India is known for its rich cultural heritage, diverse landscapes, and vibrant traditions. These factors make its tourism industry a significant contributor to the country’s economy. With the launch of the Nifty Tourism Index, investors now have the opportunity to tap into this thriving sector. Let’s explore the potential of the tourism industry from an investment perspective. We will also keep in mind its broader economic impact. See top stocks of this sector.

1. Understanding the Indian Tourism Industry

Tourism in India has evolved significantly over the years. The industry includes segments like leisure travel, business travel, hospitality, and transportation.

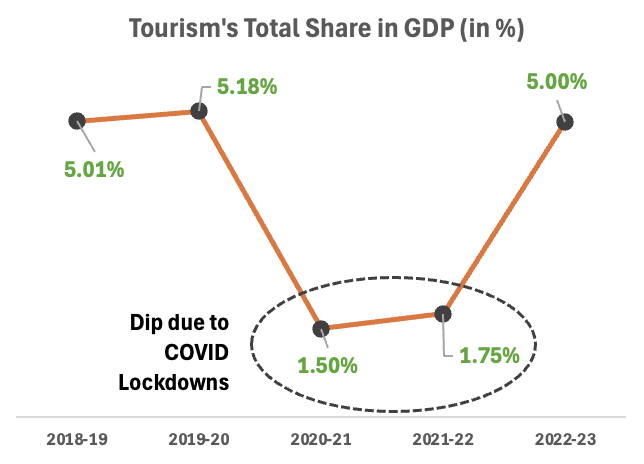

The government’s initiatives, such as Incredible India and Dekho Apna Desh, have boosted domestic and international tourism. In FY 2023, the tourism sector contributed approximately $200 billion, or about 5% of India’s GDP. In FY2024, the sectors contribution increased to about $233 billion which is about 6.5% of India’s GDP (read this KPMG report, dated Aug’2024). On an average, generally, the tourism industry’s contribution to GDP stays at 5% levels in normal times.

Key drivers of the industry include the following:

Key Drivers of the Industry Include:

- Increasing Disposable Income of the Middle Class: Rising income levels in Indian households are enabling people to spend more on leisure. This has made travel and tourism accessible to a larger demographic, especially the middle class, which forms a significant part of the population.

- Improved Infrastructure Like Airports, Highways, and Rail Connectivity: The development of better infrastructure, such as modern airports, expressways, and enhanced rail networks, has significantly boosted tourism. It has made travel quicker, safer, and more affordable, encouraging both domestic and international tourists.

- Rising Popularity of Weekend and Adventure Getaways: Young professionals and millennials are increasingly opting for short weekend trips and adventure-based travel. This trend is driving demand for boutique hotels, homestays, and niche tourism services, adding diversity to the industry.

- Initiatives Like E-Visas for Foreign Tourists: Government initiatives such as e-visas have simplified the travel process for foreign tourists. This has resulted in a notable increase in international arrivals, helping India establish itself as a global tourism hub.

However, the industry also faces challenges, such as seasonality, high operational costs, and dependency on global economic stability.

2. What is the Nifty Tourism Index?

The Nifty Tourism Index is a benchmark index designed to track the performance of India’s tourism and allied industries.

It comprises a diverse range of companies involved in hospitality, aviation, travel services, and consumer services linked to tourism. This makes it a comprehensive representation of the sector’s overall health and growth potential.

