Summary:

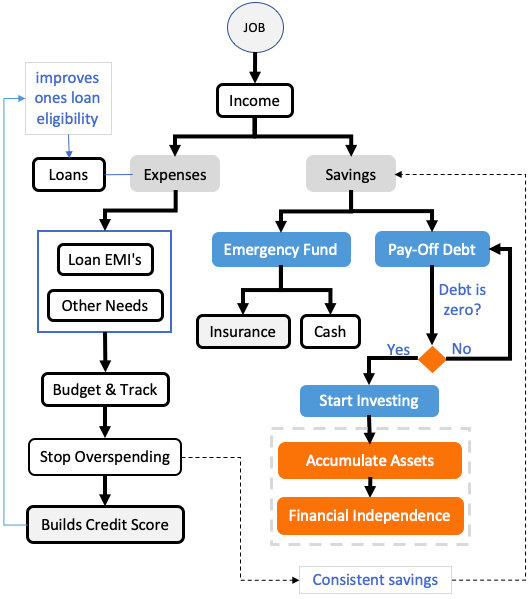

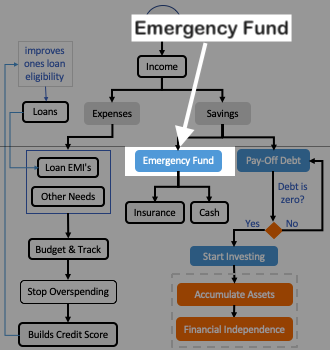

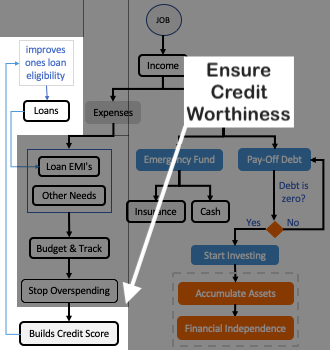

- This article outlines six essential money management rules—budgeting, avoiding overspending, building an emergency fund, paying off debt, investing, and maintaining creditworthiness—to guide common individuals toward financial independence.

Introduction

“What is the need of money management; after all we earn money only to spend it one day”. I was trying to be ironic. But I’m also sure that many will not find my statement ‘wrong‘. Read more about paycheck to paycheck lifestyle.

Most of us actually earn money only to support our expenses of life. This is how we have grown-up seeing our society, and it’s the way we have become. We earn to spend.

But not everyone think like this. People who think differently becomes filthy rich. Yes, this is the power of thinking alternatively.

We all want to become rich, right? So how we should think alternatively? We can think like this:

We are earning money to ‘accumulate assets’. The accumulated assets in turn will lead us to ‘financial independence’.

Topics:

The Bigger Purpose

Why we should implement the theory of good money management? We are doing it to improve our capability to buy assets. Why we’ll buy assets? Because the accumulated assets in turn will lead us to financial independence.

The ultimate goal is to become financially independent one day. But to reach there, we must follow all the rules of good money management at tandem.

It is important to see the bigger picture. It is necessary because, the road to financial independence is tough. This is the reason why only handful people (< 1%) in this world can claim to be financially independent.

As the road to independence is tough, there will be many a times when the temptation to give-up the chase will dominate. In those moments of dilemma, the clarity about the bigger picture will help. It will motivate us to keep going.

Here are the six rules of wise money management (applicable for common men like me and you)

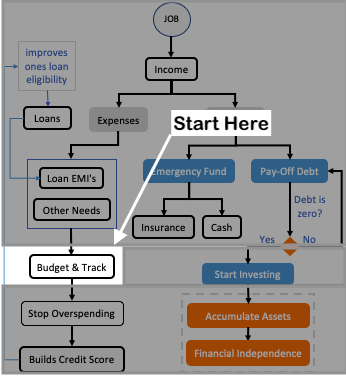

Rule #1. Start Here: Budget & Track Expenses

In the whole matrix of money management, I think the core lies in how sensitive we are to our expenses. What often keeps us down, financially, is our “bad spending habits”. We often cannot control our urges to spend money. As a result we save much lower than what is necessary. What is the solution? Budgeting & tracking expenses.

