In the world of stock markets, stories of extraordinary gains and dramatic falls are not uncommon. However, some stories reveal the dark side of trading. These stories talk about manipulations replacing genuine market activity. One such case involves the alleged market manipulation in India during 2000-01. It was a stock market scam and it was linked to Ketan Parekh, a stockbroker known for his expertise in creating artificial market booms.

In today’s news, you must have read about Ketan Parekh again. He has been banned by SEBI for orchestrating a front-running scheme. He has been exploiting non-public information of a US-based fund’s trades to generate illicit profits of Rs 65.77 crore. Read more about this latest news here.

Is this the same Ketan Parekh of 2000-01 years? Yes, this is the same Ketan Parekh notorious for the 2000-01 stock market scam. In those days, he was again banned for manipulating stock prices.

In this article I’ll share with you the story and details of the 2000-01 Ketan Parekh fiasco.

What Happened in 2000-01?

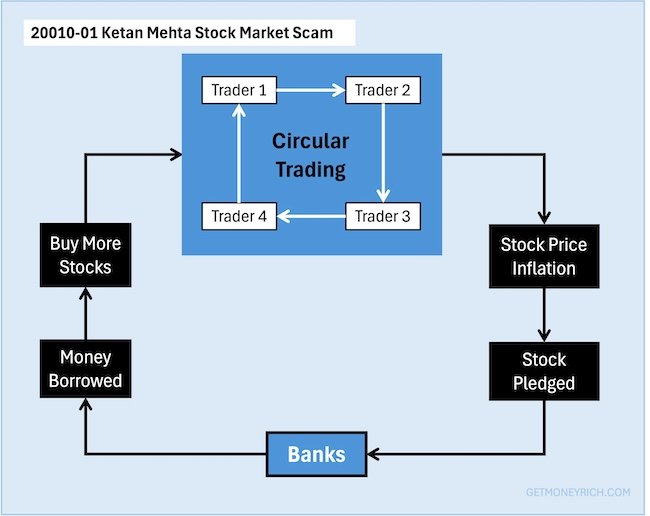

Ketan Parekh and entities associated with him reportedly engaged in practices like circular trading and synchronized trades.

What is circular trading? In simple terms, circular trading is like passing a ball in a circle among friends to make it seem like everyone is actively playing. In stock market, similar kind of thing happen, but new friends keep joining the game. In circular trading no new players join.

What is synchronised trading? Similarly, in synchronised trades, two parties agree in advance to buy and sell stocks at predetermined prices. This creates an illusion of demand for a stock which is actually untrue.

These tactics allowed Parekh and his associates to pump up stock prices artificially.

They used intermediaries, like brokers and financiers, to execute these trades. Shares would exchange hands within a controlled group, giving the appearance of high trading volumes.

This led to inflated stock prices, attracting genuine investors who were unaware of the manipulation and got trapped leading to losses.

Example

Let me explain this trading scam using an example.

Let’s say the stock of Company XYZ is trading at Rs.100.

Ketan Parekh’s group, through circular and synchronized trading, exchanges the stock among themselves at Rs.100, Rs.105, and Rs.110, making it look like demand for XYZ is increasing.

Investors looking at this “activity” might think that the stock is on an upward trend and start buying it at Rs. 120, Rs. 125, and even higher.

Eventually, the stock crashes back down to Rs.100 once the manipulation ends. What it does to genuine investors? Such unsuspecting investors are left with losses.

Actual Story

Ketan Parekh manipulated prices of K-10 stocks. It was done by circular trading and collusion with traders, companies, and institutional investors.

- Stocks like Zee Telefilms skyrocketed from Rs.127 to Rs.10,000 under his schemes.

- The promoters of companies also funded Parekh to artificially inflate share prices.

- Examples like Visualsoft surging from Rs.625 to Rs.8,448.

- Sonata Software from Rs.90 to Rs.2,936.

In February 2001, a bear cartel was formed. It was a group of traders betting on stock prices to fall (that’s why “Bear” cartel). Ketan Parekh was not part of the bear cartel. He was likely unaware of their dealings. The bear cartel opposed him, targeting his K-10 stocks to profit from their decline.

This cartel, in the BSE, began selling Ketan Parekh’s K-10 stocks aggressively. Their actions triggered a sharp decline in the prices of these manipulated stocks.

As prices plummeted, it created a payment crisis in the market, where traders and brokers faced difficulties settling their dues (this is what attracted the regulator’s attention towards the scam).

To minimize his losses and generate some liquidity, Parekh too resorted to dumping (selling off in bulk) his K-10 stocks.