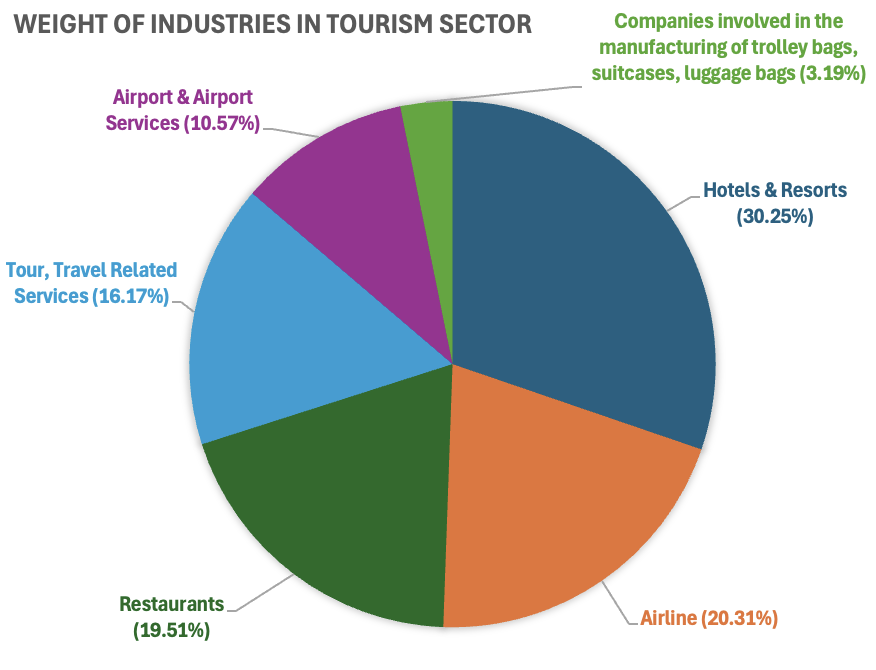

List of basic industries that are included in the Nifty Tourism Index are the following:

| Category | Subcategory/Company | Weight (%) |

|---|---|---|

| Hotels & Resorts (30.25%) | Indian Hotels Co. Ltd. | 19.26% |

| EIH Ltd. | 4.04% | |

| Lemon Tree Hotels Ltd. | 3.13% | |

| Chalet Hotels Ltd. | 2.48% | |

| Mahindra Holidays & Resorts India Ltd. | 1.34% | |

| Airline (20.31%) | InterGlobe Aviation Ltd. | 20.31% |

| Restaurants (19.51%) | Jubilant Foodworks Ltd. | 9.54% |

| Sapphire Foods India Ltd. | 3.01% | |

| Devyani International Ltd. | 2.90% | |

| Westlife Foodworld Ltd. | 2.49% | |

| Restaurant Brands Asia Ltd. | 1.57% | |

| Tour, Travel Related Services (16.17%) | IRCTC Ltd. | 13.31% |

| BLS International Services Ltd. | 1.79% | |

| Easy Trip Planners Ltd. | 1.07% | |

| Airport & Airport Services (10.57%) | GMR Airports Infrastructure Ltd. | 10.57% |

| Companies involved in the manufacturing of trolley bags, suitcases, luggage bags (3.19%) | Safari Industries (India) Ltd. | 1.76% |

| V.I.P. Industries Ltd. | 1.43% |

The Nifty Tourism Index is a barometer for the tourism industry’s performance.

When the sector prospers due to increased travel demand, above listed companies often see higher revenues and profitability, positively impacting the index.

Conversely, challenges like economic slowdowns or pandemics may reflect in a decline.

For investors, the Nifty Tourism Index provides an efficient way to gain exposure to the growing tourism sector. It captures trends like rising domestic travel, foreign tourist arrivals, and increased spending on leisure.

Tourism is a significant contributor to India’s GDP. Hence, this index not only a mirrors the industry’s potential but also an avenue for long-term investment. Investing in this sector with a long-term vision aligns with the country’s economic growth.

3. Future Potential of the Tourism Sector for Long-Term Investors

The Nifty Tourism Index shows strong potential for long-term investors with horizons of 7, 10, or 15 years. The index has delivered consistent growth, outperforming the broader market in several periods.

- For a 7-year horizon, the Nifty Tourism Index has provided 18.95% annualized returns, surpassing the Nifty 500’s 16.58%. This performance indicates robust sector growth, driven by increasing travel demand, infrastructure development, and evolving consumer preferences.

- Over a 10-year period, the index achieved 14.36% annualized returns, close to the broader market’s 15.12%. This highlights its ability to sustain growth, even amidst market volatility. The sector’s cyclical nature is offset by the growing popularity of domestic and international tourism.

- In a 15-year timeframe, the index delivered 12.72% annualized returns, showing consistent performance over economic cycles. This stability, coupled with the sector’s resilience during downturns, underscores its potential as a long-term investment.

