J Kumar Infraprojects share price has been in doldrums since last 2-3 quarters.

J Kumar Infraprojects started its operations around in year 1980’s.

In those days they used to maintain buildings of PWD.

In a course of time, they registered themselves as full fledged civil contractor of PWD.

This gave them orders for construction of roads, bridges, flyover, railway contracts, airport contracts, and other private orders as well.

These days the company also takes big construction contracts in Joint venture with Ameya Developers (50:50 JV).

As a partner, they have executed some key infrastructure projects in western India. Few are named below:

- Flyover at Konkan Bhavan Junction,

- CBD Belapur Flyover.

- Flyover at Ghatkopar in Mumbai etc.

Shareholding of J Kumar Infraprojects Ltd is as below:

- Promoters = 43.94%

- Mutual Funds = 10.84%

- Banks/FI = 0.11%

- Foreign Investor = 23.64%

- Individuals = 15.74%

- Others = 6.73%

Company in which the promoters have high stakes are generally better managed.

In Jan’18, J Kumar Infraprojects share price was on Jan’18 was at Rs.332 levels.

Today in June’18, its price is trading at Rs.370 levels. This is a price fall of 18.6% from Jan’18.

In Year 2017, trading in J Kumar Infraprojects stocks was suspended as its name appeared in the list of “suspected shell companies”.

The company was also banned by BMC from bidding for road projects.

These are few negative news about the company.

Perhaps this is the reason why, despite having reasonable business fundamentals, its price is trading at P/E ratio of 14.99.

Hence I thought to do a mode detailed analysis of J Kumar Infraprojects share price.

#1. Business Fundamentals of J Kumar Innfraprojects

In order to analyse business fundamentals of J Kumar Infraprojects, lets check the following:

- Growth rates.

- Financial ratios.

- Miscellaneous data.

- Price movement of last 10 years.

- Quarterly Trends.

- Intrinsic Value

#1.1 Growth Rates

One of the most important metric that dictates the build-up of intrinsic value is future growth rate.

A stock which is likely to grow fast in future, will have a higher intrinsic value.

The financial parameters which must grow fast enough in stocks are as below:

- Free Cash Flow Growth

- Reserves Growth

- Income Growth

- Profit Growth

- Dividend Growth &

- EPS growth (my favourite)

I use my stock analysis worksheet to quantify all these values.

J Kumar Infraprojects’s growth rates has been decent.

- FCF growth > 23%

- Reserves growth >25%

- Income growth > 25%

- EBITDA growth > 20%

- PAT growth > 21%

- Etc…

[Check: Stock Analysis Report – J Kumar Infraprojects Ltd.pdf]

#1.2. Financial Ratios

Financial ratios helps investors to comprehend the numbers better.

It gives a first impression about the stock.

The ratios that my worksheet highlights prominently are as below:

- Price Valuation

- P/E – Price to Earning Ratio.

- P/B – Price to Book Value Ratio.

- P/S – Price to Sales Ratio.

- P/FCF – Price to Free Cash Flow.

- Profitability

- Return on Equity (ROE)

- Return on Capital Employed (RoCE)

- Cash Returned on Invested Capital (CROIC)

I use my stock analysis worksheet to quantify all these values.

J Kumar Infraprojects’s Financial ratios has been as below:

- P/E = 14.99

- EV/EBITDA = 7.18

- P/Sales 0.13 P/Book Value = 1.47

- ROE = 9.8%

- ROCE = 15.1%

- DEBT / EXPENSE = 34.0%

[Check: Stock Analysis Report – J Kumar Infraprojects Ltd.pdf]

#1.3. Miscellaneous Data

How to get a rough idea about the current position of the stock’s price?

I prefer to look at the below indicators?

- Current price compared to its 52W high and Low price.

- How much the price changed in last 30 days and 12 months.

- What is the market cap.

- Compared to the Industry P/E, what is the P/E of stock.

- What is the price growth in last 3Y, 5Y and 10Year.

- What is the average dividend yield in last 3Y, 5Y and 10Year.

I use my stock analysis worksheet to get quick answers to these questions.

Few Miscellaneous data of J Kumar Infraprojects are as below:

- Price:

- 52W High = 332

- 52W Low =172

- 1 Year Change = -9%.

- Price Growth:

- 3Y growth = -8.4%,

- 5Y growth = 27%,

- 10Y growth = 17%.

- Dividend Yield:

- 3Y growth = 0.7%,

- 5Y growth = 1.4%,

- 10Y growth = 2.5%.

- Etc…

[Check: Stock Analysis Report – J Kumar Infraprojects Ltd.pdf]

#1.4. Price Chart of Last 10 Years

In last 5 years, the market price of J Kumar Infraprojects’s has shown a CAGR growth of 27%.

In last 10 years, the market price has shown a CAGR growth of 17%.

This is quite impressive.

But, frankly speaking price charts tell very less about a stock (unless you are a technical analyst).

But I still like to give it a glance. Why?

It gives an idea of how the current price is placed compared to last 10 years trend.

There can be few scenarios here:

- If price is only bullish – current price can be overvalued.

- If Price is remaining modest – poses a question why price is not growing fast enough?

- When price is falling – current price can be undervalued or business fundamentals may be weakening.

