Recently, I heard a person talking about Nifty Futures Contract in a YouTube video. He said this, and I quote: “I know many people who since lot of time has purchased Nifty Futures and keep it rolling over. They say, brother tell me this, at 10% margin you are 100% exposure. Nifty is a compounding asset, every year it grows at a rate of 12%. So, I’ve invested 10%, 12% growth I’m getting over total contract value. What’s wrong with it? So depending upon what you are understanding is towards the market, what’s your outlook is towards the market, all products are good…“

Sounds tempting, right? A YouTube guru pitching you a strategy to amplify your Nifty returns with minimal investment (use of margins)? Leverage the power of futures, they say. Ride the Nifty’s upward wave with just a fraction of the capital. But is it really that simple?

Things are rarely as straightforward as they seem in those videos, right?

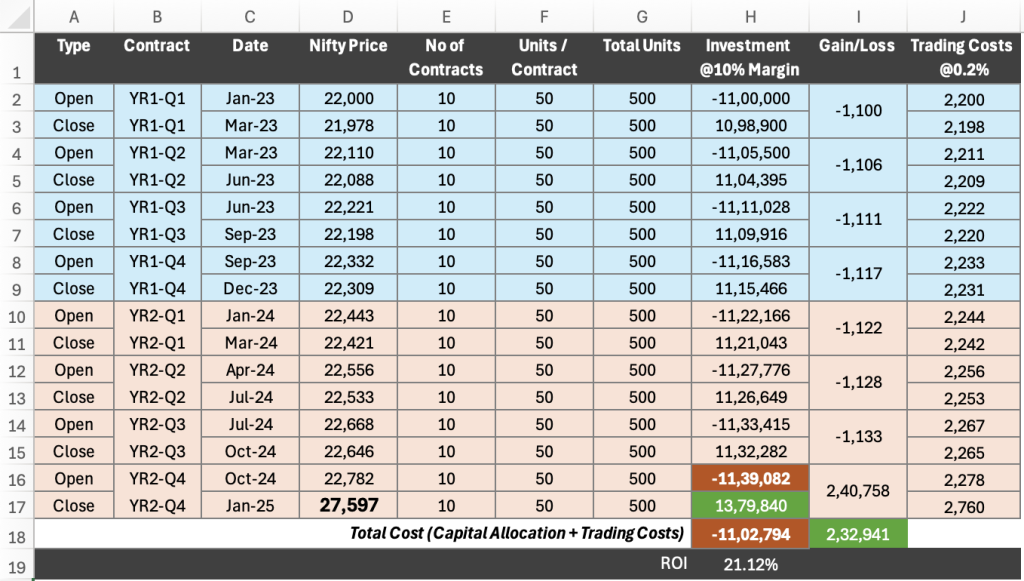

Watching this video, it was clear that the person was pitching in favour of Futures trading. But as the person was quoting too many jargons like rolling over, 10% margins, compounding asset, 12% growth over total contract value etc, I thought let’s declutter it. The first thing I did was, I tried to convert what he was saying into an excel table (pure mathematics).

The purpose was to actually quantify if the returns are really as fantastic as the expressions in the video.

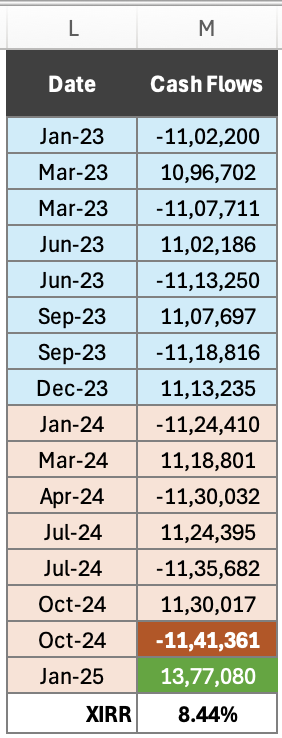

So, let me show you all the excel calculations straight away, and then I’ll explain what the person was saying and how this excel table can explain that.

