Many people dream of owning their own home. But when it comes to buying a house, there are many hurdles, especially regarding finances. Most of us do not have the capital to buy a house in India (especially in tier-1 cities of India like Delhi, Mumbai, Chennai, Kolkata, Bangalore, Hyderabad, Pune, and Ahmedabad). Hence, we are forced to avail a home loan. But people, who have the capital to buy a house (without a loan), what they should do? Is breaking the fixed deposit to buy a house a wise financial decision? This is the question we’ll try to answer in this article. Check this calculator

Cost of A House in India

| SL. | Tier-1 City | Price (2 BHK, 1000 sq ft) |

|---|---|---|

| 1 | Mumbai | ₹2 Crore+ |

| 2 | Delhi | ₹1.5 Crore+ |

| 3 | Bengaluru | ₹1 Crore+ |

| 4 | Pune | ₹90 lakhs+ |

| 5 | Chennai | ₹75 lakhs+ |

| 6 | Hyderabad | ₹70 lakhs+ |

On average, a two BHK flat in a Tier-1 city in India would cost about Rs.1.0 Crore.

This blog post will explore two options to buy a house in India:

- Option #1: Breaking the fixed deposit to buy the house.

- Option #2: Take a home loan to buy the house without disturbing the FD in the bank.

We’ll use a hypothetical example of Mr. Kumar to understand the concept. Nevertheless, I’ve also coded a simple financial calculator that will highlight the better of the two options.

Fixed Deposit Vs Loan EMI Calculator

| Description | Fixed Deposit | Home Loan |

|---|---|---|

| Amount (Rs.) | ||

| Interest rate (% per annum) | ||

| Tenure (Years) | ||

| Loan EMI | ||

| Final Amount (Rs.) | ||

People In Focus

Not many of us will face this tough call between FD liquidation and taking a home loan. However, in the last couple of decades, the earning potential of the Indian middle class has increased. There are quite a few people in our society who will have an FD worth one crore sitting in their bank accounts.

This dilemma between breaking the FD and availing of a home loan will come to challenge such people. This article is particularly useful for these people. Others can read this piece as a way to enhance their financial awareness.

This article will also answer a question that has confused many like me. I’ve always heard that debt is a double-edged sword. Hence, as far as possible, we must stay away from it. Nevertheless, I see rich people resorting to bank loans to make capital-intensive purchases. What is the reason? This article will give us the answer.

[P.Note: I’m also making this assumption that a person who keeps an FD worth Rs.1 crore in his bank account will not have cash flow issues while paying loan EMIs. I have a list of other limitations for your consideration]

Example Person

Imagine a person (Kumar) who has saved Rs. 1 crore in an FD. This deposit earns a 6.5% interest for a 20-year time horizon.

Now, suppose Kumar wants to buy a house in Bangalore.

As per his requirement, a 2-BHK apartment of around 1,000 SQFT will be just about right for his family’s use. He went around his locality and found a nice residential project which would cost him about Rs. 1 crore.

The Dilemma

- Option #1: Kumar’s instincts told him that he could immediately buy the house by liquidating his fixed deposit. For Kumar, this option was straightforward. He’ll pay for the house outright with his savings. No monthly EMIs, no additional interest. Sounds good, right?

- Option #2: But one of his friends who is also a Chartered Accountant advised him otherwise. He advised Kumar to keep the Bank FD intact and take a 20-year home loan of Rs. 1 Crore at a 9% interest.

It is at this stage that people like Kumar can use the above type of financial calculator to get more clarity about FD vs loan.

