Practicing long-term investing in stocks can be challenging. This is especially true for retail investors who often look to experts for guidance. I have observed a recurring trend in the recommendations made by the appearing guests of mutual fund houses on various TV news channels. They frequently suggest stocks that have already been performing well in the market. This may mislead a few novice individual investors into buying those stocks near their peaks. Read about the right time to buy stocks.

For example, when a certain sector or theme like defense, PSUs, capital expenditure, infrastructure, etc are doing well, they will recommend the same. My point is, these stocks have an established momentum and are known to the public. What is the point of repeating these names on TV channels when their valuations already look expensive?

They also do not mind recommending low-margin businesses like telecom, airlines, etc which are also extremely competitive and heavily regulated. As a long-term investor, I will avoid adding such stocks to my portfolio in normal times. It is not that their business model is not good, but the limitations under which these companies operate, there are better alternatives available. Unless these stock prices crash by -30% or more, I will avoid fresh additions of such stocks to my portfolio.

Topics:

A Perspective

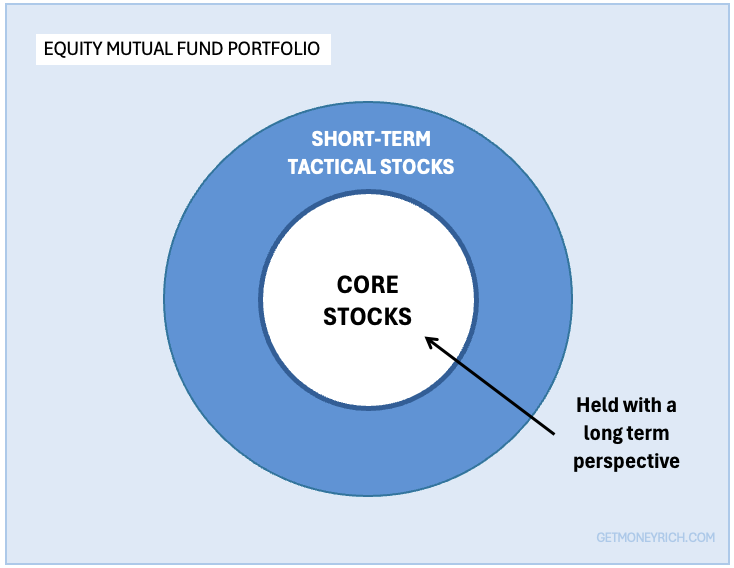

Not all stocks in the portfolio of a mutual fund scheme are bought with a long-term perspective.

- The core holdings of a equity mutual fund are typically selected for long-term growth. This aspect of their portfolio suits long term growth.

- However, the fund managers may also include a few stocks as shorter-term tactical opportunities (momentum plays, or sector rotations).

This mix allows fund managers to capitalize on market trends and also enhance the overall returns of the portfolio. This way, they not only maintain a focus on the fund’s long-term goals but also benefit from momentum investing.

So what is the problem with this approach? For mutual funds, there is no problem. They have the necessary tools, funds, and skill set to manage such a portfolio mix. But where things go wrong is on the retail investor’s side. How?

Retail investors will not know which stocks in the fund’s portfolio are held for the long term and which are short-term tactical bets. When investment managers of fund houses talk about stock-specific picks they do not disclose their intent to buy and hold those stocks. This is what can confuse the retail investors. We may end up buying their short-term bets (momentum picks) thinking them to be of long-term value.

What I think…

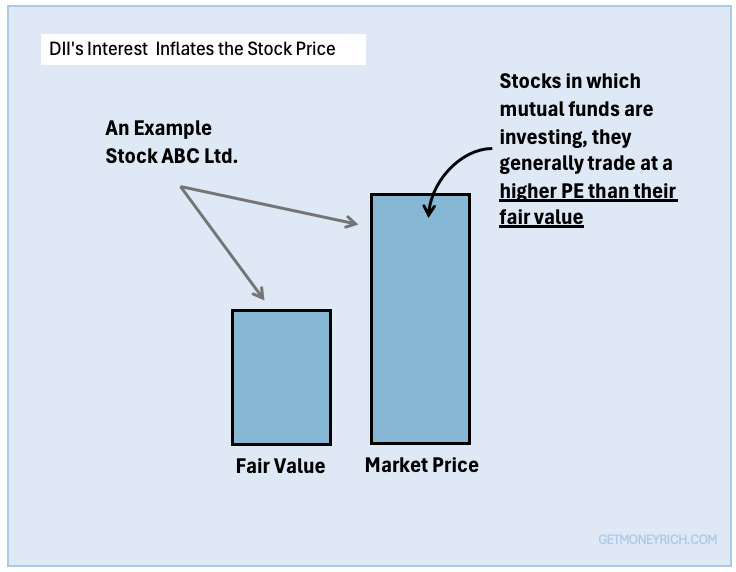

Mutual funds tend to buy quite a few stocks with a short-term perspective, typically with a 6-month to 1-year horizon. These stocks are picked when they display a strong current price momentum. Representatives of fund houses come on news channels to promote such stocks on TV. This way they further drive up their demand, subsequently inflating their PE ratios.

