In the world of stock investing, two names that come first in mind are Warren Buffett and his partner the legendary Charlie Munger. Charlie Munger, born in 1924, is a renowned American investor, businessman, and long-time business partner of Warren Buffett. He was the Vice Chairman of Berkshire Hathaway. Charlie Munger had a degree from the Harvard Law School.

He is known for his sharp intellect, emphasis on mental models, and his significant contributions to the world of value investing. On 28th November 2023, Charli Munger died in a hospital in California, Santa Barbara. At the time of his death, it is reported that his Net Worth was $2.2 Billion. In the 1970s, Charlie Munger joined Warren Buffett to manage Berkshire Hathaway.

Munger’s investment style is a fascinating blend of timeless principles and unique insights. Let’s try to unravel the magic behind the investment style of Charlie Munger.

Munger’s investment style can offer a guiding light if you’re dealing with the complexities of investments. He champions the power of mental models, urging investors to embrace diverse perspectives and past experiences. Take a cue from Munger’s inversion concept; instead of just seeking success, ponder why investments could fail. It is a simple yet potent tool in decision-making.

Munger’s love for quality businesses is a cornerstone. Think of it like choosing a reliable car – you want one that consistently performs well. Consider Nestle India. It has a solid revenue base, monopoly products, reasonable pricing, and talented minds that create a winning formula.

Let’s unravel the secrets of successful investing, Charlie Munger-style.

Video

Style #1: Importance of Experience

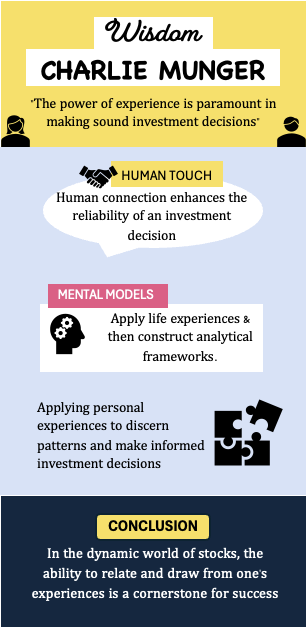

In stock investing, Charlie Munger underscores the importance of experience. His emphasis on the value of experience is a guiding principle for beginners. Munger encourages investors to draw upon their life encounters, acknowledging the power of relating to diverse situations.

As beginners embark on their investment journeys, the ability to relate personal experiences to market scenarios becomes a valuable skill.

- Example #1: Imagine an investor reflecting on their past financial choices. If they’ve experienced the impact of impulsive spending, they can relate it to the impulsive buying behavior in the stock market.

- Example #2: Consider someone who faced adversity in managing a small business. Translating that experience, they may avoid investing in companies with shaky financial foundations. Such experiences highlight the importance of investing in financially sound businesses.

Learning from personal financial experiences helps us understand the emotional aspect of stock investing. It can better equip us to navigate markets with a more informed and measured approach.

Munger’s approach aligns with the notion of using mental models. It is an analytical framework constructed from life experiences. This framework enables investors to identify patterns and make informed decisions.

Munger’s emphasis on the value of experience urges them to leverage personal encounters. We can learn from various contexts, and apply this collective wisdom to make sound investment decisions. In the world of stocks, our ability to relate and draw from our experiences can make a big difference.

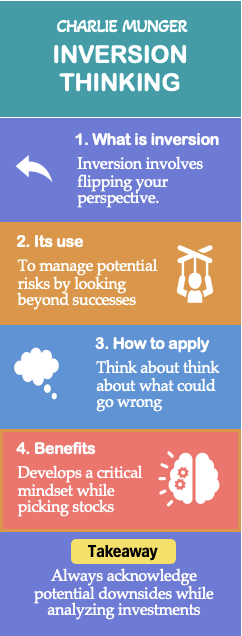

Style #2: Inversion Thinking

Charlie Munger’s philosophy of inversion thinking in stock investing is a powerful tool for beginners. Instead of focusing solely on what could go right, Munger advises investors to consider what could go wrong. It involves flipping the perspective, questioning assumptions, and contemplating potential pitfalls.

For instance, when evaluating a stock, think not just about its potential success but also its failure.

Imagine investing in a trendy tech company. Instead of getting carried away by the hype, apply Munger’s inversion principle. Consider the risks like regulatory challenges, competition, technological shifts, etc. These factors might impact the company negatively. By embracing this approach, investors become more cautious, avoiding blind optimism.

Munger’s used to say, “Invert, always invert.”

Inversion thinking acts like a safeguard, prompting investors to make well-rounded decisions by acknowledging potential downsides. This style of stock scrutiny can enhance our analytical skills and contribute to a more balanced and informed approach to picking stocks.