I use my stock analysis worksheet to generate the 10 Year price chart and analyse it accordingly.

Please use the below link to view the price chart of J Kumar Infraprojects.

[Check: Stock Analysis Report – J Kumar Infraprojects Ltd.pdf]

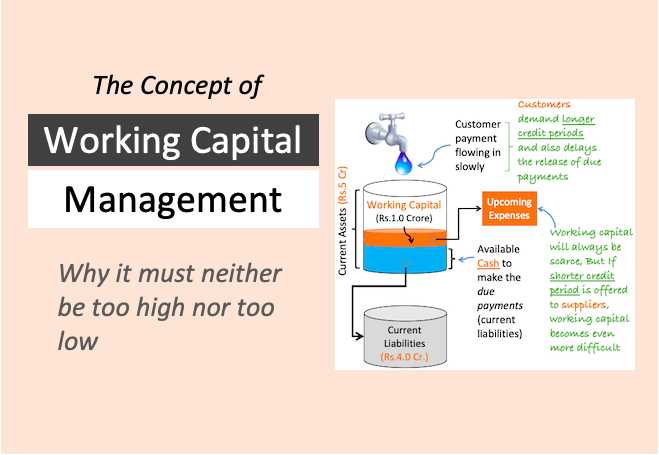

#1.5. Quarterly Trends

Why to look at quarterly results?

For investors (not traders), long term trends are more valuable.

But it is also essential that the investor should not miss to note the short term trends.

If in short term, the income, earnings are falling, its a risk factor that must be taken into consideration.

Investor must get the answers for the Why’s before proceeding.

The quarterly trends that I refer are as below:

- Total Income – TTM data verses last FY data (if rising or falling).

- Net Profit – TTM data verses last FY data (if rising or falling).

- Earning Per Share (EPS) – TTM data verses last FY data (if rising or falling).

I use my stock analysis worksheet to get pictorial chart for the above important informations.

Quarterly trends ofJ Kumar Infraprojects are as below:

- Total Income-TTM: Up (from Rs.1,560 to Rs.2,051 crores).

- Net Profit-TTM: Up (from Rs.105 to Rs.136 crores).

- EPS-TTM: Up (from Rs.13.9 to Rs.18).

[Check: Stock Analysis Report – J Kumar Infraprojects Ltd.pdf]

#1.6. What is the Intrinsic Value of this stock?

The estimated intrinsic value of J Kumar Infraprojects is higher than its market price.

It means, as per my estimates, it looks undervalued.

Its market cap is close to Rs.2,000 crore. Hence it can said to be a small cap stocks.

Considering that it is a small cap stock, it business fundamentals looks robust like a very established company.

Though the estimated intrinsic value of this worksheet may not be perfect, but it works well for me.

Even if it is a rough estimation of intrinsic value, it is still worth doing it.

Because investing in a stock without comparing its intrinsic value with its current price is a big mistake.

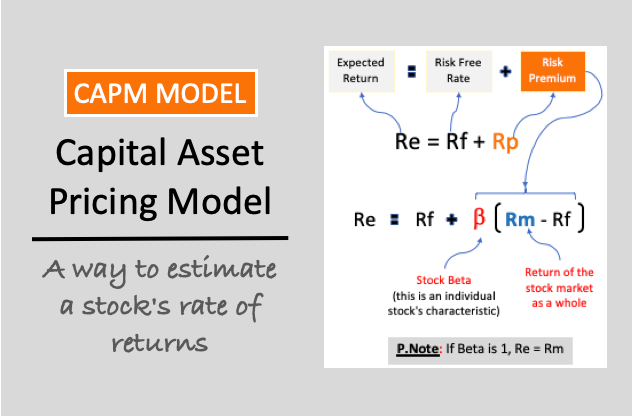

There are several ways to estimate intrinsic value of a stock. But I rely more on the following methods.

I have incorporated all of my favourite methods in my worksheet to estimate intrinsic value of stocks.

An intelligent formula then generates the net intrinsic value of the stock derived from all these individual methods:

- DCF method

- NCAPS method

- Absolute PE method

- Reproduction cost method

- Benjamin Graham’s Formula

- Earning Power Value (EPV)

I use my stock analysis worksheet to estimate intrinsic value of stock.

Please use the below link to view the intrinsic value of J Kumar Infraprojects.

[Check: Stock Analysis Report – J Kumar Infraprojects Ltd.pdf]

What is the final conclusion?

This worksheet considers all aspect of stock to arrive at a final conclusion.

What is the ultimate question in stock investing?

- The stock is good or bad?

How to arrive at this conclusion?

My stock analysis worksheet does this very nicely for me.

Based on the following parameters, it generates an overall grade for its stock.

If the generated grade is above 85%, the stock is considered good.

For J Kumar Infraprojects, the overall gradings are as below:

- Market Price: Undervalued.

- Future growth: Excellent.

- Management’s efficiency: Good.

- Profitability: Low (margins in construction business is low).

- Financial health: Decent.

- Bankruptcy thread: Nil.

[Check: Stock Analysis Report – J Kumar Infraprojects Ltd.pdf]

It must be noted that, investors must give importance to the price valuation of stock.

A stock which is priced right (undervalued), and has a score of 85%+ is ideal.