Lowest NAV mutual fund means it is undervalued? No necessarily.

One can earn higher return if one buys a good mutual fund at undervalued NAV.

There is a difference between “undervalued NAV” and “lowest NAV”. Low NAV does not necessarily mean the fund is undervalued.

Lower NAV may be cheap for your pocket, but it must also be cost effective.

How a fund can be cost effective?

When a fund gives higher returns per unit price, it is said to be cost effective.

In financial terms, this “cost effectiveness” is generally referred as “yield”.

Cost effective mutual funds yields better returns for its investors.

Everyone invests in mutual funds for better yields. But people often misjudge this fact that, lower NAV cannot guarantee higher yields.

Undervalued NAV can certainly guarantee higher returns (high yield).

#1. High NAV is better or lower NAV?

Compared to mutual funds with higher NAV, are lower NAV funds better?

Once my friend once told me, lower NAV means he can buy more mutual fund units.

Does this make lower NAV funds a better investment?

If we are looking at only NAV, it does not show the complete picture.

It is very tempting to buy mutual fund which has lower NAV. But lower NAV does not always mean that it is undervalued.

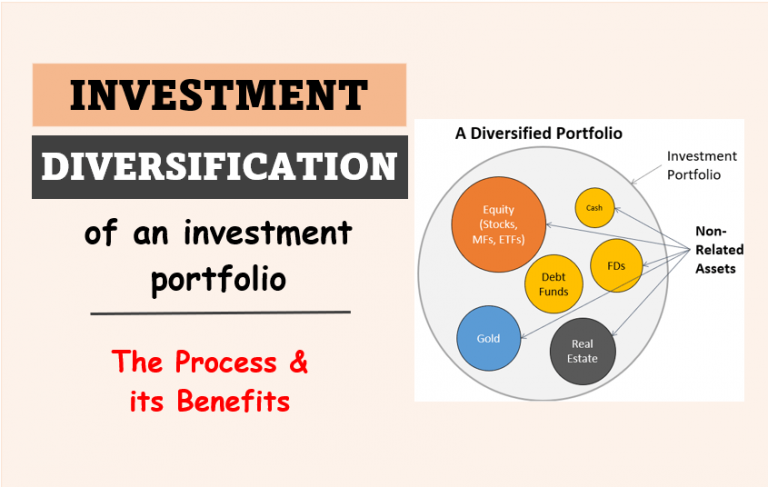

If our objective is to buy a undervalued mutual fund, it is irrelevant if its NAV is high or low. Mutual funds have a portfolio in which there are mix of securities like:

- Stocks,

- Debt linked instruments,

- Cash,

- Bonds etc.

Together, a mix of these securities creates a portfolio for mutual funds.

Net Asset Value (NAV) of any mutual fund will be as below:

Market value of its stocks, bonds, other constituents..

In colloquial conversations, when we use the terms “NAV” we actually refer to NAV per unit.

So here the NAV formula will be as below:

Market value of its stocks, bonds, other constituents../number of units

To understand if lower NAV is better or higher NAV, lets see an example:

#1.1 Example:

Suppose there are two hypothetical mutual funds MF1 and MF2.

Portfolio composition of both MF1 and MF2 are as below:

- Technology Stocks:

- MF1: TCS (X1 nos), Infosys (Y1 nos), Wipro (Z1 nos).

- MF2: TCS (X2 nos), Infosys (Y2 nos), Wipro (Z2 nos).

- Financial Stocks:

- MF1: HDFC(A1 nos), SBI (B1 nos), Kotak (C1 nos).

- MF2: HDFC(A2 nos), SBI (B2 nos), Kotak (C2 nos).

- Healthcare:

- MF1: Sun Pharma (L1 nos), Cipla (M1 nos), Lupin (N1 nos).

- MF2: Sun Pharma (L2 nos), Cipla (M2 nos), Lupin (N2 nos).

- Etc stocks (K nos).

Coincidently, the market value of portfolio constituents of both MF1 & MF2 is Rs.100 Million.

So in terms of market value, both MF1 and MF2 are at par.

But lets see a small twist, which will present MF2 and better valued than MF1.

Number of units outstanding in market for MF1 and MF2 are 10 millions and 12 million respectively.

So what will be the NAV?