Style #3: Cigar Butt To Quality Companies

The investment style of Charlie Munger has evolved from buying “cigar butt” companies to high-quality companies. Cigar butt companies are undervalued but distressed. Initially, he sought companies with some value left, akin to picking up discarded cigars with one last puff. However, he realized the limitations of this approach.

In the later stage of his investment journey, Munger shifted his strategy towards investing in high-quality businesses. Here he put a lot of emphasis on the consistency of the cash flows.

- Shift to Quality: Munger advocates for quality over quantity. Rather than seeking short-term gains, he looks for companies with robust fundamentals and reliable cash flows. For instance, buying a company that consistently generates profits is a far better approach. A company with sustained operations provides a more stable foundation for long-term success.

- Consistent Cash Flows: Munger’s philosophy involves understanding the economics of a business. He believes consistent cash flow is a key indicator of a company’s health. Imagine a company regularly generating enough cash to fulfill its working capital needs. When such companies are also profitable, they can ensure stability and resilience against market fluctuations. Munger believed that such companies are poised to yield sustainable long-term returns.

Example: Consider two companies – one with erratic cash flows and another with a steady income stream. Munger would likely favor the latter. He appreciated the predictability and reliability of its financial performance. This shift in focus illustrates Munger’s emphasis on the long-term benefits of investing in high-quality businesses.

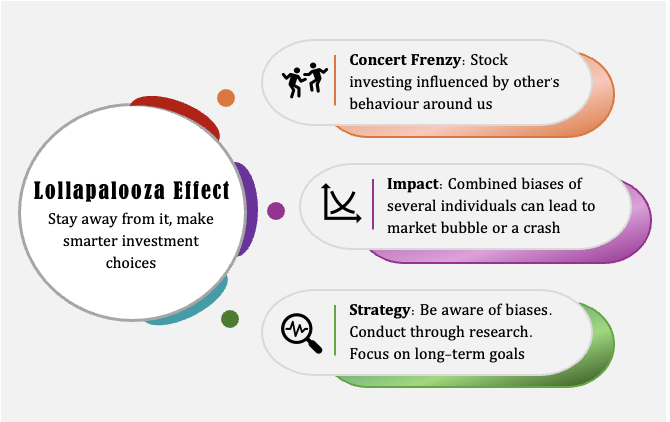

Style #4: The Lollapalooza Effect

Imagine you’re at a concert with your friends. The band is awesome, everyone’s hyped, and mosh pits are opening up everywhere. That feeling of excitement is contagious, right? You might decide to jump in the mosh pit yourself, even if you weren’t planning to before.

The Lollapalooza effect in the stock market is kind of like that concert mosh pit. It’s when a bunch of different emotions and ways of thinking all come together and push investors toward the same action.

Here’s the breakdown:

- Multiple Biases: Investors are human, and humans have some not-so-helpful mental shortcuts. Maybe you see a stock price going up and think, “Everyone else is buying, it must be a good deal.” (Herding bias) Or maybe you only pay attention to news that confirms what you already believe about a stock (Confirmation bias). These biases are like the concert hype – they cloud your judgment.

- Big Impact: When a bunch of these biases all start feeding into each other, it can have a major effect on the market. Imagine if everyone at the concert decided to jump in the mosh pit at once – it would be crazy. In the stock market, the Lollapalooza effect can lead to things like bubbles where everyone piles into an overvalued stock. It can also cause a crash where everyone panicking and selling at the same time.

For us as an investor:

- Be Aware: Knowing about the Lollapalooza effect is like knowing there might be a mosh pit at a concert. You can decide if you want to jump in or stay safe on the sidelines.

- Do Your Research: Don’t just follow the crowd. Research companies before you invest. As far as possible, don’t let emotions cloud your decisions. Staying focused on the long-term and on our investment goals is the best way forward.

By being aware of the Lollapalooza effect, we can avoid getting caught up in the frenzy and make smarter investment decisions. The Lollapalooza effect serves as a reminder to us to be aware of collective influences that might distort our rational thinking.

Style #5: Learn & Think More, Do Less

Charlie Munger believes in the importance of dedicating more time to learning and thinking than to taking immediate action. For beginners, this means focusing on gradual improvements in thinking processes every day. Munger’s philosophy revolves around making small, consistent enhancements in our understanding of the stock market.

We can think of it as a fitness routine for our brain. Just as daily exercises contribute to a healthier body, daily learning contributes to a sharper investment mind. Munger believes that this commitment to continuous learning compounds over time. It creates a solid foundation for making wise investment decisions. Read more about financial intelligence.

For instance, imagine you are learning a read the balance sheet of a company. Daily practice and learning a few new tricks each day significantly improve your reading skills over time. In stock investing, understanding a bit more about a company’s financials each day can lead to a substantial improvement in decision-making skills.

Munger’s approach encourages investors to focus on the process rather than rushing into action. It’s akin to constructing a strong building. Lay one brick at a time, ensuring each one is well-placed and secure.

