Google finance India was a great tool for individual investors in India. We did not had such excellent portfolio manager here. The best part was, it is absolutely free.

But Google discontinued it from Nov’2017. Below is the blog post which highlights the key features of earlier version of Google Finance….

Till few years back I was using moneycontrol portfolio builder.

But ever since I had my hands on Google Finance, I find no other portfolio builder as good as this.

Google Finance not only builds portfolio, but it also provides an amazing stock screener.

It is this combination of portfolio building, and stock screening that makes Google Finance the best service provider in its segment.

Earlier, Google Finance was mainly meant for United States of America.

But gradually, Google Finance has extended its services to India, China, France, Germany, Italy, United Kingdom, Australia, Singapore etc (to 37 countries of the world).

When I first came to know about Google Finance, the thing that impressed me was its tool that allows one to compare stocks.

These days I used their stock “compare” a lot.

The comparison not only allows me to compare its price graphically but other details are also tabulated well for comparison.

The details that can be compared are like dividend yield, valuation ratios and other business fundamentals.

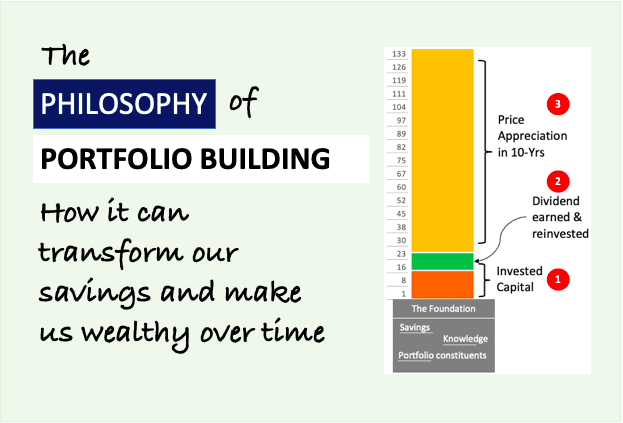

Portfolio management is very important for individual investors.

Just buying assets (stocks, funds) is not enough.

It is also essential to keep a record of it. Name of asset, cost of purchase, time of purchase, date of selling etc are information that an investors must record judiciously.

A portfolio builder like Google Finance India is a must have tool for all investors.

Small investors must not shy away from using a portfolio builder. Why to ignore its usage?

Few quick advantages of using a portfolio builder are these:

- They are available for free.

- It keeps your investment records very organised.

- You can track performance of each of your investments.

- Portfolio builder also gives you great insights about stock market in terms of recommendations and current market news.

I will personally recommend a portfolio builder to all investors as it also gives great visualisation of whether portfolio is sufficiently diversified or not.

Individuals whose portfolio consists of direct stocks, ETF, mutual funds, cash etc can use Google Finance India portfolio builder to record transactions and also track performance.

Introduction : Google Finance India

Google Finance India provides us two most valuable products:

- Portfolio tracker.

- Stock screener.

Portfolio tracker can be used to view stocks, ETF’s and funds & track their performance.

Till couple of years back, Google Finance India was not supporting mutual funds. But today we can track even mutual funds using google finance.

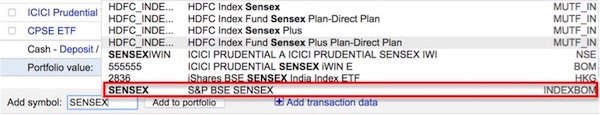

Like one can add mutual funds & ETF’s, S&P BSE SENSEX Index can also be added in portfolio.

This helps investor to compare performance of their holdings with respect to SENSEX.

In a similar way like Sensex, one can also add Nifty, S&P BSE 100 Index, S&P BSE 500 Index etc.

This feature of adding Index (with possibility to compare with individual stocks) in portfolio, makes Google Finance stand miles ahead of its competitors.

What makes Google Finance’s stocks portfolio very useful for me is their News Ticker.

At the bottom of my list of stocks, Google finance provides latest news relevant to my stock holdings or watch list.

Google finance India competes with giants like moneycontrol, Yahoo Finance etc.

But google finance has been my favourite also because is it does not bombard me with advertisements popping up right on my face.

Even though Google finance India services are completely free, they look less commercial.

How to add transactions data in Google Finance?

All type of shares, mutual funds and ETF transactions can be recorded in Google Finance Portfolio software.

Buy, Sell, Buy to Cover & Sell Short are type of transaction we can record in Google Finance.

