Navin Fluorine is a company oriented towards chemical business. They specialise in production of fluorine based products. Their main products are refrigerant gases, basic fluorides etc.

The main competitors of Navin Fluorine are listed below. They are ranked in order of their Market Capitalisation:

- Vinati Organics: Rs.81,400 Crore.

- Navin Fluorine: Rs.32,800 Crore.

- Alkyl Amines: Rs.16,600 Crore.

- Balaji Amines: Rs.15,600 Crore.

#1. Business of Navin Fluorine

Navin Fluorine has four main business verticals. The contribution of each, to the overall revenue is as below:

- Refrigerants: 25%

- Inorganic Fluorides: 21%

- Speciality Chemicals: 32%

- CRAMS: 22%

Navin Fluorine is generating a decent revenue from exports as well. The contribution of its exports and domestic business, on the overall revenue is as below:

- Exports: 32%

- Domestic: 68%

#1.1 Future Growth Projection

Revenue growth estimates of Navin Fluorine in next one year (Between FY18 and FY19) are as below:

- Refrigerants: 5%

- Inorganic Fluorides: 8%

- Speciality Chemicals: 8%

- CRAMS: 44%

Other key growth parameters expected in next one year are as below:

| Business Fundamentals | FY18 | FY19 | Growth |

| Net Sales | 9,127 | 10,256 | 12.4% |

| PAT | 1,298 | 1,648 | 27.0% |

| EPS | 36.4 | 33.4 | -8.2% |

| PE | 18.2 | 19.9 | 9.3% |

| ROE | 19.8 | 15.8 | -20.2% |

#1.3 Pros & Cons of Navin Fluorine’s Business

Pros: It has been reported that the company has acquired new customers in Japan and Korea for their inorganic fluorides business unit.

Cons: In third quarter of FY18, Gross margin of Navin Fluorine was at 24.3% levels. In 3rdQFY19, the gross margin has shrunk to 23.2%. This has been caused mainly due to increase in raw material costs.

RECOS

In Jan’19 HDFC Securities has issued a BUY rating for this stock.

| Date | Company | Broker | Reco | Buy Price | Target Price | Hold | |

| 28-Jan | Navin Fluorine | HDFC Securities | BUY | 660 | 740 | Report | 12 months |

STOCK ANALYSIS…

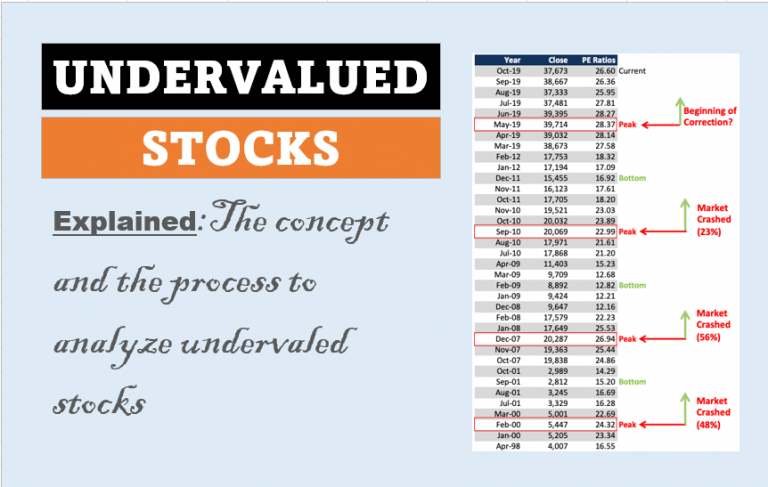

The current price of Navin Fluorine is trading at Rs.620 levels. This is below the price at which the Recos report has been issued by HDFC Securities (Rs.660 levels). Hence I thought to double check the fundamentals of Navin Fluorine using my stock analysis worksheet.

Considering the future growth potential of Navin Fluorine, I though this stock will be a good candidate for deeper stock analysis. Moreover, I personally have liking for chemical companies whose business fundamentals looks strong. Why? Because these companies tend to be more profitable than the average.

The result of my study can be accessed from here…click here (pdf copy).

I provide you few key insights from my report…

#1. Quality…

Navin Fluorine is currently debt free (zero debt since last 2 years). Their long term debt dependency trend, from point of view of managing the “total expenses”, is also low. Last 10 years average of Debt/Total Expense ratio is 12%, which is a decent number.

In terms of debt/equity ratio, last 10 years average is 0.09 (almost debt free).