- MF1 : Rs.10.00/unit (100/10)

- MF2 : Rs.8.22/unit (100/12)

By looking only at NAV, it looks like MF2 is better valued than MF1.

But in reality, inherent market value of both MF1 and MF2 is same (Rs.100 million).

So what we can conclude?

Lower NAV or higher NAV tells nothing about the mutual fund being undervalued or overvalued.

Whether mutual fund unit is cheap or costly cannot be decided by looking at its NAV.

#2. Good Vs. Bad Mutual Fund

Suppose you have two mutual fund available in front of you:

- One is a bad mutual fund and

- Other is a good mutual fund.

A bad mutual fund has a lower NAV than a good mutual fund.

Does lower NAV justify the purchase of bad mutual fund?

Shall higher NAV restrict you to buy good mutual fund?

The point I am trying to make is this, lower or higher NAV is the last thing we shall see in buying a mutual fund unit.

What is more important is to see how well managed is the mutual fund.

This we can understand by looking at the following 10 parameters of mutual funds:

- Historical returns (3Y, 5Y, 7Y, 10Y).

- Performance of fund compared to its Benchmark.

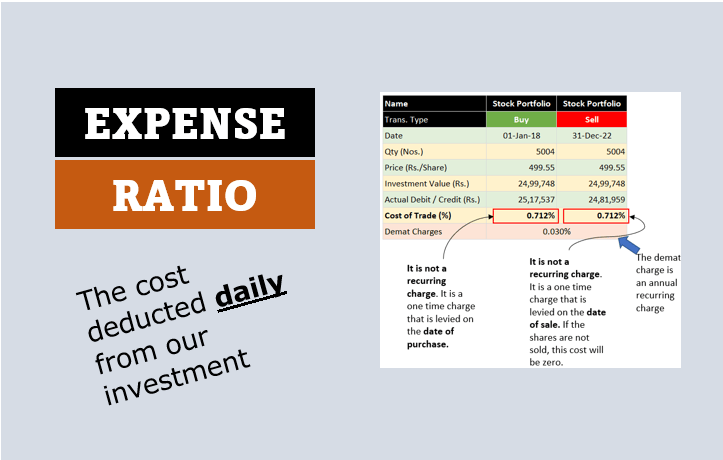

- Expense Ratio.

- The Fund Manager (track record).

- Exit and Entry loads.

- CRISIL or VRO Ratings

- Asset Size (neither should be too small or too big).

- Base of Mutual Fund (equity based, debt based, balanced etc).

- What are the individual constituents of the fund.

- Investment Objective of Mutual Fund (income generation, capital protection, capital appreciation etc).

Though the above 10 parameters check’s do not include everything, but it gives a very fair idea about the mutual fund.

If one can study these 10 parameters, picking between two funds become easier.

But if one picks funds based on only lower NAV parameters, he is more likely to pick a bad one.

One mutual fund with Rs.100 as NAV can prove to be undervalued compared to mutual fund whose NAV is Rs.10.

Conclusion

The price at which one buys mutual fund units becomes irrelevant if you are earning higher returns.

Lower NAV means nothing when it comes to deciding whether mutual fund being overvalued or undervalued.

Target shall be to buy a good fund units at undervalued price levels.

Suppose a mutual fund with Rs.1 as its NAV is giving 8% per annum return.

Another mutual fund with Rs 10 as its NAV is giving 15% per annum returns.

What do you think, which mutual fund is better?

The mutual fund with higher returns will be a better buy, right?

No matter if the the NAV is higher or lower, the parameter that decides true value is funds future returns prospects.

Low NAV, Good Mutual Funds in India (2018)

(updated Mar’18)

- Aditya Birla Sun Life Tax Relief 96 30.15

- Axis Long Term Equity Fund 40.32

- Kotak Select Focus Fund 31.82

- Aditya Birla Sun Life Pure Value Fund 60.24

- Invesco India Contra Fund 44.94

- ICICI Prudential Focused Bluechip Equity Fund 38.64

- SBI Bluechip Fund 37.23

- IDFC Tax Advantage (ELSS) Fund 56.34

- Reliance Top 200 Fund 31.03

- SBI Magnum Multicap Fund – Direct Plan 45.96

Check this link to find Start Rating, Expense Ratio, Return (1Y) and Net Asset of the above low NAV mutual funds.

Some what helpful