You can use this simple tool to explore common questions about earnings and commissions for Ola and Uber drivers. By selecting a question from the dropdown menu, you will receive an informative answer based on available information I could gather about the topic. Whether you’re curious about income potential or how the business model works, this tool provides straightforward insights. Feel free to use it to quickly get answers and better understand this business.

FAQ’s Related To OLA / UBER

One of my friend asked me this question, whether investment in Ola Uber Cab is a profitable business prospect? We had no idea of how Ola Uber cab drivers made money. Read more about how to build an alternative income source.

So we thought to do some research work. I this I article, we will see how Ola Uber make money and profits. People who are interested to put a cab in Ola or Uber as an investment, can also read this article for reference.

I have done some number crunching here. The bigger idea was to find few answers as an investor (who would like to invest in Ola Uber).

I am sure, when other people would gauge Ola and Uber as a business proposal, their findings will be different.

But to keep the calculation simple, without missing the important details, I decided to view Ola Uber can as an investor.

I hope you will like the calculation part of this article.

A lot went into finding the answer of, “whether investment in Ola Uber cab is profitable or not”.

Hence I am getting too impatient to tell you the final conclusion. So before we start, let me give you a small hint of the final result.

More trips and longer rides, make profit making out of Ola and Uber cabs easier.

How I have arrived at this conclusion?

I will show you some calculation to prove it.

I am not an expert of Ola and Uber’s business model. Even enough information is not available on websites of Ola and Uber.

Hence, I was forced to do some fishing on the internet.

Based on data that I have gathered, allow me to present you a general picture of Ola Uber’s business model.

The approach of this article will be to find answers to the following questions:

- How Ola Uber cab drivers earn Income?

- What are the costsinvolved to run a Ola Uber cab?

- How much is the net profit(loss) per annum?

- What is the return on investment (ROI) of Ola Uber cab?

So lets start with their income model first…

#1. How Ola Uber cab drivers earn income on daily basis?

The money is earned by the cab owner in the following ways:

- Cashreceived from passengers

- Incentivesreceived from Ola Uber

Payments are made by the passengers in form of hard cash or online through wallets.

This is one mode of income which happens after every ride.

[Note: Payments received in the wallets are paid to the cab owner within next 2 days of receipt]

The second mode of payment is by incentives.

Incentives are also received online by the cab owner from Ola and Uber.

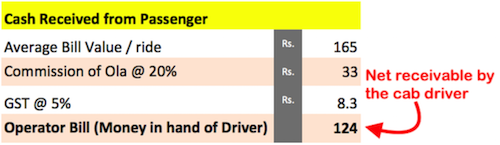

#1.1 Cash Received from Passengers

Suppose a passenger orderd for a Ola cab for airport drop from his residence.

The total bill for the airtport drop is Rs.165.

The passenger pay these Rs.165 (in cash or through online wallet) to the cab driver after the end of the trip.

But all of this Rs.165 is not the cab drivers income.

Following charges are deducted from this bill:

- Commission of Ola Uber (20%) – Rs.33

- GST @ 5% – Rs.8.3

After these deductions, the net cash received by the cab driver (Rs.124) is shown below:

#1.2 Incentive received from Ola Uber

The incentives received from Ola Uber is what makes this business interesting.

It is this incentive portion which actually makes the Ola Uber business model profitable for the cab drivers (operators).

The incentive model is kept very hush-hush by Ola Uber from common public.

Though they do not try to hide it, but I have realised that they do not circulate the information about incentive freely in their websites.

Hence, I was forced to do some fishing for this information on internet.

I am not sure how reliable or updates in this information.

But I think it will not be too far away from the reality.

The incentive received by the cab driver is based on MBG.

What is MBG?

MBG is “Minimum Business Guarantee”.

What does it mean?

Ola Uber guarantees a minimum business (revenue per day) to every Cab driver.

If that revenue is not reached, Ola Uber will pay the balance amount as top-upto the cab driver.

