When one first starts to feel the need for a personal finance overhaul? It does not happen while just starting in a job. The need for organizing finances creeps in after few years on the job. It’s the time when one is wondering where the money is going?

This query starts a chain of thoughts in our minds. Eventually, we realize that our finances are not in order. What causes our Financial mess? The root cause is our bad habits of handling money.

Money is a finite resource. No matter how much a person is earning, wrongly managed money gets spent in no time. The bigger problem is, ill-spent money never comes back.

When I was about 30 years of age, I first began to realize that I must build some savings. I had no assets. The only thing that I was doing was earning from one hand and spending it from the other.

Those days I was not aware of better money management practices. But at least I knew that more savings in the bank are good. So I thought, how to get there? By organizing finances.

See video: Organising Finances

Organizing Finances – What all to control?

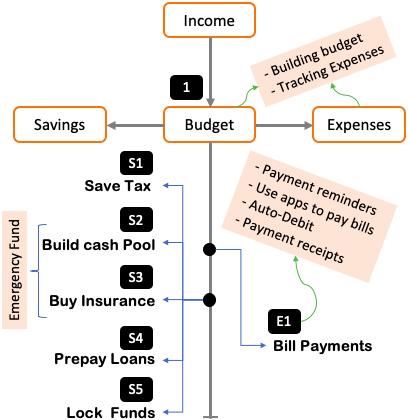

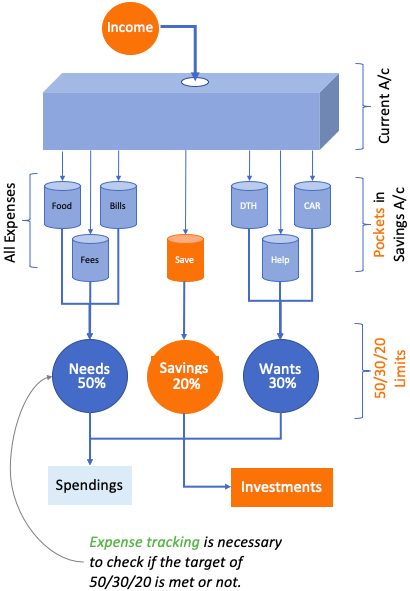

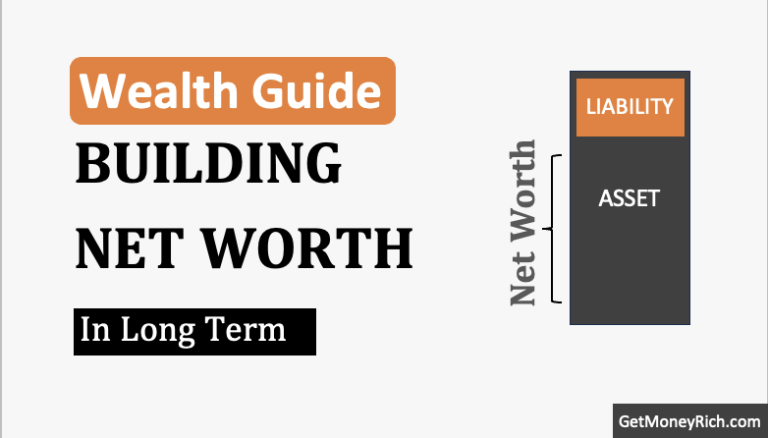

The above infographic is a typical representation of what needs to be done as a part of organizing finances. It all starts with income generation. Once the income stream begins to flow-in, along with it comes the need to stay financially organized and healthy.

Further, to begin organizing finances, the next step is to create a budget. But an expense-budget alone is not enough. It is also necessary to track expenses to make sure that the money is flowing-out as budgeted.

Once the budget and expense tracking is in place, then comes the practical work of organizing the finances. It starts with remembering one’s bills, paying them on time, and keeping their receipts. No matter how timid it may sound, but the majority of our disorganized finances happens because we forget to plan and pay our bills on time.

It must also be remembered that savings, income tax planning, and investments, all-together builds the foundation of strong and organized finances. Omitting any of them, and expecting a financially organized life, will not happen.

