Allow me to tell you a story about why I’m writing an article on the topic of mutual fund charges. Recently, I met a worried senior citizen (my uncle). He was upset about the low returns his mutual fund (SIP) is yielding.

He was so upset that he was even calling it a scam.

Uncle even shared his grievance with other people. They made him even more confused. According to them, the low return was because of the undisclosed charges applicable to mutual fund investments. Somebody fed him with keywords like expense ratio, entry load, exit load, transaction charges, one-time charges, recurring charges, etc.

I think my uncle’s skepticism about mutual funds is not fair. Mutual funds in India are far from a scam. They are one of the best-managed instruments in our financial market.

I’m sure my uncle is not the only one who feels like this. There will be others who might be feeling cheated. Hence, I decided to write an article for my uncle, which might also help others.

My Uncles Problem

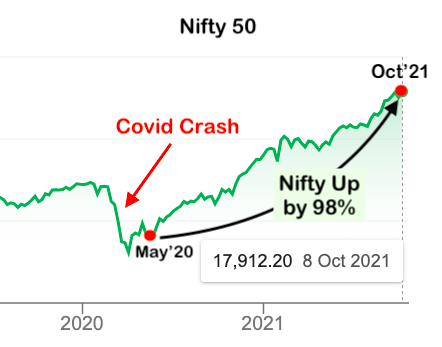

In May’20 last year, after the COVID-19 market crash, my uncle thought of investing in the stock market. He was ready to invest about Rs.1.0 lakhs. But expecting further downsides, he decided to use the SIP route to invest in an index fund.

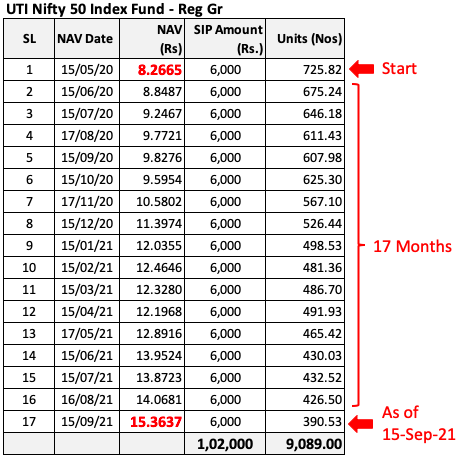

He purchased the first lot of the index fund’s units on 15-May’2020. Henceforth, he gave an ECS mandate to his SIP to invest Rs.6,000 on the fifteenth day of each month till the next 24 months. As of today, his SIP’s purchase schedule looks like this:

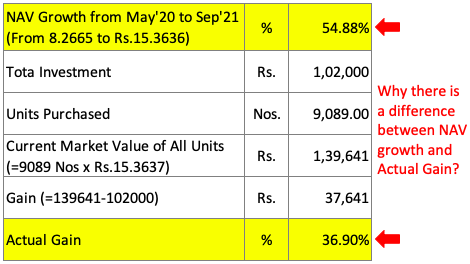

When my uncle did a bit of digging into these numbers, he saw the problem. His concern was that the NAV growth rate between May’20 and Sep’21 was higher than his actual gain. The difference was substantial. It was not OK for my uncle. The NAV grew from Rs.8.2665 to Rs.15,3637 at a CAGR growth rate of 54.88% in 17 months. But his actual gain was only 36.9%.

According to my uncle, his return is less by 17.98% (54.88% minus 36.9%)

People who know the reason for the difference (actual gain being 17.98% less) might judge my uncle for his naive thinking. But I’m sure many senior citizens might have a similar query. The difference between NAV growth and actual gain raises doubt.

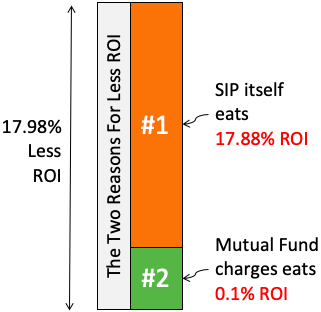

There are two main reasons for it. I’ll explain both reasons in this article.

The Two Reasons for 17.98% less return

The root cause of the difference in value between ‘NAV growth’ and the ‘actual gain’ is the process of SIP itself. The second minor reason is the mutual fund charges.