The revenue based incentive model (of Ola Uber is like this):

- Minimum daily revenue of 1500. But this incentive will be applicable only if the cab driver has generated an operator’s bill of minimum Rs.800+.

- Minimum daily revenue of 2100. But this incentive will be applicable only if the cab driver has generated an operator’s bill of minimum Rs.1300+.

- Minimum daily revenue of 3000. But this incentive will be applicable only if the cab driver has generated an operator’s bill of minimum Rs.1900+.

- Minimum daily revenue of 4500. But this incentive will be applicable only if the cab driver has generated an operator’s bill of minimum Rs.2400+.

- Minimum daily revenue of 5200. But this incentive will be applicable only if the cab driver has generated an operator’s bill of minimum Rs.2700+.

- Minimum daily revenue of 6000. But this incentive will be applicable only if the cab driver has generated an operator’s bill of minimum Rs.3100+.

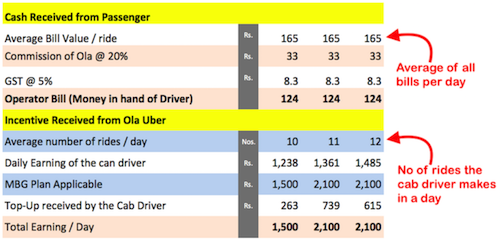

So based on this incentive model, lets see how much a cab driver can earn on daily basis:

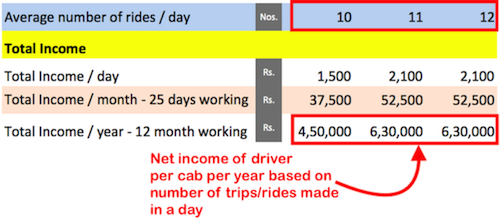

#1.3 Total income of cab owner per annum.

Based on the total earning of the cab driver per day, per year income can be computed.

Following has been assumed to arrive at the annual yearning:

- Number of days worked / month – 25

- Number of month worked / year – 12

So lets see what will be the total revenue of the Ola Uber cab driver:

#2. What are the costs involved to run Ola Uber cabs?

Till now what we have seen is only the income part of the Ola Uber cab business.

But in order to run a cab, some cost also needs to be incurred.

Before going into the calculation part, I would like to make a point.

A cab which has zero loan balance can prove very profitable for Ola Uber cab business.

But for my cost calculation part, I have assumed that the driver has purchased as new car (Maruti Swift) and attached it to Ola.

Lets see the various costs involved to run the Ola Uber cab business…

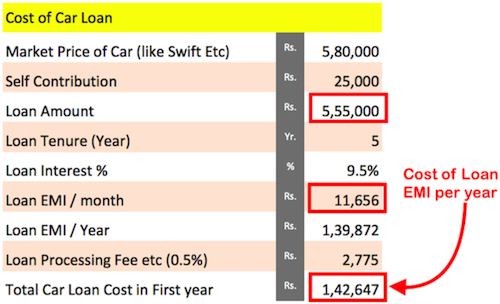

#2.1 Cost of Car Loan

I have assumed that the driver has opted to buy a new car (Suzuki Swift).

On road price of this car will be approximately Rs.5,80,000.

I have also assumed that the cab driver puts Rs.25,000 from his pocket to buy this car.

Following are the details of the loan:

- Loan amount – Rs.5,55,000

- Tenure – 5 Years

- Interest – 9.5% per annum

- Loan EMI – Rs.11,656

- Loan processing fees – Rs.2,775 (one time cost).

The total annual cost of this car loan will be Rs.1,42,647. The calculation is as below:

#2.2 Cost of Daily Running of Cab

I have assued the following cost in the head of “Daily Cost”

- Daily fuel(diesel/CNG/Petrol) expense.

- Daily wagepaid to the driver

As this is one of the biggest cost, I have tried to keep my assumptions as realistic as possible.

Unfortunately, I was not able to get a confirmed value of these expenses.

Hence, I decided to use the following rule of thumb:

- Minimum wage of driver : Rs.600/day or 30%of daily operators bill (whichever is higher).

