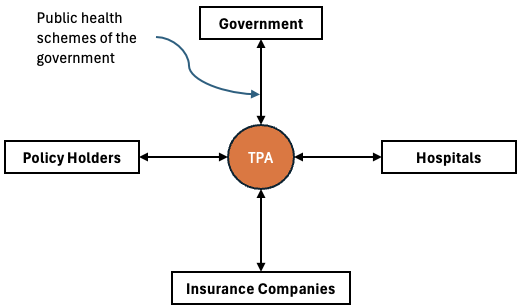

Medi Assist is a TPA, or Third Party Administrator, one of the largest TPAs in India. The company has launched its Initial Public Offering (IPO) on January 15, 2024. Medi Assist helps people who have health insurance use their benefits. They do this in three main ways:

- For employers: Medi Assist works with companies to manage their employees’ health insurance plans. This includes tasks like processing claims, finding hospitals in the insurance network, and answering questions about the benefits.

- For individuals: People who buy health insurance directly (not through their employer) can also use Medi Assist services. They can help you understand your plan, submit claims, and find healthcare providers.

- For government programs: Medi Assist also helps manage some government health insurance programs in India. This ensures that people who qualify for these programs can access healthcare easily.

Medi Assist acts as a bridge between insurance companies and the people who use their plans. They make it easier to get the healthcare people need while staying within their insurance coverage. That is why they are called TPAs (Third Party Administrators).

Medi Assist IPO Details

| IPO Open Date | 15-Jan-2024 |

| IPO Close Date | 17-Jan-2024, 5 PM |

| Listing Date | 22-Jan-2024 |

| Price Band (per share) | Rs.397 to Rs.418 |

| One Lot Size | 35 Shares |

| Total Issue Size | 28,028,168 shares |

| Listing At Exchanges | NSE and BSE |

Introduction

Medi Assist stands out as a market leader in the TPA business for insurance companies.

Notably, a substantial portion of its revenue is intricately linked to the premium under management (PUM) of health insurance companies. This unique positioning provides investors with a chance to participate in the future growth of the health insurance industry.

The outlook for Medi Assist is largely positive. My assumption is supported by a decent industry tailwind and the company’s established position within it. However, like all companies, Medi Assist also has its own set of strengths and challenges.

Strengths:

- Rising health insurance penetration: India’s health insurance market is expected to grow at a CAGR of 10-18% over the next few years. Rising incomes, increasing awareness, and government initiatives are a few contributing factors. This presents a significant opportunity for Medi Assist to expand its client base and revenue.

- Tech-driven innovation: Medi Assist invests in technological solutions to automate its processes and improve efficiency. This focus can improve their competitive advantage.

- Strong brand recognition: Medi Assist is a known brand in the Indian TPA market. This established brand reputation can attract new clients and partners.

Challenges:

- Concentration risk: A significant portion of Medi Assist’s revenue comes from a few large clients. Dependence on a small number of clients can be risky if any of them decide to switch to another TPA.

- Competition: The TPA market is becoming increasingly competitive, with new players entering the space. As per the IRDAIs website, as of Jan’2024, there are already about 23 nos listed TPAs.

- Regulatory changes: The Indian insurance industry is subject to frequent regulatory changes. Any changes in TPA regulations could impact Medi Assist’s business model and profitability.

- Profitability concerns: While Medi Assist’s revenue is growing, its profitability has been under pressure in recent quarters. The company needs to effectively manage costs and improve margins to sustain long-term growth.

The outlook for Medi Assist is promising, but not without challenges.

Are There Any Other Listed TPAs in NSE and BSE?

Medi Assist is indeed a prominent TPA to be listed on the Indian stock market. It will be the only pure-play TPA company listed on BSE and NSE. Several other publicly listed companies in India offer TPA services alongside other businesses:

- Apollo Hospitals Enterprise: This healthcare giant provides TPA services through its subsidiary, Apollo Healthnet TPA.

- Star Health and Allied Insurance: While primarily an insurance company, Star Health also offers TPA services through its subsidiary, Star TPA Services Ltd.

- ICICI Lombard General Insurance: This insurance company provides TPA services through its subsidiary, ICICI Lombard TPAS Ltd.

It’s important to note that these four (4) companies primarily focus on their core businesses (healthcare or insurance). They view TPA services as a complementary offering. This differs from Medi Assist, which solely focuses on TPA services and derives its entire revenue from that segment.

Therefore, you won’t find another pure-play TPA company like Medi Assist on the Indian stock market.

Investors may question why they should opt for an alternative play like Medi Assist rather than direct investments in listed insurance companies such as Star Health and ICICI Lombard General Insurance.

The answer lies in the stability that TPAs offer in comparison to the typical risks associated with insurer stocks. Compared to insurance companies, the risk of TPAs is more limited.

Introduction of Medi Assist IPO

As Medi Assist IPO unfolds, I feel, we are faced with a compelling opportunity to get a taste of the insurance sector from the TPA business perspective. This IPO, amounting to approximately Rs 1,172 crore, presents itself as an offer-for-sale (OFS) and not a fresh issue.

An OFS in an IPO isn’t raising fresh capital. Instead, existing shareholders (like promoters in the case of Medi Assist) directly sell their shares to investors. Hence, post the listing of Medi Assist, the equity stake of the promoters will undergo a significant reduction from 77.14 percent to 45.75 percent.

Moreover, OFS doesn’t benefit the company itself with new funds. OFS is not a fundraiser for the business but it is for the benefit of the promoters.

Why OFS is done?

For example, suppose Medi Assist kind of company has been operating successfully for years. It has generated decent revenue through its TPA services. The founders and early investors hold a significant portion of the company’s shares (like 77.14% in the case of Medi Assist).

