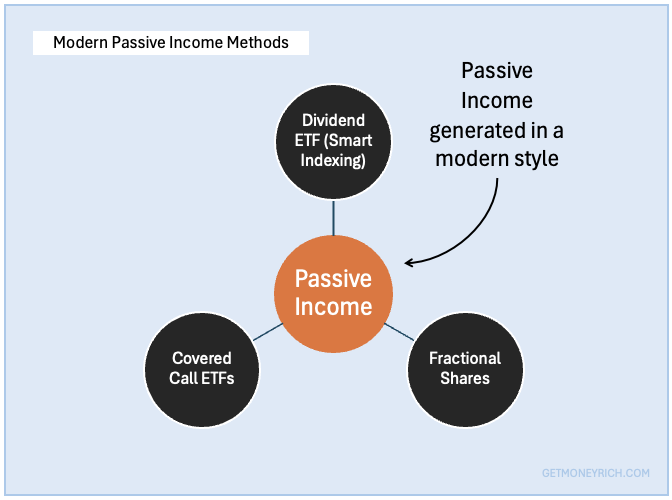

Generating passive income from the stock market has evolved significantly in recent years. Traditional methods like dividend investing still hold value. But modern techniques offer more efficiency, automation, and diversification. Below, we explore three contemporary approaches to earning passive income through stocks in 2025 and beyond.

Investors today have more tools and strategies at their disposal than ever before. It’s now possible to build a steady income stream with minimal effort. The shift towards automation and smart investing has made passive income from stocks more accessible. I think, the below strategies are effective even for those with limited market experience.

Market conditions are constantly changing. Hence, relying solely on old-school dividend investing may not be enough.

Modern strategies blend traditional principles with newer financial instruments. This way, they ensure a more stable and resilient income stream. Whether you’re looking for consistent cash flow or a way to maximize returns without active management, these methods provide a fresh take on passive income generation.

Table of Contents

1. Dividend ETFs with Smart Indexing

Dividend investing has always been a reliable way to generate passive income, but the game has changed.

Traditional dividend stock picking required careful research, monitoring company fundamentals, and manually rebalancing a portfolio. That’s where modern Dividend ETFs with smart indexing come in. They do all the heavy lifting for you, combining automation with intelligent stock selection to maximize returns while minimizing risks.

Unlike basic dividend ETFs that track broad indices, smart-indexed dividend ETFs use advanced screening methods to ensure you’re investing in financially strong companies with sustainable dividends.

These ETFs don’t just chase high yields, which can sometimes be risky. Instead, they analyze multiple factors like a company’s cash flow, profitability, debt levels, and historical dividend growth.

The goal is to build a portfolio that offers consistent payouts while also benefiting from capital appreciation over time.

Example

Take Schwab U.S. Dividend Equity ETF (SCHD) as an example. As reported on the website of Schwab, the current annual dividend yield of this ETF is about 3.5%.

It doesn’t just include any company paying dividends, it filters for businesses that have increased dividends for at least 10 years. Then, it scores them based on return on equity, free cash flow, and yield to ensure only the most stable performers make the cut.

The ETF is also market cap-weighted and rebalanced annually. This ensures that your money stays allocated to the best opportunities. This means you can earn passive income without having to actively manage individual stocks.

Whether you’re a beginner or an experienced investor, smart-indexed Dividend ETFs provide a hands-off yet highly effective way to generate reliable income.

2. Fractional Share Investing with Automated Dividend Reinvestment

Imagine you want to own a piece of a company like Apple or Google, but their stock price is really high.

Before, you’d need to save up a hefty sum just to buy a single share. Now, with fractional share investing, you can buy a tiny slice of that company, even if it’s just worth $10. This opens up a world of possibilities, especially for those just starting out or working with a limited budget.

So, how does it work? Well, many modern brokerage platforms like M1 Finance or even Fidelity’s fractional trading service, let you invest in fractions of shares. This means you can build a diversified portfolio of high-quality, dividend-paying stocks without needing a ton of capital.