Unfortunately, retail investors who follow these recommendations might find themselves buying at inflated prices. These investors are also left holding these stocks even after the mutual funds have exited. Most of the time, we find it only in the next one or two quarters that the scheme has already exited their holdings. This can result in significant losses for those who entered the market based on the TV commentaries.

I firmly believe that retail investors should adopt a different strategy. They must focus on buying stocks with a long-term horizon of 10-20 years. With this mindset, we are poised to pick different types of stocks that can continually compound year after year for the long term. In this mindset, we’ll learn to differentiate between long-term value stocks and momentum stocks.

In this article, we will explore key differences between how mutual fund managers invest in stocks compared to retail investors. By understanding this difference, we retail investors can gain valuable insights and develop strategies to build a strong, long-term stock portfolio.

We can learn to avoid the pitfalls associated with following mutual fund portfolio holdings as our buy-and-hold guides.

In this article, I’ll share my insights on the key differences in stock investing strategies of mutual fund managers vs. retail investors.

1. Investment Goals and Objectives

When a retail investor is investing with a long-term horizon in mind, he/she is actually doing it for wealth building. This activity of stock investing is a personal act of trying to achieve the ultimate goal of financial independence. The individual is practicing investing to get out of the rat race of the world and lead a life on his/her terms. From the financial side, the act of stock investing is done with a focus on the final corpus — the bigger the corpus the better.

Suggested Reading: How to reduce our dependency on monthly salary.

Mutual fund managers (Fund Houses) perform the same act of stock investing, but what they are doing is their job. It is not a personal act. Their target is different than ours.

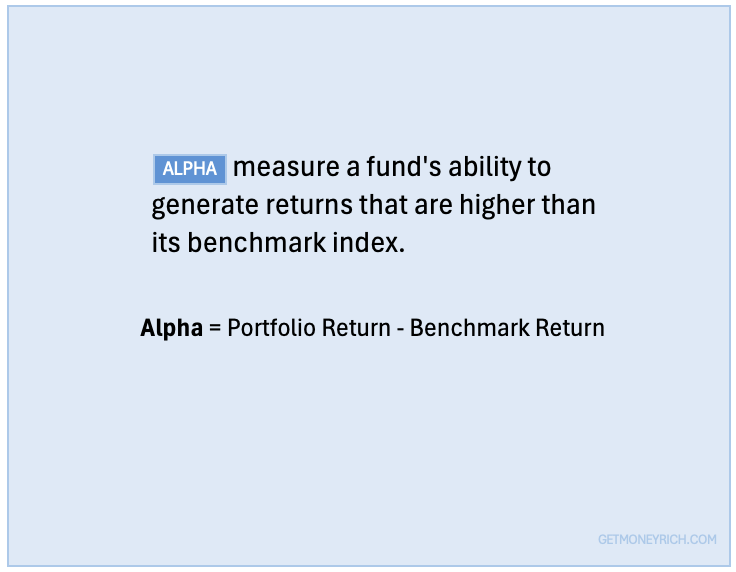

A mutual fund manager’s goal is to generate the alpha for the portfolio. Alpha is the return generated by the portfolio higher than its benchmark index. The higher the alpha the better. Read more about Alpha here.

1.1 The Focus

So you can see the difference in the focus between an individual investor and a fund house. The former does it for personal wealth generation and the latter is doing his job to generate the alpha. Eventually, a higher alpha will build higher long-term wealth for its investors, but still, there is a difference.

What’s the difference? A mutual fund might do a few things differently from an individual to get that alpha for its portfolio. Why? Because the NAV of the portfolio is reported every day. The NAV of the mutual fund is not just a pricing tool of the mutual fund schemes, their growth rate is also used as a marketing tool. So, the higher the NAV growth, the better it is for marketing the scheme.

If the NAV of a mutual fund scheme is growing even at a fraction of basis points higher than its peers, it will make a lot of difference.

For example, suppose there are two similar-themed mutual fund schemes following the same benchmark index. One claims a return of 16.25% per annum compared to its peer who claims 16.30%, which fund you will choose? The latter one, right? People get attracted to higher returns. Thereby, such schemes draw in more investments from people.

