It is surprising that how much we can learn by just digging deeper into the investment quotes of Warren Buffett.

When I speak about money and investment, not many will turn and listen to me.

But when a mighty investor like Warren Buffett speaks, his every word is deciphered.

Each and every Investment quotes of Warren Buffett are scrutinised for clues.

People not only listen to Warren Buffett but they also preach him as their investment idol.

People following investing principles of Warren Buffett as a bible.

But who is Warren Buffett?

Wikipedia describes Warren Buffet as “American Business Magnet”.

Warrent Buffett is perhaps the world’s most successful investor of 20th century.

Net Worth of Warren Buffett is close to $74 Billion.

How this compares with India’s richest man Mukesh Ambani (Chairman of Reliance Industries)?

Mukesh Ambani’s Net worth is still $22 billion. This is not even half of Warren Buffett.

By making this comparison I am not trying to prove that one is bigger than other.

This comparison will only highlight to an Indian that how rich is Warren Buffett, and he has reached there by careful investing.

This is why, when Warren Buffett Speaks we mortals must listen to him.

What Warren Buffett speaks about investment are not only words, but they are real-life investment philosophies.

Buffett is a professional investors.

Day in and day out what he does is only investing.

He has been in investment profession since last 60+ years. In this process, he has become one of the worlds richest man.

When this person speaks about investment, they are not just words, they are philosophies.

The words spoken by Warren Buffett are so simple that one can miss the hidden clue

Warren Buffett is a great man. Even when he is speaking about underwear’s we must not ignore it.

[Buffett owns a brand in America known as ‘Fruits of the Loom’, which sells underwear’s. This brand is known for its quality]

Lets look at few investment quotes of Warren Buffett

“Rule 1 is Never lose money and Rule 2 is Never forget rule 1.”

All investment quotes of Warren Buffett are simple.

But this one is the simplest of all. Perhaps this is why its ranked as number one.

The importance of this quote is un questionable.

How often we take a hasty decision while buying and selling stocks?

When stock market is buoyant we jump into the bandwagon.

In this situation we end up buying some needless, overvalued stocks.

In only short time we will see the same stocks price tumbling down.

The result is, in panic the stocks get sold.

When Buffett says ‘never lose money’ he wants to tell us to buy stocks that will never lose money for us.

Fundamentally strong stocks…

He wants us to buy ONLY fundamentally strong companies at undervalued price levels.

These stocks will never let us lose our money.

Suppose we have 20 stocks in our portfolio worth $1000, and each stock earns us $1 as dividends each year.

In total we have earned $20 as dividends @ dividend yield of 2% per annum.

Most of us does not like to invest our money for such low (2%) yields.

Instead we would opt for much publicised growth stocks and end up loosing more than we actually gain.

Warren Buffett is telling us to invest in only those options from which income is assured.

Do not mistake Buffett, he is not asking your to invest in fixed deposits.

He is only asking you to invest in those investment whose future cash-flows you can predict.

If one can only understand fixed deposits, he should with this. If one can understand stocks, he ca opt for this risky option as well. But the control point is “Know-how”.

If one is not sure, investing in options for as low yield as 2% is good, but never lose money.

“It is better to hang out with people better than you … you’ll drift in that direction.”

There are several investment quotes of Warren Buffett that you can follow, but this is one you can practice.

Influence of good people and their habits can influence others in their vicinity.

If I am hanging out with my friend who is very passionate about sports then I will tend to develop a liking for sport.

If you are not a good investor then keeping in close vicinity with people who manages their money well, will ultimately lead you to this good habit.

How much I like to hang out with Warren Buffett, but this is not possible for now. So what I can do?

I read about Warren Buffett. This gives me insights about him.

I practice this philosophy in building my investment portfolio as well.

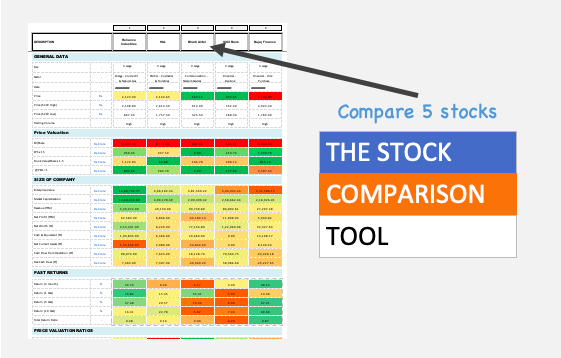

I keep only those stocks in my portfolio whose fundamentals are super strong.

This way I try to live in company of good stocks.

That green arrow pointing upward motivates me to buy more of such stocks.

But important here is how I calculate my returns.

I never look at market price of stocks to estimate my returns, I just see the dividend earnings.

I try to keep my dividend earning above 4% yields levels for all stocks.

In good company of positive yielding stocks, I tend to take better investment decisions.

“I don’t look to jump over 7-foot bars: I look around for 1-foot bars that I can step over.”