However, this was done outside regular trading hours (between 5 PM and midnight) at the Calcutta Stock Exchange. It was done like this to bypass the typical checks in place during market hours. This mass sell-off caused panic among investors, leading to a stock market crash the following day.

The crash deeply affected institutional investors, including mutual funds and insurance companies, which had holdings in these artificially inflated stocks.

Further investigations revealed that Parekh had ties with entities like Global Trust Bank (GTB) and Madhavpura Mercantile Cooperative Bank (MMCB), which were allegedly used to finance his manipulative activities.

Other instances of fraud by Ketan Parekh:

- 1995: His malpractice wasn’t limited to K-10 stocks; it spanned years, with similar tactics dating back to 1995.

- 1992: In this year Parekh faced his first conviction, resulting in a one-year sentence for irregularities involving Canara Bank.

- 2009: Despite being barred from stock trading, SEBI found evidence in 2009 that companies and individuals were acting as proxies for Parekh. They were continuing to manipulate the markets on his behalf. This led to trading bans for 26 entities.

- 2014: A CBI court also put Ketan Parekh to two years imprisonment.

- 2025: In this year, Ketan Parekh is again caught is Rs.65 crore front-running operation.

Why Did They Do It?

Of course the bigger purpose was to make easy money but he used banks to leverage his returns. Let’s understand it using analogy and a hypothetical example.

Imagine you hear about a concert by a famous artist, and tickets are selling fast.

You rush to buy one because you don’t want to miss out. But when you arrive at the venue, you realize there’s no concert. It was just a fake advertisement to trick people into buying tickets.

Similarly, in the stock market, manipulated stock prices give the illusion that the stock is “hot,” tempting genuine investors to buy it.

Ketan Parekh and his associates created this illusion by artificially inflating stock prices. Their goal was simple: raise money without relying on traditional bank loans. Bank loans come with rules, documentation, and interest payments. Instead, Parekh manipulated stock prices to generate money faster.

They Used Settlement Cycles (T+5 or T+2) To Their Advantage

Settlement cycles are the time frame within which a stock market trade is completed.

- T+5 (Trade Date + 5 Days): In this older settlement system, a trade made on Day 1 (Trade Day) had to be fully settled by Day 6.

- T+2 (Trade Date + 2 Days): In the newer system, trades settle faster, on Day 3 after the trade.

During the settlement cycle, you don’t immediately pay for the stocks you buy or receive money for the stocks you sell. There’s a gap between the trade and settlement. Parekh exploited this gap.

How This Exploitation Worked:

Parekh used circular and synchronized trading to inflate stock prices.

Example: A stock worth Rs. 50 is repeatedly traded within his group to make it look like it’s worth Rs. 100.

After inflating the price, he could pledge these stocks to brokers or financiers as collateral to borrow money. Example: Consider pledging stocks worth Rs. 100 (inflated price) to get a loan of Rs. 80.

Parekh would use the borrowed funds to buy more stocks, repeat the manipulation, and raise even more money before the settlement cycle ended.

By the time the settlement day arrived (T+5 or T+2), the stock price were artificially pumped. Then he would sell and book profits.

It left unsuspecting investors holding overpriced stocks when the manipulation collapsed.

Example in Action: Let’s assume Parekh starts with Rs. 10 crore. He buys 1 lakh shares of Company ABC at Rs. 50 each and inflates its price to Rs. 100 through circular trading. Next, he pledges these shares worth Rs. 1 crore (at inflated prices) to borrow Rs. 80 lakh. Using the borrowed Rs. 80 lakh, he repeats the cycle with another stock, inflating its prices and raising more funds.

By the time the settlement cycle catches up, Parekh has raised significant short-term funds.

The innocent investors who bought the stock at inflated prices lose money once the bubble bursts.

This strategy allowed Parekh to generate large sums of money in a short time.

Impact on the Market

The essence of the stock market is the natural price discovery of the stocks. Market manipulation disrupts the natural process of price discovery.

For example, suppose the price of mangoes is decided not by the its demand in the market but by a cartel secretly raising prices. In this case the buyers would end up paying unfairly high prices.

Similarly, manipulated stock prices hurt genuine investors who believe in the fairness of the market.

What’s The Lesson For Us:

- Look Beyond the Hype: Always verify why a stock price is rising. Is it backed by strong company’s fundamentals or just rumors?

- Diversify Investments: Don’t put all your money into one stock or even one asset class. Why? It is imperative that some stocks will perform and some will loose. Spreading money across multiple asset classes increases the resilience and longevity of our portfolios.

- Trust the Data: We can rely only on financial reports and audited statements to assess a company’s value. Do your own analysis or take advice of your trusted financial advisor before investing.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.