- Minimum cost of fuel : 35%of daily operators bill.

With these assumptions in mind, lets see what will be the total daily cost of operation:

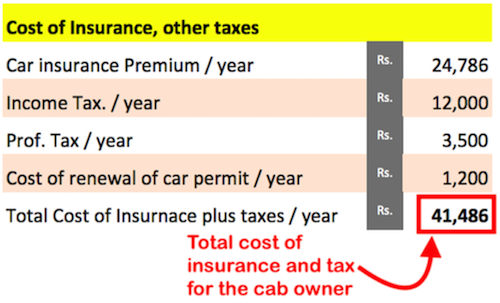

#2.3 Mandatory Costs like Insurance and Income Tax etc.

For cab to continue to operate on road, it is mandatory for it to have the receipts of the following:

- Updated Car insurance

- Taxpayment receipt.

- Car permitrenewal receipt.

For cabs, whose daily running is more than other cars, I have assumed a slightly higher insurance premium than normal.

For tax part, I have considered income tax and professional tax.

I am sure car permit renewal is not a very cost incenttive activity. I assume it will be between Rs.1000-1200.

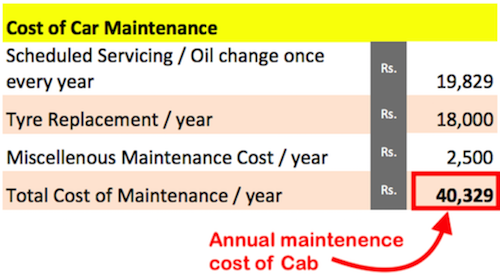

#2.4 Cost of Car Maintenance

As this is a cab service, it is essential to keep the car under working condition each day. C

To achieve this target, regular annual maintenance of the car cannot be ignored. Compared to a normal passenger car, a cab will have a higher annual maintenance cost.

The annual maintenance of the car will have the following costs:

- Scheduled servicingand oil change.

- Four tyrechange once every year.

- Miscellaneousmaintenance needs.

Lets see what will be the total annual maintenance cost of the cab…

#2.5 All Cost attached with runniner a Ola Uber Can is as below:

- Cost of Car Loan – Rs. 1,42,647

- Cost of Car’s Daily Run – Rs.3,09,938

- Cost of Car Insurance & Tax – Rs. 41,486

- Cost of Car Maintenence – Rs.40,329

- Total Cost – Rs. 5,34,400

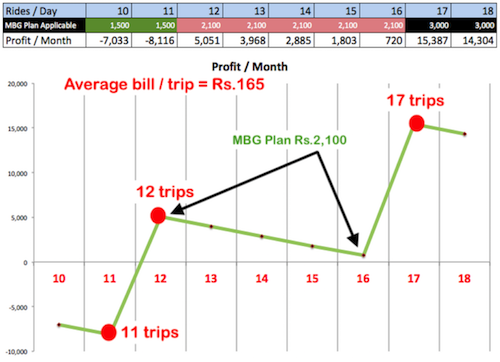

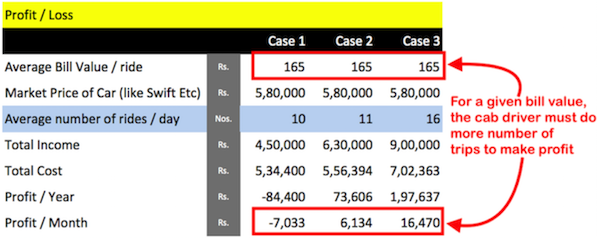

#3. What is the net Profit/Loss made by the Cab Operator?

Net Profit = Total Income – Total Cost

In order to arrive at a conclusion on profit, we have considered several cases.

Study of these cases made us realise that, in order to increase the profit, cab drivers/owners must do the following:

- They must pick longer rides (higher billing values).

- They must pick more trips per day.

With lower billing valves and lesser number of trips, there are more chances to incur losses.

See the below chart:

Important Notes:

- For lower bill values, driver must do more number of trips per day to make profit.