The result of the calculator

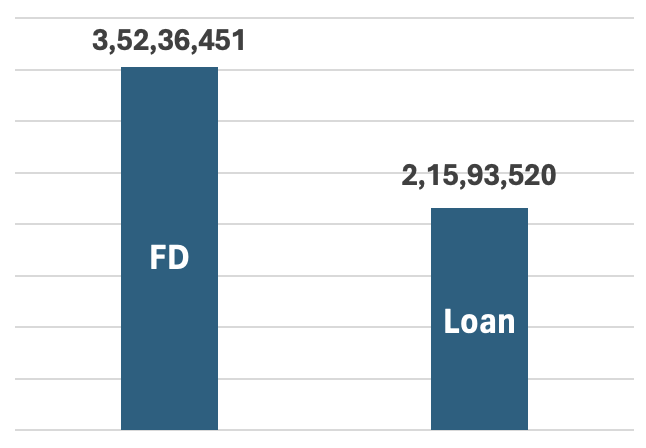

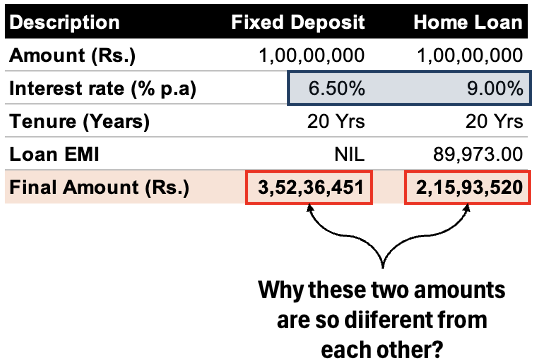

Kumar used the above calculator and got the following answers. Let’s observe the numbers first.

| Description | Fixed Deposit | Home Loan |

| Amount (Rs.) | 1,00,00,000 | 1,00,00,000 |

| Interest rate (% per annum) | 6.50% | 9.00% |

| Tenure (Years) | 20 Yrs | 20 Yrs |

| Loan EMI (Rs.) | NIL | 89,973 |

| Final Amount (Rs.) | 3,52,36,451 | 2,15,93,423 |

- Observation #1 (FD): Rupee one crore put in a fixed deposit (FD) at 6.5% per annum for 20 years. The final appreciated amount at the end of the twentieth year will be Rs.3.523 crores.

- Observation #2 (Home Loan): Rupee one crore worth of a home loan taken for 20 years at 9% per annum. The monthly EMI for this loan will be about Rs. 89,973 per month. The total payment (principal plus interest) made towards this loan by the end of the twentieth year will be Rs.2.159 crores.

What do the above two observations mean?

To understand it, allow me to make this simple cash flow statement for you:

| Year | Description | Cash Out | Cash In | Savings | Remark |

| 0 | Fixed Deposit @6.5%, for 20 Years | 0 | 0 | 1,00,00,000 | Saving in Bank |

| 0 | Home Loan @9%, for 20 Years | 0 | 1,00,00,000 | – | Bought a House |

| 1 | 12 Nos Loan EMI @ Rs.89,973 / month | 10,79,676 | 0 | 1,06,50,000 | – |

| 2 | – Do – | 10,79,676 | 0 | 1,13,42,250 | – |

| 3 | – Do – | 10,79,676 | 0 | 1,20,79,496 | – |

| 4 | – Do – | 10,79,676 | 0 | 1,28,64,664 | – |

| 5 | – Do – | 10,79,676 | 0 | 1,37,00,867 | – |

| 6 | – Do – | 10,79,676 | 0 | 1,45,91,423 | – |

| 7 | – Do – | 10,79,676 | 0 | 1,55,39,865 | – |

| 8 | – Do – | 10,79,676 | 0 | 1,65,49,957 | – |

| 9 | – Do – | 10,79,676 | 0 | 1,76,25,704 | – |

| 10 | – Do – | 10,79,676 | 0 | 1,87,71,375 | – |

| 11 | – Do – | 10,79,676 | 0 | 1,99,91,514 | – |

| 12 | – Do – | 10,79,676 | 0 | 2,12,90,962 | – |

| 13 | – Do – | 10,79,676 | 0 | 2,26,74,875 | – |

| 14 | – Do – | 10,79,676 | 0 | 2,41,48,742 | – |

| 15 | – Do – | 10,79,676 | 0 | 2,57,18,410 | – |

| 16 | – Do – | 10,79,676 | 0 | 2,73,90,107 | – |

| 17 | – Do – | 10,79,676 | 0 | 2,91,70,464 | – |

| 18 | – Do – | 10,79,676 | 0 | 3,10,66,544 | – |

| 19 | – Do – | 10,79,676 | 0 | 3,30,85,869 | – |

| 20 | – Do – | 10,79,676 | 0 | 3,52,36,451 | – |

| A | Total Amount Paid in Loan EMIs | 2,15,93,520 | – | – | – |

| B | Total Amount Received From FD | 3,52,36,451 | – | – | – |

| C | Net Savings (B – A) | 1,36,42,931 | – | – | – |

What does this cash flow tell?

