Best Stocks to Buy Today India for Long Term

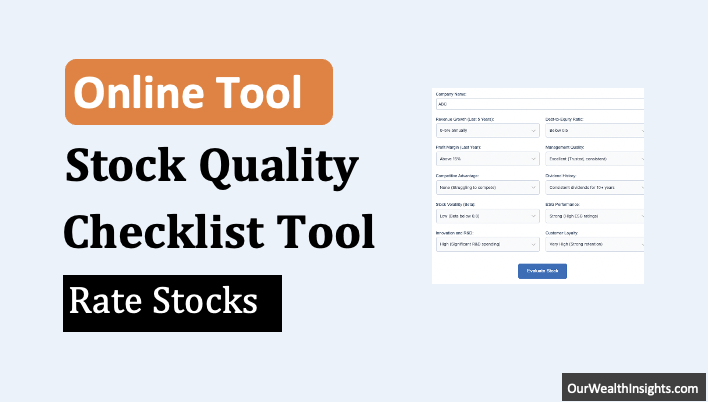

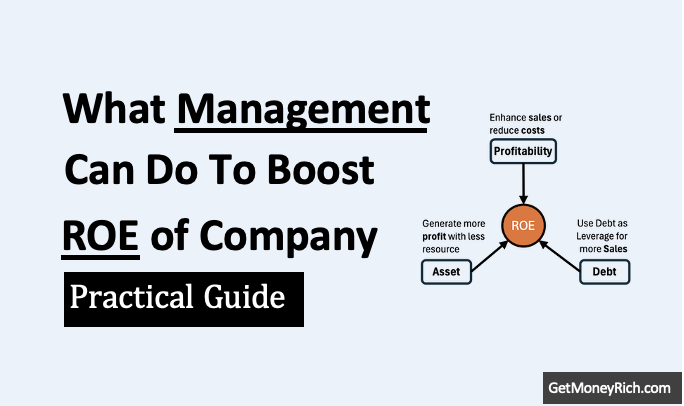

Best Stocks Screener is Here Table of Contents 1. Discover the Best Indian Stocks for Long-Term Investment in 2025 2. What Makes a Stock “Good” for Long-Term Investment? 3. The Challenge of Picking the Best Stocks 4. Introducing The Stock Evaluator Tool 5. How the Tool Helps You Find Top Stocks 6. Key Metrics You…