Let’s read about the seven (7) important steps that one must take to organize one’s finances to near perfection.

#1. Budgeting – Do not spend a dime without it

We are talking here about organizing finances. How relevant is our talk about the expense budget? One of the main factors why our money stays in disarray is because of our overspending habits.

No financial organizing pep-talk will ever work if there is no control over spendings. How to control overspending? The best way to do it is by following an expense budget.

If you feel that you are not able to control your money, then in 99 out of 100 cases, the cause is hidden in your spending habits. Ask yourself, do I have an expense budget? If the answer is no, focus on budgeting expenses

Want to know how to build an expense budget? Follow the 50/30/20 budgeting rule. It is a simple and executable way of building an expense budget for a first-timer.

#1.1 Tracking Expenses

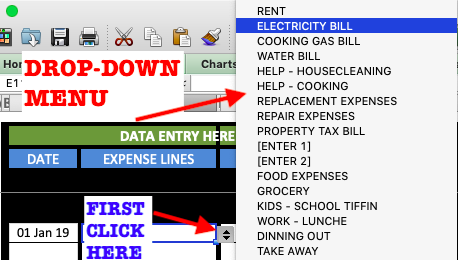

Building an expense budget is like reading a theory on a subject. How to bring this theory into practice? It can be done by using an expense tracking worksheet.

It is the most challenging part of organizing finances. Why? Because expense tracking is mostly a manual activity. Expense data needs to be entered into an excel sheet, or a mobile app manually. Which is the best way?

I have been personally tracking all my expenses for the last 10+ years. In the initial few months, the activity felt particularly laborious. But there was also excitement. I was always excited to know how I fared in the month. Did I save or overspent?

At the end of the month, I used to compare my actual expenses with the budgeted one. I used to check every line item in my budget to confirm that if I’m savings enough or not.

No matter how laborious was the expense tracking process in the initial months, but the feedback that I used to get every month about my spending habits was becoming addictive.

Today I’ve built this habit of recording all my spendings in an excel sheet. Among others, this one habit has the most impact on achieving my goal of financial independence.

#2 (E1) Bill Payments

Once we are done with budgeting and expense tracking, the next thing to take care is payment of bills on time. These are those types of expenses that must be paid on time. Few such expenses can be like electricity bills, water bills, school fees, credit card bills, rent, insurance premiums, etc.

Making timely bill payments cannot happen only by setting reminders. Few things must be brought to practice to make regular bill payments easy. Let’s see each of them.

Organizing The Bills

We must learn to keep relevant papers properly. How to do it? For paper bills, buy a few thin-folders. Keep one folder for every type of paper bill you receive in your mail-box. Like, one folder for electricity bills, another for landline bills.

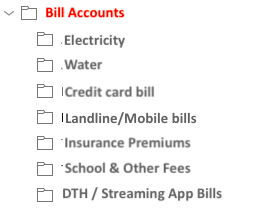

What about bills received over email? Make sure to create folders and drag/move relevant emails into their assigned folders. Check the below image for how folders should look-like in your Inbox.

Make sure to keep all bills either in your paper folders or inside the relevant folders in your email. Eliminate the habit of keeping some bills at home, some in the office bag, some in emails, etc. More organized will be your papers, better will be the bill-payment history.

In addition to this, if you would like to keep an email or phone reminders on your device, that should make it fool-proof. For example, let yourself receive a reminder on your phone on the 5th of every month @9:30PM that you have 6 pending bills for payment. Once you get this reminder, open your folders, and be ready for the payment.