#1 Reason – SIP Eats 17.88% ROI

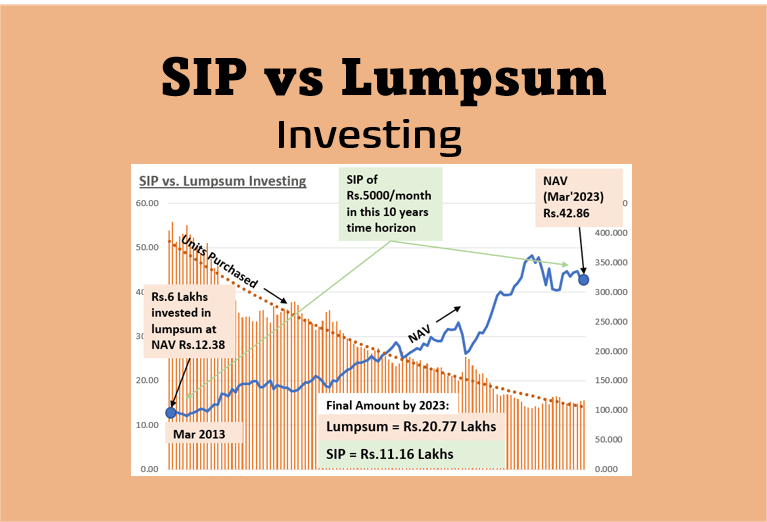

In a rising market, investing in a lump sum will yield maximum returns. As my uncle was investing gradually (using SIP), his return got averaged out. Allow me to explain it using a simple analogy.

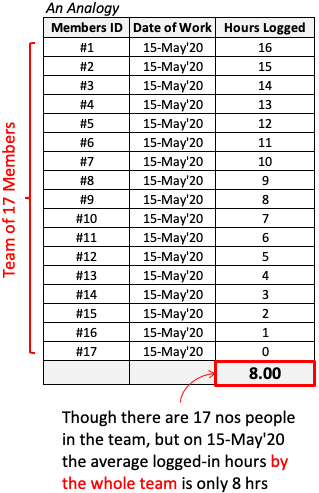

Suppose there are 17 members in a team. Each member worked for different hours on 15-May’2020. Below is their work chart. Though there are 17 number people, on the 15th of May’20, the average logged-in hours by the whole team is only 8 hours.

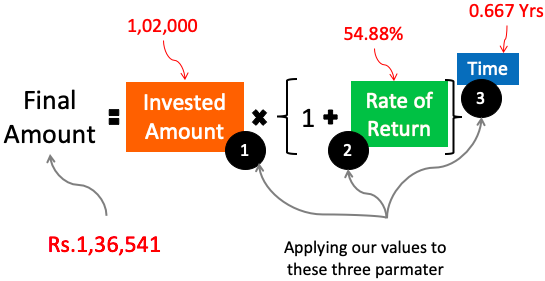

Similarly, though the investment was happening for the last 17 months, the average period is less. On average, the money (Rs.1,02,000) has to remain invested for only eight (8) months (0.667 years). So, applying the compound interest formula, his final amount is only Rs.1,36,541. It is almost the same as what my uncle’s SIP gain calculation is showing.

#2 Reason – Mutual Fund Charges

Mutual fund investment is not without cost. The services provided by mutual fund companies are not free. But their charges are negligible if one is investing in a large index fund, like my uncle.

The reduction in ROI due to mutual fund charges was only 0.1%. Allow me to present to you what mutual fund schemes are allowed to charge to our investments.

#2.1 One-time Charges

- Entry Load (0%): It is the charge applicable at a time when units of mutual funds are purchased. As per the present regulation of the SEBI, a mutual fund cannot charge an entry load on any scheme.

- Exit Load (1%): This charge is applicable upon the sale of mutual fund units. Some schemes charge exit load, and some don’t. Generally, the equity funds charge an exit load of 1% based on the holding time. If the holding period is less than one year, schemes can charge an exit load.

Suppose I bought a mutual fund about ten months back. The current NAV of the mutual fund scheme is Rs.100/unit. Upon selling my units now, the charges applicable as an exit load will be 1%. How it affects the sale? The NAV that will be applicable on the sale will be Rs.99 instead of Rs.100.

| Current NAV | Rs. 100.0 |

| Exit Load 1% of NAV | Rs. 1.0 |

| Net NAV on Sales of Units | Rs. 99.0 |

- Transaction Charges (Zero to Rs.150): This charge is applicable only once at the time of investment. These charges are collected to pay the distributors or the intermediaries. If the investment value is below Rs.10,000, no charges are applicable. If the value is over Rs.10,000, see the below table for the applicable charges. For first-time investors, Rs.150 is applicable. For the existing investors, charges are Rs.100. The investors whose total SIP amount is above Rs.10,000 (like Rs.2,000/month x 12 months), their charges will be Rs.100. But the Rs.25 is gradually deducted in four installments between the second, third, fourth, and fifth months.

