Almost all salaried people in India contributes to EPF scheme to build a retirement corpus. But NPS (National Pension System) did not had this kind of penetration. In 2009, GOI made NPS available for ‘all citizens’ of India. Earlier it was available only for the government employees. Today we know that NPS can build a bigger retirement corpus than EPF.

Since 2009, lot of people have availed the facility of NPS. People who started investing in NPS schemes are basically those people who knew that NPS will give a higher returns. How? Because NPS has a higher equity component.

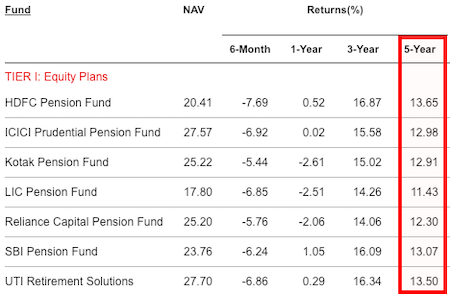

EPF can have a maximum equity exposure of 10%. Whereas equity based NPS can maintain equity component till 75%. As a result, last 5 years average return of NPS funds were as high as 12.3% p.a.

| Description | EPF | Equity NPS |

| Equity Exposure (min-max) | 0%-10% | 25%-75% |

Comparison of NPS with index mutual funds and EPF…

Comparing NPS’s return with the returns of index funds (13% p.a.), NPS has performed reasonably. This is irrespective of its cap of 75% on equity exposure. In the same period the return from EPF was at 8.75%.

NPS can build bigger retirement corpus…

What is shown above is a list of Tier-1 equity based NPS schemes which are yielding higher returns than our traditional EPF plans. On one side EPF is yielding 8.75% vs 12.3% return for NPS. The difference is only 3.55%. What difference does it make?

- Investing Rs.10,000 / month for 25 years @8.75% p.a. returns will build a corpus of Rs.1.08 Crore.

- Investing Rs.10,000 / month for 25 years @12.3% p.a. returns will build a corpus of Rs.2.00 Crore (nearly double than EPF).

| Description | EPF | NPS |

| Investment | 10,000 / month | 10,000 / month |

| Time Horizon | 25 Years | 25 Years |

| Return | 8.75% | 12.30% |

| Retirement Corpus | 1.08 Crore | 2.00 Crore |

Alleged risk of investing in NPS to build retirement corpus…

National Pension System (NPS) schemes are basically a retirement linked investment plans. But there are few very vocal critics of NPS scheme. What it their point?

When people invest for retirement, they tread with care. Why? Because after retirement, they will be totally dependent on their retirement corpus for the livelihood. Hence, the bigger will be the retirement corpus the better.

In this backdrop consider this example. Suppose there is a person who is 59 years of age as on today. By Aug’19, he is scheduled to retire. Most of his retirement fund is locked in NPS (high equity exposure).

In this scenario, suppose the world economy goes into recession (like year 2008). As a result retirement corpus in NPS shrinks by almost 50%. In such a situation, what the retired person will do? He shall wait for the market to recover?

He can do that if he has a choice. But there are lot of retirees who will not be ready for this after-shock. At the time of retirement, corpus erosion is the last thing they would like to see.

For sure this is one of the big drawback of investing in equity. On one side they can deliver high returns, but on other side the risk of loss (uncertainty) also looms around.

How NPS schemes manages the risk of price volatility?

How NPS manages the market volatility and ensures bigger retirement corpus?

There is a reason why NPS schemes has been rated so highly by experts for building retirement corpus. What is the reason? They are tailor-made to prevent potential risk of loss like explained above.

How they do it? By altering the asset allocation with the age of the investors. How is the asset alteration done with age?

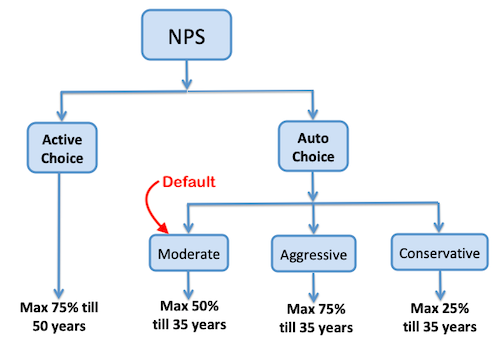

Before we get into this detail, I will like to bring your attention to the two choices available in a NPS Scheme:

- Auto Choice.

- Active Choice.

Auto Choice: When the subscriber selects the auto choice, the invested money is distributed within the asset classes in a predefined proportion. The subscriber need not indulge in the hassle of asset allocation.

Active Choice: When the subscriber selects the active choice, the invested money is distributed within the asset classes as per the preference of the subscriber. Here the subscriber decides the asset allocation.

P.Note: A subscriber of the NPS scheme (who does not indicate his/her preference), will be allocated the “Auto Choice – Moderate Fund” by default.

#1. What is NPS’s “Active Choice”?

In the active choice, the subscriber is allowed to decide the portfolio composition by oneself.

