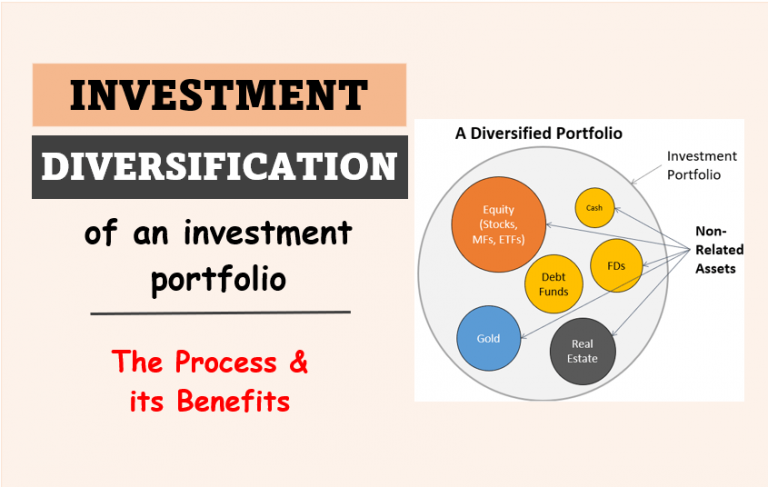

Investment Diversification: Take Less Risk, Earn High Returns

The purpose of this article is to highlight the necessity of keeping the investment portfolio well diversified. We’ll see in this blog post how investment diversification is not only about buying different types of assets, it is more about keeping a balanced portfolio. For quick answers on the diversification strategy, check the FAQs Introduction What…