- Between the year 1 and 20, Kumar faced the extra burden of loan EMI payments (Rs.10,79,676 per year).

- As Kumar did not break his FD, between the year 1 and 20, he can see the FD value grow from Rs.1 crore to Rs.3.52 crore.

- At the end of the twentieth year, the home loan balance becomes zero. In these 20 years, a total amount of Rs.2.16 crore was paid towards the home loan (principal + interest).

- At this time, the bank FD also matures which gives Kumar Rs.3.52 crores.

After twenty years, Kumar is the owner of a home. He also has Rs.3.52 crore in his kitty.

Even if Kumar pays himself a sum of Rs.2.16 crore, from his FD maturity amount (for his expenses related to the home loan), he will still left with Rs.1.36 crore.

Hence we can say that keeping the FD intact was a wise financial decision. Moreover, Kumar also gets tax benefits on his home loan EMI payments. This makes home loans even more lucrative (financially).

Key Point To Note

Why there is a difference between FD’s final corpus and total loan payment?

There is a difference in the final values of FD and of the home loan. The FD’s final value is nearly 62% higher than the total loan liability. Why?

This is happening even when the interest rate offered by the FD (6.5%) is way less than the interest rate charged (9%) by the loan. What is the reason?

The reason is the way the final values are calculated in both cases (fixed deposit (FD) vs home loan).

- The final value of the FD is calculated using the principles of compounding of interest.

- In the case of the calculation of loan EMI, the reducing balance method is used to compute the payables.

Compounding of Interest in FDs:

- Your FD is like a snowball rolling down a hill. It starts small but gathers more and more “snow” (interest) as it rolls (time passes). This is a simple example to visualize how the power of compounding works (interest earning interest). Every year, our FD earns interest not only on the original amount but also on the accumulated interest from previous years. This “interest on interest” effect makes our FD grow exponentially over time (Rs. 1 crore becoming Rs.3.52 Crore in 20 years)

Reducing Balance Method in Home Loans:

- At the start of the home loan tenure, interest is calculated on the whole principal amount. But as we start to pay the full EMIs, a part of the EMI goes to repay the principal and the balance is the interest. After every EMI payment, the principal amount of the loan is reduced. Now, the interest is calculated on the reduced principal amount.

- Unlike FD, where the principal invested amount remains constant, in our bank loans, the principal amount is reduced every month. This is the reason why, the total of all EMI payments made during the tenure yields a smaller value (as compared to an FD).

In Short…

- In an FD, you earn interest on the growing balance throughout the tenure. This compounding effect inflates the final corpus significantly.

- In a home loan, you only pay interest on the reduced balance of the principal amount. This means you end up paying less interest overall compared to the interest earned on a growing FD balance.

Are there any limitations of the above example?

Let’s talk about the limitations.

In our example, we’ve assumed that Kumar has Rs.1 Crore worth of FD in his bank account. But to get the benefit of the power of compounding he decides not to liquidate the FD. Instead, he took a home loan of a similar amount to finance his house purchase.

- #1 Limitation: Here we’ve also assumed that Kumar’s monthly income is high enough to support the monthly EMI cash out of Rs.83,644 each month. But if Kumar’s monthly income is low, it can be a major limitation. In that case, he will have no other option but to liquidate at least a part of his FD savings.

- #2 Limitation: Suppose Kumar’s income is high enough, but he has an additional burden of other loans like an education loan, a personal loan, a car loan, etc. In this case, as well, Kumar will have to resort to liquidating a part or full FD amount.

- #3 Limitation: If Kumar is a defensive person by nature. Such people may not have a psychological framing strong enough to balance savings and loan burden. They will prefer a simpler life that is devoid of any debt.

- #4 Limitation: Even if the above-discussed three limitations are not a concern for Kumar, he can still face another problem of greed. Kumar may end up liquidating the FD to buy a nice fancy car (a liability). In our example, we were discussing home loans and FD going side by side. Here, the FD was almost acting like a counter-guarantee to the home loan. If the counter-guarantee vanishes, all related benefits will also go away.

Have a happy investing.

Another perspective is to pay the house with FD and start SIP with 89,000 in an index fund. It will grow to 4.5cr @6.5% with index fund return in 20 years. If we go with Nifty average of 14%, it will become 11cr in 20 years.