- Budget Expenses: Cliche, right? But it is essential. One should not take the next step without accomplishing this. Why? Because budgeting expenses will give clarity about ones spending habits. It will also put limits on those activities which is causing overspending. We overspend, period. Unless this stops, nothing else will be possible. Read: Benefits of Budgeting Expenses.

- Track Expense: Budgeting alone is not as effective. Recording expense is also mandatory. This can be easily done using an app or an excel sheet. At the end of the month, comparing the money-spent vs budget will highlight the ares of concern. Hence we can save more. Read: Expense tracking in excel.

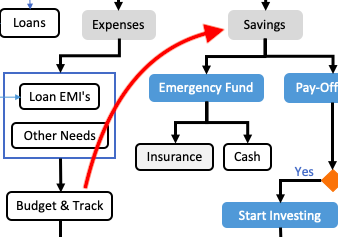

What is the ultimate objective of budgeting and tracking expenses? The objective is to spend wisely leading to no-overspending. This will also maximum our savings. These savings can then be used for more productive purposes.

How budgeting and tracking expenses helps us save more? It prevents overspending. Let’s know more about it:

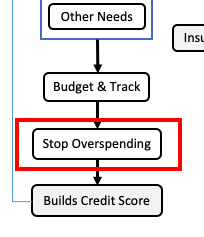

Rule #2. No Overspending

It is important for us to understand how budgeting and tracking expenses prevents overspending. This will give us clues to save even more in future.

Overspending happens only when it is ‘triggered’. What triggers it? Our urge to spend instantly. How to curb this urge? By delaying it. How to delay? By making a habit of checking – “if we can afford this purchase, before spending even a dime“. Let’s see how this is done:

- Affordability Check: When we track expenses, we are always aware that “how much we have already spent” against our budget. Under no circumstances we can overshoot our budget. This should be the mindset. This data about ‘budget’ vs ‘actual spent’ reminds us about our affordability. Recommended: Read about how to build budget.

- Tip1 – Budget for Luxury: Even if we try not to do miscellaneous shopping, it happens. Important is to understand ones pattern, when it gets out of hand, and then budget for it. Do not ignore, be ready for it. Read: How much to spend on a car purchase?

- Tip2 – Shopping List: Never go shopping without a list. Even when you are going casual shopping, don’t go without it. Family members can sit together and prepare a list. Idea is, to approach a store with a clear objective of what you want to buy. It eliminates random buying. Read: Where people spend money?

- Tip3 – Go Cash: When you are on a casual shopping spree, make sure you do it with cash. Fix a budget, go to the ATM and withdraw the money. Do not rely on the cards. Let yourself actually see your wallet getting thinner. Read: Why not to use credit card?

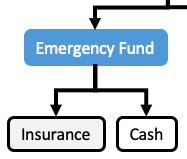

Rule #3. Build Emergency Fund

The next step will be to build a sufficiently big emergency fund. It is a saving which takes care of unavoidable money-needs for which we have not planned (unforeseen).

In our good days, emergency fund building might look like a meaningless activity. But with time, they often prove invaluable.

I’ve written a very detailed article on the topic of emergency fund. In this article you will know everything about this fund. I will suggest you to read this article in your spare time.

Emergency fund acts like a foundation to our ultimate goal of financial independence. Insufficient emergency fund will prevent us from reaching our final destination.

As a rule of thumb, an individual must have at least 6 months worth of monthly expenses in his/her emergency fund.

There are two components of emergency fund: Cash and Insurance. Both these components creates a pool of emergency money. This money-pool can be accessed in case of any cost-intensive, unforeseen event of life. Read more.

What shall be insured?

- Life Insurance: Main earning members of family must have a life insurance policy. There are two main types of life insurance: (a) Term insurance, and (b) whole life. On an average, if one purchase a term life insurance policy of Rs.1 Crore at the age of 30 years, annual premium will be about Rs.22,000. Read: About term insurance plans.

- Health Insurance: Health care is becoming expensive. Hence, it is better to get oneself sufficiently insured. At least the hospitalisation expense should be covered under the health plan. Getting every family member covered under an insurance umbrella is a must. A health cover of say Rs.500,000 can cost about Rs.18,000 annually for a family of four. Read: Buying medical cover in 40s.