One can also use Google Finance to create a watchlist.

Suppose one has ‘not’ bought any shares, but would only like to keep a watch on its performance. The same can be done with Google Finance.

This is called a watchlist. To prepare a watchlist, just put zero value in “Shares” field.

If you want to add real transactions (not just watch list), do the following:

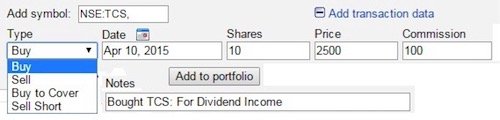

In order to add real transactions data, click the link called “Add transaction data“. After clicking, a new form will unfold. In the new form, fill data as shown below:

- Type of transaction,

- Date,

- Number of Shares,

- Price,

- Commission etc.

Who can use Google Finance?

If one has a Gmail account, Google Finance is available in totality.

One can simply login into Google finance India (using Gmail id and password).

Once a person in inside Google finance, creating stock portfolio is only clicks away.

In this article we will see how to use Google finance India to create stocks portfolio.

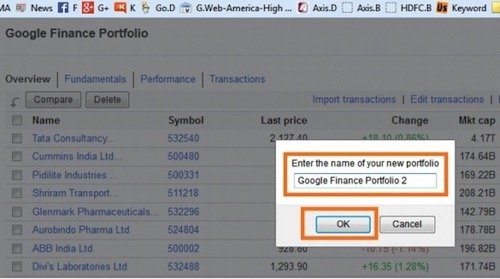

# Step 1 – Create Portfolio

Use your Gmail Login to access Google Finance.

Once a person logs into Google finance, the next step will be to create a portfolio.

The portfolio can be created by clicking the portfolio tab:

After clicking on the portfolio tab, the next step is to name the portfolio. Once the name in entered and clicked OK, portfolio is created.

But this portfolio will be empty initially.

Individual stocks, mutual funds etc that one has bought and sold, needs to be manually entered.

# Step 2 – Add stocks etc in Portfolio

Adding stocks to Google finance portfolio is easy.

By clicking on the link “Add transaction data” one can enter individual shares data.

Once Add transaction data link is clicked, next is to enter details as highlighted here:

- Stock Symbol

- Type of transaction: Buy or Sell

- Date of transaction

- Number of shares/units bought/sold

- Price of trade

- Commissions (extra fee/charges)

- Notes: I generally use it as reminder to tell me why I bought this stock

# Step 3 – Observe Stock’s Data

After entering all the transactions, a typical Google finance portfolio will look like this.

In my example portfolio we can see different Indian stocks are included.

The Portfolio snapshot that we are seeing here is in overview mode.

In the ‘overview tab‘ of Google finance, one can get following information about stocks portfolio:

- Current Market Price (Last Price).

- Percentage change in market price compared to previous day price.

- Current market capitalization of stocks.

- Market Price (Day’s Low & High).

In the ‘fundamental tab‘ of Google finance, companies financial basics are highlighted.

Parameters like EPS & P/E ratio are available.

Investors could compare today’s price with 52 Weeks high & Low price.

This makes decision making (Buy, hold or sell) easier.

Market capitalization and latest price figures are also available.

Performance visualization

Google Finance provides excellent performance visualization.

This is an essential step in investment portfolio management. It gives good insights about the performance of ‘individual stocks’ and also of the ‘overall portfolio’.

Google Finance makes it easy to visualize the performance.

Generally for me, performance tracking of the overall portfolio is more interesting.

I do not give lot of importance to performance tracking of individual stocks, funds etc.

I also do minimum cost verses present value comparisons.

Unless an until the performance of an asset remains under performed for extended period of time, I do not look into individual assets.

Till I can see the growth curve in my investment portfolio, I remain happy.

Google Finance does a great job in this perspective.

We need not open excel sheet and plot curves. Google finance automatically prepares one for us.

At the bottom of the table in Google finance portfolio tool we can see performance curves.

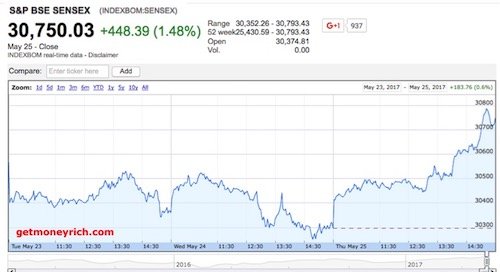

Performance tracking with respect to a reference

Here the reference can be Sensex, Nifty etc.