You could own a piece of Apple, Microsoft, Johnson & Johnson, and a few other solid companies, all with a relatively small investment.

So, what is automated dividend reinvestment

Now, here’s where the “automated dividend reinvestment” part comes in, and this is where the magic truly happens for passive income.

Most of these platforms offer a feature called a DRIP (Dividend Reinvestment Plan). Essentially, instead of receiving your dividend payouts as cash, the platform automatically uses that money to buy even more fractional shares of the same stock.

Think of it like planting a seed that grows into a tree, which then drops more seeds.

Your initial investment generates dividends, and those dividends are used to buy more shares, which then generate even more dividends. It’s a beautiful compounding cycle that works in the background, with minimal effort from your side.

This strategy is excellent for long-term wealth building. It can create a reliable passive income stream. Instead of relying solely on actively picking stocks or timing the market, you’re letting the power of compounding do the heavy lifting.

Over time, those small fractional shares can grow into a substantial portfolio, consistently generating income. It’s a smart, hands-off approach to building wealth in the modern stock market.

Plus, it removes the temptation to spend those dividends, ensuring they’re continuously reinvested for maximum growth!

3. Covered Call ETFs and Option-Based Income Funds

Covered Call ETFs and Option-Based Income Funds is another modern way to generate passive income from the stock market.

Now, I know the word “options” can sometimes scare people off, but don’t worry, we’ll break it down in a way that’s easy to understand.

Consider this, you own a stock, and you’re essentially renting it out to someone else for a short period. That’s essentially what a covered call strategy does. These specialized ETFs (Exchange Traded Funds) own a basket of stocks, and then they sell “call options” on those stocks.

What’s a call option? It gives someone the right, but not the obligation, to buy your stock at a certain price (the “strike price”) before a certain date (the “expiration date”). In exchange for giving them that right, you get paid a premium. That premium is the income you’re generating.

So, the ETF owns the stocks, sells the call options, collects the premiums, and then distributes those premiums to you, the investor, as income. It’s like being a landlord for your stocks. The good thing about covered calls is that they can generate income even in a flat or slightly down market.

What are the Trade-offs?

Now, it’s important to understand the trade-offs. When you sell a covered call, you’re essentially capping your potential upside. If the stock price skyrockets above the strike price, the person who bought the call option will likely exercise it. Meaning you’ll have to sell your stock at that strike price, even though it’s worth more on the open market.

You still get the premium, but you miss out on the potential for larger gains.

However, for many income-focused investors, this is a worthwhile trade-off. They’re willing to give up some potential upside in exchange for a consistent stream of income and some downside protection. The premium you receive from selling the covered call can act as a buffer if the stock price drops.

Examples

Good examples of these ETFs are the Global X Nasdaq 100 Covered Call ETF (QYLD) and the JPMorgan Equity Premium Income ETF (JEPI). These funds use covered call strategies to generate yields that are often higher than traditional dividend stocks.

So, if you’re looking for a way to boost your passive income from the stock market and you’re comfortable with a slightly more complex strategy, covered call ETFs might be a great option to explore.

Conclusion

Building passive income from the stock market isn’t just about picking a few dividend stocks and hoping for the best.

The market and the investors, both have evolved. The modern strategies make it easier, more efficient, and, most importantly, more sustainable.

There are modern alternative like smart-indexed dividend ETFs, they optimize your portfolio automatically. There there are covered call strategies that generate extra cash flow. There are also fractional investing that lets you compound wealth with small amounts. I think, today’s investors have more tools than ever to make their money work for them.

The key to success isn’t just choosing the right method, it’s understanding how these strategies fit into your financial goals.

- Are you looking for stable, long-term income? A dividend ETF might be your best bet.

- Want to boost returns on stocks you already own? Covered calls could add that extra layer of income.

- Only have a small amount to invest? Fractional investing ensures you’re still building wealth without waiting years to accumulate capital.

The best part? These approaches require little to no daily involvement, making them truly passive.

Have a happy investing.