Recently I was reading about the launch of India’s first Real Estate Invest Trust (REIT). As it was the first such financial instrument in India, I wanted to know more about it. Basically I wanted to know, who is behind this REIT?

This small question took me into a spiral, and what I could unearth was worth sharing with my readers. I could understand that behind a mutual fund (or a REIT) there is a whole TEAM which is working.

It is not as if everything is done and manage by a mutual fund manager. In fact a mutual fund manager is just like any other employee of a company. People who actually are the owners and top-managers of a mutual fund are different sets of people.

What I could decode was the following. If mutual fund is a company, then these are the set of who’s and what’s I wanted to know:

- Who owns the mutual fund?

- Who are the TOP Managers of a mutual fund?

- Who is the AMC of a mutual fund?

- What is the role of Custodian, Registrar, Transfer Agent, Auditors etc of a mutual fund.

- Mutual Fund Managers comes where in a fund house?

Though these queries were just answered for the sake of enhancing my G.K. but the conclusion of this exercise was rewarding. How?

Because it helped me to see the mutual funds from a difference perspective. Earlier I used to see the fund house as an investor. But after knowing about the organisation structure of mutual funds in India, I can now see the mutual funds like a “business entity”.

What is the utility? It helped me to see if the Mutual Fund is run by people whom I can trust or not.

SEBI

Why it is important to know the organisation structure of mutual funds? Because it helps us (as an investor) to understand how a mutual fund works, or who controls the mutual fund.

Moreover, if investors know the hierarchy of a mutual fund, they will also know whom to escalate the problem if necessary.

But how many time you have heard that a retail investor had to approach the fund house to sort out a grievance? Rarely it happens. Do you know why? The credit must go to SEBI – the regulator of the mutual fund business.

It is SEBI, who in the interest of the investors, has established a three tier structure for the mutual funds. It will be not be wrong to say that, this 3-tier structure makes our mutual funds so efficient.

This structure is simple, and even a lay-man can understand its built-up and utility.

From the perspective of small investors…

Knowing the organisation structure of mutual fund is like knowing about the board of directors of a company.

Suppose there is a board where people like Rata Tata, Narayana Murthy, Mukesh Ambani, Kumar Manglam Birla etc are chaired. Won’t you trust this board more than others? I am sure we all can trust them.

Why these people are trustworthy? Because they are honest, and most efficient and effective businessmen.

But this is not all, as an investor it is also our responsibility to be aware of the financial instruments in which we are dealing with.

Being ware of the organisation structure of mutual fund is one such necessary awareness. This is one reason why AMFI provides this detail in their websites.

Not only AMFI, private web-portals like Economic Times, Moneycontrol, Valuereserachonline etc has this detail on their pages.

But the problem is, we do not know how to make the meaning out of the information published by them.

I am sure, this blog post will help you in understanding the significance of the published info.

Introduction

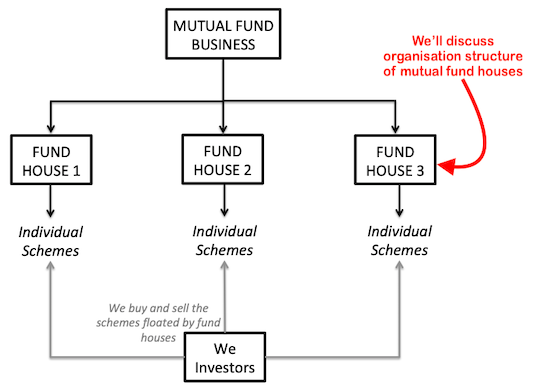

What we often phrase as “Mutual Fund” is actually a type of business. Within this line of business, there are approximately 35-40 nos fund houses.

These fund house are actually the companies, whom SEBI has allowed to operate mutual fund schemes. It is these schemes which we common people buy and sell as investment products.

I am sure you already know this, but allow me to present this information in a more graphical form for clearer understanding.

India’s Top 5 Fund Houses in term of the size of the Asset Under Management (AUM) – as on Dec’18, are listed below:

| SL | Mutual Fund Houses | AUM (Rs.Crore) |

| 1 | HDFC Mutual Fund | 3,34,964 |

| 2 | ICICI Prudential Mutual Fund | 3,07,735 |

| 3 | SBI Mutual Fund | 2,64,353 |

| 4 | Aditya Birla Sun Life Mutual Fund | 2,42,344 |

| 5 | Reliance Mutual Fund | 2,36,256 |

The most visible person of a mutual fund is the “Fund Manager”. But do you know, there is a Chairman, CEO, CFO of a fund house?

Example: Aditya Birla Sun Life Mutual Fund.

- Chairman: Kumar Mangalam Birla.

- CEO: A. Balasubramanian.

To have more clarity about how a mutual fund operates, we will have to know the organisation structure of a typical mutual fund house in India.