In one financial year, the subscriber can make only two changes in ‘asset allocation’.

Depending on the subscribers present age, he can select the asset allocation based on the maximum limits specified in the below tabulated asset allocation matrix.

| Age | Equity (E) – Max | Corporate Bonds (C) | Government Bonds (G) | Alternative Investment (A) – Max |

| Upto 50 | 75% | Decided by Fund Manager | Decided by Fund Manager | 5% |

| 51 | 72.50% | – Do – | – Do – | 5% |

| 52 | 70.00% | – Do – | – Do – | 5% |

| 53 | 67.50% | – Do – | – Do – | 5% |

| 54 | 65% | – Do – | – Do – | 5% |

| 55 | 62.50% | – Do – | – Do – | 5% |

| 56 | 60% | – Do – | – Do – | 5% |

| 57 | 57.50% | – Do – | – Do – | 5% |

| 58 | 55% | – Do – | – Do – | 5% |

| 59 | 52.50% | – Do – | – Do – | 5% |

| 60 & Above | 50% | – Do – | – Do – | 5% |

What is evident from the above table? Equity exposure is reducing with age. By the time subscriber reaches retirement age (60 years), his equity exposure is reduced from 75% to 50%.

What is the benefit?

- As equity exposure remains high during the subscribers working life, potential returns from “active NPS” can be high. As high as any equity mutual fund.

- At the time of retirement, in case of any major price falls in equity market, as the asset allocation is as low as 50%. Hence, potential loss will be minimised.

#2. What is NPS’s “Auto Choice”?

People who do not have sufficient knowledge of equity and asset allocation, can leave the hassle for the fund manager. Such subscribers should go for the “Auto Choice”.

But here also there are three further sub-choices:

- Moderate Fund.

- Aggressive Fund.

- Conservative Fund.

| Description | Moderate | Aggressive | Conservative |

| Risk | Normal | High | Low |

| Potential Return | Average | High | Low |

| Default | Yes | – | – |

If the subscriber says nothing about the sub-choice, the fund manager will allocate the invested funds to “moderate portfolio” by default.

#2.1 Moderate Funds…

As the name suggests, the moderate funds balances ones exposure between equity and debt based investment vehicles.

A subscriber who does not want to expose oneself too high to equity, but would also like to take advantage of high returns, can opt for ‘moderate funds’.

The asset allocation matrix for moderate funds is as tabulated below:

| Max Age (Years) | Equity (E) – Max Limit | Corporate Bonds (C) | Government Bonds (G) |

| Upto 35 | 50% | 30% | 20% |

| 36 | 48% | 29% | 23% |

| 37 | 46% | 28% | 26% |

| 38 | 44% | 27% | 29% |

| 39 | 42% | 26% | 32% |

| 40 | 40% | 25% | 35% |

| 41 | 38% | 24% | 38% |

| 42 | 36% | 23% | 41% |

| 43 | 34% | 22% | 44% |

| 44 | 32% | 21% | 47% |

| 45 | 30% | 20% | 50% |

| 46 | 28% | 19% | 53% |

| 47 | 26% | 18% | 56% |

| 48 | 24% | 17% | 59% |

| 49 | 22% | 16% | 62% |

| 50 | 20% | 15% | 65% |

| 51 | 18% | 14% | 68% |

| 52 | 16% | 13% | 71% |

| 53 | 14% | 12% | 74% |

| 54 | 12% | 11% | 77% |

| 55 & above | 10% | 10% | 80% |

What is evident from the above table? Equity exposure is maximum till 35 years of age (50%). After that, equity exposure keep reducing every subsequent year.

This way we can say that, the fund manager is booking profits derived from equity, and the putting the profits-booked in debt based plans.

By the time subscriber reaches retirement age (60 years), his equity exposure is reduced from 50% to 10%.

What is the benefit? In case of any major price falls in equity market, as the asset allocation is only 10% (at the time of retirement), potential loss will be bare minimum.

#2.2 Aggressive Funds…

As the name suggests, the aggressive funds maintains a high exposure to equity in the initial years.

A subscriber who wants to take full advantage of high returns from equity, can opt for ‘aggressive NPS funds’.

The asset allocation matrix for aggressive funds is as tabulated below:

| Max Age (Years) | Equity (E) – Max Limit | Corporate Bonds (C) | Government Bonds (G) |

| Upto 35 | 75% | 10% | 15% |

| 36 | 71% | 11% | 18% |

| 37 | 67% | 12% | 21% |

| 38 | 63% | 13% | 24% |

| 39 | 59% | 14% | 27% |

| 40 | 55% | 15% | 30% |

| 41 | 51% | 16% | 33% |

| 42 | 47% | 17% | 36% |

| 43 | 43% | 18% | 39% |

| 44 | 39% | 19% | 42% |

| 45 | 35% | 20% | 45% |

| 46 | 32% | 20% | 48% |

| 47 | 29% | 20% | 51% |

| 48 | 26% | 20% | 54% |

| 49 | 23% | 20% | 57% |

| 50 | 30% | 20% | 60% |

| 51 | 19% | 18% | 63% |

| 52 | 18% | 16% | 66% |

| 53 | 17% | 14% | 69% |

| 54 | 16% | 12% | 72% |

| 55 & above | 15% | 10% | 75% |

What is evident from the above table? Equity exposure is maximum till 35 years of age (75%). After that, equity exposure keep reducing every subsequent year.