Decoding the “10% Margin, 12% Growth” Claim

Let’s break down what this person in the video is actually suggesting.

At its core, he’s talking about Nifty Futures. Imagine betting on where the Nifty 50 index will be in the future. You’re entering into a contract to buy (or sell) the index at a specific price on a specific date.

Now, here’s where the “10% margin” comes in. Unlike buying stocks where you pay the full amount upfront, with futures, you only need to deposit a fraction of the total contract value as margin. This is leverage – a double-edged sword. It allows you to control a larger position with less capital, potentially magnifying your returns.

But what about the expiry date? Futures contracts don’t last forever. They have a fixed expiry, usually the last Thursday of the month. So, what happens if you want to hold onto your position for longer? That’s where “rolling over” comes in. It’s like extending the expiry date on your bet by closing out your current contract and opening a new one for the next month. But remember, this rollover comes with a cost, which we’ll discuss later.

The video highlights the inherent risk in such kind of contracts. The person in the video focuses on the upside, but what happens when Nifty doesn’t cooperate?

The Devil’s in the Details: A Reality Check

To illustrate the reality of this strategy, let’s consider a hypothetical example. I have made an excel table for an example Nifty Futures Transaction. Our trader buys 10 contracts (50 units each) at Nifty price of 22,000 with Far-Month Validity. His starting month was Jan’2023. He kept rolling over his Future contracts for 8 times (2 Years). For the first 7 times, every time his maturity came near, he found that Nifty was down by 0.1% from his purchased price, so he manually exited booking a loss. The eight time, Nifty surged and he made a profit. In the calculation I have also considered a trading cost of 0.2% for every transaction.

Let’s say a friend, let’s call him Rohan, tried this strategy. Rohan bought into the hype and decided to roll over his Nifty futures contract, thinking nifty would always go up. For seven out of eight quarters, he had to exit with small losses as the expiry date approached.

Here’s the excel I prepared for this scenario (see above).

As you can see, Rohan faced trading costs of 0.2% for every transaction, and he had to roll over seven out of eight times. You can see in the excel table the amount of money he had to endure.

ROI vs. XIRR: Unmasking the True Return

Now, let’s talk about measuring Rohan’s returns. A simple Return on Investment (ROI) calculation might paint a rosy picture. In Rohan’s case, the ROI is calculated as net profit divided by the total investment, which comes out to be 19.82%. Looks impressive, right?

But here’s the catch: ROI doesn’t consider the time value of money. Would you rather get ₹1000 today or in a year? Obviously, today! Money received sooner can be reinvested and earn further returns.

That’s where XIRR (Extended Internal Rate of Return) comes in. It’s a more accurate way to measure returns, especially when you have irregular cash flows over different time periods.

When we calculate the XIRR for Rohan’s trading activity considering the timing of each investment and return the XIRR comes out to be 10.08%. While the simple ROI calculation might look impressive, the XIRR paints a more realistic picture. It shows that the actual return, considering the time and effort involved, is significantly lower.

My Perspective: Is It Worth It?

So, here’s my take.

In a market where Nifty has historically delivered around 12% annually, is the added risk and complexity of futures trading, with all its rollovers and margin calls, really worth it for a 10% XIRR? Remember, Rohan spent a substantial amount of his time and money in this.

For me, personally, the juice isn’t worth the squeeze. I’d rather invest in a diversified portfolio of stocks or ETFs and sleep peacefully at night. As they say, there is no free lunch in stock market.

Conclusion

Futures trading is not a guaranteed path to riches. While leverage can amplify gains, it can also amplify losses. Don’t be swayed by flashy videos promising easy money.

Before diving into the world of futures trading, do your own research and understand the risks. If you are a beginner, I’ll suggest, start with long term investing in stocks, ETFs, and REITs. I think, after that you will not turn towards Derivatives (Futures & Options). Have you ever heard Warren Buffett or people like him boasting about Future Contracts in an interview? Not that they do not know about it, but what they know better is stocks.

What are your experiences with futures trading? Share your thoughts in the comments below.