It is like exercising your mind. The more you work out, the stronger will be the muscles. Unless you read about a thing, you will not learn about it. The same logic is applied to building investment basics as well. Read as much as you can about how to invest money successfully. This will build your basic know how’s.

- Investment Basics: This is your brain muscle. By reading, you are actually strengthening your brain muscles. The stronger will be your muscles (investment basics), the better rules it can frame for itself. In layman terms, your investment basics is your understanding about investment. Read more about how a beginner can start investing.

- Investment Rules: The better is the understanding, more accurate rules one can frame. Every individual is unique. Hence everyone has their own investment style. A trained mind can set rules which not only matches the investors psychology, but also assures high returns. Read more about 3 rules of investing.

- Investment Decision: After all it is the investment decisions which makes an investment good or bad. Investor must always try to take good decisions. But this is only possible if one is reading, and framing the right rules tailor-made for oneself. Read more about problems in investing.

- Returns: Right decisions invariably leads to expected returns. This is success. The more a mind sees success (based on past decisions), the more it gets refined for future decisions. Read more about how to invest money for good returns.

- Experience: It is practice which builds experience. A mind which is loaded with correct investment basics, is bound to make right rules, leading to expected returns. This builds an experience which further adds to ones learning. Read more about how to become a better investor.

Being aware of the whole process of investment is key to practising successful investing.

The foundation of investment is build upon ones ability to read about ‘”how to invest money, and comprehending the investment basics out of it”.

I will share with you few investment basics which I have learnt over a period of time.

1. What is Investment?

Investment is a process of buying assets to generate returns. The generated return can be in the form of “regular income’ or ‘capital appreciation’.

Why buy asset? Because keeping money with self will yield only low returns. When money is kept in locker – it generates zero returns. When money is kept idle in bank account – it generates only 3.5% interest.

To generate higher returns, one must invest money. Investments has potential to yield higher returns. By investing money, one actually puts their money to work. This in turn, generates higher returns.

Read more about how to invest money for good returns.

2. What are high returns?

In USA and Europe, earning even 7-8% per annum returns from equity mutual funds is considered high. But in India, 7-8% p.a. return can be generated even by debt based funds. In India, 7-8% return from equity is low.

How a common man can know, what is a good return (in a country)? There are four ways of doing it:

- Check Average Inflation: In last 10 years, the average inflation in India was 7.3% per annum. Hence, for an investment to be referred as high return option, it must have generated returns more than 7.3% p.a. in last 10 years. Read more about history of inflation in India.

- Check Index Growth: In India, there are two major indices – Nifty and Sensex. Check how much the index has grown in last 10 years. This will give you a fair idea of how much average return one can expect from equity, over long term, in a country. Example: In last 10 years, Sensex has grown at a rate of 13.86% (TRI). Hence, if one is investing in say equity mutual funds, their return-expectation should be more than 13.86% over long term. Read more about where to invest money for high returns.

- Check 10Y Govt. Bond Yield: In the above step, we have figured out expected return from equity in long term. In this step we’ll know how much return we can expect from debt-plans in long term. A ten year government bond of India is currently yielding 7.39% per annum. Hence, if one is investing in long term debt funds, their return-expectation should be more than 7.39% over long term. Read more about how to buy government bonds.

- Check Savings Deposit Rates: This rate is declared on the web site of RBI as current rates > Deposit Rates. Currently RBI’s website is showing the “Savings Deposit Rate” between 3.5%-4%. This means that, this is the minimum zero risk return one can earn in India. Read more about tips ad tricks to save money.

What is high return in India? A return higher than average inflation prevailing in the country can be said to be ‘high’. Any investment option which has generated higher returns than average index growth rate can be treated as favourite.

Talking about returns, it is also essential to measure returns in comparison to the risk of loss it poses. Idea should be to get best returns with a minimum risk of loss. This concept of risk-return balance is explained in one of my blog post called “use of sharpe ratio to buy best mutual funds“. Please read it.

3. Why to invest money?

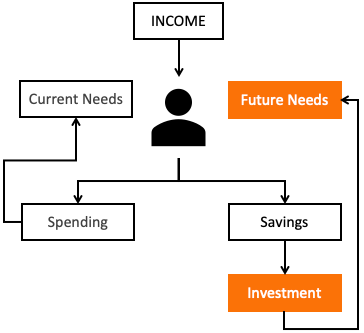

Investment is necessary to take care of future needs of life. But someone may ask, why to invest money? Saving sufficiently should be enough to take care of our future needs. Yes this is true, but often savings is not sufficient. How?