As an investor, if your investment philosophy is to buy only “large cap blue chip” stocks then useful benchmark will be BSE Top 200 index.

If investment philosophy is to buy small & mid cap stocks then benchmark like NIFTY MIDCAP 50 is good.

I personally track performance of my portfolio with respect to BSE Sensex.

I made a rule for myself that my investment portfolio shall not under perform as compared to BSE Sensex.

Other functions of Google Finance India

(1) Google Finance > Free Cash Manager

I also use Google Finance as my free cash manager.

Generally, majority portion of my cash is budgeted/allocated for specific tasks.

After allocating all my funds to tasks, what is balance is my free cash.

I can use this free cash as per my will.

Sometimes I use this cash to buy a nice gadget for self. But majority times, this cash is used to buy assets.

I use my free cash to buy stocks, mutual funds & ETF’s in general.

Suppose I have $1,000 in free cash. But I am ready to invest only $500, how Google Finance takes care of this type of transaction?

Here, google finance should show both, “cash component” & “asset portion” in my portfolio.

Google Finance does this very well for me.

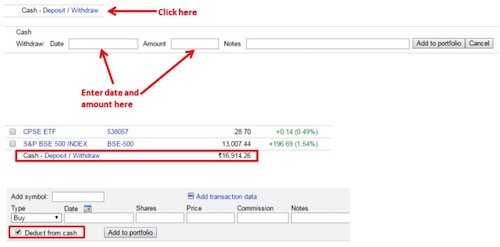

The below screenshot is self explanatory.

It indicates how I record my cash transaction inside the google finance portfolio.

After I enter my cash component in my portfolio, it appears as “Cash – Deposit/Withdrawal”.

Henceforth, whenever I buy any stocks, funds etc, I indicate to Google Finance that I am using this cash to buy them.

Suppose I bought $500 worth mutual funds. I ask google to deduct $500 from my cash deposit and buy mutual funds worth $500.

Please see the below screen short to get a feel of how Google Finance India represent this:

(2) Google Finance > News

This is one of my most used tool of Google Finance India.

I have created a watchlist portfolio for myself.

Related to all stocks in my portfolio, specific news gets filtered and available for my reading.

Google Finance makes filtered “portfolio related” news readily available for my reading.

This makes my job very easy. I need not search the whole world’s news to find the relevant ones.

I am not such a news guy. But when I see information relevant to my portfolio or watchlist, its useful reading.

It will not be an overstatement to say that Google finance helps me to improve my ‘circle of competence’.

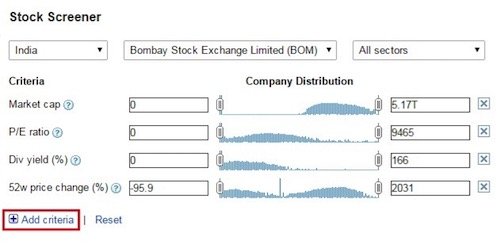

(3) Google Finance > Stock Screener for Indian stocks

This is the real USP of Google Finance. I have not seen a better stock screener than Google Finance till date.

I have used few stock screeners of Reuters and Investing.com etc, but none can match Google Finance.

The volume of information that is provided by Google Finance India for free is great.

Lets see the parameters based on which we can screen stock in Google finance.

First – Default stock screen looks like this:

When we click the add criteria we can include other useful stock screening criteria as well. Some criteria that I used very often are as following:

(3.1) How I use stock screener of Google Finance

What Google Finance gives me readily is list of Top stocks in terms of market capitalization.

I also screen these top stocks based on their price valuation (P/E ratio).

I am also a fan of those stock which carries low debt and has high profit margin. Google Finance also provides me with this information with click of a button.

This way I have list of top market cap with its P/E ratio, debt/equity ratio and net profit margin.

Final Words…

I strongly recommend use of Google Finance for all investors.

As their services are free of cost, even a newbie can use it to gain tremendous insights about our favourite stocks.

The data generated by Google Finance can also be exported to excel.

Hence portfolio analysis and detailed stock screening can be done offline as well.

Disclaimer: Since last few months, Google Finance is under massive renovation. Hence at times their Stock Screener may not be available for use. This renovation was due for many years now. Though it is taking time and may be causing some users to flee Google Finance, but I suggest them to stay put with Google.

I want to cash out Google finance