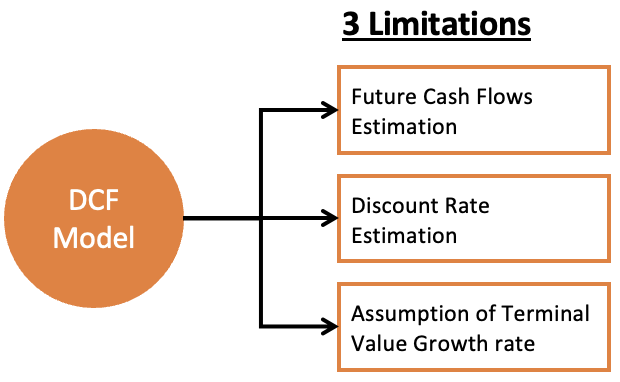

While the discounted cash flow (DCF) model is a widely used method for valuing stocks. But it is not without limitations. Let’s examine the limitations of discounted cash flow (DCF) model. The limitations are with respect to present value calculation based on the future growth rate, cash flow estimation, and discount rate. The article will explore some of the most significant limitations of discounted cash flow (DCF) Model for stock analysis.

The discounted cash flow (DCF) model is a popular approach used to estimate the intrinsic value of stocks. By discounting future cash flows to their present value, investors can determine whether a stock is undervalued or overvalued.

While the DCF model is widely used, it has limitations that investors should be aware of. In this article, we will examine some of the potential flaws of DCF analysis and discuss the implications for investors looking to use this method for stock analysis.

Overview of the DCF model

The DCF model is a method used to estimate the intrinsic value of a stock by calculating the present value of its expected future cash flows. The model is based on the idea that the value of a stock is equal to the sum of all future cash flows it generates, discounted to its present value.

Suggested Reading: Please check this article on the net present value (NPV) calculation to get a practical perspective of calculations and assumptions involved in DCF analysis. To get a better feel for the limitations of the DCF model, the knowledge of the NPV calculation will certainly help.

The basic components of the DCF model include:

- Cash flows: The cash flows used in the DCF model are the expected future cash flows generated by the company. These cash flows can be estimated using a variety of methods, such as historical data and management projections.

- Discount rate: The discount rate used in the DCF model is a measure of the opportunity cost of investing in the stock. It reflects the rate of return an investor would expect to earn on an alternative investment of similar risk. The discount rate is typically derived from the cost of capital, which includes the cost of debt (Cd) and the cost of equity (Ce) financing.

- Terminal value: The terminal value represents the expected value of the stock at the end of the forecast period. It is calculated using a multiple of the company’s expected future cash flows or earnings and represents the present value of all future cash flows beyond the forecast period.

To calculate the intrinsic value of a stock using the DCF model, we first estimate the expected future cash flows for a given period (usually 10 years). Next, we discount these cash flows to their present value using the discount rate.

Finally, we calculate the terminal value of the stock and discount it to its present value using the same discount rate.

The sum of the present value of the expected future cash flows and the present value of the terminal value gives us the intrinsic value of the stock.

Let’s know about the limitations of discounted cash flow (DCF) model.

Limitation#1: Difficulty in estimating future cash flows

One of the primary challenges of using the DCF model is the uncertainty and variability associated with future cash flows. The accuracy of the DCF model is heavily dependent on the accuracy of cash flow projections, which are inherently difficult to estimate due to a variety of factors.

For example, changes in the economy, industry trends, and competitive pressures can all impact a company’s future cash flows. Additionally, the accuracy of projections may be influenced by factors such as management’s assumptions and biases, the quality and availability of data, and the complexity of business operations.

How to address this limitation related to future cash flows

- Assume Multiple Scenarios: One way is to use multiple scenarios or sensitivity analysis to account for different potential outcomes. By considering a range of scenarios, investors can better understand the potential risks and uncertainties associated with a particular investment. For example, an investor might consider a base case scenario, as well as optimistic and pessimistic scenarios to assess the potential range of outcomes.

- Use Historical Data: The use of historical data or industry benchmarks to estimate cash flow projections is also possible. One can also look at historical trends and performance metrics for similar companies in the same industry. This way the analyst can develop more informed estimates of future cash flows.

Example

Instead of projecting high revenue growth rates, the analyst can use more conservative estimates based on historical trends and industry benchmarks. They can also run sensitivity analysis by varying the cash flow projections to see how changes affect the overall valuation. This approach helps to mitigate the risk of relying on overly optimistic projections and provides a more realistic range of potential valuations.

While the DCF model can be a powerful tool for valuing stocks, the accuracy of cash flow projections is a key limitation to consider. Investors should be aware of the potential risks and uncertainties associated with projecting future cash flows and should use multiple scenarios and sensitivity analysis to account for these factors.

Practical tip: It is comparatively easy to calculate the free cash flow (FCF) using the FCF formula. But in the DCF model, we need future FCF values (for the next 5 years). To do that we must assume a suitable FCF growth rate. The main limitation of discounted cash flow (DCF) model is this growth rate assumption. Be extra careful and try assuming the growth rate rather defensively.