- Auto Insurance: Automobile is another item that must be covered under insurance. In today’s time of extreme traffic and stress, road accidents (minor and major) are like a daily event. Insurance cover can save a good deal of money in long term. Read: About motor insurance.

Insurance is a cost. Their returns are not evident till one faces an emergency. Hence, it is easy to see people ignoring insurance. But ignorance is a mistake. Make sure to include the cost of insurance in your budget. It’s worth it.

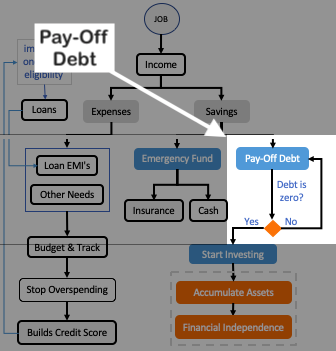

Rule #4. Pay-Off Debt

The idea of implementing this step is to become debt free. Like emergency fund creation, becoming debt free puts a person in front of the race of achieving financial independence.

For me, becoming debt-free is one of the preconditions to start investing.

I prefer not to invest my money till my debt is either zero or close to zero. No matter if it is home loan, personal loan, or auto loan. A debt is a debt, and it must be paid-off in quickest time.

I follow following two rules to control my debt:

- Debt Dependency Check: Debt on its own is not bad. But I make sure that I use debt as a leverage & not for overspending. How to use debt for leverage? A simple rule is, not to be more than 50% dependent on loans to buy a thing. Example: Suppose you want to buy a car of Rs.10,00,000. Fund the purchase by paying at least Rs.5,00,000 from your savings. The balance Rs.5,00,000 can be bank financed (auto loan). Read: How to identify debt trap.

- Affordability Check: Suppose you have decided to buy a car of Rs.10,00,000. You also have Rs.5,00,000 in your savings. Hence, you can take Rs.5,00,000 auto loan (for 5 year). Loan EMI will be approximately Rs.11,000 /month. Check if the loan EMI is within your affordability. How to check? Refer your monthly budget. Add an expense like item (auto loan) there. Check if after paying the EMI of Rs.11,000 you are still able to contribute sufficiently to your emergency fund, expenses, insurance premiums etc. Read: How to stop overspending.

These two observations will help you gauge a new-debt in perspective. You will exactly know when you can buy, and if you can afford it. These two clarities can help one to substantially kill the temptation of accumulating new debt. Moreover, it will also enhance the understanding of affordability.

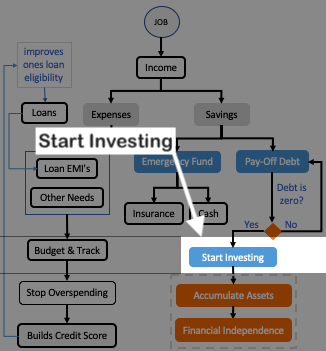

Rule #5. Start Investing

For common men, investment is easy. Why? Because variety of mutual funds are there to take care of ones investment needs. There is another reason why mutual funds are better for small and medium investor. This allows investments to operate on autopilot.

Few things to remember about investments:

- Estimate Goals & Its Cost: Before starting to invest, it is necessary to know why investment is required. How to know this? By fixing clear goals. Each goal has a cost. Suppose you want to buy a home after 5 years from today. This will cost in two ways: (a) down payment, and (b) monthly mortgage payments. Identifying goals and estimating its cost will help in framing a clear investment strategy.

- Rationing of Goals: Suppose you have two goals. Each goal ask you to invest Rs.5,000 and Rs.10,000 per month respectively. But your current affordability is only Rs.7,000. How to go about it? Proportionately distribute the money for each goal (Rs.2,350 and Rs.4,650). Read: The best investment strategy.

- Increments: One may start small, but the contributions must increase with time. What should be the increment criteria? Every time there is a hike in paycheck (income), there should be a proportional increase in the contribution too. Following this simple rule can do the trick. Read: How to invest money?

- Save Tax: Start your investments by purchasing those assets which can also save you some tax. At a given point of time, one must utilise maximum tax breaks possible – through investments. There are two benefits here: (1) Often tax-efficient investments are safer, (2) they can gradually mould the person to handle riskier investment (like equity etc). Read: Income Tax Slabs.

Suggested Reading: ELSS Mutual Fund & Tax Savings.