This is one investment quote of Warren Buffett that I took time to understand and digest.

When I started investing in stock market, the returns that I used to imagine was 35% per annum.

Later on, after more experience with Mr. Market, I realized that even 12% per annum return is good.

Though this reduced expectation from 35% to 12% was drastic, but I soon realized that I am not able to make even this.

What I was making more was losses, forget 12% growth.

This made me learn a very important lesson.

I learnt that aiming too big in in managing money is not advisable.

First one must learn to take baby steps before running.

What baby steps I am talking about? Baby steps in investment is Saving.

The saving is more important than investing as without learning to save, we cannot make it grow.

So I decided to slow down my pace.

I was loosing majority funds due to needless investing in stocks. Hence I decided to practice a ‘save capital’ approach.

The decision to focus on small but positive capital appreciation was taken.

This keeps me motivated and take further wise investment decisions.

Investing in bank deposits that generates predictable income can be a good starting point.

One can also invest in dividend yielding mutual funds that also generates stable income.

Buying dividend yielding stocks for income generation is also a good idea.

This way one cannot make more than 8% p.a. return. But over a period of time, ones net worth will increase several folds.

Just by practicing savings approach (protection of capital), one can become a better investors.

“Someone’s sitting in the shade today because someone planted a tree a long time ago.”

There are no easy cakes and quick money in this world.

If you want to get rich you will have to do in only the hard way.

The hard way is not only difficult but it is also slow.

This is the reason why long term investing is the surest way of getting rich.

If you want to be rich in next 10 years then you must start investing now.

The small seed that you will plant today, will grow and become a big tree in next 10 years.

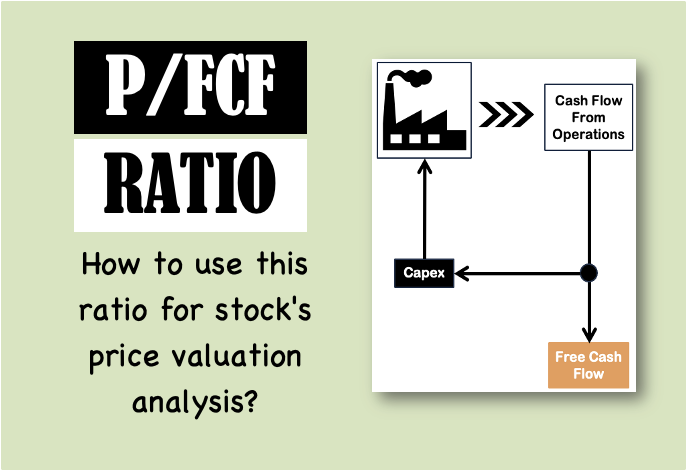

“Price is what you pay. Value is what you get.”

Small Investors mostly get fascinated by market price of stocks.

For trained investors, market price of stocks tells only part of the story.

The complete picture will be visible once we unfold the true value of stocks.

What price we pay for a stock must always be less than its true value.

Buying stocks without knowing its true value is a big mistake.

Without understanding if we are buying a overpriced stock, is a crime in investing.

When we are buying anything, its price must always be less than its value (true).

Intelligent investors knows how to calculate true value (also called intrinsic value).

“We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

This is also one investment quote of Warren Buffett that can be perfectly implemented.

If one can follow this simple quote of Buffett, money can be made even more than the experts.

In year 2008 when market saw its worst nightmares, few people bought quality stocks like Tata Motors, Tata Steel, DLF, Reliance Industries, TCS etc.

When they sold them in year 2010 their percentage return was near to triple digits.

What right they did was ‘they bought stocks when others were selling them’.

When there is excessive selling in the market, stock price fall drastically.

Heavy selling brings down the market price of stocks to below true value levels.

Buying at these undervalued price levels are very profitable.

But inverse happens in the market, people start buying stocks when cheers are heard from stock market.

People forget to realize that during the happy hours of stock market, good stocks trade at overvalued price levels.

If one buy stock at these price levels, they are only planning to lose money.

“If a business does well, the stock eventually follows.”

As I told you, investment quotes of Warren Buffett are so simple that we feel it can be ignored.

This particular quote look very simple, but when it comes to implementation it can only be done the hard way.

How to know if a business is doing well?

We can know this by looking at its financial reports.

One of the most predominant fundamental that directly influences stock price is EPS.

If a company is continuously increasing its EPS YOY, then market price of stocks will follow the same trend.

Sir, I want to start SIP , can you suggest long term MF I.e for 10 years

Depending on your risk profile, you can go for Equity, Debt, or Hybrid type mutual funds.

Search for these types of funds using this link.

[Tip: Go for the funds which currently has 5 star rating]

everything is vert good giving very good basic knowldge if examples are given something like stock price 5 years back nd their fundamentals at that tlme and how it has grown so that i aiso slowly enter into this with some guidance