To keep reporting a higher alpha, mutual funds must take some tactical bets. These tactical steps often do not complement the rule of long-term capital compounding.

For a mutual fund company, alpha gives them their salary increments and promotions. A long-term individual investor is more like a tortoise of the story. Mutual Funds are fast and fancy, retail investors are slow but steady. Individual investors are there in the market to capitalize on the effect of the power of compounding. Hence, they are there to stay for 15-20 years and build a huge amount of wealth for themselves.

1.2 The Confusion

Most retail investors are practicing stock investing with no goals in mind. They are there to make money. For them, stock investing is yet another way to make money. But it is not the right approach, stock investing can build wealth only by staying invested for the long term.

Even experts promote stock investing as a way to achieve personal goals, such as saving for retirement, funding a child’s education, buying a house, car, etc. Till the goals are 7-10 years ahead in the future, there are no problems, but for goals that are due in the next 3-4 years, stocks are not suitable.

But many retail individual investors come to the stock market for their short-term goals (like income generation etc). That is why we see so much interest in derivative-based investing like intraday and F&O (Future and Options). This is a mistake. They are doing it because they do not know that stocks are better as along long-term investment vehicle. This lack of clarity leads to impulsive decisions and inconsistent investment strategies.

Whereas, mutual fund companies have very clear objectives. They are also regulated and hence these regulations also work as their guide to know what is good and what is bad. Moreover, fund houses are also managed by experts, hence their goals and objectives are very clear.

I think, the confusion in the minds of the retail investors, related to stocks, is an induced effect. It has been created by our TV news channels and experts appearing on them. When they promote their short-term tactical bets as long-term picks (at least we perceive it like that), we get influenced. Next time, when we watch TV for stock pick, we must keep this fact at the back of our minds.

2. Profit Booking: Mutual Funds vs. Individual Long-Term Investors

Here we’ll explore how profit booking practices differ between mutual fund managers and individual long-term investors. I’ll try to highlight the regulatory and strategic constraints that limit mutual funds’ long-term returns. I will also talk about how the flexibility individual investors enjoy in terms of profit booking can help maximize their long-term growth prospects (power of compounding).

2.1 Mutual Funds’ Profit Booking Practices

Pure equity mutual fund schemes operate under specific regulatory and strategic constraints. These constraints influence their profit booking practices.

Fund managers must also achieve the fund’s goals. They must balance long-term growth and short-term performance. For example, they may invest in stable, long-term stocks like TCS, and Reliance for growth, while also buying high-momentum stocks from defence or PSU space for short-term gains to attract and retain investors.

This dual mandate can create scenarios where profit booking becomes necessary, even if the long-term potential of the stocks remains high.

Key Factors Influencing Profit Booking by Mutual Funds:

- #1. Regulatory Requirements and Compliance: Mutual funds must adhere to regulatory guidelines set by SEBI. It often requires periodic rebalancing and adherence to specified exposure limits for individual stocks and sectors. This regulatory framework can necessitate selling high-performing stocks to maintain compliance.

- #2. Liquidity Needs: Mutual funds need to maintain a certain level of liquidity to handle redemption requests from investors. This requirement can force fund managers to book profits on certain stocks to ensure enough cash is available, particularly during periods of market volatility or increased redemption pressure.

- #3. Performance Metrics: Mutual fund performance is often evaluated on a quarterly or annual basis. This can lead the fund managers to book profits to show consistent gains and enhance short-term performance metrics. This practice can help in marketing the fund and attracting new investors. But counterintuitive such actions may limit the ability to hold onto stocks with strong long-term potential.

- #4. Market Sentiment and Tactical Decisions: Fund managers may also engage in tactical profit booking based on market sentiment, economic forecasts, or sector rotations. This strategy involves selling stocks that have appreciated significantly. This is done to lock in gains and potentially reinvest in undervalued opportunities.

2.2 Individual Long-Term Investors’ Profit Booking Practices

Individual long-term investors enjoy more flexibility and fewer constraints compared to mutual fund managers. These investors are not bound by regulatory mandates. Neither they are required to maintain liquidity for redemptions. Instead, their profit booking decisions can be more strategically aligned with their investment goals, market conditions, and valuation scenarios.

Advantages of Individual Investors:

- #1. No Mandatory Rebalancing: Individual investors are not required to rebalance their portfolios based on regulatory guidelines. They can hold onto high-performing stocks as long as they believe in the long-term growth potential. For them, there is no pressure to sell due to exposure limits or compliance issues.