- PF/EPF/PPF: If you are in job, ensure maximum contribution to EPF. If you are self employed, use NPS or PPF options to save for retirement. Read: Everything about annuity.

Investing is an essential step of the overall management of ones personal finance. But here the outcome is also dependent on ones decisions. More informed will be the decisions, bigger will be the success. What I mean by informed decision? Buying the right assets at right prices. Read more about how to build assets.

Investment Management

In #5 above, we saw how we can start investing. But occasionally the portfolio must also be reviewed. What to review in the investment portfolio? Two main things:

- Asset Balance: There can be two types of asset, equity and debt. A person in 20’s will have more equity in portfolio than a 60 years old. How to decide Equity-Debt balance? Follow this formula: Equity = 100 – your age. If you age is 45, debt will 45% and equity 55%. Debt portion becomes heavier with age. Review assets every 12 months. Book profits in equity and transfer the sale proceeds to debt. Read: About investment diversification.

- Return Vs Risk: The best investment strategy for a common man is to keep it simple. How to do it? Follow the mutual fund route. Identify few good mutual funds and keep investing in them regularly. How to identify a good fund? One such tool is called sharpe ratio. It points to such mutual funds which generates high returns at minimum risks.

Suggested Reading: Improve your financial health score.

#6. Remaining Credit Worthy

The idea behind good money management is to best utilize our income to take care of all money needs of life. But no matter how effectively we practice it, we might need bank loans for few capital extensive purchases (like home, education loan etc).

Hence it is always better to be aware of ones Credit Score. Remaining credit worth at all times is important.

Though one must always try to remain debt free – but it is not bad to be aware of ones ‘credit worthiness’. It will come handy in times of need.

Moreover, ensuring credit worthiness can also support the cause of ‘money management’ – how? Because in this process, people are obliged to follow wise money habits.

- Credit Limit: Suppose you have a credit card whose credit limit is Rs.500,000. What is a credit limit? In simple language, this is the maximum value of purchases you can make using your card. But, here comes the caution. Using credit cards for amount more than 10% of credit limit, raises a red flag. A person who consistently use the credit card for values below 10% of credit limit will have stellar credit worthiness. Read: Habits of people with high credit score.

- Monthly Payments: Never miss your monthly payments of any loan EMI. Let it be mortgage, student loan, personal loan, auto loan or a credit card bill. Make sure that the payments go through as scheduled. Over a period of time, such timely-bill-payments can build a strong credit worthiness. Read: How to use credit card?

- Check Bounce: Suppose I’ve paid someone using my checkbook (say Rs.20,000). But my savings account has only Rs.19,500 as balance. In this case, when the bearer of check will try to withdraw money, the check will bounce. Reason? Insufficient balance in my bank account. Such check bounces can damage my credit ratings.

Conclusion

Managing money is not about savings and investment alone. It requires a more holistic view of ones personal finance. The same has been detailed in this article.

Hence, the activity of money management becomes tedious. People who can afford, offloads this responsibility to their money manager. But for majority it needs to be done by self.

What are the benefits of a sound money management?

- Quality Cash Flow: In the above 6 rules, we have seen that everything is done to start investing. What we do in investing? We buy assets. These assets in turn takes us closer to financial independence. But a stage will come, when the investor will realise that only accumulating assets is not enough for financial independence. They must reduce their dependency upon earned income and build a passive income source. When passive income is more than earned income, I call it “quality cash flow”. Read: The concept of passive income.

- Focus on Net worth: At the end of the day, all what matters is ‘cash flow’ and individual’s net worth. Purchase of investments, insurance will ensure the sustainability of ones ‘ever growing net worth‘. When people practice money management, the focus on net worth is unmistakeable. Use this: Networth Calculator.

- Quality of life: Why we care about money management at all? To take care of our ‘needs of life’. Peoples needs are dependent on their standard of living. If one can ‘effortlessly‘ maintain a desired standard of living, it is a sign of leading a quality life. Only efficient management of ones personal finance can lead to it. Read: Manage money like wise men.

I hope you like my take on the concept of overall money management. One day I was talking to my friend and we discussed about how piece-meal approach to money management hardly helps.

Hence I though to present a bigger picture of money management for my readers. I hope you liked it.

Have a happy investing.