Let’s talk about something that’s been buzzing in my head lately, market sentiment analysis. I’ve been thinking how tools like Google Trends might just be the secret sauce to smarter stock investing. I mean, we’ve all been there, right? Scrolling through financial news, dissecting earnings reports, or staring at candlestick charts until our eyes cross, trying to figure out what’s driving the market. But what if I told you that the collective curiosity of millions, yep, those random Google searches we all do, could give us a sneak peek into where stocks might be headed?

Buckle up, because we’re diving deep into this one, and I promise it’ll be worth your time.

What’s Market Sentiment Anyway?

Consider this, the stock market is like a giant mood ring.

- When investors are feeling optimistic, say, after a killer earnings report from a company like Tesla, prices tend to climb.

- But when fear creeps in (think “recession” headlines or a global pandemic), it’s like someone flipped a switch, and everything tanks.

That’s market sentiment in a nutshell, the crowd’s vibe toward a stock, a sector, or the whole darn market.

For years, we’ve leaned on stuff like the VIX (aka the “fear gauge”) or investor surveys to get a read on this. Solid tools, no doubt. But they’re kind of like checking the weather after you’re already soaked.

Enter Google Trends, a free, real-time window into what people are actually typing into that search bar. It’s not just trivia; it’s a pulse on human behavior. And since markets are driven by humans (well, and some sneaky trading bots), to me, this feels like a goldmine worth exploring.

How Google Trends Fits Into the Stock Game

So, how does this work?

Google Trends tracks how often people search for specific terms over time. It tries spitting out a handy little graph from 0 to 100 based on peak popularity.

Want to see if folks are freaking out about a “stock market crash”? Type it in. Curious if Tesla’s latest Cybertruck drama is spiking interest? Search “Tesla stock.” You can even narrow it down by region or timeframe, pretty slick, right?

Here’s where it gets juicy. Spikes in search volume often signal something’s brewing.

Back in early 2020, before the COVID-19 market nosedive. Searches for “economic crisis” and “market crash” started creeping up. Coincidence? Maybe not.

Fast forward to 2021, and the GameStop saga had “GME stock” searches hitting the roof just as Reddit traders sent it to the moon.

It’s like the crowd’s Google habits were yelling, “Heads up!” before the action hit Wall Street.

Real-World Wins and Wipeouts

Let’s unpack a couple of examples to see this in action.

- First up, Bitcoin. If you’ve ever dipped a toe in crypto, you know it’s a rollercoaster. Research, like a 2018 study from the Journal of Behavioral Finance, found that when Bitcoin-related searches spiked, price swings often followed. A surge in “buy Bitcoin” might mean a rally’s coming, but “Bitcoin crash” searches? Brace yourself for a dip. It’s not foolproof, but the pattern’s hard to ignore.

- Then there’s the meme stock madness. GameStop’s wild ride in January 2021 is the poster child here. Google Trends showed “GameStop stock” searches exploding from obscurity to stratospheric levels right before the stock soared from $20 to nearly $500. Retail investors on platforms like Reddit’s WallStreetBets were the muscle. Those search spikes were the early smoke signal. I wish I’d been paying attention, could’ve made a quick buck instead of just watching in awe. 🙂

On the flip side, broader market downturns give us clues too. Before the 2008 crash, searches for “housing bubble” and “recession” ticked up.

It’s almost eerie how our collective Googling mirrors our gut instincts, and how those instincts can move markets.

How to Actually Use This Stuff

Okay, so it’s cool in theory, but how do we make it practical? Here’s my playbook after messing around with this for a bit:

- Spot Trends Early: Set up Google Trends to track terms like “Apple stock” or “EV sector.” A sudden spike might mean news is brewing, get ahead of the curve before CNBC blasts it.

- Cross-Check Like a Pro: Don’t just YOLO into a trade because searches are up. Pair it with fundamentals (like P/E ratios) or technicals (RSI, moving averages). If Tesla searches are surging and their earnings beat expectations, that’s a stronger case.

- Beware the Hype Trap: Skyrocketing searches for “meme coin” or “NFT stocks”? Could be a bubble. I’ve seen friends get burned chasing hype. Use it as a caution flag, not a green light.