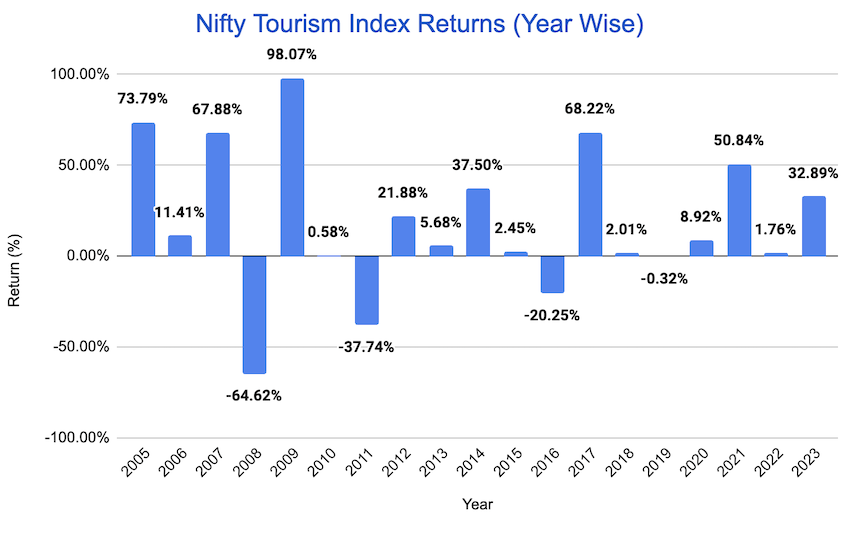

Calendar year performance adds further confidence. The index achieved positive returns in 15 of the past 19 years, including standout years like 2005 (73.79%), 2009 (98.07%), and 2021 (50.84%). Even in challenging times, such as 2020, it managed a modest 8.92% gain.

For investors willing to accept moderate volatility, the index offers significant rewards. Backed by India’s expanding middle class, infrastructure upgrades, and rising tourism demand, the sector presents a compelling case for wealth creation over the next 7 to 15 years.

Deeper Insights (Risk vs Return)

| Period (Yrs) | CAGR Return (Nifty Tourism Index) | CAGR Return (Nifty 500) | Return To Risk (Nifty Tourism Index) | Return To Risk (Nifty 500) |

|---|---|---|---|---|

| 19 | 12.48% | 15.42% | 0.47 | 0.75 |

| 15 | 12.72% | 14.58% | 0.54 | 0.87 |

| 10 | 14.36% | 15.12% | 0.63 | 0.92 |

| 7 | 18.95% | 16.58% | 0.81 | 0.97 |

| 5 | 22.25% | 19.78% | 0.90 | 1.06 |

| 3 | 30.26% | 19.99% | 1.36 | 1.39 |

Let’s dissect the Nifty Tourism Index’s past returns. To get a better perspective, we’ll compared it with the Nifty 500 index.

- At first glance, the Nifty 500 seems like the clear winner over the long term. Higher CAGR returns across most periods, especially the 19-year mark.

- However, the story shifts as we zoom in. Over shorter durations, like the last 7, 5 and especially 3 years, the Tourism Index has not only beaten the Nifty 500 but has done it handsomely.

- This shows a clear upward trajectory in recent times.

Now, let’s talk about Return to Risk metric.

- Return to Risk data It tells you how much return you’re getting for each unit of risk you’re taking. See how, at the 19-year mark, both numbers are significantly lower, while in recent times it is converging?

- Over the last three years, the Nifty Tourism Index has a return-to-risk ratio of 1.36, very similar to Nifty 500, which is at 1.39.

- This means both indices were equally volatile in near terms. But the returns provided by Tourism Index was way higher. This recent performance suggests a strong growth phase for the tourism sector.

- I personally think the India’s growing middle class, increased disposable income, and a desire to travel should keep driving this growth. There are big opportunities in the Indian tourism sector for a long-term investor.

While the long term might feel a bit uncertain, recent trends suggest a great period of growth for the Indian tourism sector.