- For a Given MBG Plan (like 2100 shown in the chart), lower is the number of trips the better.

- For every jump in MBG Plan (like from 2100 too 3000), there is a dramatic increase in profit (see the above chart).

- For higher bill values, driver can do less number of trips per day to make profit.

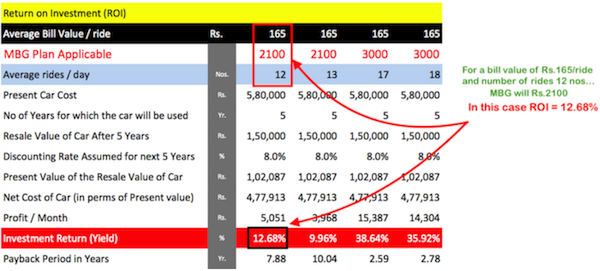

#4. Return on Investment (ROI)

To calculate the ROI of the invested-money in Ola and Uber, I have assumed the following:

- Car is purchased on loan.

- Cost of Maruti Swift (of Rs.580,000), is used for calculation.

- Average bill amount of Rs.165 for all rides done in a day.

- Car was sold after 5 years of usage at Rs.150,000.

Now, in order to calculate the ROI, following 4 cases has been considered:

- Case1 – MBG Plan Applicable: Rs.2100, No of rides: 12

- Case2 – MBG Plan Applicable: Rs.2100, No of rides: 13

- Case3 – MBG Plan Applicable: Rs.3000, No of rides: 17

- Case4 – MBG Plan Applicable: Rs.3000, No of rides: 18

The calculated ROI for the above 4 cases are like this:

- Case1 – 12.68%

- Case2 – 9.96%

- Case3 – 38.64%

- Case4 – 35.92%

If car is driven for 18 HR a day by a driver then there may be more profit

Thanks brother i found all answers of my questions through your analysis. Thanks alot

Great analysis and you have cleared my doubts ,what i have searched to know its there in your analysis.thank you

If I buy a car full cash and without taking loan for Ola and Uber is it profitable?

Kindly help me to know.

I want to buy a car on loan for Ola and Uber is it profitable?

Kindly help me to know.

It is my WhatsApp or calling Number 7447230208 please let me know on those number.

U have good patience. Really I appriciate. I am planning to join uber or Ola as a owner. Is it profitable, please suggest this thing bro. If u have any other better business ideas, please tell me. U can calm me on 8850241714 or whatsapp message.

great work… logical and real time analysis….congrats for such thoughtful effort….

What if i buy 2nd hand car from 1st owner?

Very good effort. Thanks and congrats on behalf of all.

Good One…helpful for beginners…

I don’t know about the authenticity of the article but I appreciate your patience and research on this. well done.

I am planning to join I ola as a owner cum driver is it printable or loss please suggest this thing bro and you very talented bro

With the above scenario, if I need to put my car on rental in Ola/Uber, which is Loan free, was it the right thing to put the car on rental……Pl suggest your view…

so what should be the moral out of that long explanation should we stop driving in ola uber if not then give the ideas and help

Dear brother, I do not know how to appreciate your efforts, I am speechless. You did a marvelous job in collecting the required information.

Though I am busy, I could not control myself to put my comments. I am certainly curious to speak with you if possible. I can be reached at 00966535084476 (both phone and what’s up) or if I get your number I can reach to you as well. Thanks

Sanjeeb Rath

I am planning to start the business of Ola,Uber cab service as an owner.Your article has cleared almost all my queries.Thanks a lot.

I glad this article could help.

great assumption , so all the expectations that I had proved to be absolutely wrong as it very difficult to even earn 30000 PM as a cab owner in real scenario

Excellent research.. this was helpful…

Excellent analysis for newcomers. Thanks

Thanks

I completely found answers to all my queries here…thanks buddy for such a great Analysis.

Your assumption is awesome. Nice calculation and great conclusion.

Thank you so much for this.

Good analysis with reasonable assumptions. Thank you.

Thanks for your comment.