- #2. Long-Term Focus: Unlike mutual fund managers who may need to demonstrate short-term performance, individual investors can focus purely on long-term gains. They can afford to ignore short-term market fluctuations and avoid booking profits prematurely. This can allow their investments to enjoy the effect of compounding over time.

- #3. Flexibility in Decision-Making: Individual investors can make profit-booking decisions based solely on their analysis of a stock’s valuation, such as when they perceive the price-to-earnings (PE) ratio to be excessively high. This flexibility enables them to maximize returns by timing their sales based on long-term value assessments rather than short-term market conditions.

- #4. No Redemption Pressure: Without the need to accommodate investor redemptions, individual investors can remain fully invested in their chosen stocks. This lack of liquidity pressure means they can ride out market downturns and wait for the market to recover, capturing the full growth potential of their investments.

3. Investing in Underperforming Sectors: Mutual Fund Managers vs. Retail Investors

Mutual funds often operate under constraints that prevent them from investing heavily in underperforming sectors. Even if those sectors have long-term potential they may not invest in those sectors/industries. Let’s look at some of their constraints.

3.1 Mutual Fund’s Disadvantage:

- #1. Performance Pressure: Mutual funds are evaluated based on their short-term and long-term performance. Consistent underperformance can lead to redemptions and a loss of investor confidence. This pressure forces fund managers to avoid sectors that are currently underperforming to maintain attractive short-term returns.

- #2. Regulatory Compliance: Mutual funds must adhere to specific regulatory requirements, including diversification rules and exposure limits. These regulations can prevent them from concentrating too heavily on any single sector. It is especially true for that sector that is currently underperforming, even if it has long-term potential.

- #3. Investor Expectations: Mutual fund investors expect steady returns and low volatility. Investing in underperforming sectors may introduce higher short-term volatility. For majority investors, who are not as informed about equity investing, such volatility may be unacceptable. Fund managers are therefore incentivized to prioritize sectors with more stable and predictable performance.

- #4. Market Sentiment: Mutual funds often follow market sentiment and trends. They are more likely to invest in sectors that are currently in favor and exhibit positive price action. This behavior can delay their entry into underperforming sectors until there are clear signs of a turnaround.

3.2 Individual Retail Investors’ Advantage

In contrast, individual retail investors have more flexibility and fewer constraints:

- #1. Long-Term Focus: Individual investors with a long-term horizon of 10-20 years can afford to ignore short-term market fluctuations. They can invest in underperforming sectors and patiently wait for a recovery. This way they can capture significant gains when the sectors eventually turn around. They can afford weaker near-term returns for windfall gains in the longer time horizons.

- #2. No Redemption Pressure: Unlike mutual funds, individual investors do not face redemption pressure. They do not need to maintain liquidity to meet withdrawal demands. This allows them to hold onto investments through periods of underperformance. Such holdings can yield above-par returns when price actions become favorable.

- #3. Strategic Positioning: Retail investors can strategically increase their positions in underperforming stocks at their bottom levels. This contrarian approach can yield substantial long-term returns as these sectors recover and grow.

- #4. Independent Decision-Making: Without the need to satisfy short-term performance metrics, individual investors can make independent, long-term investment decisions. These decisions have focused on maximizing long-term returns.

Mutual funds provide diversification and professional management for their investors. However, their need to balance short-term and long-term expectations often limits their ability. They will avoid investing in underperforming sectors until clear signs of recovery are evident.

Individual retail investors, on the other hand, can capitalize on these opportunities. They can invest in such stocks with a long-term perspective, strategically positioning themselves for future gains.

This fundamental difference highlights the potential advantage individual investors have in achieving windfall long-term gains, despite short-term underperformance.

4. A Hypothetical Example

Let’s consider an example to illustrate the differences between a mutual fund manager and a retail investor:

Mutual Fund Manager:

- Name: Ms. Anila Shah

- Fund: XYZ Growth Fund

- AUM: Rs.100 Crore

- Investment Strategy: Long-term growth, diversified portfolio, rigorous research, and analysis

- Team: 10-person research team, access to company management, and industry experts

- Resources: State-of-the-art technology, advanced data analytics, and robust risk management tools

Retail Investor:

- Name: Mr. Arun Singh

- Investment Portfolio: Rs.1 Crore

- Investment Strategy: Self-directed, occasional trades, limited research, and analysis

- Resources: Online brokerage account, limited access to company information, and basic research tool like Stock Engine.