Style #6: Knowing What We Don’t Know

“Knowing what you don’t know is more useful than being brilliant.”

– Charlie Munger

This highlights the importance of acknowledging the boundaries of one’s knowledge. For beginners, this means being aware of the areas where they might lack expertise.

It is like roaming around in the streets of a new city. First, we must admit that we don’t know the streets. This realization will give us that extra push to read the map more effectively. Similarly, in investing, recognizing our blind spots allows us to seek guidance. It also encourages us to conduct thorough research in areas where we are a bit unsure.

Munger’s point is powerful because it steers us away from overconfidence. In the stock market, the majority of people lose money due to this common pitfall. For example, say there is a student who excels in math but struggles with literature. Admitting this, the student seeks help in literature, fostering overall growth.

Likewise, in investing, recognizing what you don’t know can lead to informed decisions.

For instance, if technology stocks are not within my expertise, admitting this will give me an edge over others. How? It is because, now I’ll either learn more about the sector or consider seeking advice from someone with a stronger understanding.

Munger’s approach encourages humility, reminding investors that brilliance doesn’t eliminate the necessity of acknowledging gaps in knowledge. It’s this self-awareness that lays the groundwork for making prudent and well-rounded investment choices.

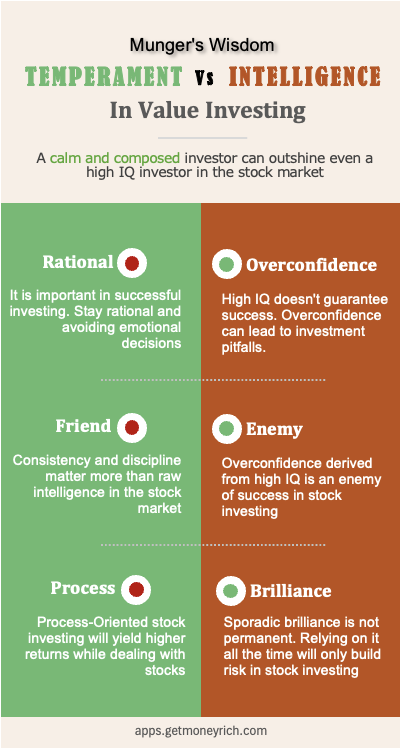

Style #7: Temperament Over Intelligence

In the stock market, high IQ can be a disadvantage because such people mostly suffer from overconfidence. This is why Charlie Munger advocates for humility even from high IQ individuals.

Imagine intelligence as the horsepower of a car and temperament as the steering wheel. Having a powerful engine is useless without the ability to control the vehicle.

Consider a skilled driver who understands the road, follows traffic rules, and remains patient. This type of behavior mirrors an investor with the right temperament. On the other hand, someone with a fast car but reckless driving habits (akin to high intelligence with overconfidence) may end up in accidents.

Munger’s point becomes clearer in the context of investing. A high IQ may breed overconfidence, leading to impulsive decisions and overlooking risks. Meanwhile, a balanced temperament involves patience, discipline, and an understanding of one’s limitations.

For example, envision a chess grandmaster (high IQ) playing against an opponent. Despite superior intelligence, the grandmaster becomes emotionally agitated and makes hasty moves. A less skilled but composed opponent might secure victory because of the other’s hasty decisions. In investing, a level-headed approach, even with modest intelligence, often outperforms brash decision-making driven by overconfidence.

Conclusion

Charlie Munger left an indelible mark with his unique approach to stock investing. His recent passing in November 2023 marked the end of an era. But for investors like me, his investment philosophy continues to illuminate our paths.

Munger’s investment style revolves around practical principles. One of his key teachings is the importance of drawing from our personal experiences. This translates to we investors leveraging our life encounters, relating to various market scenarios. Learning from past financial choices can greatly help us pick our new multibagger stocks. We have to observe our past successes and failures more deeply.

Inversion thinking challenges investors to consider potential pitfalls rather than just focusing on success. This approach acts as a safeguard against blind optimism.

Munger’s evolution from investing in cigar butt companies to high-quality businesses underscores the significance of quality over quantity.

The Lollapalooza effect serves as a cautionary note. It reminds investors of collective influences that might distort rational thinking.

Knowing what we don’t know is a humility-driven approach that steers us from overconfidence. It emphasizes the necessity of recognizing knowledge gaps to make wiser decisions.

Our intelligence is like the horsepower of a car, our temperament is the steering wheel. Both are necessary to drive the car safely to its destination (goal). Only intelligence will take it nowhere.

Have a happy investing.

Suggested Reading:

![India's Food and Beverage (F&B) Sector Analysis [2025] - Thumbnail](https://ourwealthinsights.com/wp-content/uploads/2025/01/Indias-Food-and-Beverage-FB-Sector-Analysis-2025-Thumbnail-768x461.jpg)