By the time subscriber reaches retirement age (60 years), his equity exposure is reduced from 75% to 15%.

What is the benefit?

- At the time of retirement, in case of any major price falls in equity market, as the asset allocation is as low as 15%. Hence, potential loss will be minimum.

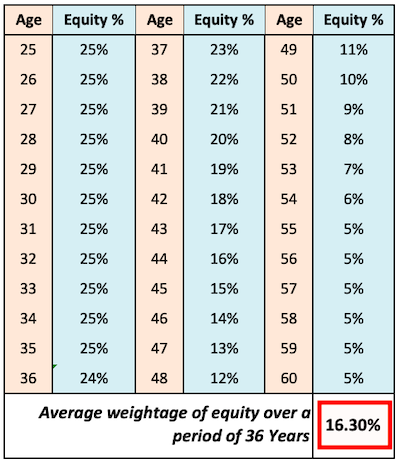

#2.3 Conservative Fund…

As the name suggests, the conservative funds maintains only a small exposure to equity in the initial years.

A subscriber who does not want to take risks with his retirement corpus, can opt for conservative NPS fund.

The asset allocation matrix for conservative funds is as tabulated below:

| Max Age (Years) | Equity (E) – Max Limit | Corporate Bonds (C) | Government Bonds (G) |

| Upto 35 | 25% | 45% | 30% |

| 36 | 24% | 43% | 33% |

| 37 | 23% | 41% | 36% |

| 38 | 22% | 39% | 39% |

| 39 | 21% | 37% | 42% |

| 40 | 20% | 35% | 45% |

| 41 | 19% | 33% | 48% |

| 42 | 18% | 31% | 51% |

| 43 | 17% | 29% | 54% |

| 44 | 16% | 27% | 57% |

| 45 | 15% | 25% | 60% |

| 46 | 14% | 23% | 63% |

| 47 | 13% | 21% | 66% |

| 48 | 12% | 19% | 69% |

| 49 | 11% | 17% | 72% |

| 50 | 10% | 15% | 75% |

| 51 | 9% | 13% | 78% |

| 52 | 8% | 11% | 81% |

| 53 | 7% | 9% | 84% |

| 54 | 6% | 7% | 87% |

| 55 & above | 5% | 5% | 90% |

The risk of loss in case of conservative NPS funds is bare minimum. But even a conservative NPS scheme will give a marginally higher returns than EPF. Why?

Because average weightage of equity in a conservative fund, over a period of 36 years, is approximately 16%. In case of EPF, equity exposure is maxed at 10%.

Conclusion…

It is true that few NPS schemes has equity exposure, hence there is a risk of loss. But according to me this scepticism is not so justified. Why? Because in long term (15-20+ years), a good equity portfolio necessarily gives high returns.

The chances that there will be low (or negative) returns is too small. For such a small probability, one shall not put NPS schemes in bad light. Moreover, equity NPS are built to manage this probability. How? By means of age based asset allocation.

Equity exposure of EPF schemes is maxed at 10%. But in NPS schemes there is lot of variety. People can choose the type of NPS scheme based on ones preference.

On one side there is a NPS, whose portfolio is conservative. It does not invest more than 25% in equity.

On the other side there is NPS, whose portfolio is almost like a balanced mutual funds – aggressive & moderate NPS. Here they invest a maximum of 75% & 50% respectively in equity.

As equity component of NSP is higher, in long term horizon (15-20+ years), a much bigger retirement corpus can be built compared to EPF.

But just because NPS invests in equity does not make it non-suitable for retirement linked goals. NPS’s asset allocation changes with the age of the subscriber.

- In younger age – equity exposure is higher.

- In older age – equity exposure is minimised.

The trick lies is selecting the right NPS scheme, based on ones risk taking capacity and personality:

- Adventurous person: Auto-Aggressive plan.

- Cautious person: Auto-Conservative plan.

- Balanced Person: Auto-Moderate plan.

People who would like more control on the NPS portfolio; and also has a good understanding of equity market, can opt for the “Active Choice”.

Note:

- It is only Tier-1 NPS which can save tax upto Rs.2,00,000. Tier-2 NPS offers no tax advantage. I see no point why people should go for Tier-2 NPS schemes.

- To invest in Tier-2 NPS schemes, it is mandatory to subscribe for Tier-1 schemes first.

Equity Linked Savings Schemes (ELSS) is another good option for people who want to save tax and also invest for retirement.

![Wealth Building: How To Build Wealth in 30s [Wealth Formula]](https://ourwealthinsights.com/wp-content/uploads/2010/07/Wealth-Building-Image.png)