Now, let’s say both Ms. Anila and Mr. Arun are interested in investing in the technology sector. Ms. Anila, with her team and resources, conducts extensive research. They attend industry conferences, and meets with company management teams. She decides to invest only 0.25% of her fund’s assets in a promising tech stock. The team intentionally limit their exposure to this sector considering its underpoerformance.

Mr. Arun, on the other hand, relies on his own research, limited to reading news articles and online forums. He invests 20% of his portfolio in the same tech stock. He did so strategially at this time as the sector has been underperfoming but looks promising in long-term.

In this example, Ms. Anila approach reflects the characteristics of a mutual fund manager. She started with allocating funds to keep the fund’s portfolio diversified. She also used her tools and resources to do a Rigorous research and analysis. But her limitations prevented her to invest more in the stock.

On the other hand, Mr. Arun’s approach illustrates the common traits of a retail investor. Though he had only limited research and analysis skills and resources, but he could find an undervalued sector (Stock). As a result he decided to go all all out investing in it.

Five years from now, both Anila and Arun would report the same CAGR numbers. But the quantum effect that this CAGR number will have on Arun’s portfolio will be more rewarding.

5. Data Supporting The Argument

Individual investors who wisely invest in value stocks directly can fetch better returns. I’m compareing returns generated by fund managers of top mutual fund schemes in the long term. We have already discussed how mutual funds are restricted by constraints such as:

- Diversification requirements

- Asset allocation limits

- Quarterly performance pressure

- High operating expenses

In contrast, individual investors can take a more focused approach, investing in high-growth stocks that have a strong potential for long-term returns.

For example, consider the 10-year returns of some top Indian stocks:

- Reliance Industries: 21.48%

- Bajaj Finance: 41.85%

- Titan: 25.91%

- Britannia: 28.05%

In comparison, the 10-year returns of some top Indian mutual fund schemes are as below. Also consider this fact that most of the equity schemes will have stocks like RIL, Banaj Finance, Titan, Britannia type of stock in their portfolio, yet their returns are only sober.

- ICICI Pru Blue Chip Fund: 16.51%

- Nippon India Large Cap Fund: 16.36%

- Quant Focused Fund: 19.21%

As you can see, the top individual stocks have outperformed the top mutual fund schemes by a significant margin. This highlights the potential for individual investors to earn higher returns by investing directly in value stocks, rather than relying solely on mutual funds.

Conclusion

Based on what has been discussed in the article, it is crucial to recognize that mutual funds operate under multiple constraints. The constraints are regulatory requirements, liquidity needs, and performance pressures. These constraints often lead mutual funds to pick and publicize stocks that may not be suitable for long-term holding, particularly in terms of valuations.

In contrast, individual retail investors, with their flexibility and long-term focus, are better positioned to take quality bets that can outperform mutual fund portfolios over the long run.

By understanding these differences, retail investors can avoid common pitfalls. We are more poised to take long-term decisions as compared to mutual funds. This can help us in maximization of our long-term return.

This strategic approach can lead to significant long-term gains, leveraging the power of compounding. We retail investors have a tremendous advantage in holding undervalued stocks through market fluctuations. Mutual funds cannot do it as they also have to report returns in shorter time horizons.

Final Words…

Use this article as your guide and start taking long-term bets. How? By investing in stocks of those sectors and industries where mutual funds are not investing. Buy these stocks and sit on them for the next 7-10 years. Repeat this process in every cycle, and keep investing in unfavored sectors and holding on to them for the long term. Moreover, try to avoid investing in stocks that mutual fund managers are advocating as “good buys” on TV news channels.

You will be surprised how much alpha your portfolio can generate compared to even the best-performing mutual funds of any category.

Frequently Asked Questions

Mutual funds also need to focus on short-term performance. Why? Because they are also bound by regulatory requirements and liquidity needs. Moreover, their need to attract and retain investors by demonstrating consistent returns can force them to take short tactical bets (instead of more lucrative long-term bets).

Mutual funds frequently book profits to comply with regulations, meet liquidity needs, and show consistent short-term performance. On the other hand, we individual investors can hold stocks longer to maximize long-term gains.

Stocks recommended by mutual fund managers often have strong current momentum and inflated valuations. More often than not, it may lead to buying at peak prices and potential losses when mutual funds exit these positions.

Individual investors have the advantage of not being bound by regulatory rebalancing, redemption pressures, and short-term performance metrics. We, individual retail investors, can focus solely on long-term growth.

Understanding these differences helps retail investors avoid the pitfalls of following mutual fund strategies blindly. It will enable us to develop personalized, long-term investment plans that capitalize on market opportunities.

Have a happy investing.

Indeed, very interesting article on direct stock investment vis a vis mutual funds.

Thanks

Thanks