Three Tier Structure of Fund House

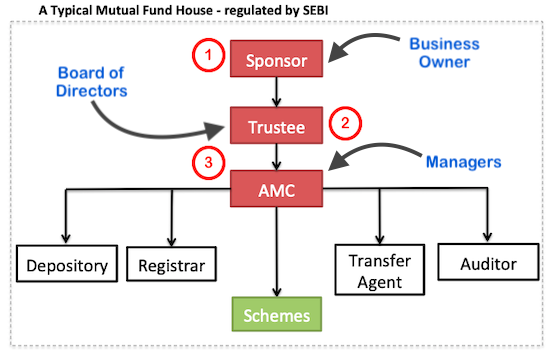

The three tier structure of a mutual fund house consist of the following heads:

- Sponsor.

- Trustee.

- AMC.

It is SEBI who has prepared the framework of the above 3-tier structure of mutual funds. All mutual funds operates in India under SEBI guidelines.

It is the SPONSORS (also called promoters) who first conceptualise the idea of starting a mutual fund business. Before they can act further, they must approach SEBI for registration of the business.

If the sponsors has the necessary credentials, SEBI will issue the “Certificate of Registration” to the sponsors. Which are the credentials required?

- The sponsor must have experience of 5 years in financial services.

- They must be a profit making company (3 out of 5 years).

- Last 5 years net worth of the company must be positive.

Once the certification is received, further steps can be taken to start a mutual fund activity. Which are the next steps?

- Formation of Trust.

- Appointment of AMC.

- Appointment of Depository (Custodian), Registrar, Transfer Agent, and Auditor.

#1. Trustee – Father Figure

The sponsors of mutual fund forms a Trust. This Trust must have a “Board of Trustees” (like board of directors).

Who shall be in the Board of Trustee (BOT)? There is a stipulation of SEBI which must be followed in the BOT.

The minimum strength of the board must be four (4) members.

Out of the whole board members, two-third members must be “Independent Directors”. Who are independent directors? Those people who have no relation with the sponsors in any way.

The idea of the formation of a Trust is to have a management in place. The priority of this management will be like this:

“Protect the interest of the unit-holders and their invested money”

It is also the responsibility of the Trustee to ensure that, mutual fund operates as per the regulations of SEBI.

As per SEBI guidelines, at all times, out of the total net worth of the AMC, a minimum amount must be contributed by the sponsors.

There is another reason why SEBI has stipulated such strict norms related to the Board of Trustees. What is the reason? Generally corporate houses are the sponsors of mutual fund schemes. Example: Tata Group, ICICI bank, Mahindra and Mahindra Group, HDFC bank etc.

SEBI has stipulated such rules to ensure that the investors pooled money is not used by the sponsors in their group companies.

BOT members may not engaged in the day to day operations of the mutual fund.

Daily operations of the mutual fund is managed by the appointed “Managers (AMC)” and other team members.

#2. AMC – Manager of Mutual Fund

After Trustees, the most important entity in the mutual fund is its AMC (The Asset Management Company).

AMC of a mutual fund is formed as per the “Companies Act 1956”. The AMC must also be registered with the Government of India accordingly.

After an AMC is registered, it will start functioning as a full fledged company. This is one reason why we see the following three types of AMC’s in India:

- Private Limited Company.

- Wholly Owned Subsidiary of an already Public Limited Co.

- Joint Venture (Indian or Overseas Companies).

When the trustees are forming the AMC, it is also their job to appoint the following managers who will in turn run the AMC:

- CEO

- Chief Investment Officer.

- Fund Manager

- Chief Investment Officer.

- Chief Marketing Officer (CMO)Chief Operations Officer (COO)Compliance Officer.Etc.

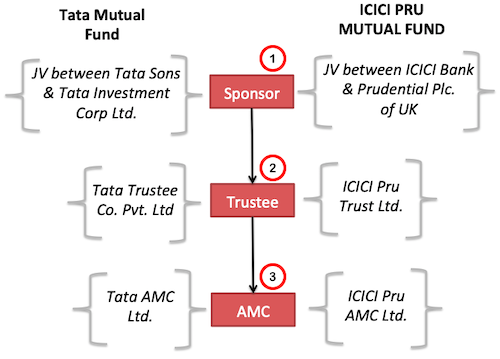

Example of Three Tier Structure:

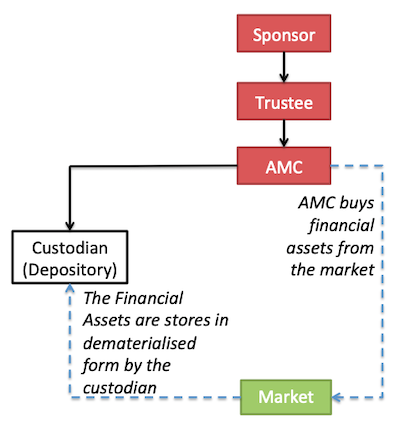

#3. What is the role of the Custodian (Depository)?

A mutual fund scheme purchases various types of financial assets. Some of these assets can be like this:

- Stocks of companies.

- Government bonds.

- Company deposits.

- Cash etc.

It is the responsibility of the depository (custodian) to hold all financial assets safely in its custody.

A good analogy of a ‘depository’ is our bank’s locker. In the locker we can keep important documents, jewellery etc.