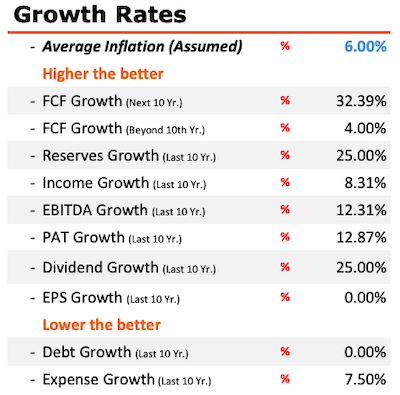

Past growth numbers of Navin Fluorine has been good as well.

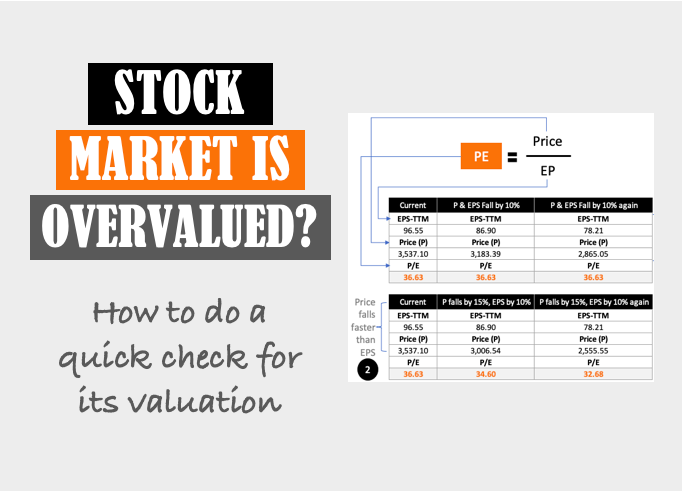

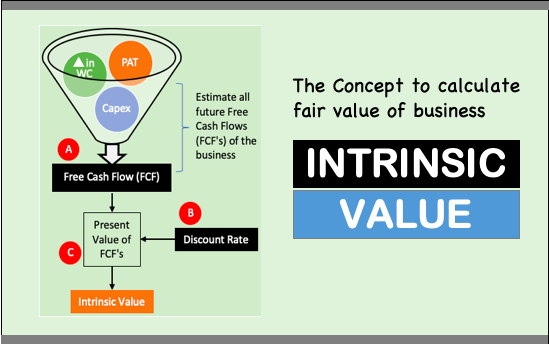

#2. Price Valuation…

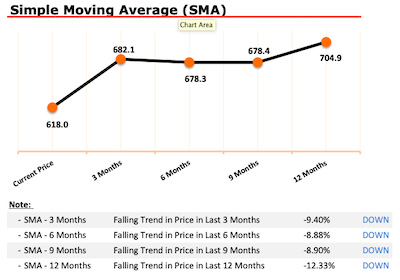

In last 12 months, the market price of Navin Fluorine has fallen from 700 to 630 levels. Upon further deliberations I have found that this stock can offer a good buying opportunity during further price corrections.

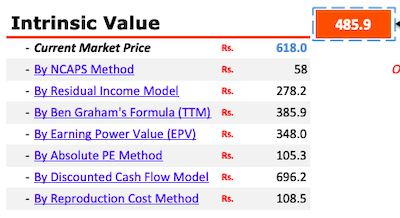

In term of its Intrinsic Value, Navin Fluorine may not be an instant buy today. But it is already treading close to its buying levels.

My stock analysis worksheet has estimated the intrinsic value of Navin Fluorine as Rs.486. But considering that the Discounted cash flow model is estimating its intrinsic value as Rs.650+, hence I found it apt to include Navin Fluorine in my watch list.

Overall Score…

The overall score of Navin Fluorine is good. My stock analysis worksheet is giving a 90%+ rating for Navin Fluorine. Generally a 85%+ rating is good enough.

Considering that future growth projection of Navin Fluorine is also decent, hence I thought to give this stock a green flag for inclusion in my watch list.

According to me, a buy price of Rs.600 and holding period of next 24 months should give decent returns. Hence I am keeping a look on this stock for next few weeks.

Hi Mani,

This is brilliant and look at the current price! You are doing a great work and I immensely like your articles.

Please advise if you have posted analysis on other stocks as I am not able to navigate through your blog. Also consider to place a search space and to date the article as well.

I tried to buy the worksheet with the button below (60% discount) but it seems not working as it takes me to a page asking for a full price, could you please look at it.

Thanks again and keep doing the good work.

Its really amazing. But you give only the judgement. A lot of homework to be done by customer. Today its very open.That work can be done by you which is easier to you and you can charge more for it.Really I am telling its simply amazing.

Hey, excellent analysis. You should look into Indo Count Industries. Its price has fallen so much that now it is very close to its NCAVPS value. This company has excellent financial metrics (ROE, ROCE,etc.)