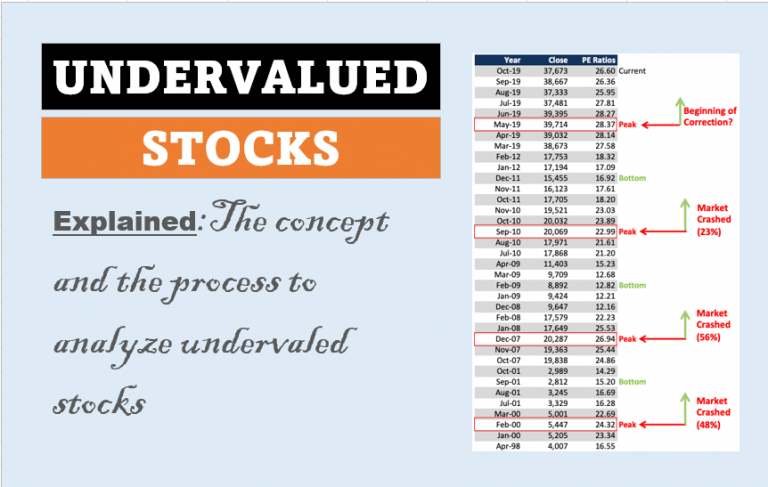

Ketan Parekh Stock Market Manipulation of 2000-01 [Explained]

In the world of stock markets, stories of extraordinary gains and dramatic falls are not uncommon. However, some stories reveal the dark side of trading. These stories talk about manipulations replacing genuine market activity. One such case involves the alleged market manipulation in India during 2000-01. It was a stock market scam and it was…