Example: Suppose you have to make a downpayment of Rs.10 lakhs for your home purchase. You will need the downpayment amount after 5 years from today. If you plan to keep your savings parked in your savings account, earning 3.5% interest, you must save Rs.15,300 per month to accumulate Rs.10 lakhs.

But if you decide to invest in a multi cap fund which generates a return of 14% p.a., you must invest only Rs.11,700 per month to accumulate Rs.10 lakhs in 5 years.

| Corpus to be Built (Rs.) | |

| Expected Return p.a. (%) | |

| Time (in years) |

| SIP (monthly contribution) (Rs.) |

The further is the goal, more beneficial the investment will look. You can use this SIP calculator to check the monthly investments required to build a corpus.

Small Contributions are Enough

Investment is not a burden. The only care one has to take is to identify the goal much in advance. How does it help?

No matter how big is the requirement (say Rs.1 Crore), small regular investments may be enough to meed the demand.

Example: Suppose one needs Rs.1.0 Crore after 17 years from today to pay for the child’s education fee. Though the amount may look daunting today, but by investing just Rs.7,500 per month in say a small cap fund, can build this corpus in time.

We excellent mutual funds in the market. One can invest in them using SIP’s. This way, small regular investments can take us to our financial goals. Read more about systematic investment plan (SIPs) here.

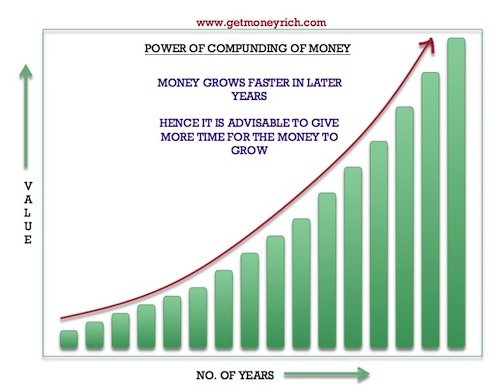

The Power of Compounding

Allow me to explain the power of compounding using an example. Below is a table, which specifies how much one-time investment of $1 grows at different interest rates and maturities.

| Years | 5% | 10% | 15% | 20% |

| 0 | $1 | $1 | $1 | $1 |

| 1 | $1.05 | $1.10 | $1.15 | $1.20 |

| 5 | $1.28 | $1.61 | $2.01 | $2.49 |

| 10 | $1.63 | $2.59 | $4.05 | $6.19 |

| 15 | $2.08 | $4.18 | $8.14 | $15.41 |

| 25 | $3.39 | $10.83 | $32.92 | $95.40 |

| 30 | $4.32 | $17.45 | $66.21 | $237.37 |

Allow me to explain how to read the above table:

- @5% Return: $1 will grow by 4.32 times in 30 years.

- @10% Return: $1 will grow by 17.45 times in 30 years.

- @15% Return: $1 will grow by 66.21 times in 30 years.

- @20% Return: $1 will grow by 237.37 times in 30 years.

What we can conclude from these numbers? The higher is the return, the bigger is the corpus.

There is another way to look at the above table.

$1 invested at rate of 20% p.a. becomes $237.37 in 30 years. But note the following two points about the money growth:

- First 15 Years: In the first fifteen years, the invested $1 grew by only 15.41 times. Kindly note the gradient of the curve between year 0 and year 15. It shows a relatively slow growth rate.

- Next 15 Years: In the next fifteen years, $15.41 multiplies at a whopping pace to become $237.37. Kindly note the gradient of the curve between year 15 and year 30. It shows a rapid money multiplication.

What we can conclude from these numbers? Money grows faster in the later years of investment.

This is what is called as power of compounding. The longer the money stays invested, the bigger it becomes. But more importantly, the size of investment will shape more in the last few years, than in the initial years.

For young people, who has longer holding time available, can use the power of compounding to become millionaires and billionaires.

Example: Raj invested Rs.1.0 Lakhs in a multi cap fund when he was 21 years of age. He kept this money invested till he became 60 years of age (holding time 39 years). At 18% per annum returns, Rs.1.0 Lakhs became Rs.6.4 Crore. Read more about compounding investment returns here.

