How the Economy Works – Understanding the Basics [Explained]

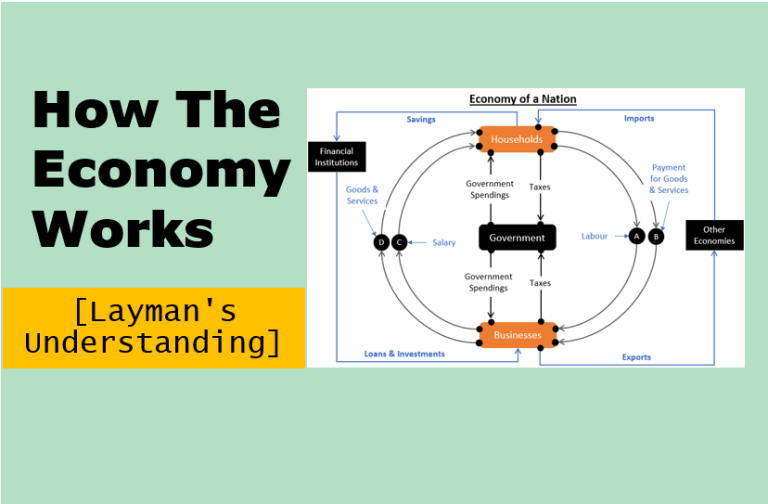

How Does The Economy Work 🔍 How Does An Economy Work? An economy works through the flow of money, goods, and services among people, businesses, and governments, driven by supply and demand, with government policies and economic cycles shaping growth and stability. How does money flow in the economy? The economy is a cycle where…