Limitation#2: Sensitivity to the discount rate

The discount rate used in the DCF model reflects the opportunity cost of investing in the stock. It is a key input that affects the resulting valuation.

The discount rate represents the rate of return an investor would expect to earn on an alternative investment of similar risk.

The appropriate discount rate is challenging to determine and can be subjective. The discount rate is influenced by a variety of factors, such as the company’s cost of capital, industry risk factors, and macroeconomic conditions.

The sensitivity of the DCF model to the discount rate means that small changes in the discount rate can significantly affect the valuation of the stock. For example, a slight increase in the discount rate can result in a large decrease in the present value of future cash flows. This eventually decreases the estimated intrinsic value of the stock. Similarly, a small decrease in the discount rate can result in a large increase in the present value of future cash flows and hence the estimated intrinsic value.

How to address this limitation related to the discount rate

- Range of Discount Rates: One way to address this limitation is to use a range of discount rates to account for different potential outcomes. For example, the analyst shall consider a base case scenario, as well as optimistic and pessimistic scenarios. This will yield a potential range of outcomes.

- Sensitivity Analysis: The analyst can also use sensitivity analysis to understand the impact of small changes in the discount rate on the valuation of the stock. Start with a base case scenario using a discount rate of say 10%. Then run the DCF model using a 0.5% increase in the discount rate (10.5%) and a 0.5% decrease in the discount rate (9.5%). This way the investor will realize how much the intrinsic value changes for even minor changes in the discount rate. It will sensitize the analyst to use a more accurate discount rate number.

The appropriate discount rate is challenging to determine, and small changes in the discount rate can significantly affect the valuation of the stock. Investors should be aware of these factors and use sensitivity analysis and a range of discount rates to better understand the potential risks and uncertainties associated with a particular investment.

Practical tip: In the real world, analysts use the weighted average cost of capital (WACC) as the discount rate. In the WACC formula, there are two critical components, cost of debt (Cd) and cost of equity (Ce). The analysts must take extra care in calculating the Cd and Ce values.

Limitation#3: Terminal Value Assumptions

The terminal value is the estimated value of an investment at the end of a specified period (say 10 years). In the context of the DCF model, it represents the present value of all future cash flows beyond the projection period (the 10th year).

The terminal value is a critical component of the DCF model, as it can account for a significant portion of the total valuation. The majority portion of the estimated intrinsic value draws its juice from the terminal value. Out of all limitations of discounted cash flow (DCF) model, the terminal value component poses the biggest concern.

The assumptions made to calculate the terminal value have a big impact on the overall valuation.

For example, If the investor assumes a high terminal growth rate, the resulting terminal value will be higher, leading to a higher overall valuation. Conversely, if the investor assumes a low terminal growth rate, the resulting terminal value will be lower, leading to a lower overall valuation.

Example

Let’s say an investor is trying to value a startup technology company using the DCF model. The investor estimates the future cash flows of the company over the next five years and assumes a discount rate of 10%.

To determine the terminal value, the investor must make assumptions about the growth rate of the company beyond the five-year projection period. The investor assumes a terminal growth rate of 5% based on the company’s historical growth rate and market trends.

However, a year later, a major competitor enters the market and starts to capture market share from the company. The investor realizes that the assumptions made about the terminal growth rate are no longer valid, as the competitive landscape has changed significantly.

As a result, the investor decides to revisit the terminal value assumptions and adjusts the growth rate to 2%. This results in a significantly lower terminal value and a lower overall valuation for the company.

Hence, it can be difficult to predict the long-term growth rate of a company or the industry in which it operates. Additionally, changes in the competitive landscape, regulatory environment, or technological advancements can make it challenging to accurately forecast future cash flows.

Practical tip: In a company’s intrinsic value there are two components. The first component is the preset value (PV) of the next 5/10 years FCF, let’s call it PVFCF. The second component is and PV of the terminal value let’s call it PVTV. Intrinsc value (IV) = PVFCF+PVTV. Generally speaking, almost 75% value of IV is derived from PVTV. Hence, to estimate a correct IV, it is essential to first calculate a correct TV (this is the TV formula). To do it, the assumption of the right terminal growth rate is paramount.

Conclusion

The DCF model is a powerful tool for valuing stocks and other assets, But there are limitations of discounted cash flow (DCF) model.

The three key limitations discussed in this article include the difficulty in estimating future cash flows, sensitivity to discount rates, and terminal value assumptions.

Investors need to be aware of these limitations when using the DCF model and should approach its results with caution.

It is also important to use the DCF model as part of a broader analysis that incorporates other valuation methods and qualitative factors such as market trends, competition, regulatory environment, and management quality.

By doing so, investors can gain a more comprehensive understanding of the value of an asset and make more informed investment decisions. While the DCF model is a valuable tool, it should be used in conjunction with other methods to ensure a well-rounded and informed investment approach.

Have a happy investing.

Related Reading:

Thanks for giving me this information. This post contains valuable and unique information, and I know it takes time and effort to create an excellent article.