How to make the payment? Read next…

Use Mobile Apps

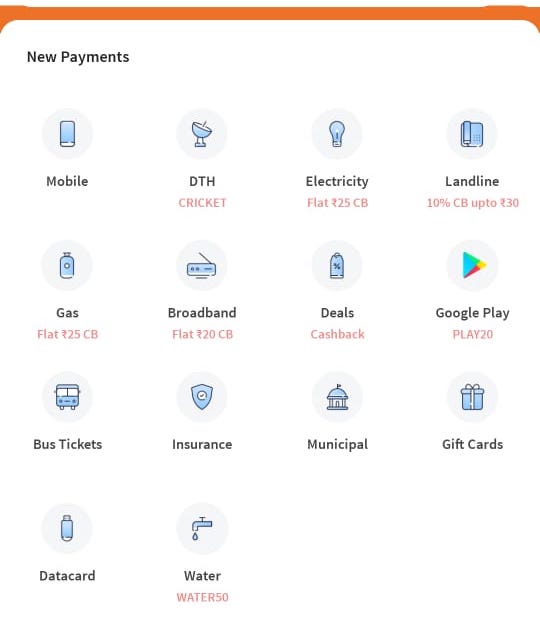

Mobile Apps like PayTM, UPI Apps, Freecharge, PhonePe, among others, have made bill payments super easy. For first time users, they would need to register their bills in the app. Once they are registered, click a button, enter your card details, and there goes the payment.

These Apps have a user-friendly interface. Each type of bill payment has a separate icon. Like there are individual icons for mobile, DTH, Electricity, Landline, Gas bills, etc. It makes bills payments quick and easy, even when we are on the run.

Automatic Payment

If you are someone who is very busy and hence forgets even checking the bill-reminders, then do this. You can enable the automatic payments of your bills. One can use their mobile banking app to initiate automatic bill payments.

The automatic bill payment feature will also be available with your credit card provider. If you are using SBI’s Credit Card, google this phrase: “automatic bill payment SBI Credit Card.” Almost all credit card providers have the “Auto Bill Pay” feature enabled.

Keep Payment Receipts

If you are tracking your expenses (say in Excel), then as soon as you’ve made the payment, record it. You can also keep a copy of the bill paid in the relevant bill folder.

These days, most of the bill payments are online, so email a copy of the receipt to yourself, and then drag/move the email into its relevant folder.

Organizing Savings

Managing bill payments is only a part of getting finances organized. To really make it more effective, the savings side of money management shall also be arranged. But before we go into managing savings, we must comprehend its utility.

Suppose you are someone who makes all the bill payments on time. You have been doing this for years together. But when you look at your asset-side, there is no savings, no investments, neither you have a home. How will you feel at this time? Not good, right?

A lack of discipline with money-handling causes no-savings. It’s a kind of financial disorganization. Hence organizing savings & expenses together will suffice the bigger cause overall financial overhaul.

Let’s talk about the finer bits which eventually leads organizing savings.

#3 (S1) Save Tax & File Returns

No matter what we do, one is liable to pay income tax as per one’s tax slabs. It is unavoidable. But the government has given options to save on our tax liability.

Everyone must use these tax saving options to lower their tax load. Why? Because if not done, our income is getting spent needlessly due to excess tax payments. This is one of the profound examples of bad financial management that needs immediate organizing. How to do it? Through income tax planning.

The idea is to save as much income-tax as per the exemptions provided by the government. It is necessary to pay an income tax. But equally important is to file the income returns (ITR).

Organizing Finances & Emergency Fund Building

An emergency fund is both a pool of cash & a basket of few insurance products. The emergency fund is a must for organizing finances. Why? Because it will assist the person when he/she in need. For example, in times of medical emergency.

Time and again small-small emergencies do prop-up in our lives leading to expenses. Few examples of such emergencies can be like a child’s new activity in school, fridge breakdown, house door-lock repair, etc.

Most of the time, we allot no savings to handle such small emergencies. It leads to frustration and a feeling of money scarcity. How to manage such a situation? A way-out is building an emergency fund. Let’s read more about it.

#4 (S2) Build Cash Pool

In the Indian context, a pool-of-cash must be equivalent to six months worth of income. It means, if one’s monthly-income is Rs.1.0 Lakhs, then the minimum cash the person must accumulate is Rs.6.0 Lakhs (Rs.1 x 6). Read here more about emergency funds.

It is also essential to keep replenishing the pool of cash every time money is withdrawn from it. The rule is to maintain the minimum balance of 6 times income as a pool.

How to do it? Start a recurring deposit (RD), or start a SIP in a liquid mutual fund and continue investing till the minimum balance is reached.