- Play the Contrarian: When everyone’s searching “stock market crash,” panic might’ve already peaked. Oversold conditions could mean a rebound’s near. I’ve nabbed some cheap shares this way during mini-dips.

Pro tip: Set Google Trends alerts for your watchlist. It’s like having a little birdie whisper in your ear when something’s up.

Where It Falls Short

Now, before you ditch your Bloomberg app for Google, let’s talk limitations.

First, correlation isn’t causation. Just because “Nvidia stock” searches are spiking doesn’t mean it’s going up. Maybe a scandal’s tanking it instead. Second, this data leans heavy on retail investors. Big institutions with their algo-trading wizardry? They’re not Googling “best stocks to buy”, they’ve got proprietary tools we can only dream of.

Oh, and timing’s tricky. By the time a trend’s obvious, the smart money might’ve already moved.

I learned this the hard way trying to ride a search spike for a biotech stock. jumped in late and ate a 300% dip. Lesson learned? Use this as a heads-up, not a gospel.

Leveling Up Your Game

Ready to kick things up a notch?

Let’s talk about blending Google Trends with some heavier hitters, like fundamental analysis or technical indicators. It will really sharpen your investing edge.

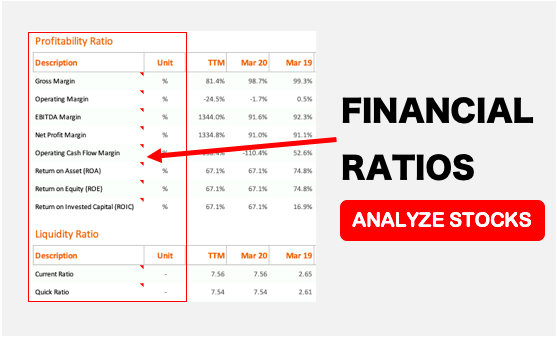

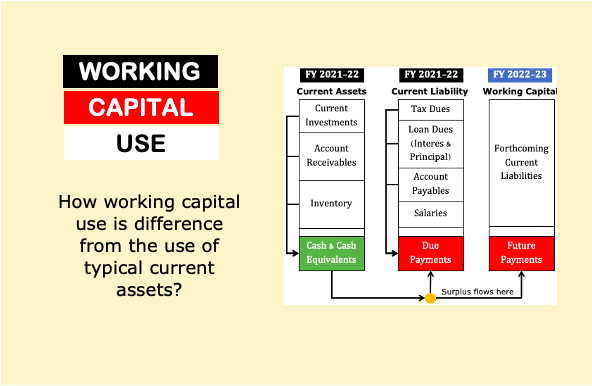

- Imagine this, you spot a spike in “Nvidia stock” searches. Cool, people are interested. But is it worth your money? Dig into the fundamentals, check their revenue growth, profit margins, or debt levels. If the numbers look solid and searches are climbing, that’s a green light with some real horsepower behind it.

- Or pair it with technicals. Sy, the stock’s hugging its 50-day moving average and Trends shows a breakout in interest. That’s a combo that’s got me scribbling in my trading journal like a madman.

Here’s where I get geeky. I’ve started screenshotting those Trends graphs and stacking them against price charts. Think of it like a DIY sentiment overlay. It’s a bit obsessive, sure, but spotting those overlaps is starting to feel like cracking a code.

Oh, and a quick hack, filter Trends by region. If “solar stocks” are lighting up in Texas but snoozing elsewhere, maybe a new state energy policy’s in play.

That’s the kind of sneaky insight that keeps you one step ahead of the pack.

Conclusion

So, where do I land on this?

Google Trends isn’t a magic bullet, but it’s a wickedly cool tool to add to your investing toolbox.

It’s like eavesdropping on the world’s biggest coffee shop chat, raw, unfiltered, and sometimes prophetic. Pair it with your usual research, and you’ve got a fresh angle to play with.

I’ve started using it to flag stocks for my watchlist, and it’s honestly made me feel a bit more in tune with the market’s mood swings.

What about you? Ever thought about letting Google guide your trades? Or maybe you’ve got a killer strategy I should steal—er, borrow?

Drop your thoughts below; I’d love to hear how you’re navigating this wild investing world. Let’s figure this out together.

Have a happy investing.