Example: HDFC Bank provides custodian service to ICICI Pru Mutual Fund.

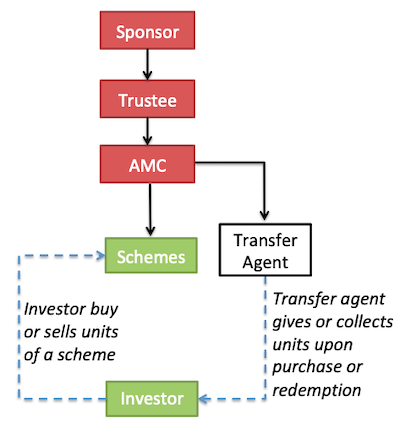

#4. What a Transfer Agent does?

AMC appoints a transfer agent. The transfer agent handles the following:

- Communication with investors.

- Maintains investors data.

- Process all transactions of units (purchased or redeemed).

Example: For ICICI Pru Mutual Fund, the transfer agent is ICICI Infotech along with CAMS Ltd. For Tata AMC, the transfer agent if CAMS.

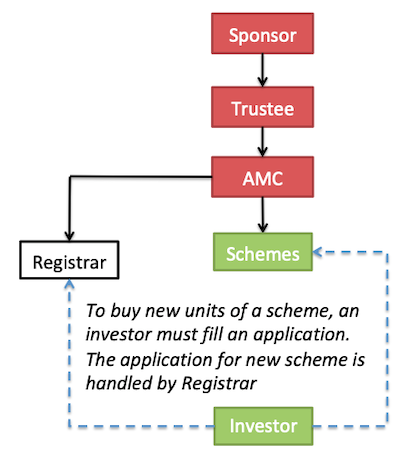

#5. What is the role of a Registrar?

Again, it is the AMC who appoints the Registrar for its mutual funds.

These days generally the role of Transfer Agent and Registrar is performed by the same company.

In India the most common registrar utilised by mutual fund companies are CAMS and Karvy.

The main functions of Registrar are the following:

- Data Entry.

- Send Account Statements to Investors.

- Etc.

#6. Role of an Auditor…

As per companies act, all companies must get their book of accounts audited by an external financial auditor. These auditors are basically certified chartered accountants.

All financial transactions done by a mutual fund company must be presented to the auditors for scrutiny. At the end of the financial year, the auditors also checks and certifies the financial reports prepared by the mutual fund companies.

Conclusion

In case you are interested to know the details of your Mutual Fund house, you can check their details here at AMFI’s website.

Once the mutual fund house has organised its 3 tier structure as per SEBI’s guidelines, the AMC is ready to launch their new schemes.

This is the stage where the mutual fund house is ready to appoint a competent fund manager.

In todays practice, a single fund manager can handle two or more mutual fund schemes at a time.

Three Tier structure of few Indian mutual funds:

| SL | Name of Fund House | Canara Robeco Mutual Fund | ABSL Mutual Fund | Axis Mutual Fund | HDFC Mutual Fund | ICICI Pru Mutual Fund | Kotak Mahindra Mutual Fund |

| 1 | Sponsor | Canara Bank, Robeco Groep | Aditya Birla Nuvo, Sun Life (India) | Axis Bank Limited | HDFC Ltd. / Standard Life Invest. | Prudential Plc and ICICI Bank Ltd. | Kotak Mahindra Bank Limited |

| 2 | Trustee | – | Birla Sun Life Trustee Company Pvt Ltd. | Axis Mutual Fund Trustee Ltd. | HDFC Trustee Company Limited | ICICI Prudential Trust Ltd. | Kotak Mahindra Trustee Co. Ltd. |

| 3 | AMC | Canara Robeco AMC Ltd. | ABSL AMC Ltd. | Axis Mutual Fund AMC | HDFC AMC Ltd | ICICI Pru Mutual Fund | Kotak Asset Management |

| 3A | Custodian / Depository | Hongkong and Shanghai Banking Corp & HDFC Bank | Citibank NA | Deutsche Bank | HDFC Bank, Citibank & Deutsche Bank | HDFC Bank | Deutsche Bank AG, Standard Chartered Bank |

| 3B | Transfer Agent | Karvy Fintech Pvt. Ltd | CAMS Ltd. | Karvy Fintech Pvt Ltd. | CAMS Ltd. | CAMS Ltd. | CAMS Ltd. |

| 3C | Registrar | Karvy Fintech Pvt. Ltd | CAMS Ltd. | Karvy Fintech Pvt Ltd. | CAMS Ltd. | CAMS Ltd. | CAMS Ltd. |

| 3D | Auditor | M/s. S. R. Batliboi | M/s. Haribhakti & Co | M/s S R Batliboi & Co. and and M/s Haribhakti & Co. | BSR & Co. LLP & S.R. Batliboi & Co. LLP | M/s S. R. Batliboi & Co. LLP | Price Waterhouse & S R Batliboi & Co LLP |

Very nicely explained.

Thanks

This article is comprehensive for a layman like me.