Start Investing Early

This is a very easy conclusion we can draw after learning about the power of compounding. To achieve a bigger financial goal, one must increase the investment’s holding time. But increasing investment time is not always possible. So better is to start as early as possible. Let’s understand this with an example.

- Starting @Age30: Suppose you are currently 30 years of age. As per your company’s policy you will retire at age 60. You still have 30 years in hand. By the time you retire you want $1 million as your retirement corpus. How much you must invest per month to build this corpus (assuming 16% p.a. average returns)? You must invest $113 per month.

- Starting @Age25: Suppose you started investing early. You realised the necessity of building a big retirement corpus when you were 25 years of age. How much you must invest now to build the corpus of $1 million (@16% p.a.)? Just because you have started 5 years early, you need to invest only $51 per month.

Read more about how long is long term investment in equity.

4. Preparations Before Investing

Before diving into investments, it’s crucial to lay a strong foundation. Investing needs focus and discipline and for it there are some preparatory steps they must be completed.

In this section, we’ll discuss about two important steps that I think can will help a lot in ones investing journey.

So, let’s discuss about them.

4.1. Eliminate Costly Debts

First one must lower the costly debt and then think about investment. Why? Because every dollar you save on credit card debt saves you more than 30% interest. Which investment can earn you 30% returns even in long term? None.

If you have a lump sum money in your saving and you are confused whether to pay credit card debt or invest this money, choose credit card.

By paying your credit card debt, you are instantly reducing you interest burden growing at rate of 30% per annum. This is like investing money and earning a return of 30%.

List of debts in order of their interest cost is listed below:

- Credit Card: If there is an unpaid credit card balance, which is due beyond the credit free period, it must be cleared first. This type of debt will attract more than 30% interest rate. Read more about how to use credit card.

- Personal Loan: These are unsecured loans for the bank, hence they charge high interest rate on it. At present, in India, a typical personal loan can cost as high as 15%-20% per annum. Before investing a dime anywhere else, it is advisable to clear this loan first. Read this guide on personal loan.

- Education Loan: Typically, an education loan can cost between 13-16% to its borrowers. In India it is mostly the parents who carry the load of education loan. Factoring their age, parents can handle education loan better. But if a young student is carrying an education loan, he/she must pay-back the loan within the first 5 years itself. Read more about planning for soaring education cost.

- Secured Loans: Which are secured loans? Home loan, car loan, gold loan, reverse mortgage etc. These are loans on which the risk of loss for the banks are minimum. Hence they charge less interest rates on them. Typically in India, the cost of these loans will be between 8.5% to 12% per annum. I personally would prepay even these loans before investing anywhere else. Read more about loan prepayment here.

I personally have a goal to remain debt-free in my next phases of life. For me, leading a debt free life can give more financial independence than investing itself. Hence I’ll suggest my readers to become debt free first. Read more about why to become debt free.

4.2. Pay Yourself First

Paying oneself first is a concept which allows you to divert bigger portion of income towards investment. How it is done? As soon as the salary gets credited into your bank account, divert a predefined portion of it to your other savings account.

This saving is then used to buy investments. Though the concept may look childish, but I will request you to read more about it here. Pay yourself first concept can help you invest far more effectively than you are doing now.

This is a concept made popular by Robert Kiyosaki, which has powers to transform lives for good. So go ahead and read it please.

5. Where to Invest?

There are plethora of investment options available for a common man. Once I challenged myself to list down 100 investment options available in India. Guess what, I dit it. Read my blog post on it (where to invest money).

But just knowing the names of investment options is not enough. As an investor one must also know how to use them wisely. What I mean by wisely? Utilisation of correct investment options, so that there is a best risk-return balance.

- Direct Stocks: This is perhaps the best investment vehicle available for a common man. But a skill is necessary to buy right stocks. How to build the skill? By learning stock analysis. Know more about stocks.

- Equity Mutual Funds & ETFs: This vehicle is for those investors who want to invest in equity, but does not have time to learn ‘direct stock investing’. Here the investor just needs to invest their money without bothering about the details like which stocks to buy, when to sell etc. This activity is taken care by the mutual fund manager, by charging a nominal fee. Needless to say that majority middle-class people prefer to invest in equity through this route. Know more about mutual funds.