| New Investor | Rs. 150.0 |

| Existing Investor | Rs. 100.0 |

| SIP (Rs.25 in 4 Installments) | Rs. 100.0 |

#2.2 Recurring Charges

The fund houses incur expenses each day to manage a mutual fund scheme. The investors must bear this charge as an expense ratio. But individual investors might not worry about the expense ratio calculations. Why? Because the NAV published each day is net of it.

There is a limit of how much expense ratio a mutual fund scheme can charge from its investors. SEBI decided the limit.

| Net Assets Value (NAV) | TER of Equity Scheme | TER of Debt Scheme |

| Upto Rs. 100 Cr | 2.50% | 2.25% |

| Next Rs. 300 Cr | 2.25% | 2.00% |

| Next Rs. 300 Cr | 2.00% | 1.75% |

| Above Rs. 700 Cr | 1.75% | 1.50% |

Example of expense ratio calculation of a “large-cap mutual fund” having NAV of Rs.950 Crore

| Description | Calculation | Unit | Rs.Crore |

| First Rs. 100 Cr | 2.5% of Rs. 100 Cr | Rs.Cr. | 2.500 |

| Next Rs. 300 Cr | 2.25% of Rs. 300 Cr | Rs.Cr. | 6.750 |

| Next Rs. 300 Cr | 2% of Rs. 300 Cr | Rs.Cr. | 6.000 |

| Above Rs. 700 Cr | 1.75% of Rs. 250 Cr | Rs.Cr. | 4.375 |

| – | Total Expenses | Rs.Cr. | 19.625 |

| – | Total NAV | Rs.Cr. | 950 |

| – | Expense Ratio | % | 2.07% |

Example of expense ratio calculation of a “large-cap mutual fund” having NAV of Rs.150 Crore

| Description | Calculation | Unit | Rs.Crore |

| First Rs. 100 Cr | 2.5% of Rs. 100 Cr | Rs.Cr. | 2.500 |

| Next Rs. 50 Cr | 2.25% of Rs. 50 Cr | Rs.Cr. | 1.125 |

| – | Total Expenses | Rs.Cr. | 3.625 |

| – | Total NAV | Rs.Cr. | 150 |

| – | Expense Ratio | % | 2.42% |

So you can see that, for the same equity scheme, the calculated expense ratio is different. A mutual fund with a larger NAV will have a lower expense ratio.

| Fund Size | Expense ratio computation | Expense Ratio |

| NAV Rs. 950 Cr | Rs. 19.625/900 Cr | 2.07% |

| NAV Rs. 150 Cr | Rs. 3.625/150 Cr | 2.42% |

There is also a rule on the Total expense ratio (TER) calculation. The expenses are deducted from the NAV of the scheme daily. The NAV published each day is after adjusting the applicable TER.

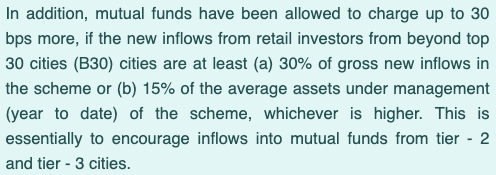

To encourage the penetration of mutual funds beyond the B30 cities of India, SEBI has given an incentive to the fund houses. Beyond what is listed above, mutual funds can charge 0.3% extra if 30% of the new investments are coming from beyond the B30 cities. Check the details extracted from AMFI’s website.

Conclusion

My uncle was unhappy because he was miscalculating his capital gains. Had he invested his corpus in a lump sum, the profit would have been 54.78% (NAV growth). But since he opted for SIP, the average gain he could get was only 36.9%.

Anybody who will opt for SIP should calculate their returns as explained above. You can also check my online SIP return calculator here.

A part of the ROI was also due to mutual fund charges. But the quantum of loss attributable to “the charges” was only 0.1%.

Suggested Reading: STP – A way to invest the money in a lump sum.

Hi Mr. Mani(sh),

Very well explained about the various charges by the fund managers, which I am sure most of the investors are unaware of. Keep up the good work.

The investment in the above case is for a short duration. What about the STCG or what happens when the investment is done for more than 5 to 10 years period through SIP mode?