As an investor, I believe the tourism sector offers significant potential in the long run. While the Nifty 500 is a stable benchmark for the Indian economy, the Nifty Tourism Index is something we should at least keep an eye on.

4. Rolling Return Analysis of Nifty Tourism Index

| Horizon | <0% CAGR (%) | 10%-15% CAGR (%) | >15% CAGR (%) | Min CAGR (%) | Max CAGR (%) | Median CAGR (%) | Average CAGR (%) |

|---|---|---|---|---|---|---|---|

| 10 Years | 0.39 | 26 | 11 | -0.42 | 18.72 | 7.1 | 7.89 |

| 7 Years | 14.54 | 30 | 12 | -4.68 | 21.36 | 8.84 | 7.62 |

| 5 Years | 18.98 | 23 | 20 | -12.11 | 25.77 | 8.07 | 7.75 |

| 3 Years | 24.29 | 20 | 28 | -23.39 | 42.34 | 9.42 | 8.59 |

The Nifty India Tourism Index demonstrates a strong potential for long-term growth. I think it is an an attractive proposition for investors with 7 to 10-year horizons.

Rolling return analysis reveals that the probability of earning positive returns increases significantly with longer investment durations.

- Over a 10-year horizon, the index delivered positive returns in over 99% of instances, with an average CAGR of 7.89%.

- Similarly, for a 7-year horizon, the index delivered positive returns approximately 85% of the time, with an average CAGR of 7.62%.

- For a 5-year horizon, the index delivered positive returns approximately 81% of the time, with an average CAGR of 7.75%.

Shorter investment horizons, such as 3 show higher variability.

- However, even for the 3-year horizon, the index delivered positive returns in over 75% of instances, with an average CAGR of 8.59%.

India’s tourism sector is poised for sustained growth. It is supported by rising domestic travel, government initiatives like Dekho Apna Desh, and increased foreign tourist arrivals. The Nifty India Tourism Index’s historical resilience and capacity for long-term positive returns highlight its alignment with the sector’s growth potential. I think for investors who can bear risks, the tourism sector is a compelling option in a long-time horizons.

5. Return of Top stock in Nifty Tourism Index [20-Jan-2025]

| Stocks | CAGR (5Y) |

|---|---|

| Indian Hotels Co. Ltd. | 41.28% |

| EIH Ltd. | 22.88% |

| Lemon Tree Hotels Ltd. | 22.97% |

| Chalet Hotels Ltd. | 18.97% |

| Mahindra Holidays & Resorts India Ltd. | 16.51% |

| InterGlobe Aviation Ltd. | 22.33% |

| Jubilant Foodworks Ltd. | 13.93% |

| Sapphire Foods India Ltd. | 5.44% |

| Devyani International Ltd. | 9.16% |

| Westlife Foodworld Ltd. | 11.44% |

| Restaurant Brands Asia Ltd. | -0.08% |

| IRCTC Ltd. | 31.57% |

| BLS International Services Ltd. | 93.76% |

| Easy Trip Planners Ltd. | -0.09% |

| GMR Airports Infrastructure Ltd. | 25.97% |

| Safari Industries (India) Ltd. | 49.80% |

| V.I.P. Industries Ltd. | -0.02% |

Conclusion

India’s tourism industry is more than just a driver of GDP. It also represents the country’s cultural and economic vibrancy. For investors, it offers opportunities to participate in the growth of a sector that directly impacts millions of lives.

From my perspective, tourism stocks can be a valuable addition to a long-term portfolio. The only care we must take is to include only fundamentally strong companies. Hence, I though to study this sector taking rerences from the Nifty Tourism Index.

As travel resumes its pre-pandemic glory, I believe that this fundamentally sound companies of this is certainly going to generate the alpha for long-term investors.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.

Source: Nifty Indices [1]

![India's Food and Beverage (F&B) Sector Analysis [2025] - Thumbnail](https://ourwealthinsights.com/wp-content/uploads/2025/01/Indias-Food-and-Beverage-FB-Sector-Analysis-2025-Thumbnail-768x461.jpg)