- Debt Funds: Equity based mutual fund’s portfolio mainly consist of stocks. Debt based mutual funds contains less risky financial instruments like bonds, company deposits etc. Though these options are less risky, but they also earn lower returns (compared to stocks and equity funds). Read more about ‘…are debt funds good for small investors‘.

- REITs: This is one investment option using which a common man can invest in real estate sector at a low cost. REIT is like a mutual fund whose portfolio consists of physical real estate properties like office spaces, shopping malls etc. Read more about REIT India here.

- Physical Real Estate: This investment option is for those people who has high disposable capital, and would like to take advantage of it. Such people generally resort to physical real estate properties like land, apartments etc. I would personally would not like to buy a property with home loan funding. Read more about property investment idea.

- E-Gold: These days it is possible to avoid physical gold purchase. How? By resorting to e-gold. Who should invest in gold? I will personally use equity as my vehicle. When my net worth will grow bigger, I will consider physical real estate and e-gold as part of investment diversification. Otherwise, I will try to avoid gold. Read more about if gold is a good or bad investment option.

I have only listed few (6) investment options above. For sure there are a lot more available for potential investors. If you are interested to know about other available investment options, try reading this.

Always Diversify

I personally feel that the priority of investment diversification becomes more dominant when the size of portfolio becomes big. Let’s understand the priority of diversification with help of a hypothetical example.

Suppose you are a business man who has started his own retail shop in a market place. At this point of time, your personal savings in a cooperative bank was say Rs.50,000. Nothing much to talk about, hence you decided to keep all amount in one place.

But over next three years, your personal savings grows to Rs.500,000. Seeing the growth trend, you could feel that, this savings is only going to grow bigger in next 3 years. Hence you decided to spit your savings in multiple banks. Why you thought like this? Because keeping all money in one place maybe risky.

The same logic applies to our investments as well. When our portfolio size is smaller, we can afford not to worry about diversification. But when size of portfolio becomes bigger, it is better to spread ones money in different (non-related) investment options (see point #9 above). Read more about investment diversification is a strategy to reduce risk of loss.

6. Overcome mental blocks

Now, before one proceeds and start implementing the above-discussed investment basics, it is necessary to remove a few mental blocks. These mental blocks are faced mostly by the beginners during the start of their investment journey.

- I cannot invest because I can’t afford it: There is always a scope for investment in real life. No matter how tight are our pockets, we can always afford to sneak in some money for investment. These days, one can start a SIP with as low as Rs.500 per month. Read more about biggest problems in investing money.

- I’ll start investing from tomorrow: Generally people delay their investment decisions because they do not know ‘how to start doing it today’. They think that they will research about it online or with friends, and then start. But unfortunately, tomorrow never comes. These days we have mobile apps (like fundsindia) which can help you to start investing from today. Read more about investment strategies for a 30 year old.

- Avoid equity as it is risky: Stocks, equity mutual funds has potential to earn high returns. But less people know about how to invest in equity. This is one investment options about which one must first learn and then invest in it. If done like this, potential to earn higher returns increases several folds. Read more about investing in stocks and mutual funds.

Also read about 10 money facts nobody told you before.

Conclusion

These are the 11 investment basics which I’ve almost by-hearted like my favourite poem. Based on these basics, all of my investment decisions are taken.

It is one of those articles which I keep reading to reinvent my investment style time and again. This is one of those articles of mine, which I have read the most till date.

I hope you liked this work. Have a happy investing.

Suggested Reading:

Knowing the basics of investment is very important. And this article is the best.

HI Manish,

iam planning to invest 500000 in KISAN VIKAS PATRA in post office scheme, as Kisan Vikas patra double the Money, i just need to ask a question related to this, is in this investment TDS will get dedcuted at the time of maturity ? , please reply

TDS is exempted upon maturity…

I just read this blog and feeling like awesome information shared here. So i think can be regular follower of this blog.

Hello sir, I am following your blog for 3 – 4 months. I have purchased your e books for basic and now I have purchased package of 9 including excel sheet of stock analysing. I want to invest 5000 per month in stocks from October so pls guide me what should my learning curve to use sheet to get better return in future.

Thanks Chirag for posting your comment. You can now start asking questions like what are my goals, how much should I invest for each goal, where to invest money, ‘am I saving enough, how to check for good stocks etc.

Awesome article. Teaches power of money to those who have just started earning.