#5 (S3) Buy Insurance

Only a Pool of cash will not be able to take care of all kinds of unplanned (emergency) expenses. I’m talking about such expenses which are more cash-intensive. Hence to manage such unplanned expenses a basket of insurance products will help. Minimum insurance cover that must be included are the following:

- Life Insurance: Best time to buy a life insurance cover is in one’s twenties (’20s). A term insurance plan purchased in the ’20s will yield the cheapest premium. A life cover not only gives a sense of security for the family, but it also can save some income tax (U/s 80C).

- Medical Insurance: This is one insurance cover that will prove its utility with age. In younger years, they may not show their value. But as the family begins to get older, health issues become frequent. This is the time when a health cover can save people lakhs of Rupees. Medical insurance can also save income tax (U/s 80D).

- Motor Insurance: People who live in metro cities cannot live without a motor insurance cover. Moreover, motor insurance is also mandatory for all vehicles. Nevertheless, overtime motor insurance can save more money for people than the cost of its premium. Read about new rules for motor insurance.

#6 (S4) Prepay Loan

Loan creates a large cash-outflow in the form of EMI’s. The quantum of the EMI is inflated, particularly for home-loans buyers and education loan buyers. So what is the problem? Everyone avail loans!

The loan in itself is not an issue. It is a financing tool that can assist one to raise capital. At this point, some might say that everyone takes loans. Even reputed companies rely on bank loans. So why an individual should worry about it?

Good companies make sure to maintain a suitable debt to equity ratio (D/E), and interest coverage ratio (ICR) while availing loans. But do we take care of such things while applying for a loan? Never. Read: About debt-free companies.

This is the reason why most people end up overspending under the influence of a bank loan. Anything which causes overspending will ultimately lead to financial blunders.

Even if one is able to pay the EMI’s, it cannot be comprehended as a good loan. The thumb rule is, one’s EMI should not be more than 35% of the net income. The majority will fail this test. Hence comes the need for loan prepayment.

If one has already exposed oneself to the risk of expensive loan EMI’s, then reducing the loan balance should be the priority. How to do it? By the way of loan prepayment. Read: How to become debt-free.

#7 (S5) Lock Funds

Keeping money idling in savings account calls for overspending. This is the type of money that eventually gets spend on unnecessary things. Probably this is the reason why experts discourage keeping too much liquid cash.

Keeping money in FD, buying endowment plans, investing in tax savings options, etc are some fronts where we can keep our money locked. If you have excess cash and would like to explore more, buy your first house as early as possible. This is a great example of keeping the money locked.

The idea is to buy such assets that are not easily sellable (liquidated). Another asset type that can lock our money is physical gold. One can also invest in e-gold. But it is comparatively easier to liquidate.

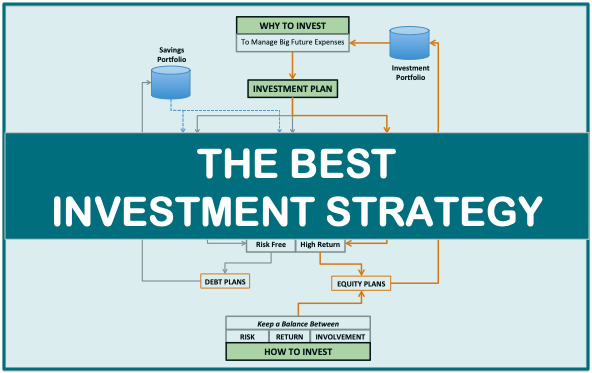

In case you are also interested in multiplying your corpus relatively faster, consider locking your money in equity. But make sure to stay invested for a very long time (7-10 years). Read: How to become rich.

Conclusion

Becoming interested in organizing one’s finances is the first step towards leading a financially clutter-free life. Following the above 7 steps will result in no missing bills, no missed payments, and above all – a financially secure life.

Generally, people in their first job (the early twenties) are not bothered about getting their finances organized. But by the time they enter the ’30s, with increasing responsibilities, people cannot afford to remain in financially disarray.

Dear Mr. Mani(sh),

Your excellent way of explanation is remarkable. Appreciate if you could expand your horizon to NRIs investment and savings opportunities.

Keep up the good work.

Thank you for the feedback

Eye opening article Manish! Thank you for this 😊…

Thanks