Now, these early stakeholders want to free up some of their “assets” in the company. Instead of directly selling to each other, they hold IPO inviting the public to buy some of their shares. Why will investors buy their stake in OFS? They might do it to become part-owners of the company. If the company is growing and profitable, the public participates more handsomely with an expectation of future capital compounding.

The new “shareholders” who bought shares simply become partial owners of the company. However, the money from their purchases doesn’t go back into the company (like Medi Assist). It simply goes directly to the promoters of the company.

In the case of Medi Assist’s OFS, the promoters are “selling their seats at the table,” not raising new capital for the company to expand its TPA services or acquire new clients.

Remember, the company itself (Medi Assist) continues its regular operations, using its existing resources and revenue to grow. The only change is that some new “owner-guests” join the existing stakeholders.

Business Prospects of Medi Assist

Mostly, insurance companies use TPAs to deal with their policyholders, hospitals, and the government. TPAs are mostly worth the front face of the insurance companies, especially with hospitals and policyholders. As of date, 32 insurance companies use the services of Medi Assist as their TPA.

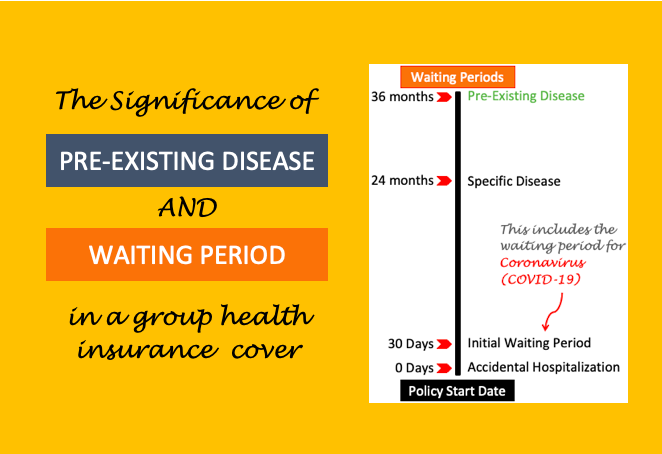

We can broadly classify all insurance policies into four broad categories: Group policies (companies), individual policies (family floaters), government-sponsored policies (like Ayushman Bharat Yojana), and other policies. Medi Assist’s income break-up between these four is as follows:

- Group Policies (Companies): ~75%

- Individual Policies (Family Floaters): ~11%

- Government-Sponsored Policies (like Ayushman Bharat Yojana): ~10%

- Other Policies: ~4%

As the per-capita income is growing in India, group policies and family floater policies are selling like hotcakes for insurance companies. It means that the income of TPAs like Medi Assist will also grow fast in years to come.

Peers of Medi Assist

There are about 23 nos listed TPAs on IRDAI’s website including Medi Assist. All these TPAs get business from the public and private health insurance companies. Among all the TPAs, Medi Assist has a market share of 34%. it means that out of the total insurance premiums managed through the TPAs, 34% are being managed by Medi Assist alone.

Future Growth Prospects

Expensive health care and increasing disposable income are two main drivers of the health insurance sector. Currently, the penetration of health insurance is also low in India. Only about 37% (about 52 crore people) of Indians have health insurance coverage. After COVID, people have become more aware of the importance of reliable health insurance coverage.

It has been reported by research agencies that group insurance coverage (provided by companies) is expected to grow at a rate of 20% per annum in the next 2-3 years.

As more people are getting covered by health insurance policies, insurance service providers are taking assistance from TPA to provide their services to the end users (policyholders, and hospitals). As of the year 2022, out of the total premium under management (TPU), 54% was done through TPAs. This percentage is only expected to grow in times to come. Why? As the volumes will increase, insurance companies will like to focus more on their core business.

Experts even say that the business growth of TPAs will outpace the growth of the health insurance companies themselves.

Financials of Medi Assist

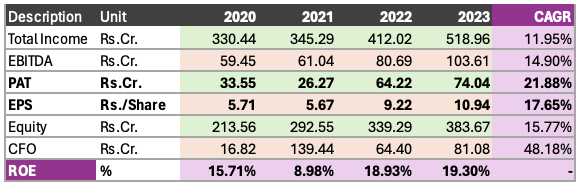

In the last four years, Medi Assist was able to grow its total income at a CAGR of 11.95%. In the same period, its EPS grew from Rs.5.71 to Rs.10.94 per share. This is a growth rate of 17.65% per annum.

Between FY 2020 and 2023 (four years), the ROE of the company has also improved from 15.71% to 19.3%.

A combination of rising EPS and improving ROE is pointing towards a financially healthy company.

Price Valuation

At the upper IPO price band of Rs.418 per share, the price-to-earnings ratio (P/E) of Medi Assist comes out as 38.21 times. If FY2023 EPS (Rs.10.94/share) grows at a rate of 20% in the next two years, in FY2025, its EPS will be Rs.15.76/share. At this future EPS, and current IPO price of Rs.418 per share, the PE multiple of Medi Assist comes out as 26.6.

In the last five years, the ROE of the company has also appreciated from 15.71% to 19.3% levels.

Please note that the revenue model of TPAs is very reliable. They earn a fixed percentage (about 3.5% to 4%) of the total premium they manage for the insurance companies. This is almost like a return generated from a fixed-income security.

I would personally like to buy this type of business for my investment portfolio with a holding time of 5-7 years at least.

Have a happy investing.

Suggested Reading:

![If A Bank Closes What Happens To The Deposits? [DICGC]](https://ourwealthinsights.com/wp-content/uploads/2021/06/If-a-bank-closes-what-happens-to-deposits-image2.png)